Typically, traditional futures contracts settle on a monthly or quarterly basis. At settlement, the contract price converges with the spot price, and all open positions expire.

Perpetual contracts are widely offered by crypto-derivative exchanges, and it is designed similar to a traditional futures contract. Albeit, perpetual contracts offer a key difference.

Unlike conventional futures, traders can hold positions without an expiry date and do not need to keep track of various delivery months. For instance, a trader can keep a short position to perpetuity unless he gets liquidated. As a result, trading perpetual contracts are very similar to trading pairs on the spot market.

Since perpetual futures contracts never settle in the traditional sense, exchanges need a mechanism to ensure that futures prices and index prices converge on a regular basis. This mechanism is also known as Funding Rate.

What is Funding Rate?

Funding rates are periodic payments either to traders that are long or short based on the difference between perpetual contract markets and spot prices. Therefore, depending on open positions, traders will either pay or receive funding.

Funding rates prevent lasting divergence in the price of both markets. It is recalculated several times a day - Binance Futures does this every eight hours.

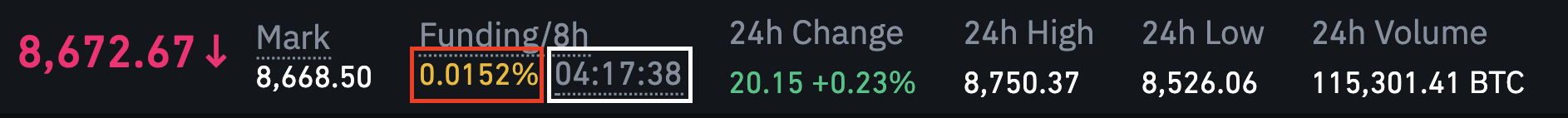

On our Binance Futures platform, funding rates (highlighted in red) and a countdown to the next funding (highlighted in white) are displayed as such:

Image 1 - Funding rate displayed on Binance Futures platform

Source: Binance Futures

What determines the funding rate?

The funding rate comprises two components: the interest rate and the premium.

On Binance Futures, the interest rate is fixed at 0.03% daily (0.01% per funding interval), with the exception of contracts such as BNBUSDT, LINKUSDT, and LTCUSDT, where interest rates are 0%. Meanwhile, the premium varies according to the price difference between the perpetual contract and mark price.

In periods of high volatility, the price between the perpetual contract and the mark price may diverge. In such instances, the premium increases or decreases accordingly.

A large spread equates to a high premium. Conversely, a low premium indicates a narrow spread between the two prices.

When the funding rate is positive, the price of the perpetual contract is higher than the mark price, thus, traders who are long pay for short positions. Conversely, a negative funding rate indicates that perpetual prices are below the mark price, which means that short positions pay for longs.

Funding rates are paid peer-to-peer. Therefore, Binance takes no fees from funding rates as they happen directly between users.

How does it impact traders?

As funding calculations consider the amount of leverage used, funding rates may have a big impact on one’s profits and losses. With high leverage, a trader that pays for funding may suffer losses and get liquidated even in low volatility markets.

On the other hand, collecting funding can be very profitable, especially in range-bound markets.

Thus, traders can develop trading strategies to take advantage of funding rates and profit even in low-volatility markets.

Essentially, funding rates are designed to encourage traders to take positions that keep perpetual contract prices line in with spot markets.

