At Binance, we’re always focused on delivering a better experience for our users. In jurisdictions where there’s increasing clarity on crypto regulations, many users care about reporting their crypto tax accurately and compliantly. To meet this need, Binance recently launched the Tax Reporting Tool*, a new API tool that helps Binance users keep track of their crypto activities.

With the Tax Reporting Tool, users can transfer their Binance transaction history to third party tax vendors of their choosing and obtain a real-time overview of their local tax liabilities. The Tax Reporting Tool is optional and simply serves as a connecting point to third party tax vendors, enabling users to stay on top of their tax requirements without compromising data privacy.

*The Binance Tax Reporting Tool is only available to Binance.com users.

To use the Tax Reporting Tool, simply select your respective applicable tax jurisdiction by integrating our API with your preferred third party tax vendors.

What The Tax Reporting Tool Means For You

Transfer your transaction history and records of capital gains and losses on Binance to third-party tax vendor tools

Integrate third party tax vendor tools and get a real-time overview of your local tax liabilities.

Use our Tax API import function to automatically pull transaction history and records from your financial year to help you file taxes.

Benefits Of The Tax Reporting Tool

Report your taxes quickly and easily.

Protect and control your financial data when requesting your transaction history

Integrate Binance’s reporting tool with your preferred third-party tax tools

How To Use The Tax Reporting Tool

You can use our Tax Tool Functionality API to generate statements and transaction records dating back to more than one financial year, and integrate with third-party tax vendors to file your taxes in seconds. Follow the steps below to get started, or read our in-depth guide here.

