In simple terms: you lend to other traders who need leverage for their positions. You earn while keeping ownership of your crypto.

Historically, margin lending has offered generally higher returns than conventional savings accounts, making it an alternative for long-term holders who wish to generate earnings with their otherwise idle assets.

What Is Margin Lending?

Margin lending (also called Margin Funding on Bitfinex) is a peer-to-peer (P2P) marketplace where you can lend your assets to traders who want to trade with leverage.

Here’s how it works in simple terms:

You (the lender) have funds (can be cryptocurrency or fiat) sitting in your account. Instead of letting it sit idle, you offer it to traders at an interest rate you choose.

Traders (the borrowers) need extra capital to amplify their trading positions, whether going long (betting prices will rise) or short (betting prices will fall). They put up collateral, borrow your funds temporarily and pay you interest.

The platform (Bitfinex) matches your lending offers with traders’ borrowing offers, manages the collateral, and handles the interest payments automatically.

Why Consider Margin Lending?

Earn Daily: You earn daily without requiring active trading or technical analysis. Earnings are credited every day around 01:30 AM UTC, providing a consistent payment stream.

2. Potential Higher Returns Than Traditional Savings: During periods of high trading activity or volatility, rates can spike significantly as demand for leverage increases.

3. You Stay in Control: You decide:

How much to lend (minimum $150)

The interest rate you’re willing to accept

The duration of the loan (from 2 to 120 days)

4. Platform Safeguards: Bitfinex has implemented multiple protective measures:

Collateral Requirements: Traders must provide collateral from their margin wallet before borrowing

Automatic Liquidation: If a trader’s position moves against them and their collateral drops below the maintenance margin, their position is liquidated automatically

Priority Protection: In a liquidation event, your lending is paid back before traders can access their funds

5. Flexibility: Once you lend your funds for a chosen period, you can’t cancel the loan early. However, the trader who borrows your funds can return them at any time before the period ends, and your interest is calculated based on how long the funds were actually used. If the funds are returned in less than an hour, you will still receive a full hour of interest. This means your funds may come back sooner than expected, but you’re always paid for the time they were lent out.

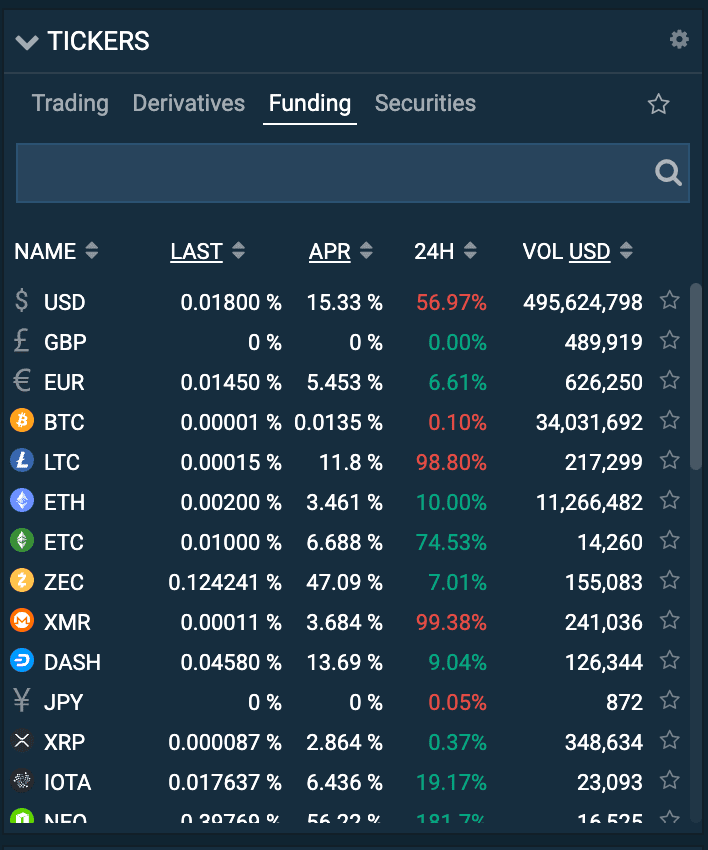

6. Diverse Currency Options: Bitfinex supports margin funding in multiple currencies, not just Bitcoin or Ethereum, but also stablecoins like USDT (this is actually the most popular currency for lending in Bitfinex’s peer-to-peer lending marketplace) and many others, giving you options based on your risk tolerance and portfolio composition.

