As the STO and RWA sectors continue to gain momentum, HTX Ventures has invested considerable resources to explore this domain through research.

STO Market: Boasting Huge Potential and Growing Rapidly

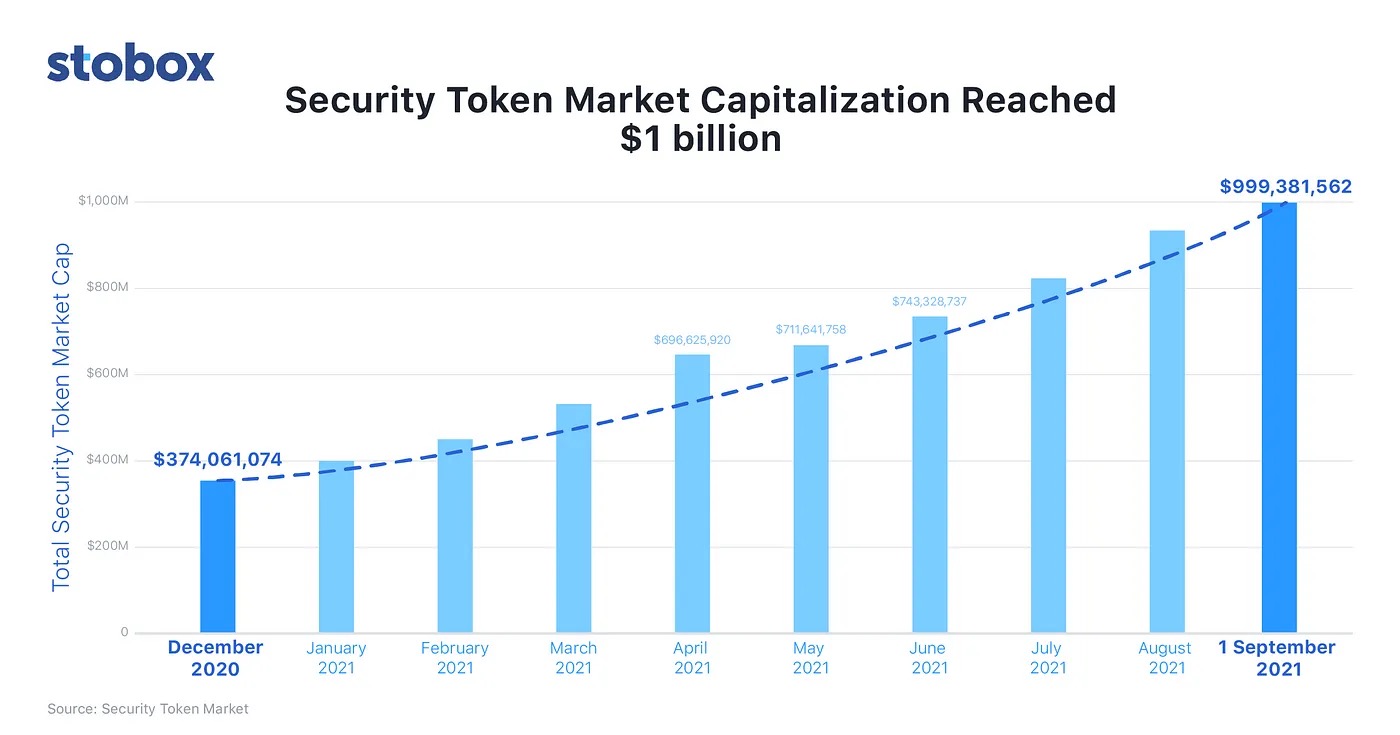

Based on data from the STO market, the STO market cap has experienced tremendous growth, surging from 374 million to approximately 1 billion from December 2020 to September 2021, representing an extraordinary growth rate of 2670%. This momentum has persisted into 2022. From April 2021 to April 2022, STO trading volumes witnessed a remarkable increase of 386%, accompanied by a 2650% growth in the market cap. In May 2022, the total market cap of traded security tokens grew twentyfold in a year to surpass $19 billion. Looking ahead, it is anticipated that by 2030, the STO market in Korea will reach an impressive 367 trillion Won ($287 billion).

