What is DeFi

First things first, just what is DeFi? The abbreviation is short for decentralized finance, which as the name implies, involves decentralized and distributed networks and cryptocurrencies. Some popular DeFi blockchains are of course Ethereum, which is the most well known, and some others like Uniswap or Chainlink.

Each blockchain network may have it’s own purpose, different from another, all contributing to the overarching DeFi ecosystem. By having multiple use-cases and focus-areas of these blockchain networks, they all make up one big system of DeFi. Another common term for DeFi is also, “open finance.”

One of the ways that the cryptocurrency space is able to have DeFi is through the use of smart contracts. Smart contracts is just a fancy way of saying automated ways to execute transactions on a blockchain if certain conditions are met. At a very high level, let’s say for example, Alice wants to sell David a digital banana. If Alice puts up her banana for sale for $5, and David pays the $5 for it, the ‘smart contract’ will automatically take the funds and send it to Alice and then send David the banana.

Smart contracts can do very complex things though, such as issuing insurance contracts, helping supply chains, feed into data oracles, provide digital rights and more.

Why is DeFi popular

When you take into consideration all the things that can happen under the umbrella of DeFi, it’s not hard to see why it is so popular. There have been many applications, tools, and coins, built around DeFi.

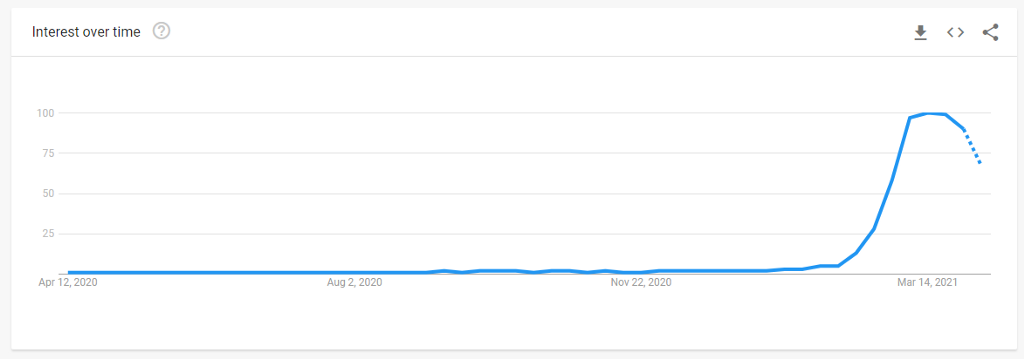

For example, one of the biggest trends recently has been with non-fungible tokens (NFT). According to Google Trends, the search trends for NFT skyrocketed recently, reaching a climax in mid-to-late March 2021, with it starting to decline as the hype has slowed down a bit.

NFTs have made big news lately, for example digital artwork was sold by the artist “Beeple” to the tune of $69 million. There are other uses for NFTs such as collectibles, music, and sports.

Other reasons fueling the demand for DeFi are specific coins that are doing new and innovative things, such as Uniswap (UNI) which is a decentralized exchange. Another coin driving DeFi hype recently is Filecoin (FIL), which is a decentralized file storage system, used heavily by NFTs. Chainlink (LINK) has also seen a big surge during this bull run, which is a oracle network used often in various decentralized finance applications.

According to CoinGecko, the total market cap for DeFi as of this writing is $105 billion, with a total value locked (TVL) of $82 billion, as pictured above.

What does the future hold for DeFi

There are many more possibilities within the spectrum of DeFi, many of which are being fleshed out. For example lending platforms such as AAVE are becoming more and more popular, and one that isn’t as popular but may take off is prediction markets. There may be new applications that have yet to be thought of, and use cases that may come to the surface later, which is one of the reasons why DeFi is taking off, because of all the new and exciting possibilities.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.