7. A Steady Option: Depending on your risk appetite and personality, lending can feel steadier than trading. Rather than guessing market direction, you simply allow traders to borrow your funds and earn from the activity. In unpredictable markets, it’s a calmer way to keep your capital working without the constant pressure of making trading decisions.

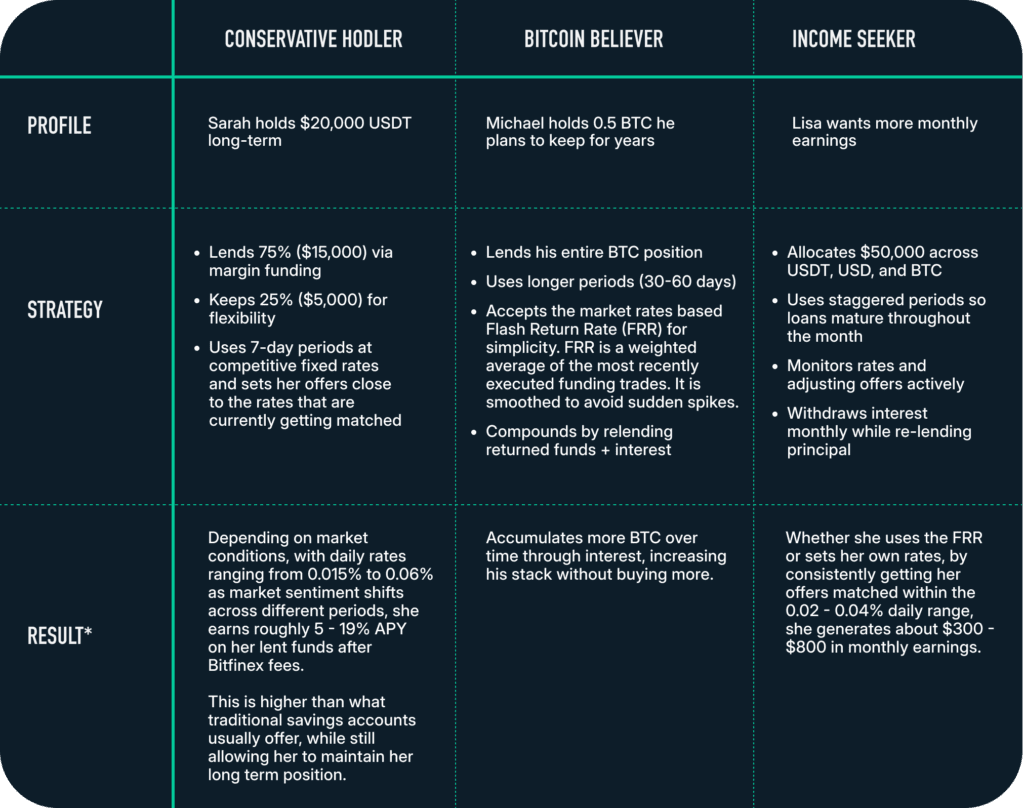

Real-World Scenarios*

\* The rates, periods, amounts and returns set out above are hypothetical and provided for illustrative purposes only. Actual earnings, interest rates or other results may differ. Bitfinex makes no guarantees regarding the amount of earnings, interest rates or other results. The peer to peer lending market on the Site is available only pursuant to the Terms of Service.

How Does Margin Lending Work on Bitfinex?

Prerequisites: Margin Trading, Margin Funding and Bitfinex Borrow require at least Intermediate level verification for all Bitfinex accounts created after March 1, 2022. Make sure your account verification is complete.