*Source: STOBOX

During his speech, Edward delved into the advantages and limitations of STO. When discussing the positive features of STO, he underscored its flexibility, technological advancement, positive token economy, complete operation under regulation, and high composability.

● Flexibility: Multiple issuers or individuals can achieve asset refinancing goals more flexibly. Issuers can diversify their financing channels, reaching a broader spectrum of investors.

● Technological Advancement: Using blockchain for enhanced liquidity across regions and exchanges. Smart contracts can be used to conduct automated transactions, and even facilitate enterprises to complete cross-border settlement and payment scenarios.

● Positive Token Economy: Tokens have an economic incentive mechanism and functional role, which can redefine property rights and production relations.

● Complete Operation Under Regulation: Effectively preventing fraud and market manipulation, while fundamentally ensuring the interests of investors and fair trading.

● High Composability: STO and DeFi, STO and NFT, etc.

Limitations of STO:

● Security tokens are subject to heightened regulation, leading to increased complexity in administrative processes.

● STO platforms must consistently adapt to ever-evolving regulations.

● Regulations in certain areas may impose limits on who can invest in STOs, thereby reducing the available pool of investors.

In the Asia-Pacific region, the STO ecosystem is still in its early stages of development. From a technological standpoint, North America maintains its dominance in this domain, producing a diverse range of exceptional products and cutting-edge technologies. However, the potential of the South Korean market should not be underestimated, especially with its unique culture and the gradual relaxation of regulations.

Japan’s STO market stands out as the most vibrant in Asia. From 2019 to 2022, many traditional financial companies, including large securities firms and banks, have entered the STO sector. The types of Japanese STOs include corporate bonds, credit card bonds, real estate, carbon emissions, etc. In line with this, the Japan Exchange Group (JPX) is set to launch the STO market in 2025.

STO vs. RWA: Analyzing Differences and Exploring Future Trends

In his speech, Edward pointed out that the main differences between STO and RWA lie in their focus and scope. To summarize, their distinctions are as follows:

1. STO focuses on the securities sector, emphasizing the issuance and trading of tokenized securities through blockchain technology. In contrast, RWA has a broader scope, tokenizing various real-world assets, encompassing both those with monetary value and non-monetary value.

2. STO emphasizes compliance in the securities sector and investor protection. In contrast, RWA focuses on introducing a variety of real-world assets into the blockchain, offering increased liquidity and avenues for value exchange.

3. In the earlier cycle, roughly around 2017-2018, before the prominence of the DeFi concept, STO narratives primarily revolved around equity issuance, such as issuing company stocks or equity-like assets, without delving much into bonds. Conversely, RWA discussions often centered around assets like U.S. Treasury bonds or fixed-income assets.

As a result, these two concepts belong to different eras and cycles, giving rise to notable divergences in narratives and contexts. In summary, STO can be considered a constrained implementation of RWA.

*Source: Relevance of on-chain asset tokenization in crypto winter

1. From April 2021 to April 2022, STO trading volumes witnessed a remarkable increase of 386%, accompanied by a 2650% growth in the market cap. In May 2022, the total market cap of traded security tokens grew twentyfold in a year to surpass $19 billion.

2. Tokenized assets are anticipated to witness increased adoption across a spectrum of sectors, including real estate, investment funds, bonds, and equities. Moreover, their application is predicted to broaden to encompass more unconventional assets, such as patents.

3. A remarkable fiftyfold increase in tokenized assets is projected from 2022 to 2030, with their value surging from $310 billion to $16.1 trillion.

4. By 2030, the value of tokenized assets may account for approximately 10% of the global GDP.

5. STOs have garnered increased popularity compared to ICOs, attributed to their enhanced security and compliance features. The number of companies specializing in tokenization rises annually, and an escalating number of STO projects have successfully secured multimillion-dollar funding.

