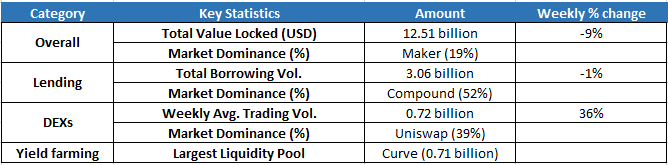

Maker continued its leadership in the DeFi sphere with a 19% market dominance level. Compound, meanwhile, maintained its market dominance in the lending sphere with a 52% share.

The weekly average trading volume of decentralized exchanges rose by 36%, and Uniswap maintained its trading volume dominance of 39%. Curve replaced SushiSwap as the largest liquidity pool this week.

Ethereum 2.0’s Phase 0 launch is highly anticipated

The DeFi community is eagerly anticipating the Ethereum 2.0 Phase 0 launch that is likely to happen, as planned, on Dec. 1. The Ethereum protocol upgrade, also known as Serenity, will transition the network to a proof-of-stake consensus mechanism, replacing the current proof-of-work model.

There are four phases of the Ethereum 2.0 upgrade. To activate the launch of the beacon chain, its deposit contract, released on Nov. 5, requires a deposit threshold of 524,288 Ether (ETH). As of the time of writing, 741,728 ETH has been staked in the deposit contract. According to Ethereum co-creator Vitalik Buterin, the beacon chain will be launched on Dec. 1.

The beacon chain is a PoS blockchain that runs in parallel alongside the existing Ethereum network. It will not impact existing users and DeFi applications on the Ethereum network. Validators will be the primary stakeholders of the Ethereum network, responsible for validating transactions. To become an Ethereum 2.0 validator, a user must stake a minimum of 32 ETH in the deposit contract.

A slow start for ETH deposits

After the initial launch of the Ethereum 2.0 deposit contract on Nov. 5, the progress to reach the deposit threshold was slow during the first two weeks. As of Nov. 17, just over 100,000 ETH was staked in the deposit contract — only 19% of the deposit threshold required.

The reason for the initially low participation in the process can be attributed to the uncertainty of withdrawal times for staked ETH. As noted by Codefi, if various DeFi protocols offer higher staking returns than Ethereum 2.0, ETH holders may stake their coins into DeFi protocols instead. Taylor Monahan, CEO of MyCrypto conducted an informal poll on Twitter and suggested that the majority of users would not consider Ethereum 2.0 as a worthwhile investment due to the uncertainty of withdrawal times for staked ETH.

Visit https://www.okex.com/ for the full report.

OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.