Step 1: Transfer to Funding Wallet

Move the currency you want to lend from your Exchange or Margin wallet on Bitfinex to your Funding Wallet. This is a simple internal transfer with no fees. Popular choices include:

USDT/USD: Generally highest demand and most stable rates

BTC: For Bitcoin holders wanting to earn in BTC

ETH: Second most popular crypto for lending

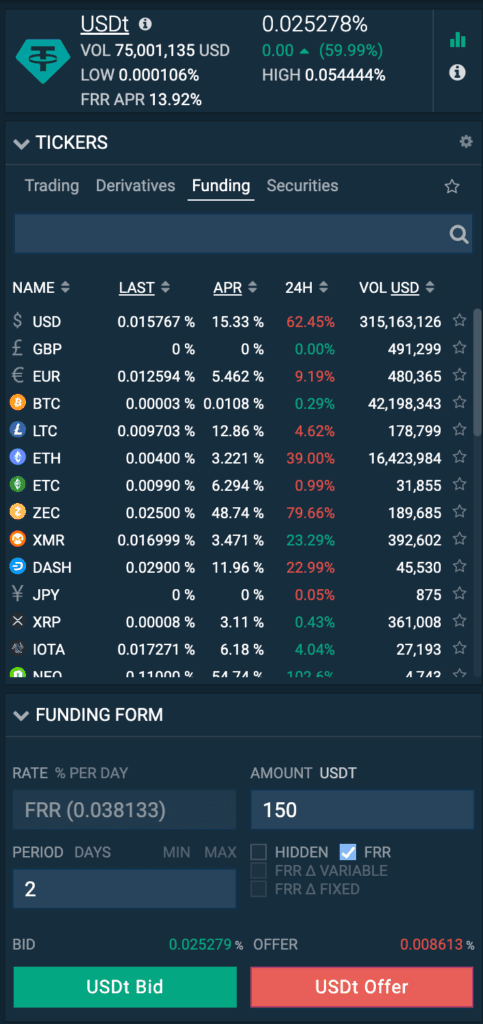

Step 2: Go to Funding

On the top navigation bar, click Funding

Select Funding (not Bitfinex Borrow)

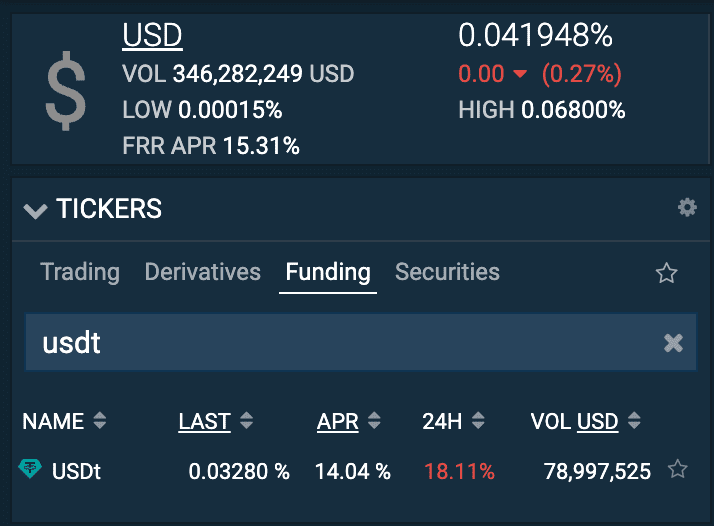

Choose the currency you want (USDT, USD, BTC, ETH, etc.)

