We take a brief look at the Cardano Vasil hard fork, which took place on September 22, 2022. In this article, we look at the aftermath of the hard fork and its effect on the network and token price.

What is the Vasil Hard Fork?

Named in honor of the late Vasil St. Dabov, a prominent mathematician, programmer, and Cardano ambassador, The Vasil hard fork was the culmination of months of research and development, making it the most extensive upgrade of the Cardano network to date. It introduced a host of features and enhancements, building on the Alonzo upgrade in 2021 which implemented smart contract capabilities via the Plutus scripting language.

The hard fork was successfully carried out using Cardano’s Hard Fork Combinator ( HFC) technology, which allowed the upgrade to be carried out seamlessly. The HFC combines protocols, essentially enabling the chain to contain both the old and new block models without needing a system restart.

Note that the new capabilities will be available for developers to from September 27, 2022, five days after the upgrade.

Plutus v2

Source: @timbharrison , via Twitter

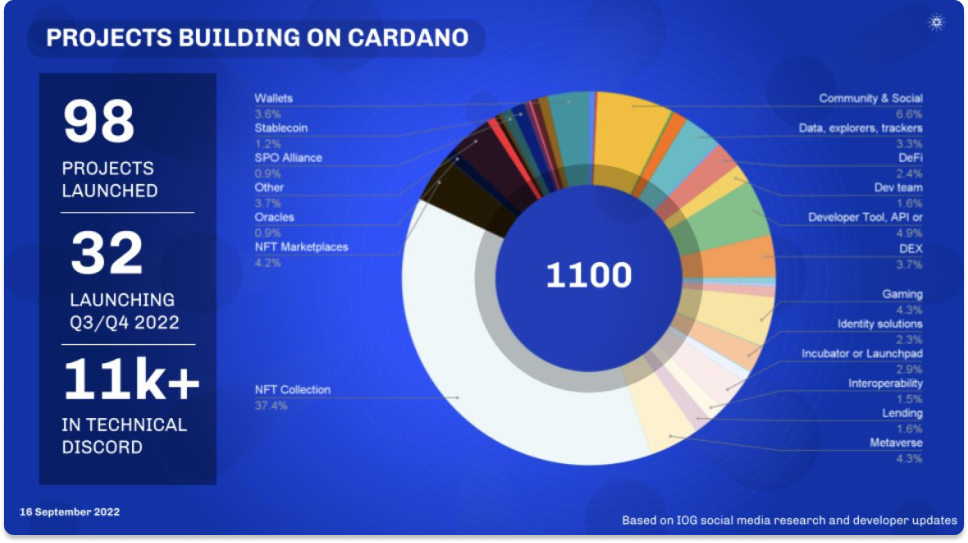

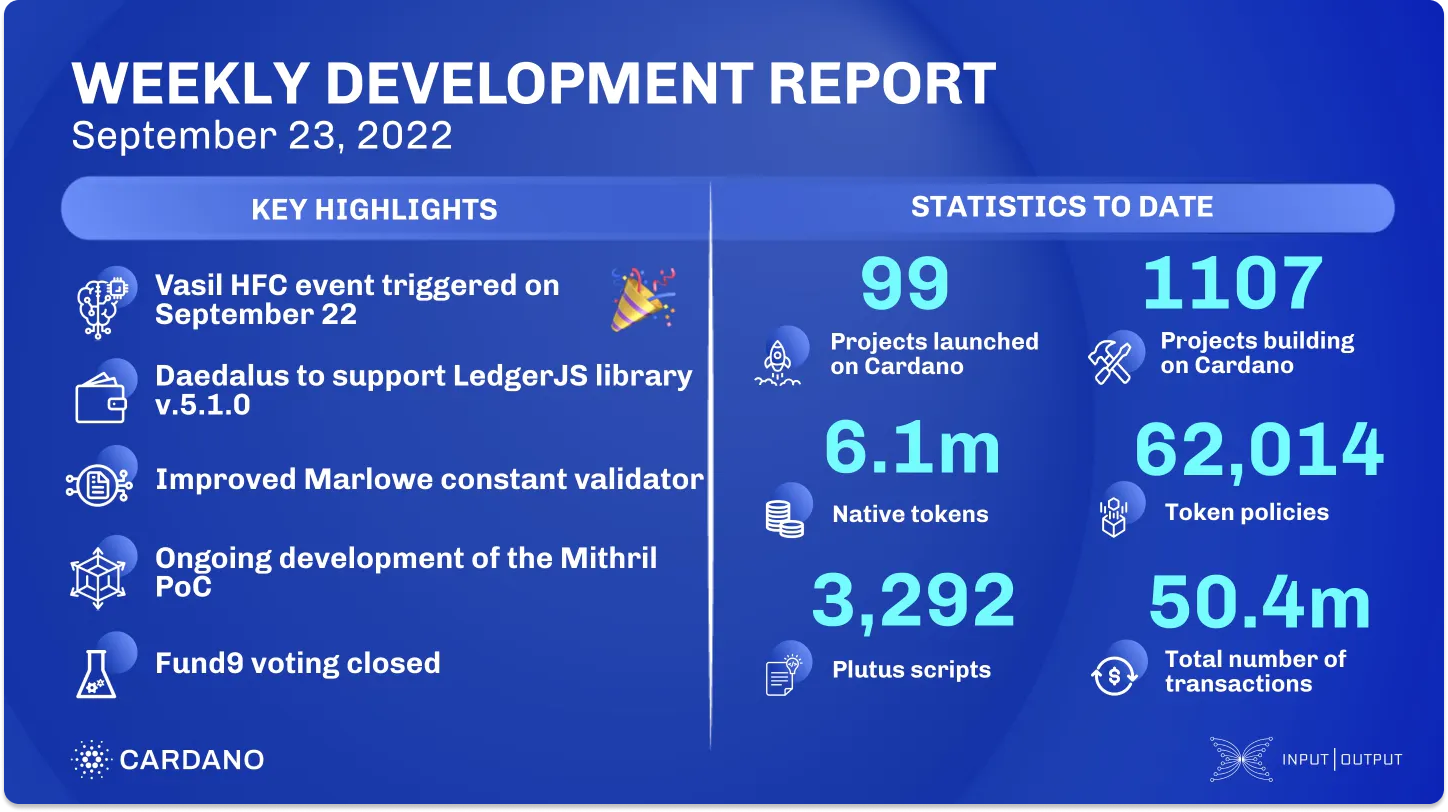

Source: essentialcardano.io

Amongst the enhancements from the upgrade comes Plutus v2, the second iteration of the Plutus scripting language introduced in the fall 2021 which enabled smart contracts. As of September 16, 2022, over 680 projects (not including NFT projects) are now building on Cardano, covering a wide range of dApps.

