What is the Beacon Chain?

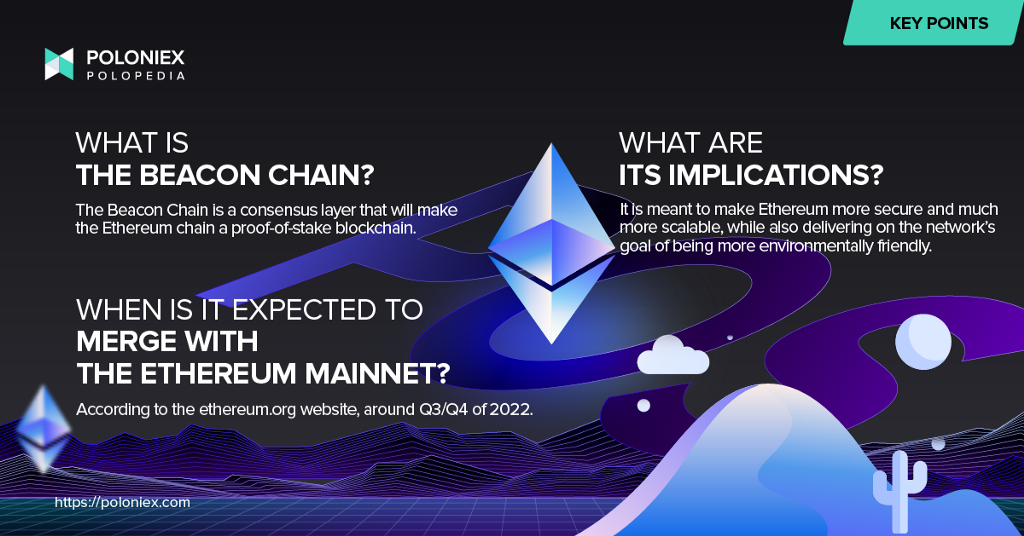

The Beacon Chain, which shipped on December 1, 2020, is the Ethereum network’s upgrade to a Proof-of-Stake blockchain. Essentially it is a PoS consensus layer that handles a network of stakers.

In order to understand what the Beacon Chain can do for the network, it’s important to understand the problems that the network currently faces. Right now, Ethereum’s consensus layer is what’s known as a Proof-of-Work consensus layer, same as Bitcoin’s. This involved different nodes run by computers solving complex math problems in order to come to consensus and be able to produce the next block on the blockchain. While the system itself works fine, with a lot of users conducting transactions it becomes quite unwieldy.

You see, Proof-of-Work, often abbreviated as PoW, has a pretty low throughput of transactions per second, or TPS/tps. That is, the network can currently handle 12–15 tps, while other networks, like the TRON network, can handle 10,000 tps due to their more efficient consensus layers. When you have a low throughput blockchain that is handling as many transactions as Ethereum’s, especially due to its capability of handling smart contracts (which we will discuss in a later article), you get problems like network congestion and high gas fees.

So, enter staking, a way to activate validator software and keep the Ethereum network secure while vastly improving its tps, making it much more scalable. Not only this, but considering that Proof-of-Stake requires only a computer capable of, well, staking, to be a validator or participate in the network is much less prohibitive than with PoW. This means more participants, which means more decentralization, a cornerstone value of Ethereum and its ecosystem.

Okay, so what is staking exactly?

Staking is a network’s way of enlisting user help to secure its network and validate new transactions. When you stake, you are locking up your tokens for a set period of time to then earn rewards by verifying new blocks. Because someone is putting their coins on the line to do all this, they are inherently disincentivized from acting dishonestly.

Since the Beacon Chain shipped, staking has been live, just not live on Ethereum’s mainnet. Once the merge happens, staking users will earn higher rewards. And according to Ethereum’s info on staking, stakers will be able to withdraw rewards after the Shanghai update.

The Merge

As aforementioned, the Beacon Chain shipped late 2020, which means it’s already live. So what exactly are people waiting for? They are waiting for an event called The Merge. Sounds like something out of a movie, right? Well, it’s certainly more simple in concept than it sounds, but its magnitude is certainly worthy of its catalytic analog in any epic story.

The Merge denotes the combining of this new consensus layer with the existing layer functioning on Ethereum’s mainnet. It will fully replace the older execution layer and stop mining as a form of block validation. Furthermore, according to Ethereum’s webpage on the matter, The Merge “will reduce Ethereum’s energy consumption by ~99.95%.”

So what’s happening next?

The Merge is expected to happen around Q3/Q4 of 2022. When this happens, Ethereum’s carbon footprint will be dramatically reduced, PoW will stop and become PoS, and the network will become more decentralized, secure, efficient and scalable.

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.