Step 3: Review the market

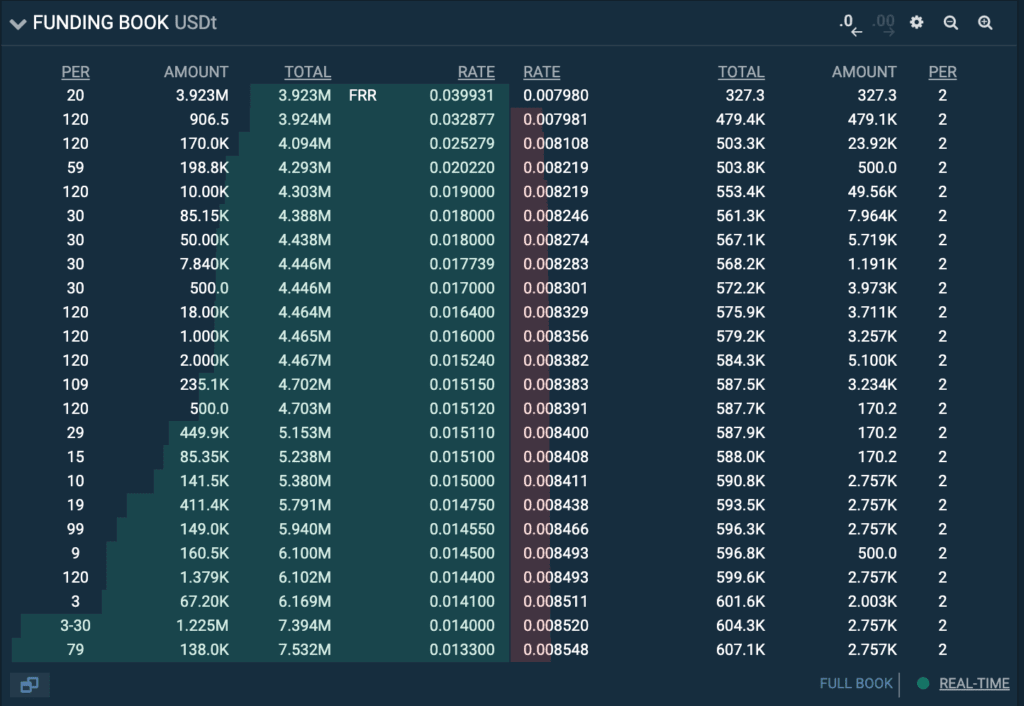

Before creating your offer, check the current market:

Green (bids): What traders/ borrowers are willing to pay

Red (offers): What other lenders/ sellers are offering

Look at the rates, amounts, and periods being requested

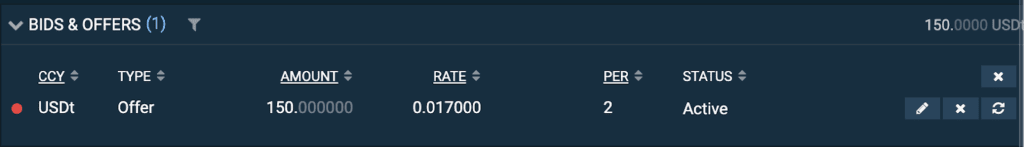

Navigate to the Funding Form and set your terms:

Amount: Minimum $150 worth

Rate: Choose between:

Fixed rate: You set a specific daily rate manually by entering the daily rate you want to receive and not checking any other boxes (Hidden, FRR, FRR Variables, FRR Fixed)

FRR (Flash Return Rate): This rate follows the market rate in the Bitfinex lending marketplace. If you select this option, your lending offers will be at the then current FRR when the loan is taken, but it stays fixed at that rate for the whole loan. (The FRR is based on the weighted average of the most recent funding trades, smoothed to avoid sudden spikes. This rate updates once per hour.)

FRR Variable: If you select this option, your rate will automatically move up and down along with the FRR and not be fixed during the term of your loan.

FRR + Delta: This allows you to make loans based on the FRR, but with a bonus for you or a reduction to make your loans more competitive. FRR with a custom offset (for example, FRR + 0.001). If you select this option, your lending offers will be at the then current FRR when the loan is taken adjusted by the offset you selected, and stays fixed at that rate for the whole loan.

Period: 2-120 days (most common: 2, 7, or 30 days)

Pro tip: Check what rates are getting filled. Setting your rate slightly more competitive than others increases the chance of quick matching.

