Ethereum and Solana Show Strength as Major Capital Rushes In

Ethereum and Solana have recently stood out in market performance. Data from HTX shows Ethereum(ETH) has risen from around 2,474 USDT in early July to a peak of 3,857 USDT, an increase exceeding 55%.

This significant rally is no coincidence. On-chain monitoring platform Lookonchain shows that between July 1 and 21, around 23 whales or institutions collectively purchased 681,103 ETH, worth about $2.6 billion, indicating that Ethereum is becoming a core accumulation target for institutional major capital.

Meanwhile, ETF inflows also signal high investor confidence. Trader T tracks a record net inflow of a staggering $297 million into ETH spot ETFs on July 21, accounting for 80% of Bitcoin ETF trading volume and marking the 12th consecutive day of positive inflows.

Moreover, Solana, once considered as “the Ethereum killer”, has also registered impressive rally. Per HTX data, the price of Solana (SOL) has risen from 157.8 USDT to 204.6 USDT with an increase of 29.6%. At the same time, various Solana ecosystem tokens are seeing notable gains: RAY (+21.01 %), PENGU (+20.5 %), JUP (+17.14 %), and AI16Z (+14.73%) over the last 24 hours as of July 22 at 10 AM UTC.

ETH and SOL’s uptrend isn’t limited to a few assets, rather, it’s a structural market signal: capital is rotating from Bitcoin into more volatile and growth‑oriented altcoins. The stage for “altcoin season” seems set.

Bitcoin Dominance Continues to Fall, While the Altcoin Season Index Strengthens

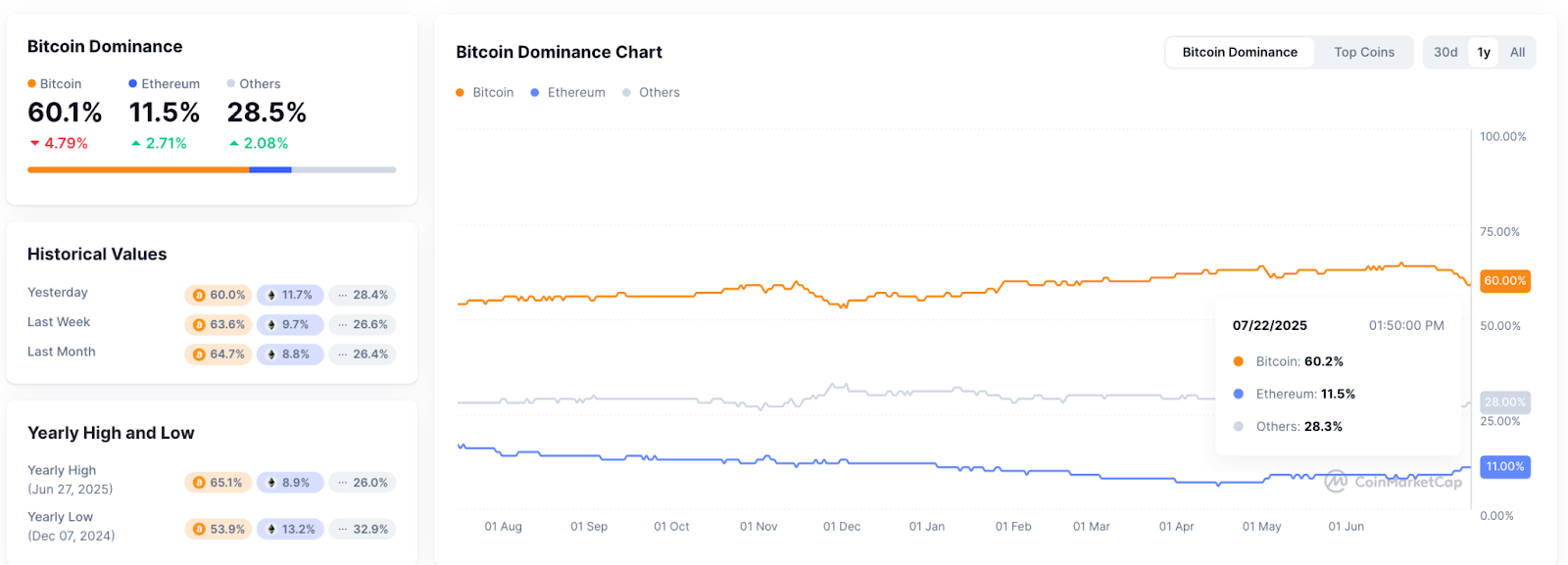

As ETH and SOL rally in turn, the market structure is subtly shifting. Bitcoin’s dominance is gradually being eroded, opening room for capital to flow into altcoins.

CoinMarketCap data shows Bitcoin’s dominance has dropped to 60.1%, marking a new low since March. Meanwhile, the Altcoin Season Index climbed as high as 55 on July 21 and currently stands at 50. The index indicates that roughly 50 of the top 100 cryptocurrencies have outperformed Bitcoin over the past 90 days.

According to Chloe (@ChloeTalk1), author of HTX DeepThink and research analyst at HTX Research, Bitcoin’s strong breakout to new highs has fueled market expectations for an “altcoin activation season”. Bitcoin’s rally, driven by its safe-haven appeal and status as a dollar-denominated credit asset—alongside rising Japanese government bond yields, a potential pivot in global interest rate trends, and bullish option market structures—provides a structural foundation for capital rotation from BTC to altcoins.

Market Outlook: The Real Altcoin Bull Market May Still Be Ahead

QCP Capital, in its latest market report, highlights several indicators suggesting an altcoin season may be quietly underway. The Altcoin Season Index has surpassed 50, reaching its highest level since December 2024. The passing of the GENIUS Act has established a clear regulatory framework for stablecoin issuance, prompting corporate treasuries to consider ETH, SOL, XRP, ADA and similar tokens as a new generation of crypto reserve assets. Besides, approval of a staked ETH spot ETF could further drive institutional capital shift from Bitcoin ETFs toward Ethereum, as seen by ETH spot ETF inflows surpassing BTC ETF inflows for two consecutive days last week, signaling significantly increased confidence from major firms like BlackRock. The options market is showing strong bullish signals, with significant call-spread positioning in Q4, reflecting a positive outlook for the end of the year.

Contract whale James Wynn forecasts a possible Bitcoin rally to around $145,000 by late July, followed by a sharp correction back to $110,000. And this will be followed by a strong altcoin bull market over the next 1–2 months, a true stage for FOMO to take hold. He also predicts Bitcoin’s long-standing dominance will be challenged, with altcoins rising steadily. If the Federal Reserve begins cutting rates in Q4, he believes Bitcoin could launch a new uptrend toward $160,000–$240,000.

The post first appeared on HTX Square.