The Vasil upgrade improved efficiency of the smart contract platform by leveraging the extended unspent transaction output ( EUTXO) model, reducing load off the chain, which enables it to scale efficiently and safely.

Major upgrades included a number of enhancements via Cardano Improvement Proposals (CIPs). Notable improvements include :

Reference Inputs( CIP-31)

CIP-31 enabled on-chain data sharing. Before the upgrade, data stored in transaction outputs were accessed by spending the output, resulting in the recreation of UTXOs. Reference inputs thus facilitate access to stored data without the extra steps.

Inline Datums( CIP-32)

This change attaches datums directly to outputs instead of connecting them via datum hashes. This allows for simpler communication as users are able to see datum values instead of its hash.

Reference Scripts ( CIP-33)

This upgrade allows for the use of reference scripts to be attached to outputs in order to satisfy script requirements, rather than requiring the spending transaction to do so. This results in smaller script and transaction sizes, improves throughput, and reduces execution costs.

Explicit Collateral Outputs ( CIP-40)

Due to the UTXO model on Cardano, all wallets interacting with dApps previously had to put up collateral in order to cover the potential cost of smart contract execution failure. This change aims to increase the network’s Distributed Denial of Service (DDoS) protection and protect users from potential loss of ADA collateral.

Data Serialization( CIP-42)

This new feature enables data serialization and reduces overall memory and CPU load as validators leverage on the new optimizations.