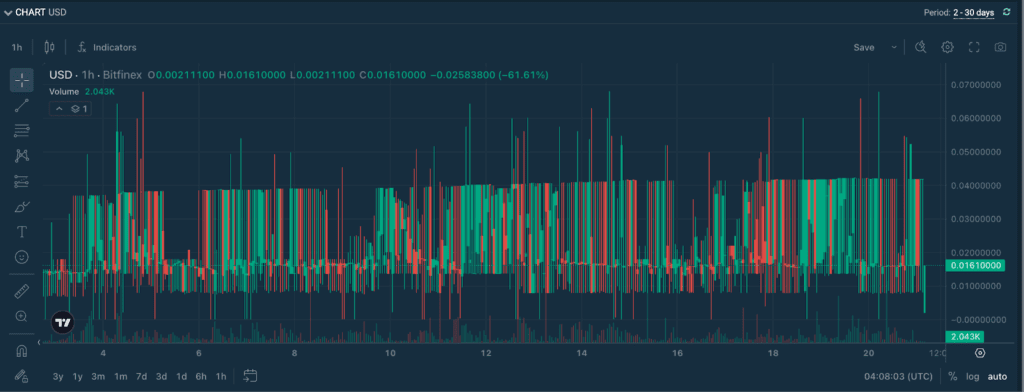

Bonus: Use the chart to see historical funding rates, matched funding volume, and FRR APR:

See the main chart for historical funding rates. You could also add indicators like Moving Averages (MA) or Relative Strength Index (RSI) to better filter volatility and average highs.

See top left for volume and FRR APR*.

*FRR APR = FRR daily x 365

Step 4: Order Matching & Earnings

Your offer goes into the funding order book.

When a borrower’s bid matches your offer terms, the funding is provided automatically.

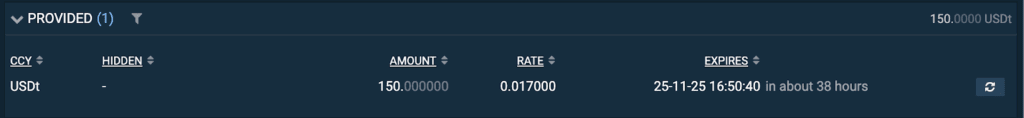

Once matched, you’ll be able to see the amount you are offering, the rate at which interest will be calculated, and when the funds are scheduled to return to you. Interest accumulates daily and is credited around 01:30 AM UTC.

Step 5: Monitor & Collect Under “Provided”, track your active loans, interest earned, and time remaining. When the loan period expires or the trader closes their position early, your principal plus accumulated interest returns to your Funding Wallet, ready to be lent again or withdrawn.

Understanding the Numbers

Interest rates on Bitfinex are quoted as daily rates, but it may be easier to think in annual terms.

Example:

You lend $10,000 USDT at a daily rate of 0.06%

Daily earnings: $10,000 × 0.06% = $6.00 per day

Annualized rate: 0.06% × 365 = 21.9% per year

As a funding provider, you receive the interest paid by the trader borrowing your funds. Bitfinex deducts a 15% fee from your earned interest (or 18% for hidden orders).

So your actual daily earnings would be:

$6.00 × 0.85 (after 15% fee) = $5.10 per day

Approximately $1,861.50 per year on a $10,000 loan

Understanding the Risks and Why “Whales” Choose Bitfinex

While margin lending on Bitfinex has protective mechanisms, it’s important to understand the potential risks:

1. Extreme Market Volatility

In theory, if the price changes dramatically losses could be incurred by margin funding providers. Think of extreme scenarios like flash crashes or “black swan” events where liquidation mechanisms can’t execute fast enough.

There’s a reason Bitfinex has been the platform of choice for institutional traders and “whales” since 2012. Margin lenders have never suffered losses from lending in the 13 years that Bitfinex has been in operation, even during events such as the 2020 COVID crash, the 2021 Evergrande crisis, and the 2022 Luna collapse. Our multi-layered liquidation engine is designed to protect lenders first and has a track record of doing just that.

2. Platform Risk

While Bitfinex’s security infrastructure, regular proof-of-reserves, and conservative risk management have earned the trust of the world’s largest crypto traders, like any exchange-based activity, there’s inherent platform risk to margin lending. Your funds remain on an exchange while lent out, so standard exchange security considerations apply.

3. Opportunity Cost

If you lend your cryptocurrency at a fixed rate and market rates spike dramatically, you’re locked into your original rate until the loan period expires or is repaid. This is simply the nature of fixed term lending. That said, Bitfinex’s funding market offers both fixed and flexible rate options, which can adjust more quickly to changing market conditions. It also allows for shorter loan periods (2-7 days) so you can stay nimble. Once a short-term loan expires, you can update your fixed rate to match the latest market conditions. This is why many lenders tend to prefer shorter durations: they get to refresh their offers more often and stay aligned with where the market is heading.