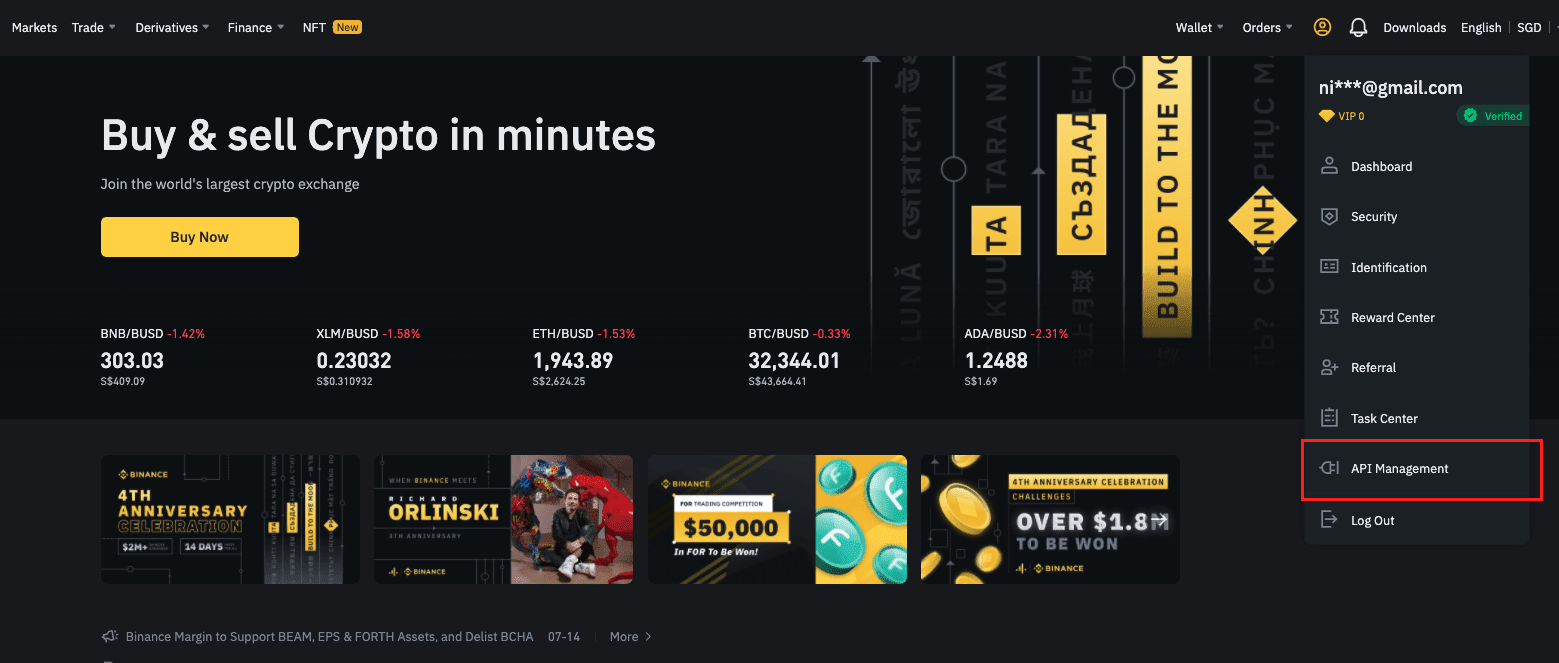

1. Log in to your Binance account and click [Account] - [API Management].

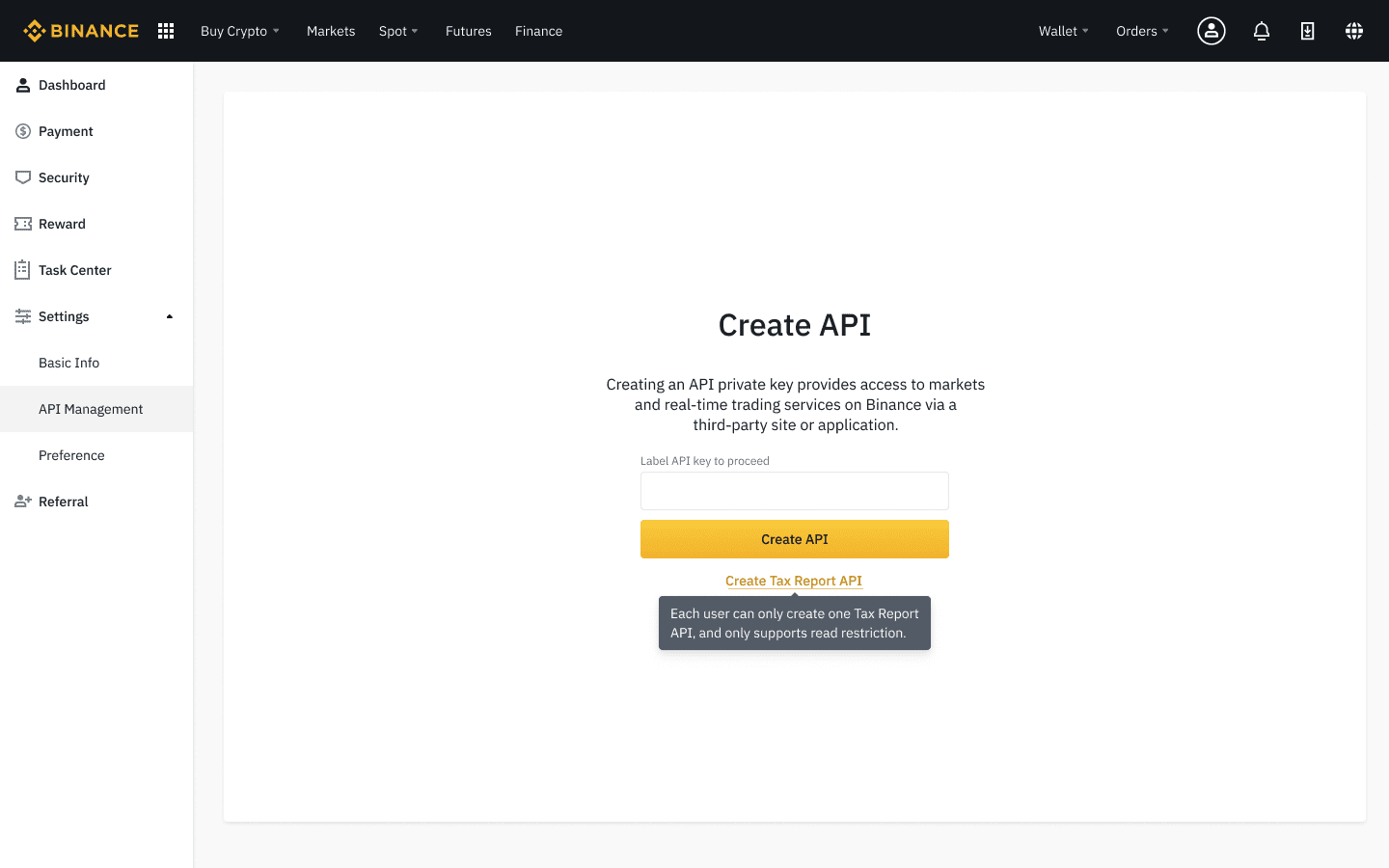

2. Click [Create Tax Report API].

Please note that each user can only create one Tax Report API, and the tax tool functionality only supports read access.