Referenced Article: https://iohk.io/en/blog/posts/2022/09/16/vasil-what-to-expect/

Diffusion Pipelining

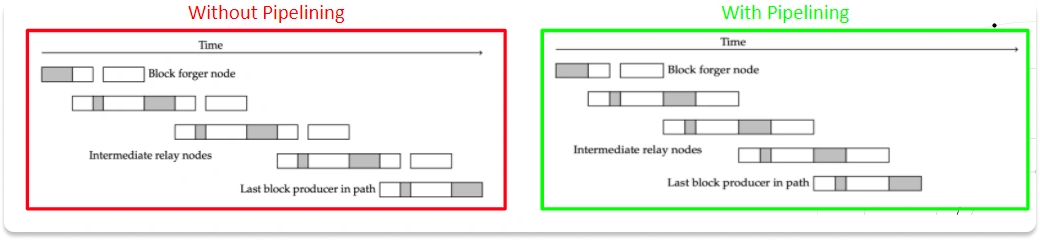

Source: iohk.io

Diffusion pipelining is a scaling solution for Cardano’s consensus layer, allowing for optimization of network parameters such as block size and memory units. This directly impacts Cardano’s capabilities to handle network traffic and volume.

Blocks on Cardano go through a serialized journey where all steps occur in the same sequence every time at every node, which results in slow block transmission times. With diffusion pipelining, steps are overlaid on top of each other, thus improving the following:

Block size — more capacity for transactions and scripts

Plutus memory limits — more memory available for a Plutus script to run

Plutus CPU limits — more computational resources can be allocated for a script to run more efficiently

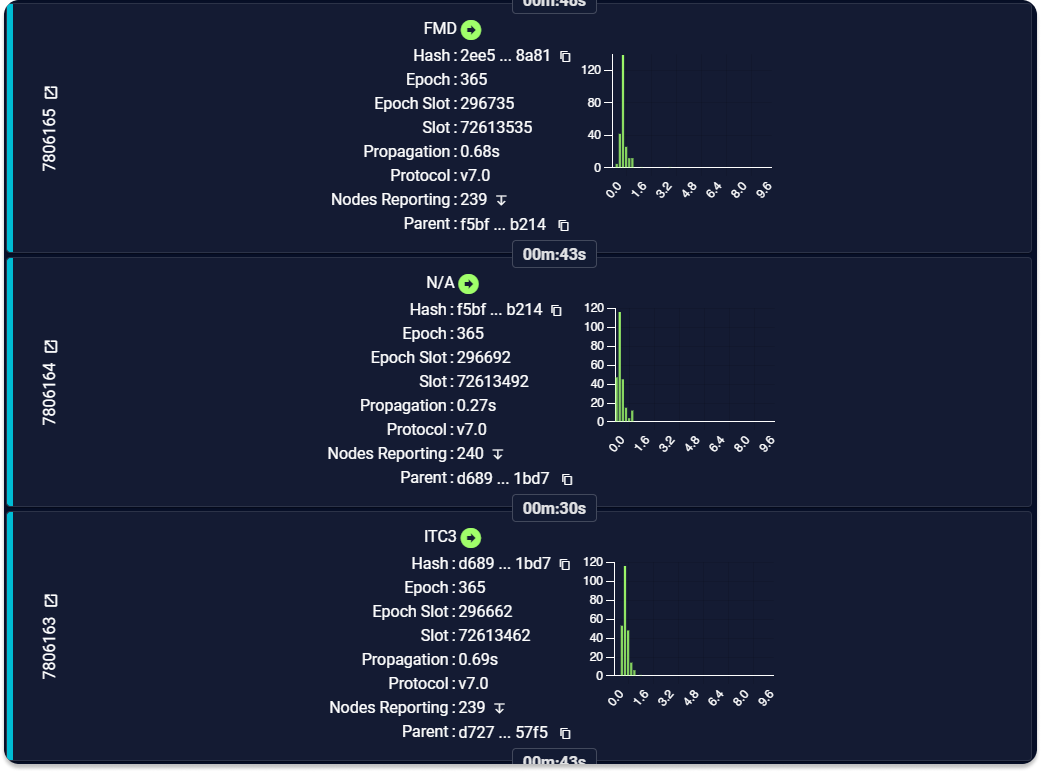

Source: pooltool.io

Network propagation is the maximal network delay for a new block to reach 95% of the network. As seen above, network propagation times are around 700ms after diffusion pipelining was implemented — pre-Vasil saw network propagation times of around 1.5s.

