Whilst cooling inflation has provided tactical support for bitcoin, persistent services inflation and ongoing spot distribution signal the market remains in a transitional phase.

The latest US data presents a mixed macro backdrop. Headline inflation eased to 2.4 percent year-on-year in January, down from 2.7 percent previously, while monthly CPI rose 0.2 percent. At first glance, this suggests continued disinflation progress. However, the underlying picture is less decisive.

Core inflation increased 0.3 percent month-on-month and remains at 2.5 percent annually. The moderation in headline CPI was largely driven by falling energy prices, particularly gasoline. In contrast, services inflation rose 0.4 percent on the month and remains elevated at 3.2 percent year-on-year. Given that services account for roughly two-thirds of the CPI basket, this persistence limits how quickly the Federal Reserve (the Fed) can pivot toward aggressive easing.

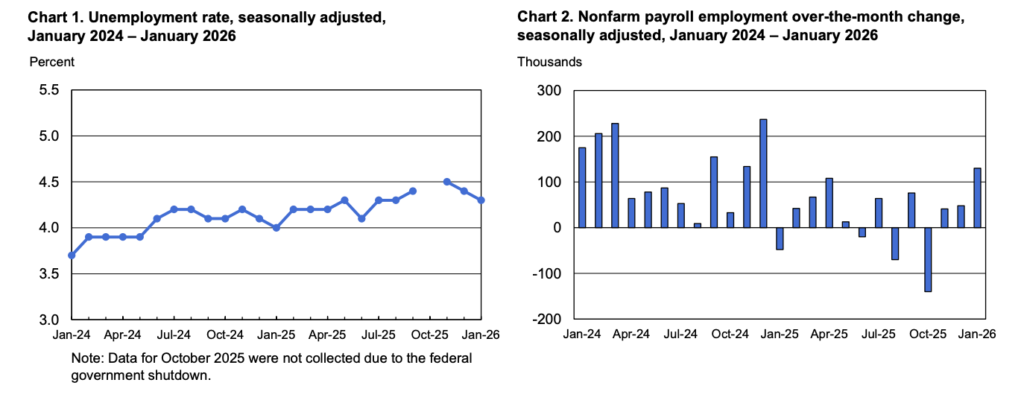

The labour market reinforces this “gradual stabilisation” narrative. Nonfarm payrolls rose by 130,000 in January, and the unemployment rate sits at 4.3 percent. Whilst prior job figures were revised lower by 898,000 through benchmark adjustments, recent hiring trends suggest a low-growth but non-recessionary environment. Wage growth remains firm at 3.7 percent annually, contributing to continued services inflation pressure.

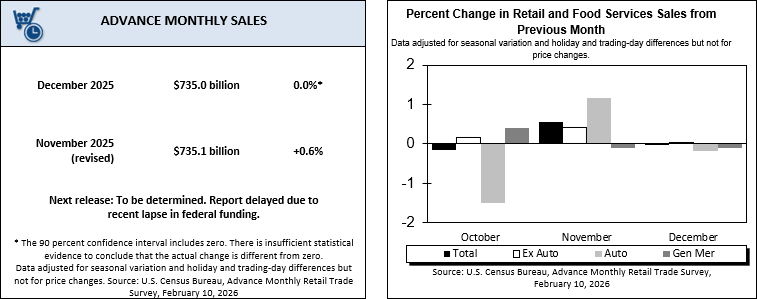

At the same time, consumer demand has softened. Retail sales were flat in December, with the control group declining slightly. This divergence between stable employment and weaker consumption reflects an economy transitioning into slower, more productivity-driven growth rather than one driven by aggressive hiring.

Monetary policy remains patient. Markets assign meaningful probability to rate cuts later in the year, but persistent services inflation and stable employment reduce urgency. Importantly, the Fed has shifted from balance sheet contraction to measured expansion in order to maintain adequate reserve levels in the financial system. Whilst this is not a crisis stimulus phase, it does represent structural liquidity returning to the system.

The broader implication is clear: the US economy is not overheating, but it is not weak enough to force immediate easing. Growth is moderating, inflation is improving unevenly, and liquidity conditions are gradually becoming more supportive.

Implications for Crypto: Liquidity Cushion, But Not a Full Pivot

Crypto markets are highly sensitive to marginal changes in liquidity, rate expectations, and dollar dynamics.

The cooling in headline inflation, combined with a rising probability of rate cuts, has provided psychological support to risk assets. However, the stickiness of services inflation keeps the Fed in a cautious stance. This creates a backdrop where rallies can develop, but sustained breakouts require either clearer disinflation or stronger liquidity acceleration.

The more structural development is the Fed’s balance sheet expansion. Even though this move is operational rather than stimulative, the return of reserve growth reduces the probability of systemic liquidity stress. Historically, expanding base liquidity tends to support scarce assets such as bitcoin, particularly when paired with a gradually weakening US dollar.

That said, this is not an aggressive easing cycle. Liquidity is building incrementally, not explosively. As a result, crypto moves are likely to unfold in waves rather than in a straight-line trend.