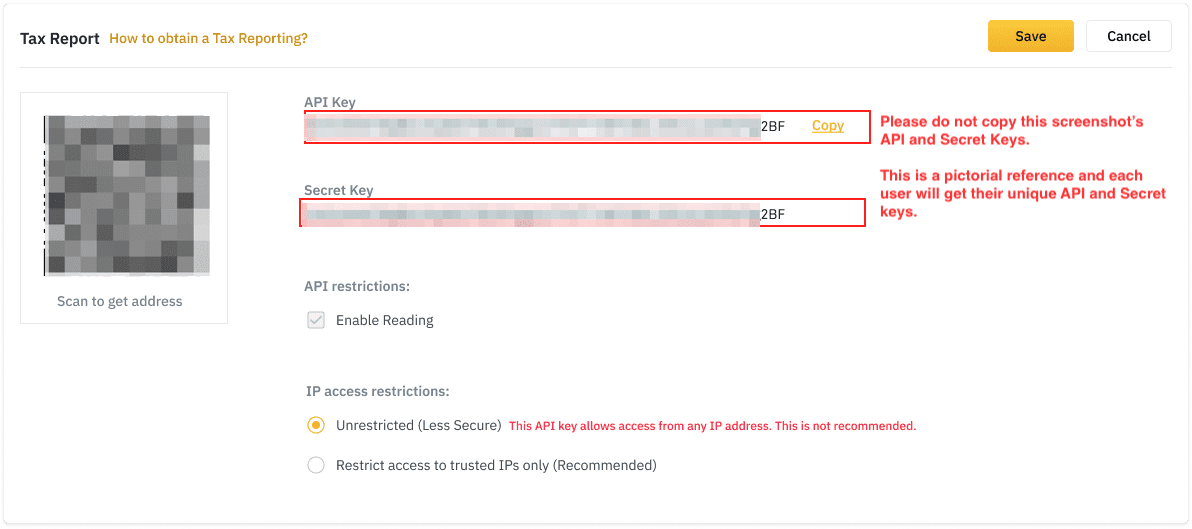

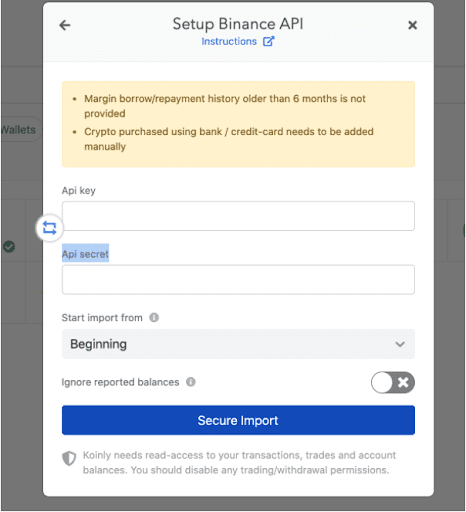

3. You’ll receive the unique API and Secret Key for your Tax Report. Please copy the keys if you want to integrate your tax report with a third-party tax vendor.

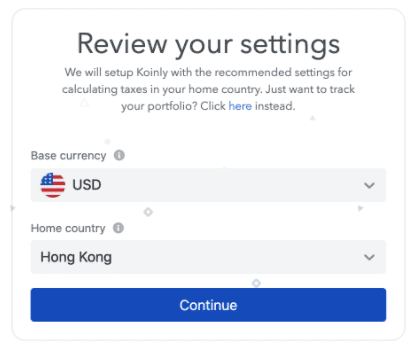

4. Select a third-party online tax reporting tool (i.e Koinly, BearTax) you would like to use. We’ll use Koinly as an example.

Note: Binance is not endorsing any particular third-party tax tool software. The guide and accompanying screenshots are only an illustration of the steps required to connect Binance’s tax reporting tool with your preferred third party tool. Please exercise your own discretion and/or consult your personal tax adviser based on your personal tax circumstances and requirements when choosing a third-party tool.

