To participate in the emerging cryptoeconomy, sign up for Coinbase today.

A war is brewing on the blockchain

Blockchain-based applications are open and transparent by default. This is beneficial because anyone can inspect the project and confirm that things are working as they should. But it comes with an interesting side effect. Because the source code is public, it’s also simple for anyone to copy existing projects (“fork” the project), change a few things, and release a competing platform.

As the DeFi ecosystem grows, some projects are beginning to enjoy strong product / market fit, with real revenue streams. So it’s no surprise that the community is now wrestling with the implications behind protocol wars — the ability for anyone to fork a successful project and try to steal their market share. Let’s look at an example.

The First Protocol War: Sushiswap vs Uniswap

Protocol wars kicked off in late August when an anonymous group of developers suddenly announced Sushiswap, a new Decentralized Exchange (DEX) copied almost entirely from Uniswap, but with one small tweak: Sushiswap would add a $SUSHI token, acting as both a governance token (holders can vote on proposals and modifications to the platform), as well as accruing 0.05% (5bps) of all trading volume on the platform.

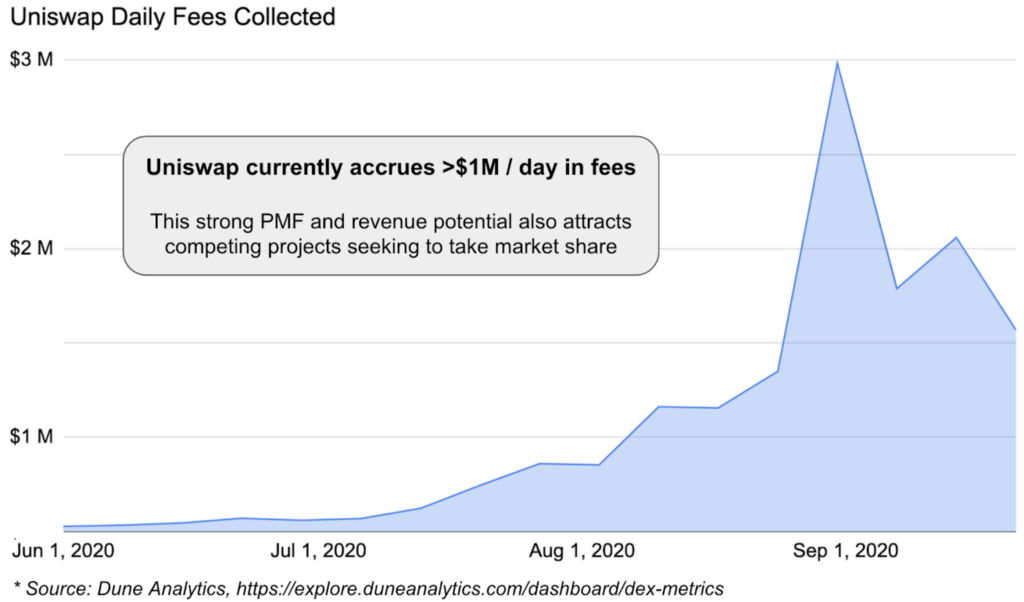

Adding the $SUSHI token wasn’t groundbreaking, but Sushiswap contends that their model provides better incentives for liquidity providers (LPs). If true, Sushiswap could gain more liquidity than Uniswap, leading to better trade execution for traders, and ultimately more volume for Sushiswap. This market is substantial as Uniswap is currently generating >$1M in fees per day (but paid primarily to LPs).

But there’s another wrinkle. Sushiswap also embraced yield farming as a fair token-distribution mechanism as well as a clever path to move Uniswap’s liquidity to Sushiswap. It works like this:

Supply liquidity (like ETH or USDC) to select Uniswap pools, which grants “Uniswap-LP-Pool-Tokens” that represent your share of liquidity in those pools

Deposit these Uniswap-LP-Pool-Tokens into a Sushiswap contract (“staking” them), and Sushiswap will supply a pro-rata portion of $SUSHI tokens as they are distributed. This is how $SUSHI is introduced to the market — given to users who commit their liquidity to Sushiswap.

At a specified point in the future, Sushiswap’s smart contracts convert all staked Uniswap-LP-Pool-Tokens into Sushiswap-LP-Pool-Tokens, simultaneously redeeming all staked Uniswap pooled assets and depositing them in identical Sushiswap pools.

