Ethereum ($ETH) once again stood out as the “hottest mainstream asset”, gaining an impressive 23% and reinforcing its appeal as a core market anchor. This consistent performance positions ETH as a primary allocation target for capital seeking both safety and stable growth. The escalating ETH 2.0 staking yields, the flourishing Layer 2 ecosystem, and sustained institutional accumulation continue to solidify ETH’s status as a core asset for substantial investments.

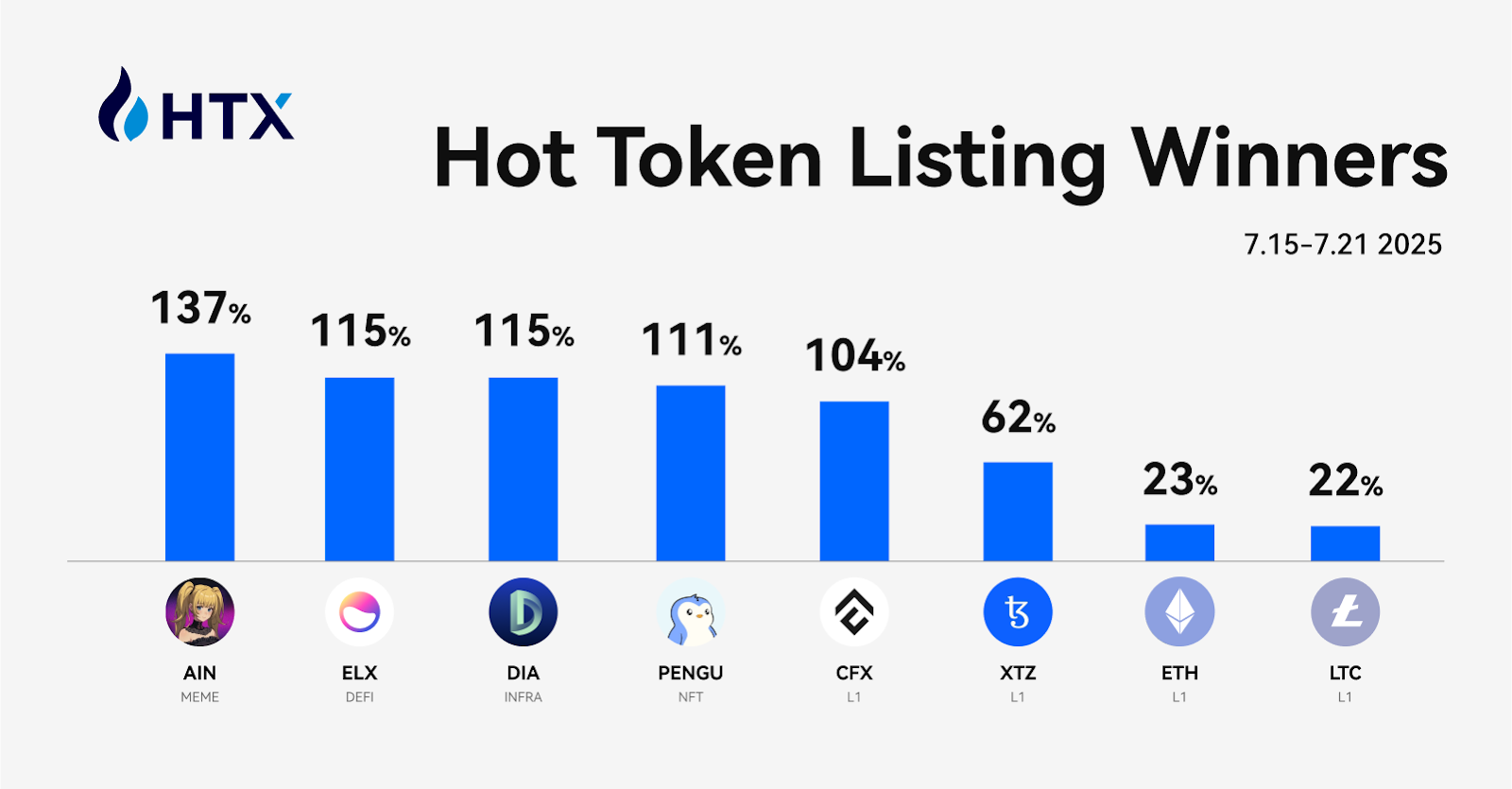

Crucially, HTX’s strategic selection of key new listings proved highly effective, with several tokens across categories such as Meme, NFT, DeFi, Social, and Infrastructure more than doubling in value within a single week. Below is a highlight of the week’s top performers:

Emerging Assets Fuel Gains, Boosting the Wealth Effect

● Ani Grok Companion ($ANI): Crowned the week’s top gainer with a staggering 137% increase in just seven days. This AI+Meme project blends the “gooning” meme with xAI and Elon Musk’s Grok image, combining AI trends with community-driven content creation. Driven by organic community buzz, innovative gameplay, and short-term trading opportunities, ANI was one of the platform’s fastest-growing tokens by trading volume.

● Elixir($ELX): Signaled a strong resurgence of DeFi narratives, posting an impressive 115% weekly gain. Elixir is a blockchain project dedicated to advancing DeFi and liquidity solutions. With a TVL exceeding $300 million, Elixir has also introduced deUSD, a synthetic USD stablecoin that maintains stability via a “Delta Neutral Strategy” and generates returns through funding rates.

● Decentralized Information Asset($DIA): This on-chain infrastructure token also saw a 115% gain over the week. $DIA is a decentralized oracle platform that delivers reliable data feeds for DeFi and other blockchain applications. Its primary function is to provide on-chain and off-chain market data, price feeds, and oracle services. DIA’s positive price momentum was supported by increased Web3 development activity and rising expectations of application-layer adoption.