Source: @RichardMcCrackn, via Twitter

Initial attempts to overload the network have so far failed, indicating that the upgrade has been successful in scaling the network.

Security

The Vasil hard fork also introduced new security features. Previously, block validation required two verifiable random functions (VRFs) at every network hop. The new update reduces this to one VRF, enabling faster validation and sync times. Thus, the network will have a higher performance without compromising security.

Cardano Ecosystem

Project Catalyst

Project Catalyst is a decentralized funding platform for Cardano and is divided into a series of funds deployed every 12 weeks. Proposals are submitted and voted on by ADA holders (500 ADA minimum). Once votes are tallied, the voting committee distributes the rewards to voters and community approved proposals.

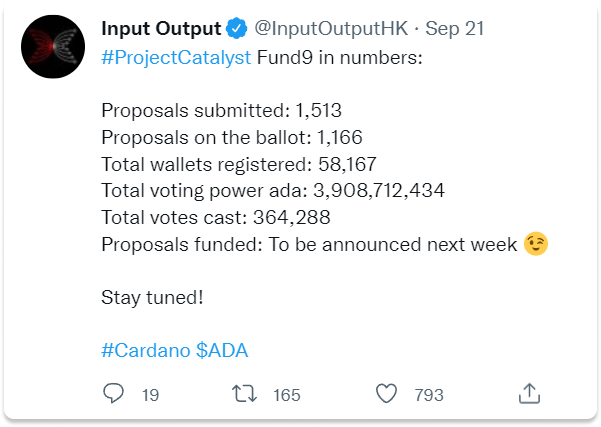

Source: @InputOutputHK , via Twitter

The most recent round (Fund9) saw a total of 1,513 proposals submitted (1,166 of which made it to ballot), participation from 58,167 wallets, and a total voting power of 3,908,712,434 ADA (around 11.6% of circulating supply).

