🧰New Features

We’ve added functionality for sub-accounts! With this addition, you can conveniently make and manage up to 50 sub-accounts from your main account. For more details, check out our help center article.

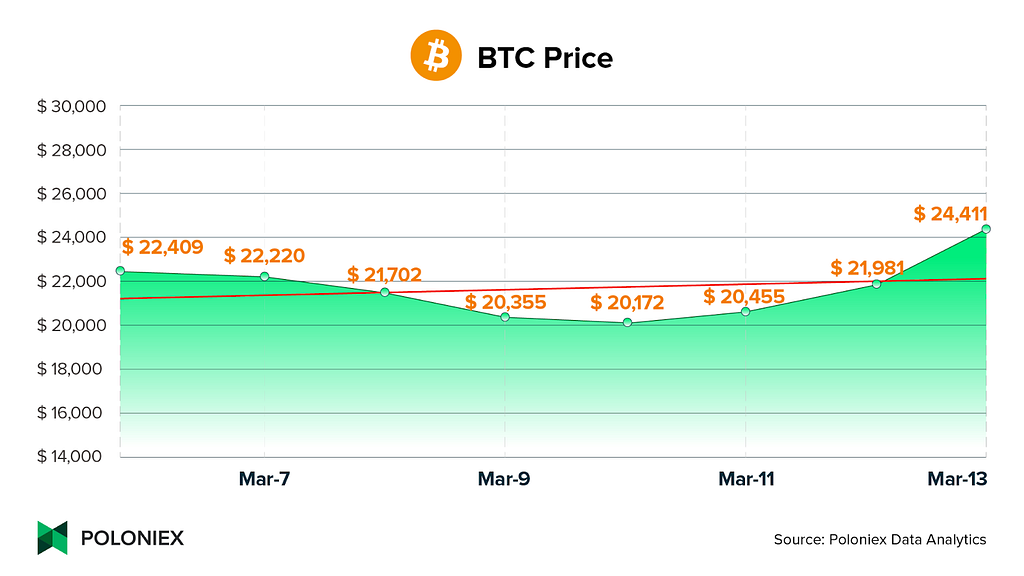

📈📉 Market Watch!

BTC starts week on a high after dipping previously

In the face of heavy market uncertainty, BTC made an over 9% gain to kick off the week. Even as the price peaks up over $24,000, the market is still holding its breath after recent bank failures and increased regulatory scrutiny.

The top gainers for the last 24 hours on Poloniex are LOOM/BTC, BLUR/USDT, GPT/USDT, BABYDOGE/USDT, and HEX/USDT.

🗞️ So, what happened?

Volt Inu becomes first token to list on Huobi as a part of Poloniex project referral program

Huobi and Poloniex are working together on multiple fronts, one of which is a program through which tokens listed on Poloniex may be listed on Huobi after satisfying certain criteria. The distinction of the first token to be listed after achieving such a performance goes to Volt Inu ($VOLT)! Congratulations to the Volt Inu team🎉

Silicon Valley Bank fails, prompting fears of domino effect

The 16th largest bank in the US, Silicon Valley Bank has failed. This came after the bank had invested in debt, namely mortgage-backed and U.S. Treasury securities. The failure is deemed to be largely due to a series of events kicked off by an increase in interest rates by the Federal Reserve. What resulted was an investor panic and rapid withdrawal of funds from SVB.

On a related note, regulators in New York, prompted by the aforementioned news, decided to shut down another crypto-friendly bank, Signature Bank. Derided by board member and Dodd-Frank co-sponsor Barney Frank, the decision is intended to mitigate further fallout and investor fear.

Customers of both SVB and Signature Bank will be able to access their funds as a part of a “systemic risk exception”, according to a report by Bloomberg. This includes uninsured as well as insured customers.

Circle’s USDC de-pegs following week of market turmoil

Although a full-on market domino effect has yet to take hold, Silicon Valley Bank’s failure did have quite an immediate effect on the crypto industry. Circle’s USDC stablecoin de-pegged from the US dollar following an unfulfilled transfer of about $3.3billion in USDC held in SVB. Stablecoins such as DAI and FRAX also depegged, due to USDC’s representation as collateral for various stablecoins.

For the uninitiated, a stablecoin is a cryptocurrency that is designed to be “pegged” to or keep the same value as another currency or asset. There are various ways in which a stablecoin can maintain a peg. That is, stablecoins can be collateralized by fiat/crypto-currencies or collateralized by assets like gold, e.g. PAXG. There are also algorithmic stablecoins that use smart contract algorithms to keep their peg.