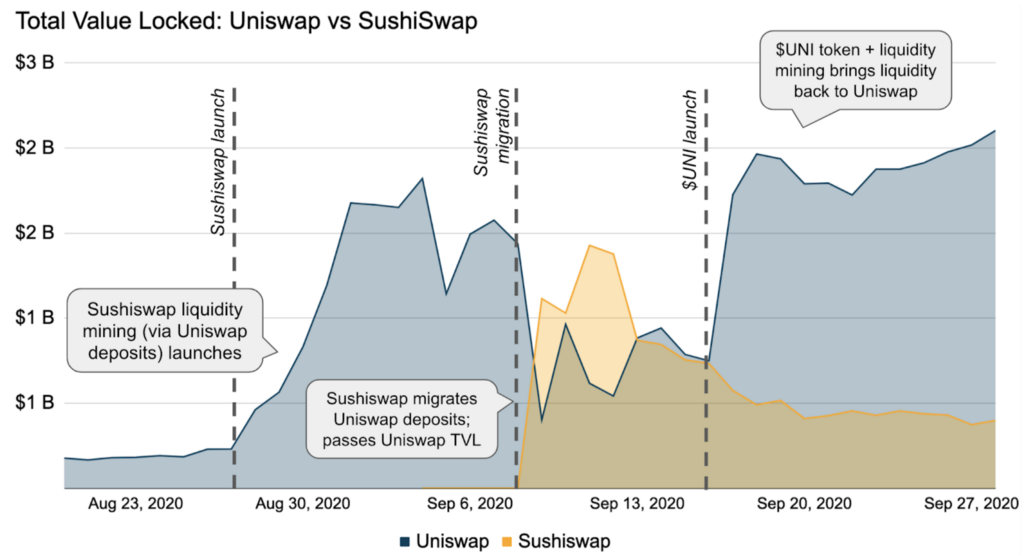

The end result? Uniswap’s liquidity would automatically migrate to Sushiswap, fueled by users seeking to receive their pro-rata share of $SUSHI tokens! Effectively bootstrapping a new DEX while simultaneously crippling the incumbent. An all-out liquidity war.

So what happened?

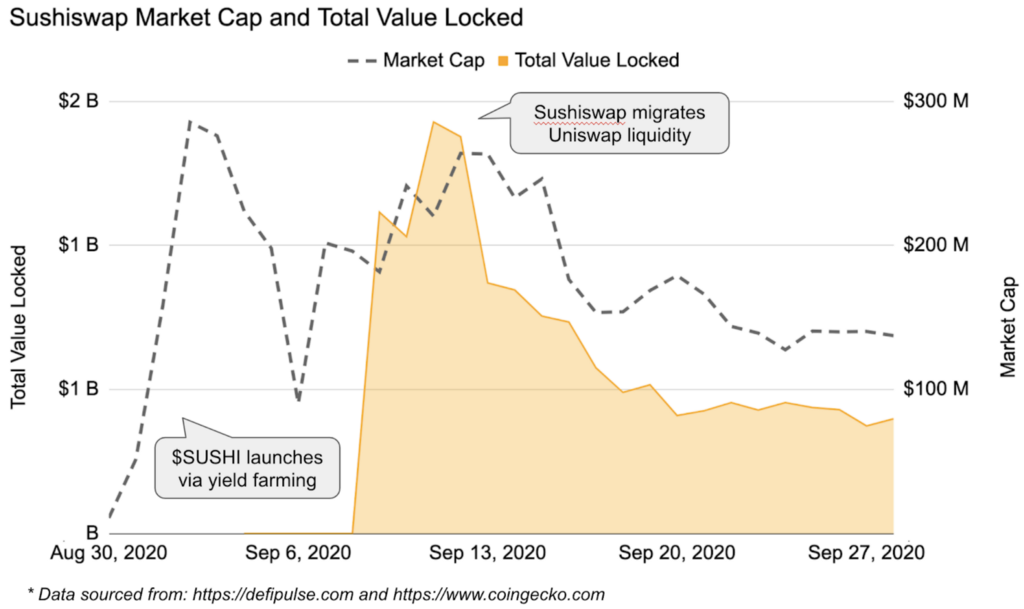

Enough for a small novella. In brief, nearly $2 billion in Uniswap-LP-Pool-Tokens were deposited to Sushiswap contracts, earning their depositors $SUSHI tokens. Yields for these Sushiswap stakers topped 1000% APY at times, driving the surge. Meanwhile, on the back of such strong deposits, $SUSHI was listed for trade on DEXs as well as some centralized exchanges and quickly appreciated in value, hitting $300M in market cap.

Then it all started to unravel over the next week. The price began to drop as more and more tokens were minted to yield farmers, some of whom were only interested in selling them as fast as possible. The drop prompted the anonymous lead developer (“ Chef Nomi”) to sell a $14M chunk of $SUSHI tokens to secure long-term funding. However this was a shock to the community and a betrayal of trust (he previously committed to avoid selling any tokens), and he was ousted from the project (later issuing an apology and returning the funds).

But the damage was done. While Sushiswap successfully migrated Uniswap’s liquidity and launched their exchange, the initial energy and enthusiasm had waned. To Sushiswap’s credit the project has now taken on a life of its own, targeting potential integrations with other blockchains like Solana, and charting their own path.

