At the infrastructure level, Plasma is secured by PlasmaBFT, a variant of the HotStuff consensus algorithm that offers Byzantine fault tolerance with low-latency finality. Its execution layer is powered by Reth, an Ethereum-compatible client written in Rust, which allows developers to deploy applications using familiar EVM tools. Together, these components provide deterministic guarantees on settlement speed and throughput, making Plasma technically capable of handling the high-volume environment associated with global payments.

A distinguishing feature of Plasma is its integration of stablecoin-specific mechanisms directly at the protocol level. For example, its paymaster system sponsors gas costs for USDt transfers, allowing users to send payments without holding the native XPL token. At the same time, other transactions incur normal fees to sustain validator incentives and maintain the network’s economic security. Over time, the network also plans to introduce additional features such as a trust-minimised Bitcoin bridge, confidential payments, and deeper integration of stablecoin-native contracts, with features rolled out in phases rather than all at once.

The network’s economic model revolves around its native token, XPL, which is used for validator rewards, staking, and fee payments beyond the gasless USDt transfers. Distribution of XPL spans public sale participants, the team, investors, and ecosystem initiatives, with a gradual unlocking schedule. Validators secure the network under a proof-of-stake model, earning rewards through controlled inflation that decreases over time to balance long-term supply. By combining consensus design, stablecoin-first features, and EVM compatibility, Plasma represents an effort to create an infrastructure layer tailored to the demands of digital money and high-volume, global payment activity.

What is the XPL Token?

The XPL token is the native asset of the Plasma blockchain, serving as the foundation of the network’s economic and security model. Similar to how ETH functions on Ethereum or BTC on Bitcoin, XPL is used to pay transaction fees, secure the network through staking, and incentivise validators who maintain consensus. While Plasma supports gasless USDt transfers through a protocol-managed paymaster, XPL underpins all other activity on the chain, ensuring that validators are rewarded and the system remains sustainable. In this way, XPL balances the goal of enabling frictionless stablecoin payments with the need to maintain robust network economics.

XPL also plays a critical role in Plasma’s proof-of-stake consensus. Validators stake XPL to earn the right to participate in block production and transaction verification, receiving rewards in return for their service. To align incentives, Plasma implements a system where misbehaving validators lose rewards rather than their staked capital, reducing the risk of catastrophic losses while still penalising misconduct. As the network decentralises over time, staked delegation will allow regular token holders to contribute to security by assigning their XPL to validators, broadening participation in consensus without requiring all users to run infrastructure.

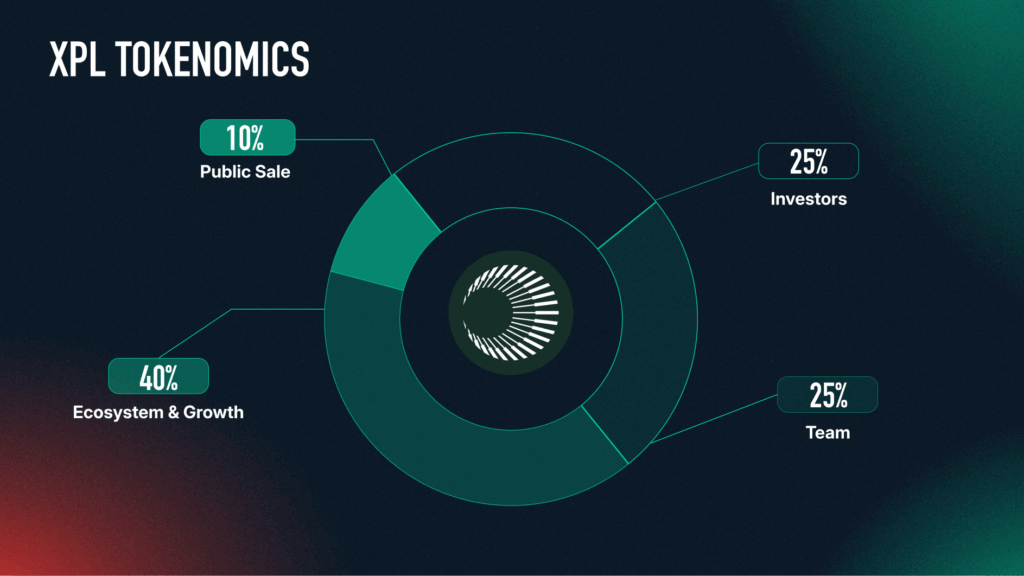

The token’s distribution reflects its dual role as both a utility and governance asset. Out of a total supply of 10 billion XPL, allocations are spread across ecosystem growth initiatives, the team, early investors, and a public sale. These tokens are subject to lockups and vesting schedules designed to support long-term alignment and prevent excessive early sell pressure. Inflation begins at 5% annually for validator rewards, gradually tapering to 3%, with EIP-1559-style fee burning helping offset supply growth as transaction volume increases. This combination of emission controls and fee-burning is meant to sustain validator participation while managing dilution for long-term holders.

Within the broader Plasma ecosystem, XPL functions as the key enabler of features beyond simple stablecoin transfers. Developers building applications on Plasma will use XPL for gas unless they opt into custom gas token arrangements, while cross-asset programmability, staking, and future governance mechanisms are also tied to XPL. In short, the token acts as both the security backbone and the value anchor of the network, ensuring that Plasma’s stablecoin-focused design remains economically viable while supporting its ambition to scale into a global payments infrastructure.

XPL Tokenomics

How to buy XPL with crypto

1. Log in to your Bitfinex account or sign up to create one.

2. Go to the Deposit page.

3. In the Cryptocurrencies section, choose the crypto you plan to buy XPL with and generate a deposit address on the Exchange wallet.

4. Send the crypto to the generated deposit address.

5. Once the funds arrive in your wallet, you can trade them for XPL. Learn how to trade on Bitfinex here.

How to buy XPL with fiat

1. Log in to your Bitfinex account or sign up to create one.

2. You need to get full verification to be able to deposit fiat to your Bitfinex account. Learn about different verification levels here.

3. On the Deposit page, under the Bank Wire menu, choose the fiat currency of your deposit. There’s a minimum amount for fiat deposits on Bitfinex; learn more here.

4. Check your Bitfinex registered email for the wire details.

5. Send the funds.

6. Once the funds arrive in your wallet, you can use them to buy XPL.

Also, we have Bitfinex on mobile, so you can easily buy XPL currency while on-the-go.

[ AppStore] [ Google Play]

XPL Community Channels

Website | X (Twitter) | Discord

The post appeared first on Bitfinex blog.