The total crypto market capitalization plunged by a huge 5.7% in the last 24 hours and fell to $378 billion, as per data from CoinGecko. The top 20 cryptocurrencies by market capitalization (excluding stablecoins) are all in the red, except for TRX.

BTC plunged 4.81%, dropping quickly from roughly $11,900 to as low as $11,180. It is now trading at around $11,300. Meanwhile, BTC dominance increased by 0.5% from a year-to-date low.

Major altcoins all recorded declines of around 10% — with Ether ( ETH) and Bitcoin Cash ( BCH) down 9.20% and 10.47%, respectively. Polkadot ( DOT) overtook Chainlink ( LINK) for fifth place in market cap rankings, due to a relatively small 5% drop overnight.

Some are claiming the crypto market selloff was triggered by news that Korea’s largest exchange, Bithumb, is being investigated for pre-selling BXA tokens.

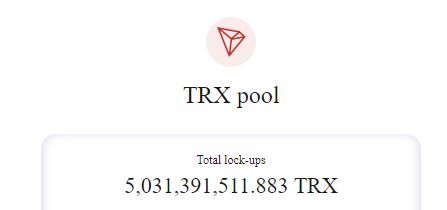

TRON’s liquidity mining project, SUN, went live last afternoon. The total value locked in SUN has surpassed 1.5 billion TRX or $180 million in 17 hours. The huge demand resulted in a TRX price increase of 0.87% — which is notable, given the wider market decline.

This has also spurred on a spike in the prices of the other decentralized finance tokens in TRON’s ecosystem. PEARL has soared to $4,000 and Jackpool.finance (JFI) skyrocketed to $2,000.

The DeFi tokens on Ethereum, on the other hand, are diverging. YFValue ( YFV), Curve ( CRV) and ANT dropped more than 20% in the last 24 hours, but Loopring ( LRC) and UMA surged by around 10%. The price of SushiSwap ( SUSHI) fluctuated wildly, falling from $10 to $6. SUSHI is back to $7 after getting rejected near $9 this morning.

Top altcoin gainers and losers

The price of Polkadot’s ecosystem token, Kusama ( KSM), pushed the altcoin to the top of today’s list. KSM is up 21.93%. Beauty Chain ( BEC), on the other hand, lost 28.75% overnight.

BTC technical analysis

In yesterday’s Crypto Market Daily, we noted that “a pullback below $11,750 is not an optimistic sign in the short-term.” Indeed, Bitcoin accelerated a decline after trading below this level — making a bearish engulfing pattern on the daily chart.

Yesterday’s drop was accompanied by an increase in trading volume, which could lead to some short-term panic in the market. This is also not conducive to price stability. However, there is no change in the current mid-term pattern, unless price drops below the threshold of $10,670.

An intraday threshold is located at $11,200. BTC would want to hold this level in order to make another rebound to $11,500 level.

Visit https://www.okex.com/ for the full report.

Not an OKEx trader? Learn how to start trading!

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.