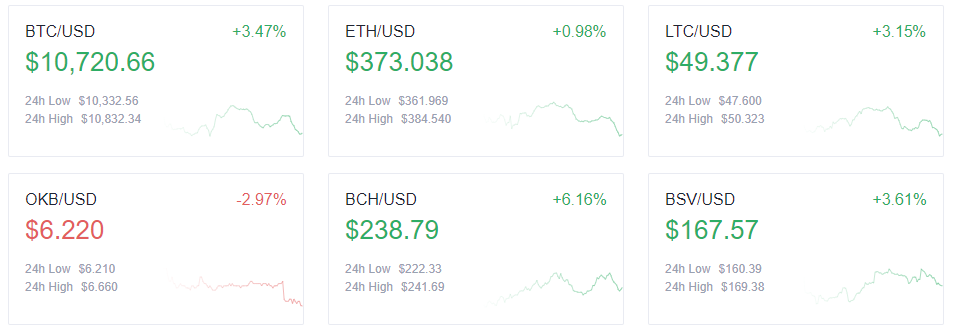

The global financial markets started the week on an optimistic note, helping push the price of Bitcoin (BTC) up 3.47% to above $10,700. At the same time, a weakening dollar and sliding United States bond yields helped the gold price record its biggest daily gain this month.

In the cryptocurrency market, major altcoins have also risen, with Bitcoin Cash ( BCH) and Bitcoin SV ( BSV) up 6.16% and 3.61%, respectively. Ether ( ETH) has pulled back after peaking at $385 overnight and is now trading at $373. Gas fees on the Ethereum network rose again last night as yield farmers moved around in search of higher yields.

The decentralized-finance sector underperformed, overall. The price of TRON ( TRX) was negatively affected as pressure from yield-farming project SUN’s upcoming unlock has made the market less confident in its price. TRX is down 4.35% alongside a sharp decline in various tokens within its ecosystem. For example, tBridge Token ( TAI) and Jackpool.finance ( JFI) lost 34.33% and 24.30%, respectively.

Native exchange tokens, which have been making waves in the DeFi sector these days, have retreated after a rapid rise over the weekend. OKB is down 2.97%.

The one exception in the DeFi sector was Nexus Mutual ( NXM), which gained 15.31% due to strong insurance demand from yield farmers. NXM has realized more than 130% over the last month.

The total cryptocurrency market capitalization increased by 3.1% and is back to $354 billion, as per data from CoinGecko. Meanwhile, BTC regained 0.4% of its dominance.

Top altcoin gainers and losers

ABT/USDT +28.31%

DIA/USDT +19.04%

PNK/USDT +18.93%

ZYRO/USDT -20.07%

JFI/USDT -24.30%

TAI/USDT -34.33%

ArcBlock ( ABT) is today’s biggest gainer and is up 28.31%. DIA and Kleros ( PNK) increased by 19.04% and 18.93%, as well.

The top three losers on today’s list are all DeFi tokens. In addition to two tokens in TRON’s ecosystem declining in value, ZYRO also fell 20.07%.

BTC technical analysis

BTC broke through the short-term key resistance level of $10,450 yesterday afternoon and saw increased volume on the breakout. The next resistance level is around $10,900 with an intraday threshold of $10,720.

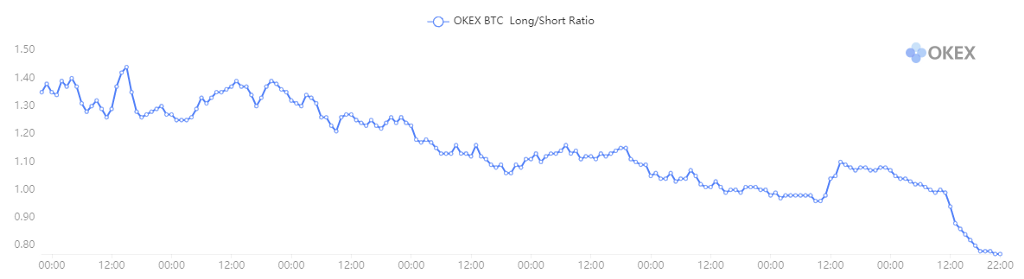

One interesting thing we’ve noticed is that the BTC long/short ratio continues to decline as prices keep moving upward. The ratio has been down from last Monday’s 1.40 to the current 0.77. We suspect this may be due to the current high yield on offer in DeFi.

More than 100,000 BTC has been moved to the Ethereum blockchain for arbitrage-seeking opportunities in yield farming, as per DeFi Pulse data. There is also a need to hedge these coins. However, a too-low long/short ratio is still noteworthy. When hedged short positions are closed, they will act as strong longs.

Visit https://www.okex.com for the full report.

Not an OKEx trader? Sign up and start trading today!

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.