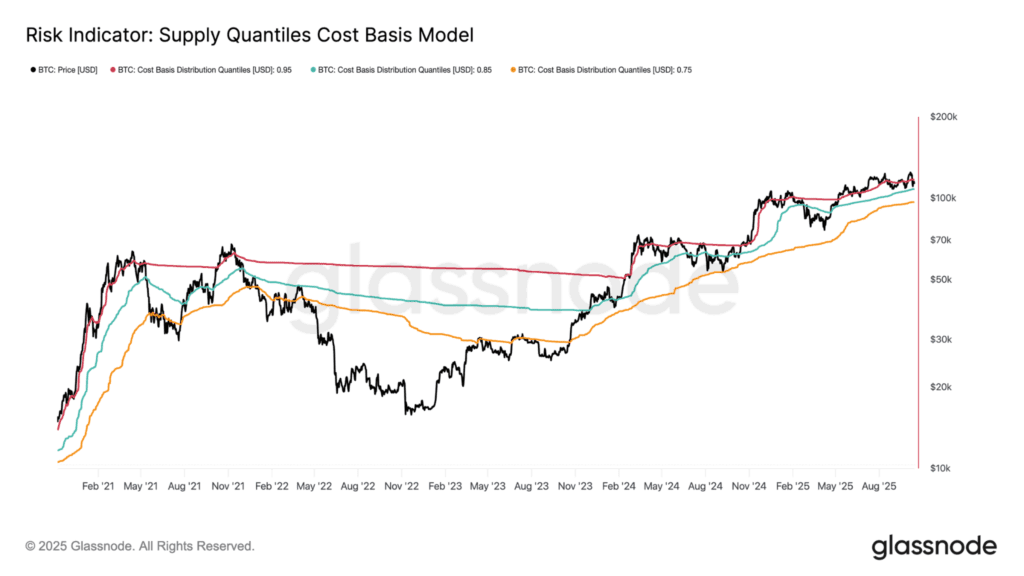

The 18.1 percent peak-to-trough drawdown we have seen this month remains consistent with prior cycle-high retests since 2023, typically marking consolidation phases rather than trend reversals. Yet, institutional demand has yet to return decisively. Bitcoin ETFs recorded over $1.22 billion in net outflows last week, mirroring equity market weakness. Long-term holders have also reduced supply by roughly 0.3 million BTC since July, signalling steady profit-taking while new inflows lag behind. For now, the $107,000–$108,000 zone remains a key inflection point. Failure to sustain above it would indicate demand-side fragility, potentially leading to further localised drawdowns before equilibrium is restored.

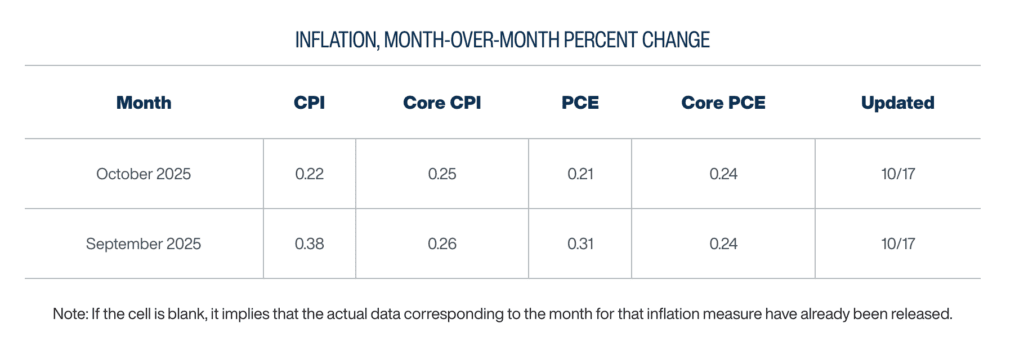

The US economy is entering a period of heightened uncertainty as the Federal Reserve is forced to operate without key data amid a government shutdown. With official reports on inflation, jobs, and spending suspended, policymakers are relying on private indicators to guide decisions ahead of the late-October meeting.

The economy shows neither clear weakness nor strength, leaving the Fed divided over whether to cut rates further. Markets are pricing in a 25 basis point cut, but tightening liquidity, volatile bond yields, and widening credit spreads reveal growing anxiety about a potential policy misstep.

Inflation remains stubbornly high, increasingly driven by tariffs rather than domestic demand. New trade measures have added roughly half a percentage point to core inflation, with food and durable goods prices rising sharply. Grocery costs are now the top source of consumer stress, keeping inflation expectations elevated and limiting the impact of future rate cuts. The manufacturing sector is feeling the strain, factory activity has contracted as input costs rise, while the housing market shows early recovery signs, thanks to lower mortgage rates.

Meanwhile, escalating US-China tensions have reintroduced global supply chain risks. New Chinese export restrictions and potential US tariffs of up to 100 percent threaten to disrupt trade flows and push costs higher. Although markets remain calm, supply-driven inflation risks are re-emerging as companies shift production to Mexico and Southeast Asia.

The US crypto landscape is rapidly maturing as institutions and policymakers move to integrate blockchain into mainstream finance. At the policy level, Florida introduced a bill that would allow up to 10 percent of the state’s public and pension funds to be invested in Bitcoin, tokenised assets, and crypto ETFs by 2026, a sign of growing acceptance of digital assets as legitimate portfolio diversifiers.

Meanwhile, Ripple announced a $1 billion acquisition of GTreasury, marking its expansion from blockchain payments into corporate treasury infrastructure. The deal aims to give Ripple more exposure to enterprise liquidity and cash management. Adding to the momentum, New York City has launched an Office of Digital Assets and Blockchain Technology, in an attempt to develop its own position as a potential hub for responsible crypto innovation and institutional adoption.

The post appeared first on Bitfinex blog.