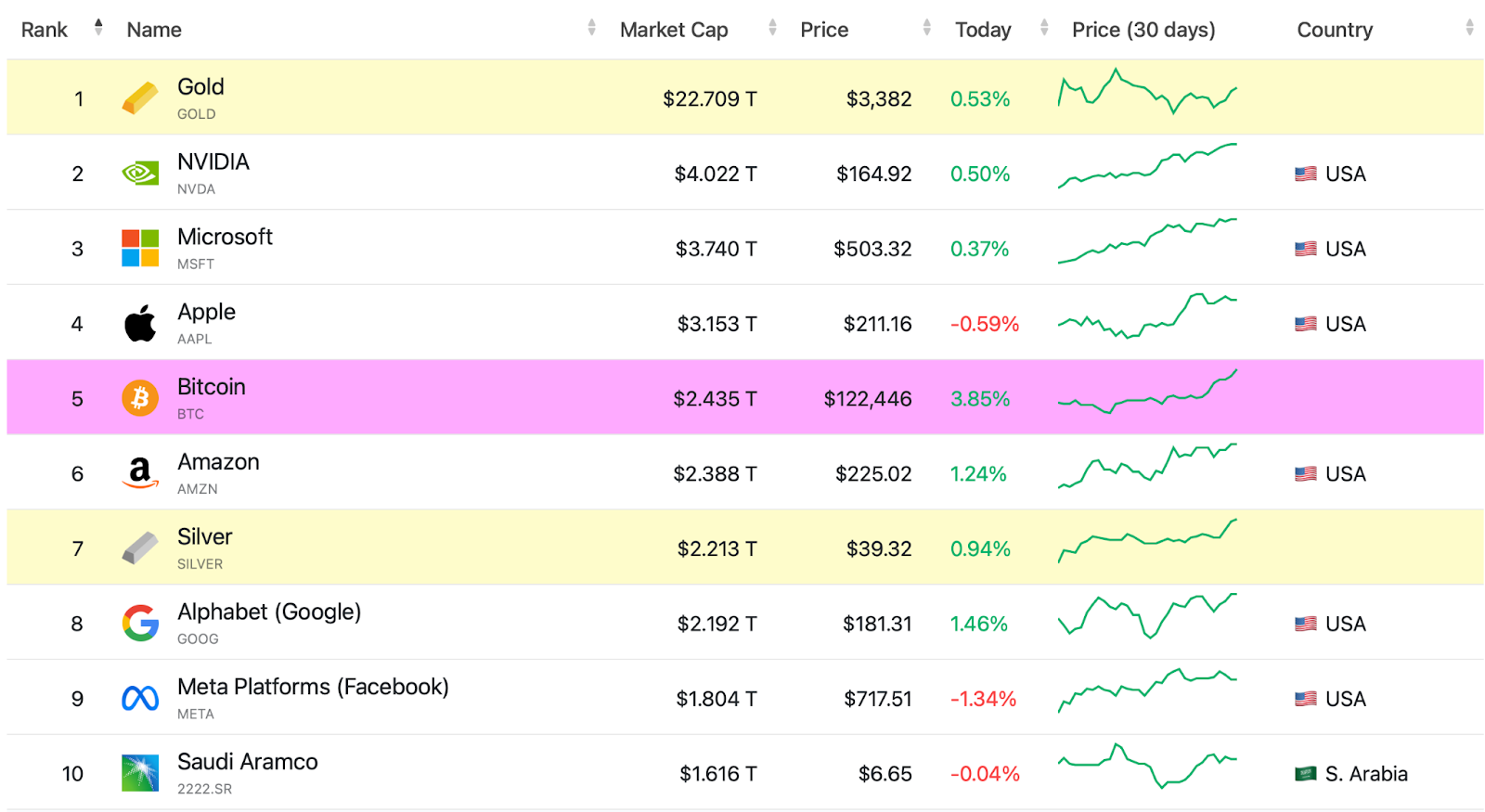

Now the fifth-largest asset in the world with a $2.43 trillion market cap, Bitcoin has surpassed both silver and Amazon, in terms of market valuation. ETF-driven demand continues to dominate, with US spot Bitcoin ETFs recording over $2.7 billion in inflows last week, significantly outpacing the mined supply of BTC last week — with BlackRock’s IBIT ETF reaching $80 billion in AUM faster than any ETF in history. Meanwhile, grassroots accumulation by wallet cohorts under 100 BTC is also outpacing new issuance by a wide margin, reducing further supply pressure.