Bitcoin Price Action: Short Squeeze Meets Structural Stress

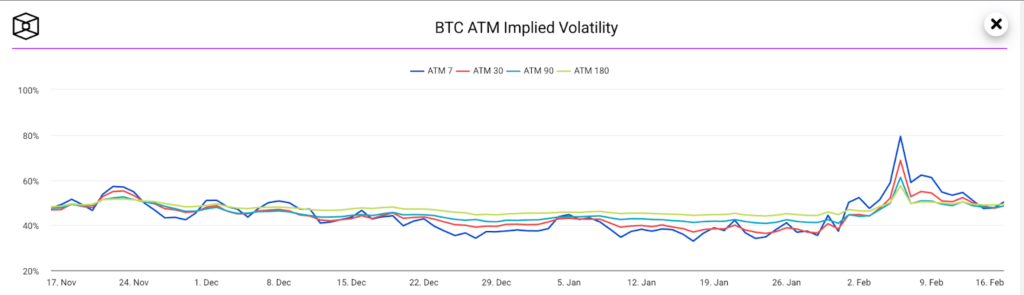

Leading into the CPI release, Bitcoin positioning was defensive. Shorts were built whilst large spot sellers distributed supply in size. At the same time, options markets were pricing elevated downside protection, reflecting high implied volatility and risk-off sentiment.

Following the CPI release, price dynamics shifted quickly. Aggressive spot buying — albeit for a very limited time — and a wave of short covering in perpetual futures drove bitcoin roughly 9 percent higher, even as open interest (OI) declined around 7 percent. The drop in OI during a price advance suggests that the move was largely driven by short liquidations and forced closures rather than fresh speculative positioning entering the market.

Funding rates moved into negative territory over the weekend, and near-term implied volatility declined, indicating that options traders were reducing expectations of immediate downside. This marked one of the first clear improvements in derivatives sentiment in several months.

However, the recovery has not been without friction. Aggressive spot sellers returned early this week, offloading a cumulative billions worth of BTC. Importantly, the market absorbed this supply more effectively than during prior distribution phases, suggesting improved bid depth and more balanced higher-timeframe order flow. Even so, sustained upside will likely require either a reversal in spot selling flows or renewed structural demand.

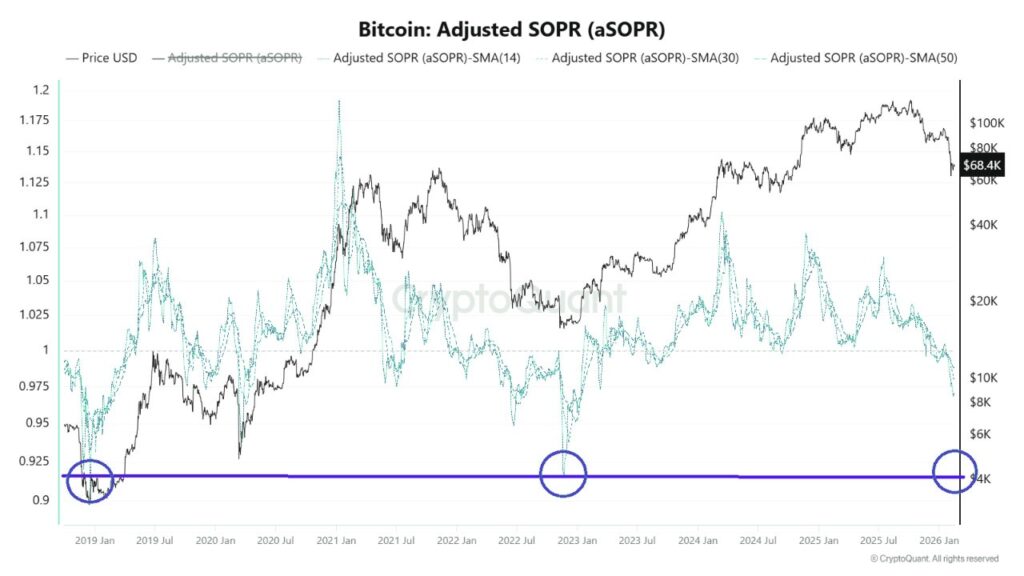

On-chain data adds a note of caution to the picture. Adjusted SOPR has fallen toward the 0.92–0.94 zone, a level historically associated with bear-market stress where a majority of coins are being spent at a loss. Unlike mid-cycle pullbacks where SOPR quickly reclaims 1.0, the current structure reflects sustained loss realisation. Whilst this does not confirm a full bear regime, it signals structural fragility rather than outright strength.

Conclusion: Tactical Optimism, Structural Work Still in Progress

The US macro backdrop supports patience. Inflation is cooling but not decisively subdued. The labour market is stable but no longer accelerating. Consumer demand is softening. Meanwhile, the return of balance sheet expansion provides a liquidity cushion that reduces systemic risk.

For bitcoin, the recent rally was technically constructive, driven by short covering and improved derivatives sentiment. However, ongoing spot distribution and stress signals from on-chain metrics indicate that the market may still be in a transitional phase rather than a confirmed expansionary cycle.

In this environment, volatility remains likely. Tactical upside moves can occur when positioning becomes overly defensive, but a durable structural advance will require clearer confirmation from both macro disinflation trends and sustained spot demand.

The post appeared first on Bitfinex blog.