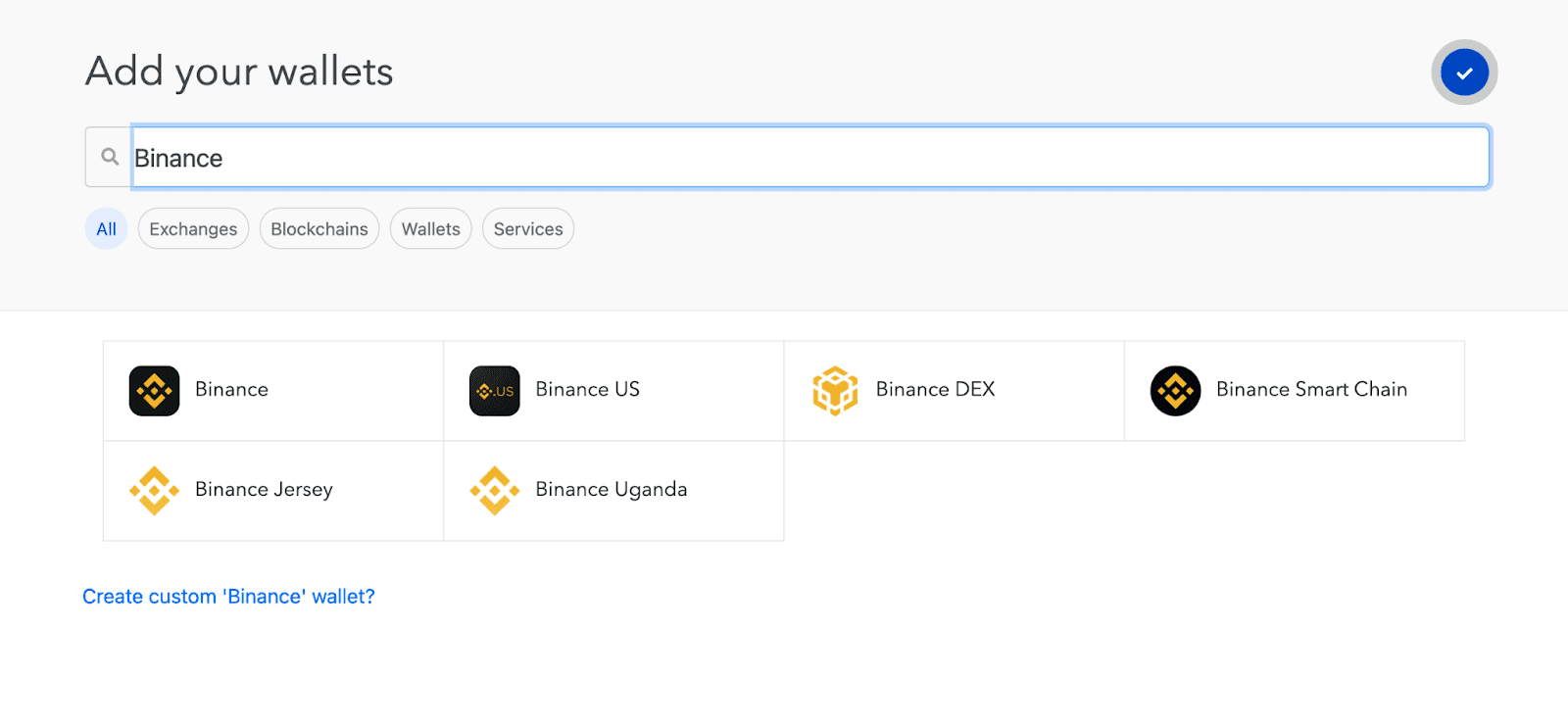

5. Go to [Wallets] and click [Add Wallet]. Select [Binance].

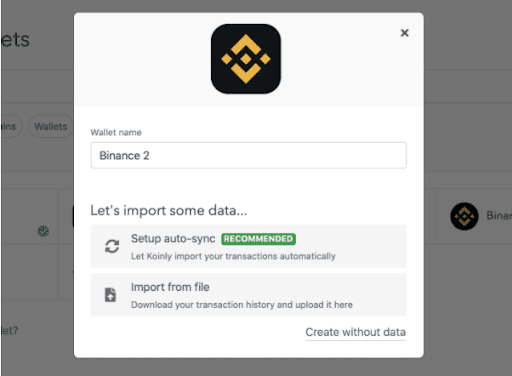

6. Label your wallet name, click [Setup auto-sync].

7. You will see a Setup Binance API pop up. Enter the unique API keys and Secret Key you received from the Binance Tax Report API. Then, click [Secure Import].

8. The API keys will automatically download your transaction history and keep your data in sync. Your tax forms will be ready soon.

Disclaimer: Binance does not provide tax or financial advice. Depending on the country's tax framework, when you trade commodities and the event produces capital gains (or losses), you may have to pay taxes. The regulatory framework for taxation of cryptocurrencies differs from country to country, hence we strongly advise you to contact your personal tax advisor for further information about your personal tax circumstances. It is your personal responsibility to select the correct tax jurisdiction that applies to you. By using this tool you hereby acknowledge that Binance is not marketing or soliciting you to trade but providing you with a tool for your own personal use and for your convenience.

Related articles:

- (Academy) How Is Cryptocurrency Taxed?