● Pudgy Penguins ($PENGU): Following last week’s surge in NFT concept assets, PENGU maintained robust performance this week with a 111% gain. The Pudgy Penguins NFT collection features 8,888 unique penguin avatars known for their strong IP attributes and deeply engaged community. PENGU’s rise reflects renewed enthusiasm and potential in the NFT sector during the current cycle.

Infrastructure and Public Chain Sectors Rotate Actively with Layer 1 Market Heating Up

A notable structural rotation took place this week in the Layer 1 sector, with several key tokens experiencing sharp upward moves.

● Conflux ($CFX): Rose 104% over the week. Conflux operates as a public Layer 1 blockchain, designed to power dApps, e-commerce, and Web 3.0 infrastructure by offering superior scalability, decentralization, and security compared to existing protocols. $CFX performed exceptionally well, driven by increased on-chain activity in Asia and the rollout of ecosystem support programs.

● Tezos ($XTZ): Gained 62% this week. As a veteran Layer1 project, Tezos identified governance deficiencies in blockchain networks as early as 2014 and pioneered on-chain governance solutions. Tezos empowers token holders to determine the network’s upgrade roadmap and priorities, effectively resolving disputes and bypassing the need for disruptive network hard forks. Recent upgrades have further propelled its ecosystem expansion, and it has also garnered pilot adoption by several institutional entities.

● Litecoin($LTC): Increased 22% weekly. Litecoin’s adoption as a payment method has grown over the years, widely accepted by various merchants and organizations, including the American Red Cross, Newegg, and Twitch. Beyond its consistent price stability, its growing integration with traditional financial concepts has attracted considerable market attention. Recently, LTC was designated as one of the initial assets linked to a “crypto stock fund” launched by a major U.S. brokerage, endowing it with new “crypto ETF-like” attributes.

To learn more about HTX, please visit https://www.htx.com/?invite_code=9cqt3 or HTX Square , and follow HTX on X, Telegram, and Discord. For further inquiries, please contact [email protected].

The post first appeared on HTX Square.