Bitfinex is among the few major exchanges that offer a true peer to peer funding market driven entirely by supply and demand. You choose your rate, your amount, and your loan duration, with terms as short as two days. Some other exchanges offer yield products where the platform dictates the terms and rates and customers have much less control.

4. Market-Driven Returns

There is no deposit insurance and funding returns are determined by market demand for leverage. In slower markets, offers may not be matched immediately. Bitfinex hosts an active margin trading community, which often leads to consistent borrowing activity however, there are no guarantees. Borrower demand usually rises when volatility picks up, and funding rates can reflect that shift more dynamically compared with traditional yield products.

Frequently Asked Questions (FAQ)

1. Can I change or close my funding offer early?

Once your funding is matched and active, it cannot be recalled early by you. You must wait until the loan expires or until the borrower returns the funds. If your offer is still pending in the order book, you may cancel or modify it at any time.

2. How does Bitfinex match lending orders?

Margin Funding is a marketplace which matches borrowers and lenders on a rate-priority + duration-compatibility basis:

Lower-rate offers tend to be matched first

Your maximum duration must be equal to or longer than the borrower’s requested duration

FRR (Flash Return Rate) offers adjust automatically, but are not guaranteed to match immediately; they are filled only when the market borrowing rate meets or exceeds the FRR level

Manual fixed-rate offers only fill when borrowers accept the specified rate

Partial fills may occur, and lenders provide liquidity to a number of different borrowers rather than to a single borrower.

3. How can I improve my lending returns?

Returns depend on market demand. Common strategies include:

Using shorter durations (2–7 days) to capture rate movements

Mixing manual fixed-rate offers (select current matched rates) with FRR for flexibility

Taking advantage of high-volatility periods

Using automated tools or bots that help adjust rates and durations dynamically

Shorter-term offers often capture market spikes more effectively.

4. Are there any fees for providing funding?

Lenders do not pay fees to offer funding. Borrowers pay interest, and Bitfinex takes a percentage of the funding earnings as the platform fee. See our fees page for more details: https://www.bitfinex.com/fees/.

5. What happens when my loan expires?

At expiration, funds return to your Funding Wallet. If Auto-Renew is enabled, Bitfinex automatically routes a new lending offer on your behalf based on the settings you selected (i.e., the same settings are your previous loan). Fixed-rate loans cannot be adjusted mid-term, even if market rates rise.

6. Can I use third-party lending bots?

Bitfinex supports third-party integrations through API keys, and many advanced customers choose lending bots to automate rate adjustments and improve capital efficiency.

However, please keep in mind:

Bitfinex does not endorse, certify, or guarantee any third-party tools

Customers are fully responsible for granting and managing their own API permissions

We strongly recommend using API keys with limited permissions and reviewing the bot provider’s security practices

If switching bots, you may generate a new API key at any time

Many experienced lenders find these tools helpful in automating their strategies, but proper caution and risk management are important when using any external service.

Ready to start earning?

Margin lending on Bitfinex presents an opportunity for cryptocurrency holders to put their idle assets to work. Whether you’re earning daily interest on stablecoins or accumulating more cryptocurrencies through lending, margin lending provides a flexible tool to increase the potential of your crypto holdings.

For more information about Margin Funding on Bitfinex, please visit our Help Center:

https://support.bitfinex.com/hc/en-us/sections/900000425526-Margin-Funding

Important Note:

You should not construe the information provided in this post as financial, legal or other advice. The information provided in this post is not an offer to borrow or lend. It is also not the solicitation, recommendation or endorsement of any course of transacting. The information provided in this post is for information and illustrative purposes only. Any references to earnings, interest rates or other results are hypothetical and not guaranteed. Actual earnings, interest rates or other results may differ. Bitfinex makes no guarantees regarding the amount of earnings, interest rates or other results. The peer to peer lending market on the Site is available only pursuant to the Terms of Service.

The post appeared first on Bitfinex blog.