What is a crypto tumbler service?

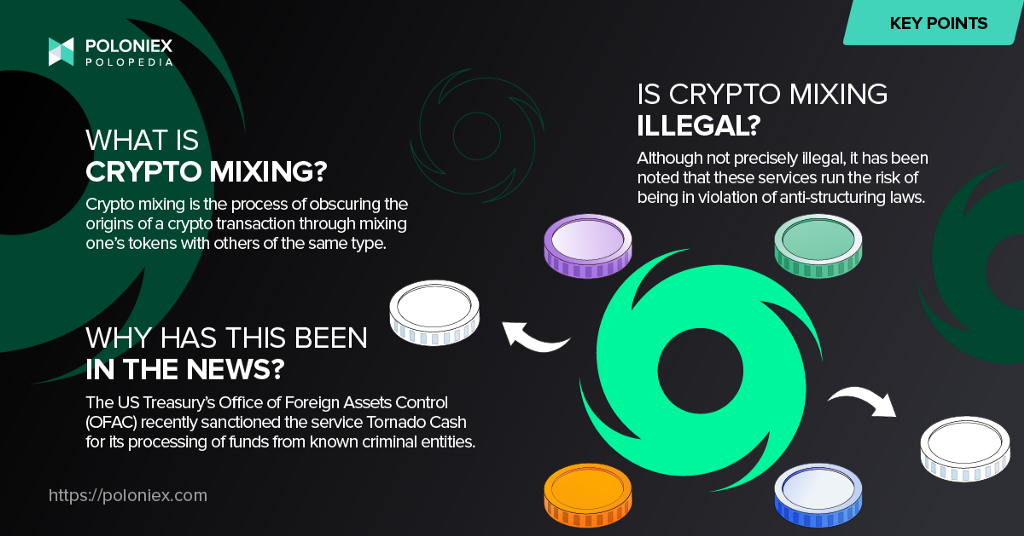

From the perspective of crypto tumbling services, these platforms deliver on the crypto community’s ethos of anonymity by obscuring the origins of token funds. While using Bitcoin itself means that one can send crypto anonymously, there is of course a publicly viewable ledger on which anyone can view any BTC transaction. Because of this those in pursuit of complete anonymity have a need for a solution. Hence crypto mixers, also called crypto tumblers or crypto tumbling services.

The way it works is that users put their crypto into a pool, which then mixes (or tumbles, or scrambles, etc etc…) it up with everyone’s crypto and coins back out at random, ensuring that users get back different crypto of the same amount they put in minus platform fees.

Now, it’s important to note that there are centralized and decentralized crypto mixing services. An example of a centralized service is blender.io. Like its centralized peers, blender.io, while not making any of the transactions or handles public, does in fact keep a record on its own server of its users’ transactions. In the event that a financial authority’s investigation leads it to a crypto mixer, a company like lender.io could be made to give up its records.

Decentralized crypto mixers on the other hand, like JoinMarket, employ the use of anonymizing protocols to fully obscure the origin of one’s cryptocurrency.

Legality

Because crypto tumbling is done in order to avoid tracking by various financial institutions, it has the potential to run afoul of anti-structuring laws.

With recent events like the investigation into crypto tumbling service tornado cash, Government agencies such as OFAC have stepped up their scrutiny of these platforms.

The Tornado Cash News

First, let’s talk a bit about Tornado Cash, which was recently sanctioned by the US Treasury’s Office of Foreign Assets Control (OFAC).

Tornado Cash is a decentralized crypto tumbling service that is made up of various servers across the globe and powered by open-source technology. The reason for the sanction was due to the conclusion of an investigation into Tornado Cash by OFAC that determined that money launderers had used the service to process $1.54 billion that belonged to various criminal entities, including “North Korean cybercriminals”. This, according to a report by Cointelegraph.

It’s important to note the context in which this sanction takes place. Previously, and establishing precedent, OFAC had sanctioned centralized crypto tumbling service blender.io after it was also used to launder funds stolen by North Korean cybercriminals.

How crypto tumblers make money

Like most services that handle your crypto, tumblers make money by collecting a percentage transaction fee from the total amount of coins mixed together in any one “crypto tumbling events“.

Interestingly (according to blender.io’s FAQ page) you can opt to pay higher fees because of their rarity of use.

Why would someone use a crypto tumbler

Because of its ability to obscure the origins of cryptocurrency, a crypto tumbler service is an oft chosen Method for money laundering. Some notable examples include the use of crypto tumbling service Bitcoin Fog in laundering some of the 96,000 stolen Bitcoin from the Sheep Marketplace hack in 2013.

In fact, it has been estimated that Bitcoin Fog has successfully laundered a total of 10 million in bitcoin over its 10 years of operation.

Of course, this isn’t the only reason that somebody would use a crypto tumbling service. Many proponents of the services cite their ability to hide crypto users‘ identities, thus protecting anonymity.

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.