Correlation with market sentiment

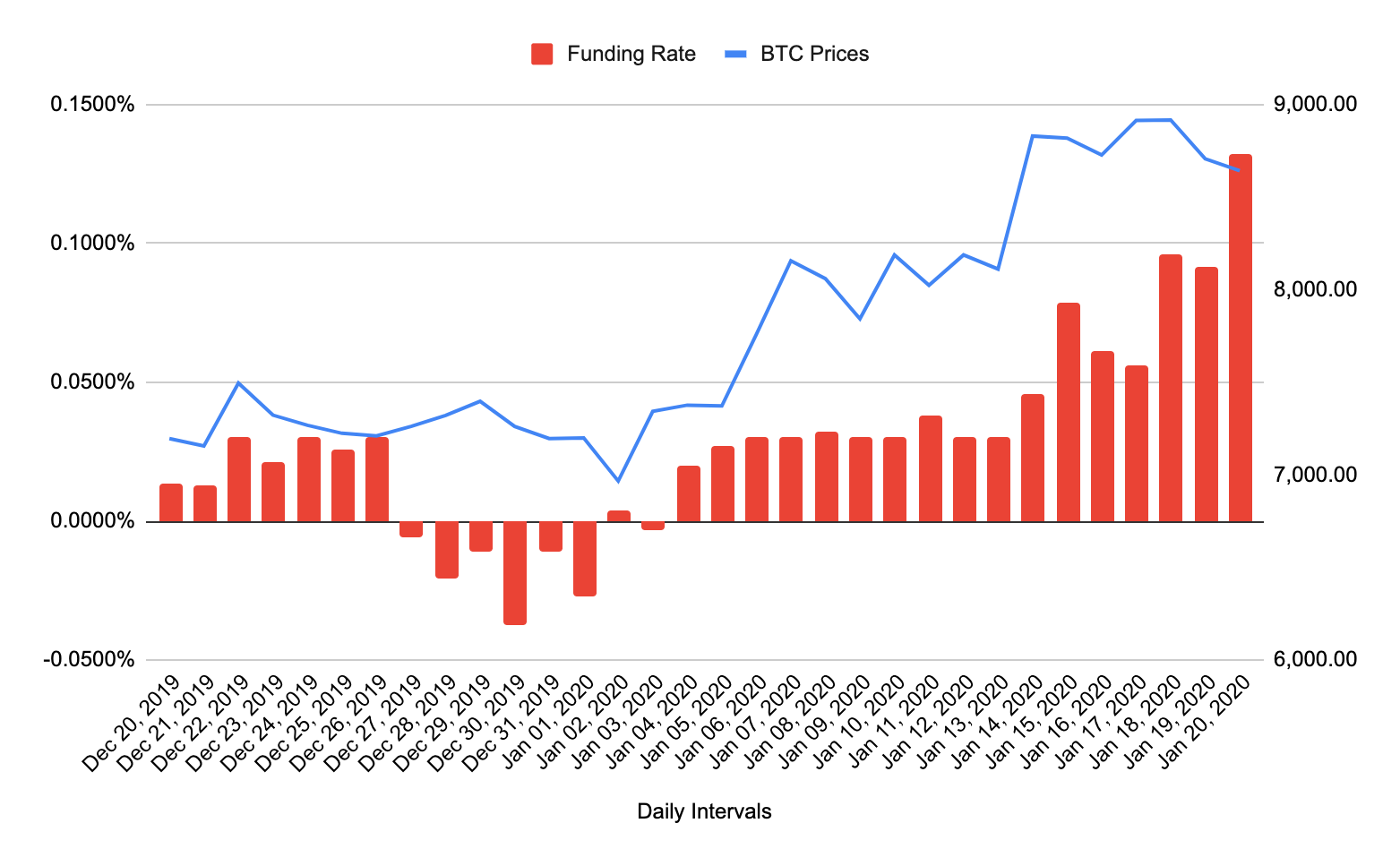

Historically, funding rates tend to correlate with the general trend of the underlying asset. The correlation does not indicate that funding rates dictate spot markets, but rather the reverse is true. The chart below shows the correlation between funding rates and spot BTC prices in a 30-day period:

Chart 1 - Correlation between funding rates and change in BTC prices

Source: Binance Futures, Data from December 20th, 2019 to January 20th, 2020.

As shown in Chart 1, funding rates doubled as BTC prices rallied since the start of the year. The increased funding rate encouraged traders to go long perpetual contracts, thereby keeping prices in line with spot markets.

