Almost all of the top 10 large-capitalization cryptocurrencies are in the red. BTC fell from around $11,600 to as low as $11,117 in eight hours and is now bouncing back to around $11,350, as per OKEx’s BTC Index price. Ether ( ETH) and Litecoin ( LTC) were down 2.49% and 4.32%, respectively. EOS, meanwhile, plunged by 5.45%.

The only exception is Polkadot ( DOT), which is currently seventh on CoinGecko’s market capitalization list. The altcoin surged 15% to go against the grain. It has posted five straight days of gains after implementing a 100x split. Additionally, OKEx’s exchange native token, OKB, also surged 9.47% to counter the wider cryptocurrency market.

The total crypto market capitalization decreased 2% to fall below $370 billion, as per data from CoinGecko. Meanwhile, BTC’s dominance remains unchanged at 56.8%.

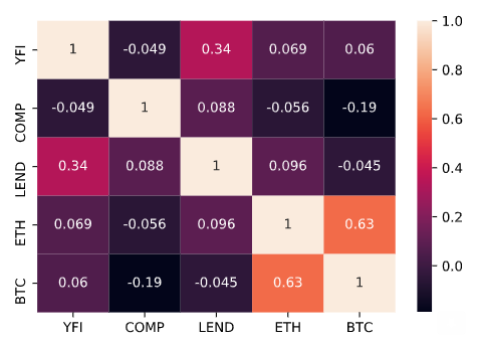

What is particularly noteworthy about yesterday’s BTC selloff is that decentralized finance tokens also saw a short and rapid decline — although many rebounded quickly. Previously, many DeFi tokens have had a negative correlation with Bitcoin, as per data from 21shares. Bancor ( BNT), 0X ( ZRX) and Compound ( COMP) have all seen declines of more than 6% over the past 24 hours.

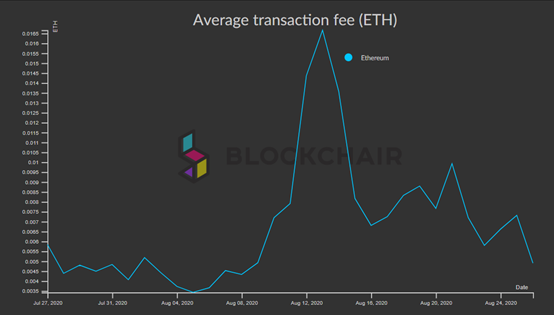

Moreover, we saw Ethereum transaction fees drop by 80% from their mid-August peak. The price of ETH has also lost its independent trend as transaction fees have fallen.

Top altcoin gainers and losers

Mantra DAO ( OM) was listed on OKEx yesterday. It has been trading 162% above its opening price of $0.20. However, it was also hit hard by Bitcoin’s pullback and fell to $0.33 before quickly rebounding.

Two other altcoins on the top gainers list also rose very sharply. Arcblock ( ABT) and KCASH surged 46.47% and 44.38%, respectively, overnight. KCASH has only experienced two days of declines in the past half month, jumping from $0.02 to $0.12.

BTC technical analysis

In yesterday’s Crypto Market Daily, we noted that BTC still has the probability to test lower support at $11,200 in the short-term. The price did test this support area with amplified volume.

The mid-term trend is still in a bullish pattern. The short-term also shows positive signs after hitting important support levels. A short-term resistance level is back to $11,600 and an intraday threshold is located at $11,400.

Bitcoin price chart — 8/26"/> OKEx BTC Perpetual Swap 1h chart — 8/26. Source: OKEx, TradingView

Visit https://www.okex.com/ for the full report.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.