Uniswap began as a way for people to access crypto without the use of intermediaries. Unlike with a centralized exchange, Uniswap isn’t controlled by a singular entity. It also doesn’t use order books to determine pricing and execute trades. Rather, it uses a model called an automated market maker which employs an algorithm to facilitate buys and sells. With this model, as long as there’s enough liquidity, a trader can trade. Uniswap’s code is also open-source, which means anyone can use it to make their own DEX. And this is exactly what Sushiswap did.

Sushiswap sprang from Uniswap as a project that was created to directly contribute to the ethos of decentralization. One of Sushi’s main critiques of Uniswap is that it doesn’t really give its users control over its development direction. So, the new entrant was made to be a decentralized exchange that is truly owned by its community.

TL;DR

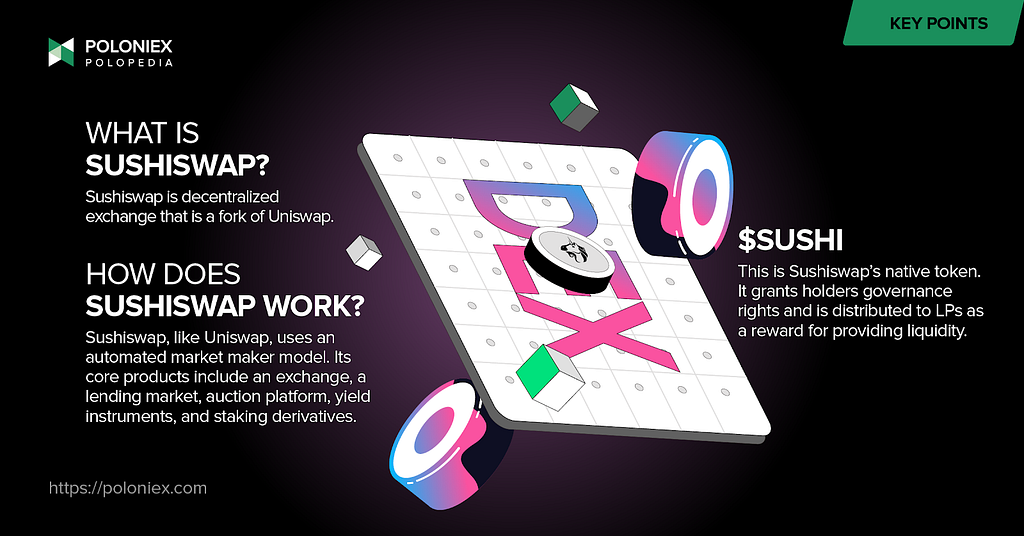

Sushiswap, which started as a fork of Uniswap offering greater returns for liquidity providers, is a DEX AMM that includes an exchange, lending market, auction platform, yield, instruments, and staking derivatives.

Founded in 2020 by two pseudonymous developers by the monikers of Chef Nomi and 0xMaki, Sushiswap pitched itself as a way for liquidity providers on Uniswap to use their LP tokens for much more returns than they were being currently offered: extra SUSHI tokens and a high APY.

Moreover, there was the promise that liquidity providers would continue to earn revenue from fees collected on the platform even if they withdrew their tokens. What resulted was $1.2 billion in liquidity for Sushiswap. All this happened over the course of two weeks as news of Sushiswap took the crypto world by storm and its native token, SUSHI, exploded in value. After a shakeup on the platform in the ensuing weeks, Sushiswap successfully migrated the collected liquidity onto its own platform.

Sushiswap, being based on Uniswap, is also a decentralized exchange using an automated market maker (AMM) protocol. This means that it can determine pricing and execute trades without an order book. Rather, users interact with smart contracts when using the platform.

Sushiswap has a token swapping function and an upcoming NFT marketplace dubbed Shoyu. As of January 2023, the platform has elected to deprecate Kashi, its lending and borrowing function, and MISO, its token launchpad.

xSushi

xSushi is what you get when you stake your SUSHI tokens in the SushiBar, similar to a liquidity provider token. As the platform’s fees are divided among xSushi holders, those tokens accrue value. In this way, they are always worth more than SUSHI tokens. To break it down a little further, .05% of the .3% fee that is charged on trades is added to the SushiBar pool as LP tokens, which is then sold for SUSHI and distributed proportionally among xSUSHI holders.

Onsen

A burden that a lot of newer projects encounter is that of incentivizing people to join their community and provide liquidity. Often, they have to allocate precious resources in order to do so, and in doing that make sacrifices elsewhere. And even with this, low-liquidity problems can still inhibit their success, causing problems like impermanent loss and slippage.

Onsen is Sushiswap’s solution to low-liquidity problems faced by newer tokens. How this program works is that projects can apply to be a part of Onsen and if accepted they are given an allocation of $SUSHI per block that yield farmers can get when they stake with those projects on Sushiswap. This of course also provides an opportunity for yield farmers to earn more rewards, as they stand to earn more $SUSHI with newer projects.

Shoyu

Shoyu, a product of a community suggestion, is an NFT marketplace. It is still in beta mode, but has promised a streamlined marketplace experience.

How does Sushiswap work?

Being a fork of Uniswap, Sushiswap also runs on Ethereum. It uses what’s called the Trident AMM framework, so instead of releasing a new version of Sushiswap everytime there is a major upgrade,

Like Uniswap, it is a decentralized exchange that uses the automated market maker protocol. Liquidity providers earn rewards in the form of SUSHI, the platform’s governance token. Like mentioned before, holders of the SUSHI token continue to earn platform rewards even after they cease to provide liquidity.

Sushiswap has different yield generating products like its SushiBar and Bentobox. As mentioned before, users can deposit SUSHI into the Sushibar pool and receive xSUSHI, which will accrue proportional value from platform fees. Bentobox is a token vault that has the added nuance of being able to deposit through use of an artificial balance. It uses low-risk yield farming strategies, putting users’ tokens to work without risking loss.

Keeping to its original promise, the big decisions on Sushiswap are made by the community. Smaller operational changes, however, are handled by a core team.

How to become a liquidity provider on Sushiswap?

Much like any other AMM, one merely has to deposit a sum of tokens on both sides of a token pair into a pool to earn a proportional percentage of trading fees. Liquidity providers earn 0.25% on trades occurring on Sushiswap.

$SUSHI

SUSHI is Sushiswap’s native token. It is also its governance token and can be used to vote on decisions regarding the platform’s future.

How to acquire $SUSHI?

$SUSHI is available on multiple exchanges like Poloniex! You can acquire $SUSHI through trading a USDT/SUSHI trading pair.

Feeling ready to get started? Sign-up is easy! Just hop on over to https://poloniex.com/signup/ to start your crypto journey🚀

🍣 was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.