Comparison of historical funding rates across crypto-derivatives platforms

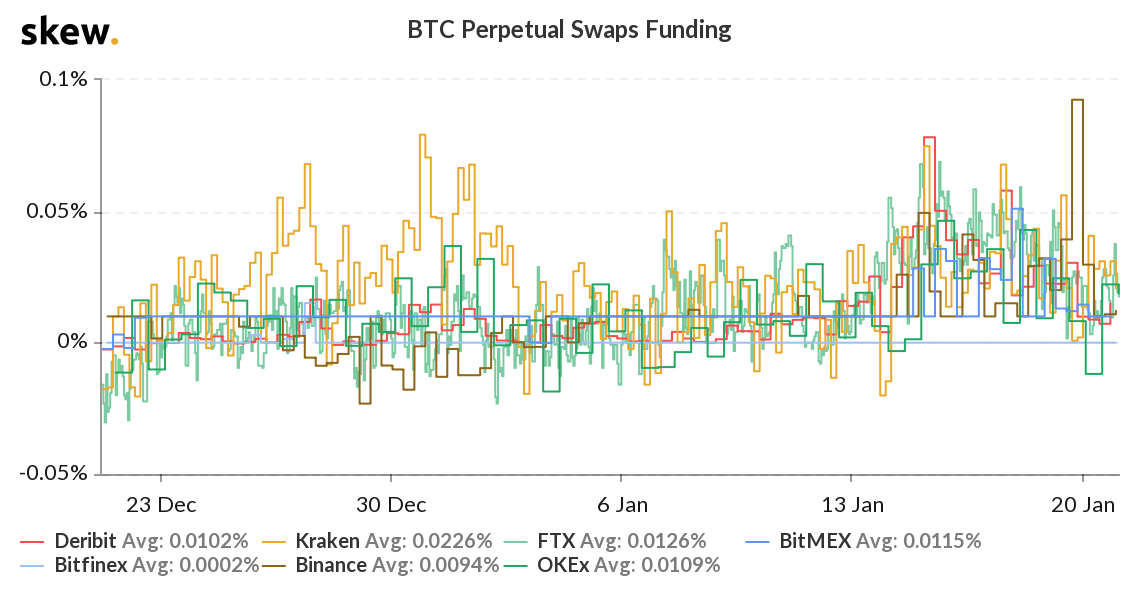

Presently, seven major exchanges offer perpetual contracts. In general, traders prefer platforms that provide the lowest funding rate as it can have a significant impact on profits and losses. Here is a quick comparison of funding rates across major exchanges:

Chart 2 - A 30-day period of historical funding rate across major platforms

Source: Skew.com, Data as of December 21st, 2019, January 21st, 2020.

In general, funding rates averaged at 0.015% across major exchanges. As mentioned, these rates vary based on changes in the price of its underlying asset.

According to Skew, historical funding rates on Binance Futures are lower than the industry average, with a mean of 0.0094%. For instance, a trader pays $9.4 for a $100,000 position on Binance Futures, while on other platforms, funding rates can be 10-20% higher.

How does Binance Futures maintain a low funding rate?

One of the key reasons why Binance Futures has been able to maintain a low funding rate is due to the ease of arbitraging between spot and futures markets.

Crypto markets never sleep. Thus, arbitrage opportunities exist continually. Binance Futures allows traders to switch between the spot and futures markets easily and quickly, enabling them to capitalize upon these opportunities.

As such, inefficiencies between perpetual contracts and mark prices are arbitraged away, resulting in a narrow spread between the two prices. Although extreme volatility may cause occasional spikes in funding rates, arbitrageurs will seize these opportunities quickly. Thus, funding rates eventually reverts to its mean.

On other exchanges where arbitraging is more restrictive, funding rates tend to be higher. This is due to restrictive transitions between spot and futures markets. For example, some exchanges limit the number of transfers that can be done in a day.

Conclusion

Funding rates serve an important role in the perpetual futures market. Most crypto-derivatives exchanges employ a funding rate mechanism to keep contract prices in line with the index at all times. These rates vary as asset prices turn bullish or bearish and are determined by market forces.

Additionally, funding rates also differ across exchanges - on some exchanges, these rates remain persistently high. In contrast, others like Binance Futures maintain a low funding rate. This is mainly due to differences in trading platform features across exchanges. On exchanges that allow a smooth transition between spot and futures markets, arbitrage is easier for traders. Thus, inefficiencies are eliminated quickly.