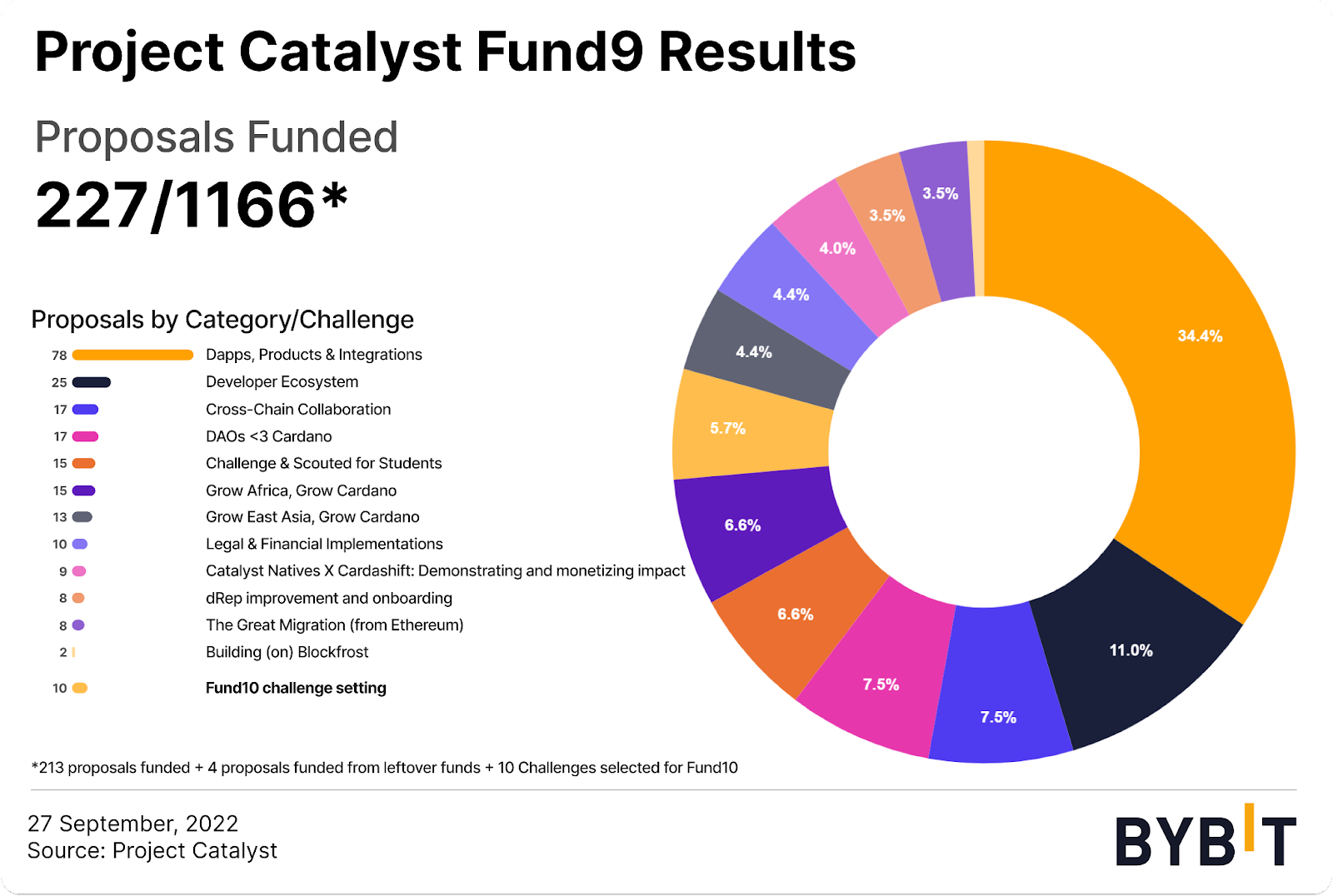

Data Source: Project Catalyst

On September 27, 2022, the results of the vote were released. A total of 227 out of 1166 proposals were funded — 213 of which were Fund9 winners, four of which were funded out of the leftover funds and met the approval threshold, and 10 of which were proposals for the challenges (categories) for the next round of funding (Fund10).

The category with the most successful proposals was ‘Dapps, Products, & Integrations’, with 78 proposals funded, accounting for 34.4% of the funded proposals. This was followed by ‘Developer Ecosystem’ (25), ‘Cross-Chain Collaboration’ (17), and DAOs (17).

Some notable proposals involve liquid staking protocols, integrations with wallet extensions and hardware wallets, and a real estate marketplace.

NFTs

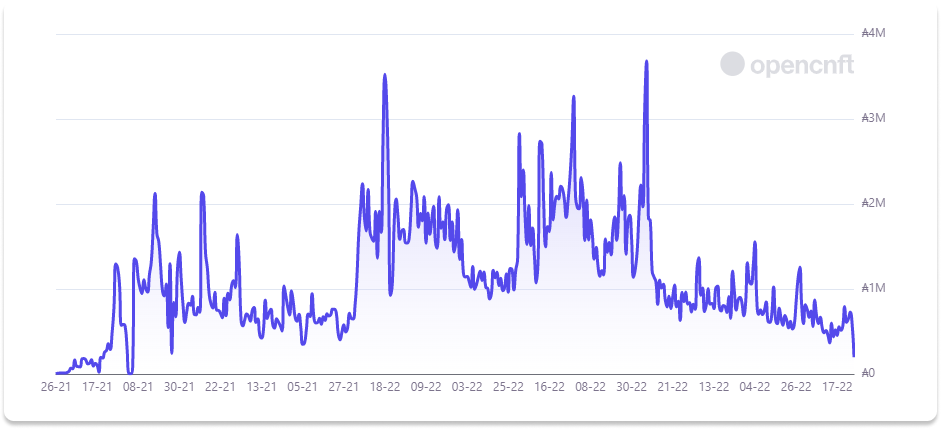

Source: opencnft.io

NFTs, or cNFTs as they are called on Cardano, were introduced after the Mary upgrade in 2021. The NFT ecosystem on Cardano subsequently took off, with nearly 6 million tokens minted and a total volume of around $205 million as of the time of writing. However, volumes have subsided as of late, in line with the broader NFT market.

ADA

Source: LunarCrush

Despite social engagement and mentions growing to a high leading up to the upgrade, ADA price was largely unaffected and remains trading in a range since May 2022, trading at around $0.44 as of the time of writing.

