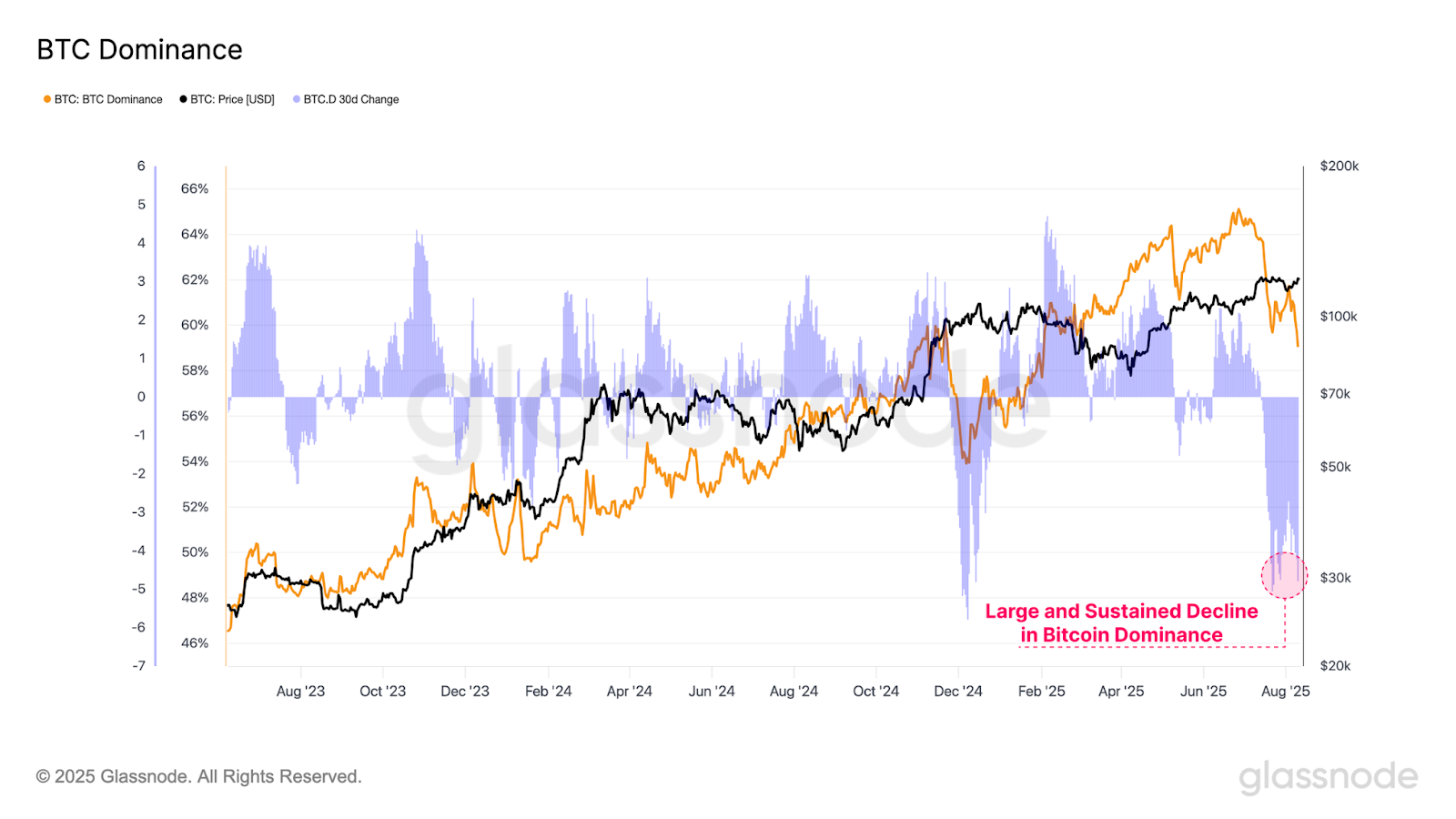

Ethereum has been the standout, climbing from $1,386 in April to $4,783 last week, within reach of its 2021 peak of $4,864. Its strength is fuelling risk rotation into higher-beta assets, reflected in Bitcoin dominance slipping from 65 percent to 59 percent over the past two months.

While this shift underscores growing speculative appetite, it also increases fragility across altcoins, where rallies remain short-lived without structural inflows. The majors continue to anchor institutional flows, leaving the broader market at a critical inflection point.