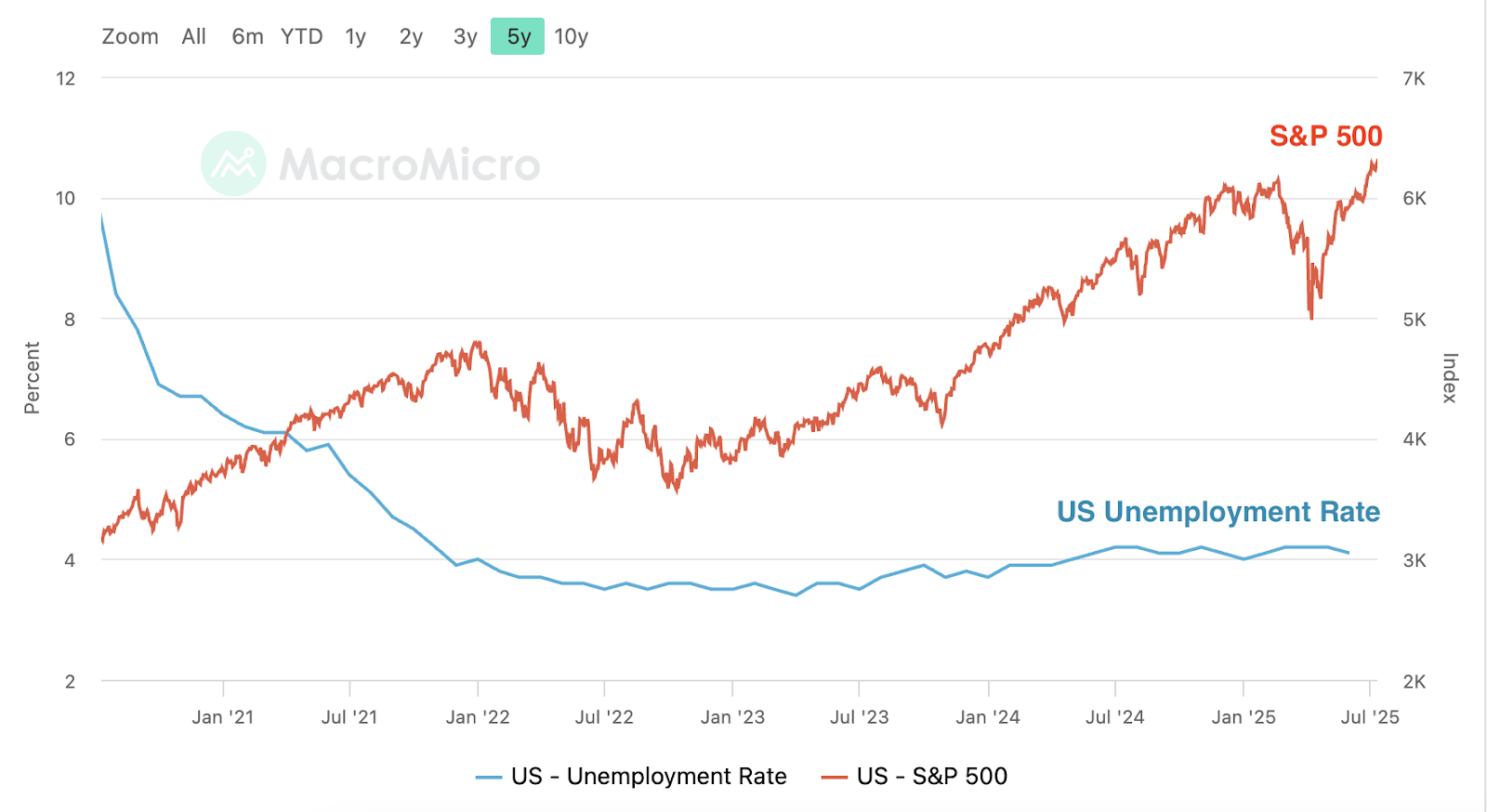

Bitcoin’s role as a digitally native monetary asset, validated by sovereign-grade allocators and balance sheet investors, is driving its ascent through the global asset rankings. The price action reflects more than just momentum, it represents a fundamental repricing of Bitcoin’s role in institutional portfolios and macro frameworks. And while headline economic indicators also suggest broader stability in the US, a closer examination reveals deepening cracks beneath the surface. Labour market dynamics are weakening, with rising continuing jobless claims pointing to challenges in workforce reintegration, especially in entry-level roles.

Simultaneously, consumer sentiment is cautiously optimistic but weighed down by persistent structural strains—elevated credit costs, essential living expenses, and growing geopolitical uncertainty are testing household resilience. On Main Street, small businesses are feeling the pinch. Despite stable readings in business surveys, data shows that many companies are grappling with sluggish sales, rising input costs, and hiring mismatches, forcing them to scale back investments and hiring plans. Meanwhile, Wall Street is showing its own signs of fragility, with a depreciating dollar, rising Treasury yields, and widening credit spreads reflecting heightened investor anxiety and scepticism toward US fiscal and monetary policy.

Amid this backdrop of macroeconomic uncertainty, the digital asset sector is gaining momentum. BioSig, a Nasdaq-listed firm, has secured up to $1.1 billion in financing to spearhead its push into tokenised commodities, following its merger with blockchain firm Streamex. The capital will underpin the creation of a blockchain-based tokenised treasury—starting with gold-backed products—positioning BioSig to capitalise on growing demand for real-world asset tokenisation. Similarly, Tether, the issuer of USDt, has bolstered its compliance capabilities by investing in blockchain analytics firm Crystal Intelligence. This move enhances Tether’s capacity to detect and respond to illicit activity, reinforcing its commitment to transparency amid a surge in crypto-related fraud. Globally, governments are also signalling increased support for digital asset innovation. South Korea has proposed reclassifying crypto firms as “venture companies,” making them eligible for tax incentives, public funding, and startup programs. This policy shift, aligned with President Lee Jae-myung’s broader pro-crypto agenda, marks a significant step toward institutionalising digital assets within the country’s tech and financial landscape.

The post appeared first on Bitfinex blog.