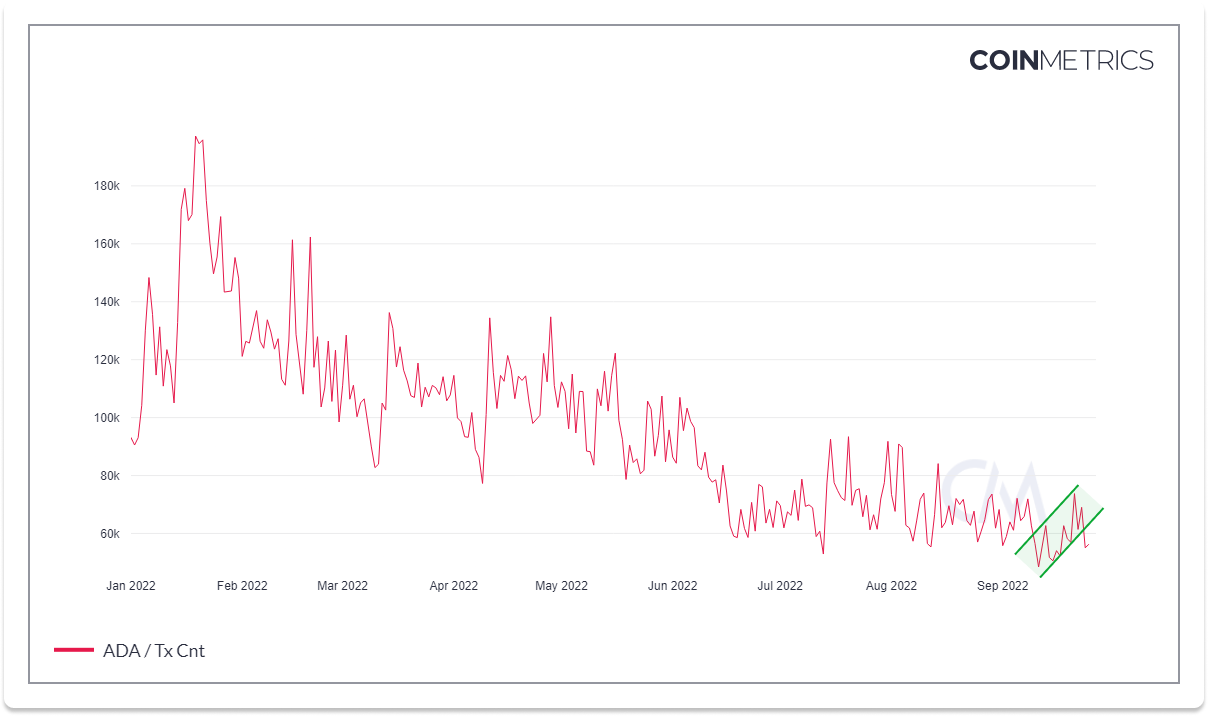

Source: Coinmetrics.io

In terms of network activity, we saw a slight growth in daily transaction count leading up to the hard fork. However, as of the time of writing, network activity has failed to maintain its growth and remains on a downtrend since the beginning of the year.

Final Thoughts

The Vasil hard fork brought much needed upgrades such as diffusion pipelining and Plutus v2 to Cardano’s network, paving the way for DeFi development and network scaling. With the Plutus v2 upgrades set to be available to developers on mainnet today, we should soon see a reversal in network activity as DeFi protocols start to launch and take advantage of the new upgrades.

Although network benchmarks show improvements in terms of network propagation and an increase in chain capacity, it will be interesting to see if these metrics hold. As more DeFi protocols launch and more load is placed on the network, we will be able to see if the network is truly able to sustain more activity.

Lastly, despite its NFT ecosystem taking off, Cardano still has a lot to prove with its DeFi development and innovation which falls behind larger ecosystems like Ethereum, BSC, and Cosmos. However, we will definitely be keeping an eye on its developments in the future.

Disclosure: Members of Bybit may be invested in some or all of the tokens and projects mentioned within the following article. This statement discloses any conflict of interest and is not a recommendation to purchase any token or participate in any of the mentioned ecosystems. This content is purely for educational purposes only, and should not in any way be construed as investment advice. Please exercise caution and practice your own due diligence if you are planning to partake in any of these projects in any way.