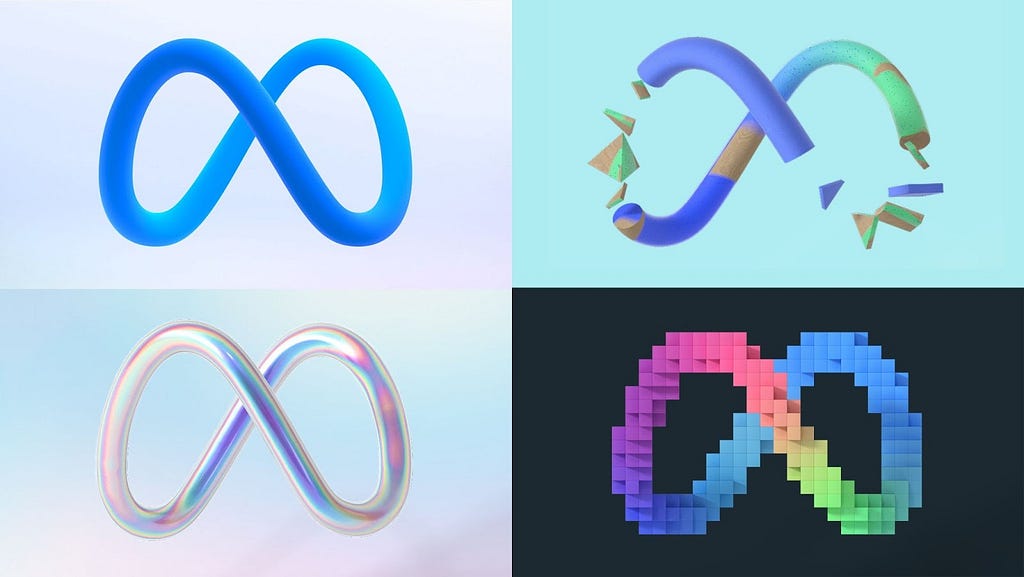

Meta to sunset NFT support

Meta’s head of commerce and financial services, Stephane Kasriel, announced via Twitter that Instagram and Facebook will sunset their support of non-fungible tokens. Meta, the two companies’ parent, had previously offered selected creators to mint and offer NFTs on Facebook and Instagram through a collaboration with Polygon. Some users had also been able to display their NFTs. Now, though, in a stated effort to explore other ways to support its users, Meta will shift focus to concepts such as decentralized social media platforms.

Still under development, the application that Meta is putting its resources into is a “standalone decentralized social network for sharing text updates” according to a Meta spokesperson quoted by TechCrunch. This may be due to Meta’s inclination to follow Web3 trends, as decentralized social media apps like Nostr and Damus have caught public attention recently. This is likely due to the voicing of support from Twitter founder Jack Dorsey and whistleblower Edward Snowden.

Coindesk, TechCrunch, Yahoo! Finance

🤑 New Listings on Poloniex

Here’s what we’ve listed recently:

New Coins

Futures

🔍 DYOR before trading

Polopedia

Read about our recent winged listing🐉, Lord of Dragons, the blockchain MMORPG!

Crypto Glossary

The Shanghai Upgrade is Ethereum’s next major update to its execution layer, and will allow stakers and validators to withdraw their staked ETH. This comes in the context of Ethereum’s recent shift from Proof of Work to Proof of Stake, and is one of various changes that aim to improve Ethereum’s scalability and carbon footprint.

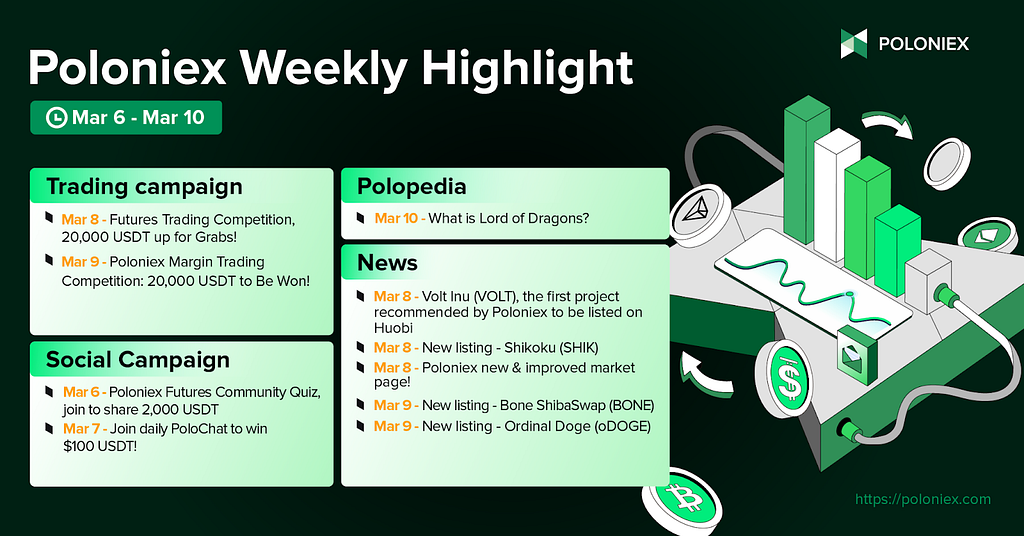

What’s happening here at Poloniex?

This is what Poloniex’s week looked like

Highlights for the week

Campaigns

Our recap of ongoing campaigns that YOU can get involved in!

Futures Trading Competition Is Here: 20,000 USDT up for Grabs

Poloniex Margin Trading Competition: 20,000 USDT to Be Won!

The community megaphone📢

Highlights from the community

https://twitter.com/Poloniex/status/1635104186248605699

https://twitter.com/Poloniex/status/1633300590326431744

https://twitter.com/Poloniex/status/1633297625712664576

Poloniex Exchange on Twitter: "Past week, we hosted an AMA with Min Seok Kim, CEO of @Global_LoD, and learnt Kim's thoughts about the blockchain gaming industry, what sets Lord of Dragons apart, and what blockchain gaming provides that traditional gaming doesn't. Read the recap 👉 https://t.co/zSedHOjuYc pic.twitter.com/Djz1I7Txpx / Twitter"

Past week, we hosted an AMA with Min Seok Kim, CEO of @Global_LoD, and learnt Kim's thoughts about the blockchain gaming industry, what sets Lord of Dragons apart, and what blockchain gaming provides that traditional gaming doesn't. Read the recap 👉 https://t.co/zSedHOjuYc pic.twitter.com/Djz1I7Txpx

And that about covers it for this week! Curious about our campaigns or upcoming events? Give us a shout in our Telegram channel- https://t.me/PoloniexEnglish

Is there anything you’d want to see us cover in our newsletter? Make sure to comment on this Medium article! Just want to show your appreciation? Smash that clap button and give a round of applause👏

Thanks for spending some time with us as we went over what’s going on. And wherever you are, from the team here at Poloniex, good morning, good day, and good evening!

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.