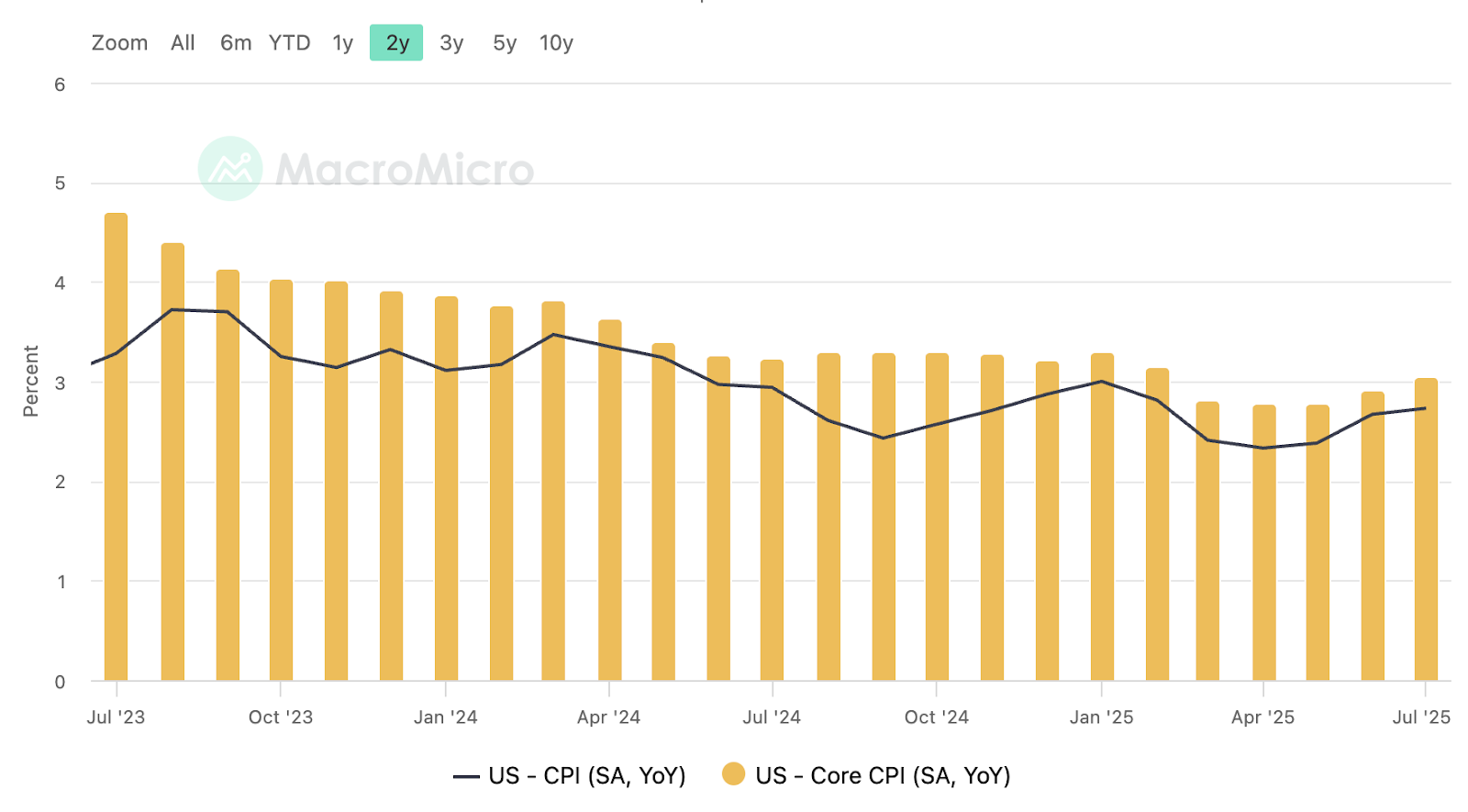

The latest US inflation reports underscored the persistence of price pressures, with both the Consumer Price Index (CPI) and Producer Price Index (PPI) highlighting how tariffs and service costs continue to strain households and businesses. July’s CPI showed headline moderation, largely due to falling gasoline prices, but core inflation climbed at its fastest pace in six months, driven by service-sector increases and tariff-linked goods.

Meanwhile, the July PPI revealed an even sharper squeeze on producers, with input costs rising more than expected and outpacing consumer price growth. This widening gap between producer and consumer prices signalled that profit margins are tightening, as businesses struggle to absorb tariff-related expenses while demand softens. Together, the reports depict a cycle of inflationary pressure building from both supply and demand sides, complicating the Federal Reserve’s path ahead of its September policy meeting. While markets initially focused on the softer headline CPI, the deeper details of the report suggest inflation is far from subdued, and expectations for swift rate cuts may prove optimistic as tariff-driven costs and service-sector stickiness weigh on the outlook for growth and corporate earnings.

Meanwhile, last week underscored how digital assets are becoming more entrenched in global finance. In the US, Treasury Secretary Scott Bessent confirmed plans for a Strategic Bitcoin Reserve built on confiscated assets, halting government BTC sales while exploring “budget-neutral” ways to expand holdings—a move that reduced supply overhang but spiked market volatility.

Hong Kong’s SFC, meanwhile, rolled out some of Asia’s toughest custody rules for licensed exchanges, mandating cold-wallet protections, whitelisted withdrawals, and real-time monitoring. The overhaul strengthens investor trust and aims to position Hong Kong as a leading regulated gateway for institutional crypto adoption.

On the corporate front, Gemini, the centralised exchange, filed for a Nasdaq IPO despite steep losses, revealing a restructuring that shifts US users to Florida and a $75M stablecoin credit line from Ripple. The listing would make it the third publicly traded US exchange, raising transparency and competitive benchmarks across the sector. Finally, the Federal Reserve ended its special oversight program for banks engaged in crypto and fintech, folding them back into regular supervision. Alongside similar moves by the FDIC, SEC, and OCC, this signals a shift toward mainstreaming digital-asset activity within the traditional banking framework, clearing the way for deeper institutional integration.

The post appeared first on Bitfinex blog.