Interestingly, Uniswap didn’t take the attack lying down. While they previously didn’t have a native token, one could argue it suddenly became a critical disadvantage. So on September 17th, they unveiled $UNI as a governance token and promptly airdropped ~$1000 in $UNI to every previous Uniswap user, rewarding past contributions as well as continued loyalty by also distributing remaining $UNI through yield farming.

Today, Sushiswap sustains a respectable $300M TVL, $40M / day volume, and $100M market cap. Not bad for a one-month old project, but dwarfed by Uniswap with $2.2B TVL, $300M / day volume, and $300M market cap. The first battle belongs to the incumbent.

Other Attacks

Where Sushiswap pioneered the movement, others have quickly followed. As a few notable examples:

C.R.E.A.M. forked Compound and Balancer

YAM and BASED modified Ampleforth

… and more

All these attacks occurred over the past two months, with varying degrees of success. But notably, none have been able to surpass the incumbent. However each project has managed to survive and take on a life of their own, with their own communities building new features to optimize their products to their market.

Implications: Protocol Wars and the Future of DeFi

The fact that none of these attacks have successfully overtaken an incumbent is reassuring. Consider the implications if Sushiswap succeeded — one could argue that they would simply be predicting their own demise by proving the model of a successful attack. It would give wind to the sails for another copy-project to simply attack Sushiswap in the same manner! But their inability to surpass Uniswap as of today is an early but important datapoint that true differentiation may be needed to win in the open market. And coincidentally, Sushiswap’s new roadmap suggests more ambitious features that could bring this necessary differentiation.

The deeper implication is that switching costs in DeFi could be larger than perceived. While it’s simple to copy code, you cannot copy a community, a brand, trust, or broader integrations and mindshare. But whatever the reason, customers seem to be drawn to Uniswap over others, helping retain their current lead.

A few other observations:

Fair-launch yield farming may not be sustainable for long-term growth: Protocol war attacks are fueled by distributing the majority (and sometimes the entirety) of tokens directly to users of the protocol. But long-term sustainability requires long-term incentive alignment. Once your tokens are distributed, how can you incentivize developers to keep building? Will a community be able to properly shepherd and navigate these nascent protocols over time? Difficult questions with a lot of possible answers, but it’s unclear today.

Community governance will be challenging: Decentralized projects embracing token-based governance are new constructs and likely to come with many tradeoffs. This is exacerbated with protocol-war projects, which are by definition new and require rapid community formation to be successful. As such, they are likely to more naturally attract short-term stakeholders who may not be long-term aligned.

Plutocracy or Democracy? In the case of Sushiswap, a wealthy fund is widely rumored to be heavily involved, staking millions of dollars and obtaining a significant allocation of $SUSHI, enough to exert strong control over the protocol’s future. Many implications here, but these projects may end up resembling plutocracies rather than democracies.

Anonymity has a dark side: Many of these projects have anonymous founders (ala “Chef Nomi”), which can be both good and bad — enabling anyone in the world to contribute and own part of a new protocol, but also potentially enabling bad actors to create malicious projects that exit scam by stealing all the funds through a hidden back-door.

In the end, this new era will be fascinating to watch. They resemble a twist on blockchain forks, like Bitcoin vs Bitcoin Cash or Ethereum vs Ethereum Classic — but with applications rather than blockchains. Similar to forks, these applications must rapidly garner a community, demonstrate a superior product, and hope to overtake the incumbents. But just as we have seen with blockchain forks, you cannot fork a community, its developers, the trust it has built, or its brand and mindshare.

This bodes well for the future of DeFi. It means founders who build unique projects and work hard to garner a lead in community and traction could have some defensibility against protocol war attacks. Ultimately encouraging more builders to create new projects and push DeFi forward.

To participate in the emerging cryptoeconomy, sign up for Coinbase today.

Quick Hits: Commentary on Notable News

News from Coinbase

News from the Crypto Industry

Gemini adds shielded Z-Cash withdrawals; leans into DeFi with 14 token listings; and launches in the UK

Institutional Crypto News

Kraken wins Bank Charter approval to become first crypto bank, headquartered in Wyoming

Baakt’s Bitcoin futures market hits all time high with daily volumes topping $100M

News from Emerging Crypto Businesses

Keep’s tBTC network relaunches to bring Bitcoin to the Ethereum Network

DeFi protocols surpass $10B in TVL; Uniswap becomes first DeFi protocol with $2B in total value locked

Ethereum 2.0 transition gets closer, Phase 0 proposal submitted

DeFi protocol bZx hacked again for $8M; attacker caught and returns funds

DEXs continue strong growth, volume hits $23.5B in September

The opinions expressed on this website are those of the authors who may be associated persons of Coinbase, Inc., or its affiliates (“Coinbase”) and who do not represent the views, opinions and positions of Coinbase. Information is provided for general educational purposes only and is not intended to constitute investment or other advice on financial products. Coinbase makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this website and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images provided herein are the property of Coinbase.

This website contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase, and Coinbase is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators.

was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.