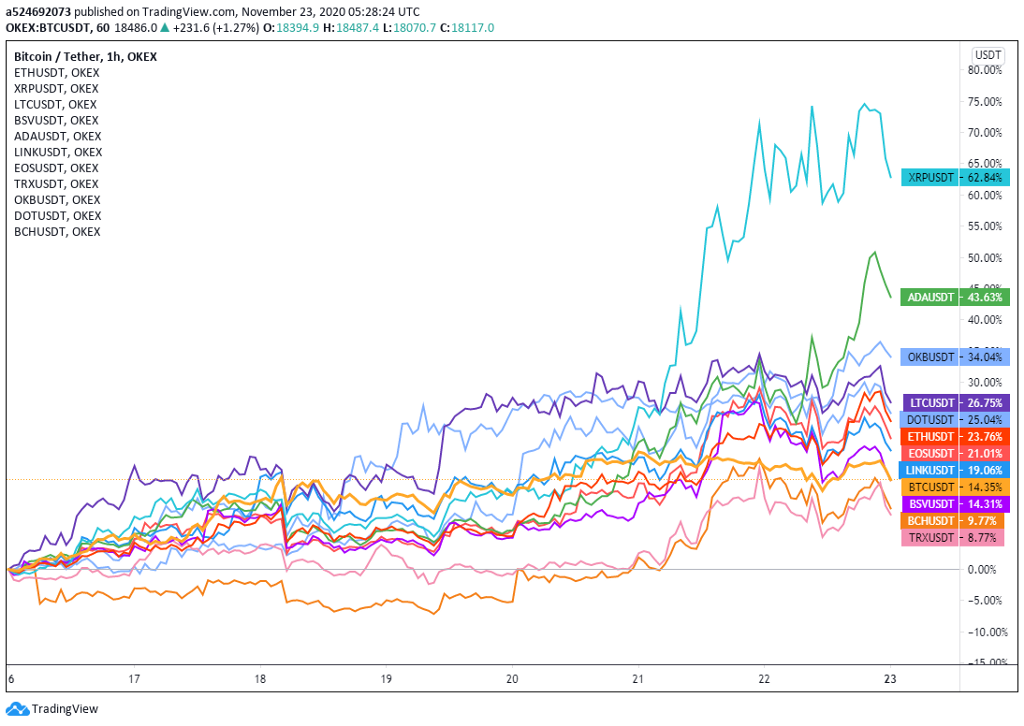

With the price of BTC surging 14.35% last week, major altcoins also took off. Only TRON ( TRX), Bitcoin Cash ( BCH) and Bitcoin SV ( BSV) undeformed Bitcoin last week, while XRP is the best performer, posting a massive 62.84% weekly gain. Cardano ( ADA) and OKEx’s native token OKB followed with 43.63% and 34.04% gains, respectively. Other major altcoins generally saw 20% to 30% increases.

Along with the continued rise in price, the aggregated open interest of BTC futures exceeds $7 billion, and hit another all-time high, as per skew’s data. OKEx topped the list with an OI of $1.18 billion, while CME’s OI exceeded the $1 billion mark for the first time.

As the bullish momentum continues, perpetual swaps’ funding rates across exchanges are trending upward. The funding rate surge has been very noticeable since Nov. 20, indicating that retail investors have been chasing the price rally and conditions are overheating in the short-term.

While positive funding rates mean that longs are dominant, stagnant prices at excessively high funding rates can cause longs to wind down, resulting in sharp corrections.

Meanwhile, CME released the latest (as of Nov. 17) Bitcoin futures position data on Nov. 21. Bitcoin continued its upward momentum during this reporting period, and market optimism was spreading.

Open interest increased from 11,311 to 11,509, maintaining two weeks of increases, while the total OI has not yet exceeded the figure from two weeks ago. This can be seen as a sign of increasing reluctance to go long when the market has already seen considerable gains.

According to the report, asset managers’ long positions rose from 832 to 845 and short positions fell from seven to four. At the same time, leveraged funds’ long positions rose from 5,097 to 5,305 and short positions rose from 7,881 to 8,097. Other reportable accounts have reduced their positions in both long and short positions, signalling risk-control measures. Overall, however, institutional investors remain bullish on the market.

In the DeFi sector, despite recent exploits, many DeFi tokens are still riding high for three weeks in a row as Bitcoin continues to surge. One of the best performers was yearn.finance ( YFI), up nearly 40%. The YFI core team and developers are continuing to build the much-anticipated Yearn V2 vaults, while the token’s highly volatile price action also makes it a favorite among active traders.

Uniswap’s ( UNI) rewards ended last Tuesday, and as we noted in our last Market Watch Weekly, funds have been moving to SushiSwap ( SUSHI) for higher yields. The drain saw SushiSwap’s total value locked increase quickly, and the token also appreciated 33% weekly.

Visit https://www.okex.com/ for the full report.

OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.