6. Europe is expected to see an STO boom in the next five years. The researchers estimate the market size for digital assets in Europe at more than a billion euros by 2026.

Moreover, STOs have garnered significant popularity across diverse industries due to their provision of a secure and transparent avenue for investment and fundraising. Sectors embracing this trend include real estate, precious stones and metals, natural resources, and private equity. Taking real estate as an example, STO solutions provide a unique opportunity to tokenize real estate assets, streamlining the process of acquiring shares in a property. They create opportunities for fractional ownership, making it more accessible for smaller investors to participate. For businesses, STOs represent an effective means of raising funds, attracting global investors, and offering enhanced liquidity and transparency. This is a win-win solution. It is estimated that 89% of all traded security tokens are allocated to real estate. The global real estate market is projected to reach $5,388.87 billion by 2026, exhibiting a CAGR of 9.6%.

Edward outlined several potential opportunities for RWA in his predictions for the future of RWA:

· Within the realm of RWA, decentralized stablecoins and fixed-income assets remain the predominant categories, still with larger room development in the future.

· Government bond RWAs will remain mainstream, with increased attention on equity RWAs. U.S. Treasury bonds have gained recognition in the crypto community.

· The tokenization of assets like real estate and carbon credits is in demand, but compliance hurdles remain a significant challenge.

· Token standards will diversify, and ERC-20 may not be the future mainstream, with significant potential for NFTs in bills, RETIs, collectibles, and other areas.

· More projects will offer opportunities for infrastructure and RWA services.

· Hong Kong and Singapore may contribute to the prosperity of the RWA due to their regulatory measures.

Regarding RWA, it’s noteworthy to highlight the Bitcoin ETF as a pivotal milestone in its development. Since 2023, eight major financial institutions have submitted applications to the U.S. SEC for a Spot Bitcoin ETF. The approval of such an ETF seems inevitable. Once approved, it will signify a pivotal moment in RWA’s development. The expected influx of trillions of dollars into the RWA market is likely to drive the acceptance and investment in Bitcoin by traditional financial institutions, family offices, and funds, ultimately boosting the mainstream credibility and acceptance of Bitcoin investments.

One highlight in the RWA sector is the tokenization of U.S. government bonds. The tokenization volume of U.S. government bonds is valued at $697 million with an approximate annual yield of 5.25%. Decentralized stablecoins and fixed-income assets remain the predominant categories. For instance, MakerDAO currently stands as the undisputed leader in the RWA sector, boasting a total business scale of $32.8 billion. Moreover, over 65% of the revenue in the MakerDAO protocol is derived from RWA.

In his concluding remarks, Edward analyzed the factors that may contribute to the future success of STO. Even though STO provides significant business opportunities and financial innovation to financial markets, investors, and issuers, its structure remains in the early stages. Looking ahead, several factors may contribute to the ultimate success of STO in the future. These factors include the STO ecosystem and stakeholders, legal and regulatory frameworks, the credibility of trading platforms, and investor education.

About HTX Ventures

HTX Ventures, the global investment arm of HTX, leverages an integrated approach that combines investment, incubation, and research to identify the most exceptional and promising teams around the world. As a pioneer with a decade of experience in the blockchain industry, HTX Ventures is committed to exploring, uncovering, and driving the development of cutting-edge technology and emerging business models within the industry. It offers comprehensive support to collaborative projects, including financing, resources, and strategic consulting, to foster the growth of the blockchain ecosystem.

To date, HTX Ventures has achieved a 60-fold return on investment, with investments spanning over 20 countries and regions. It has collaborated with more than 120 fund partners and has supported over 200 projects across various disciplines, with 60% of these projects eventually being listed on HTX.

Collaborating with its investment department, HTX is dedicated to actively monitoring and supporting the development of the RWA sector. It will provide professional guidance, consulting services, an extensive resource network, liquidity pools, and a user base for portfolio projects.