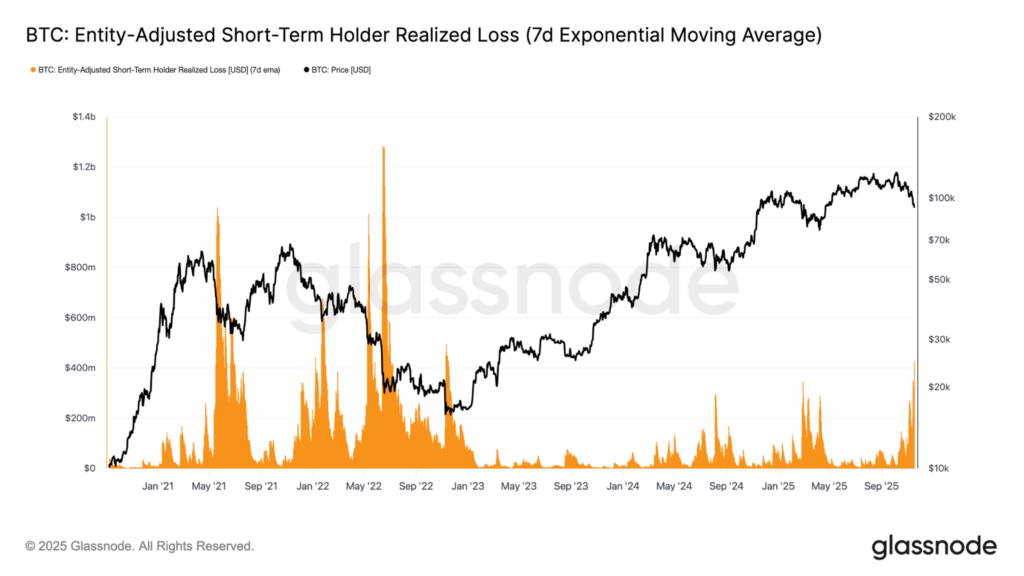

This downturn isn’t just visible on the chart; it’s embedded in on-chain behaviour. Short-term holders, typically the most sensitive cohort to volatility, are capitulating at some of the fastest rates since the FTX collapse in 2022. Realised losses for these recent buyers have surged to $523 million per day, underscoring how top-heavy the market had become in the $106K–$118K range.

The broader market dynamics are equally striking. Bitcoin once again topped out before equities, a pattern observed earlier in 2025, and could be a signal that traditional markets still have room to correct. In crypto derivatives markets, losses are still being keenly felt. Following the $19.2 billion of losses seen on October 10th, there was another $3.9bn last week. The scale of deleveraging highlights the deep stress radiating through futures and perpetual markets.

Seasonality, usually a reliable indicator, has offered no help. November is currently tracking at –21.3 percent, despite a decade-long history of averaging +40 percent gains, and October logged its first negative close in seven years.

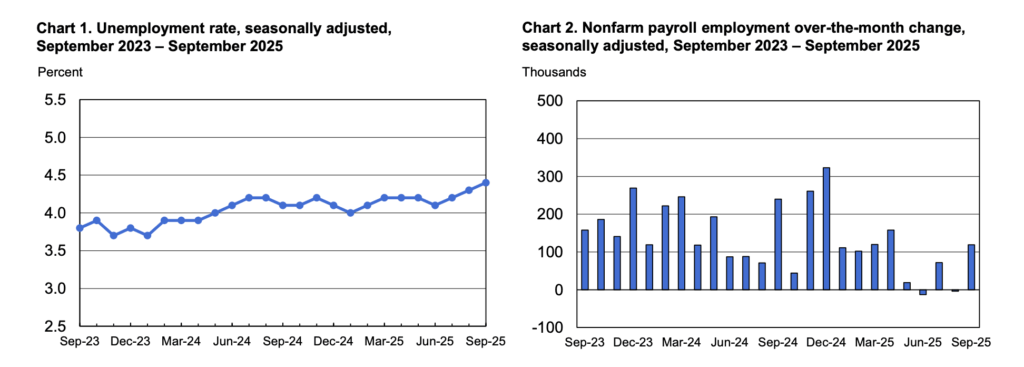

Meanwhile, the US economic landscape last week reflected a picture of moderation rather than momentum, marked by stable, but clearly cooling, labour conditions, cautious consumers, and persistent weakness in housing.

The long-delayed September jobs report showed stronger-than-expected payroll gains alongside a slight rise in unemployment, reinforcing the view that the labour market is slowing in a controlled manner. With no fresh inflation data available ahead of the December 9–10 FOMC meeting, these figures strengthen the case for the Federal Reserve to hold interest rates steady. At the same time, consumer sentiment weakened notably in November, revealing growing strain from tighter credit and reduced purchasing power, while dovish remarks from New York Fed President John Williams temporarily boosted market expectations for a December rate cut despite the lack of new data.

Housing indicators, however, remain firmly pessimistic: builder confidence stayed in contraction territory for a 19th consecutive month, buyer traffic remained weak, and price incentives intensified as affordability worsened. Overall, the economy continues to cool gradually under elevated borrowing costs, with policy uncertainty and fragile sentiment pointing to a challenging path ahead for both consumers and the housing market.

The past week in crypto saw meaningful moves across regulation, sovereign adoption, and corporate strategy. In the US, the White House advanced its review of an IRS proposal to join the OECD’s global Crypto-Asset Reporting Framework, signalling a push toward greater oversight of Americans’ offshore holdings. Meanwhile, El Salvador made headlines with a historic one-day purchase of 1,090 BTC, about US$100 million, deepening its long-term accumulation strategy despite controversy over its IMF loan commitments. Together, these developments underscore how regulatory convergence, sovereign positioning, and institutional restructuring continue to shape the evolving crypto landscape.

The post appeared first on Bitfinex blog.