Bitcoin’s growing mainstream acceptance drove prices higher, crossing above $14,000 for the first time since June 2019.

DeFi hype fades as correlation with Bitcoin goes negative.

Binance’s DeFi index down more than 60% as the DeFi party ends abruptly.

Bitcoin futures trading volume dominates as Binance Futures processed more than $179 billion in October.

Binance Futures’ open interest marked a new all-time high at $1.43 billion, 43% higher than the previous month.

Bitcoin registered its best month since April, gaining more than 27% in October. The bellwether cryptocurrency briefly crossed $14,000 for the first time in more than a year, making it one of the month's largest movers.

Bitcoin’s resurgence was boosted by positive news that has been pouring in recently. For the first time, Bitcoin sees a record number of mainstream acceptance, which has driven exponential demand for the cryptocurrency. Corporates such as MicroStrategy and Square have announced their purchase of Bitcoin. While prominent financial institutions such as Paypal and Singapore’s largest bank, DBS, have announced plans to offer crypto services to millions of their customer base.

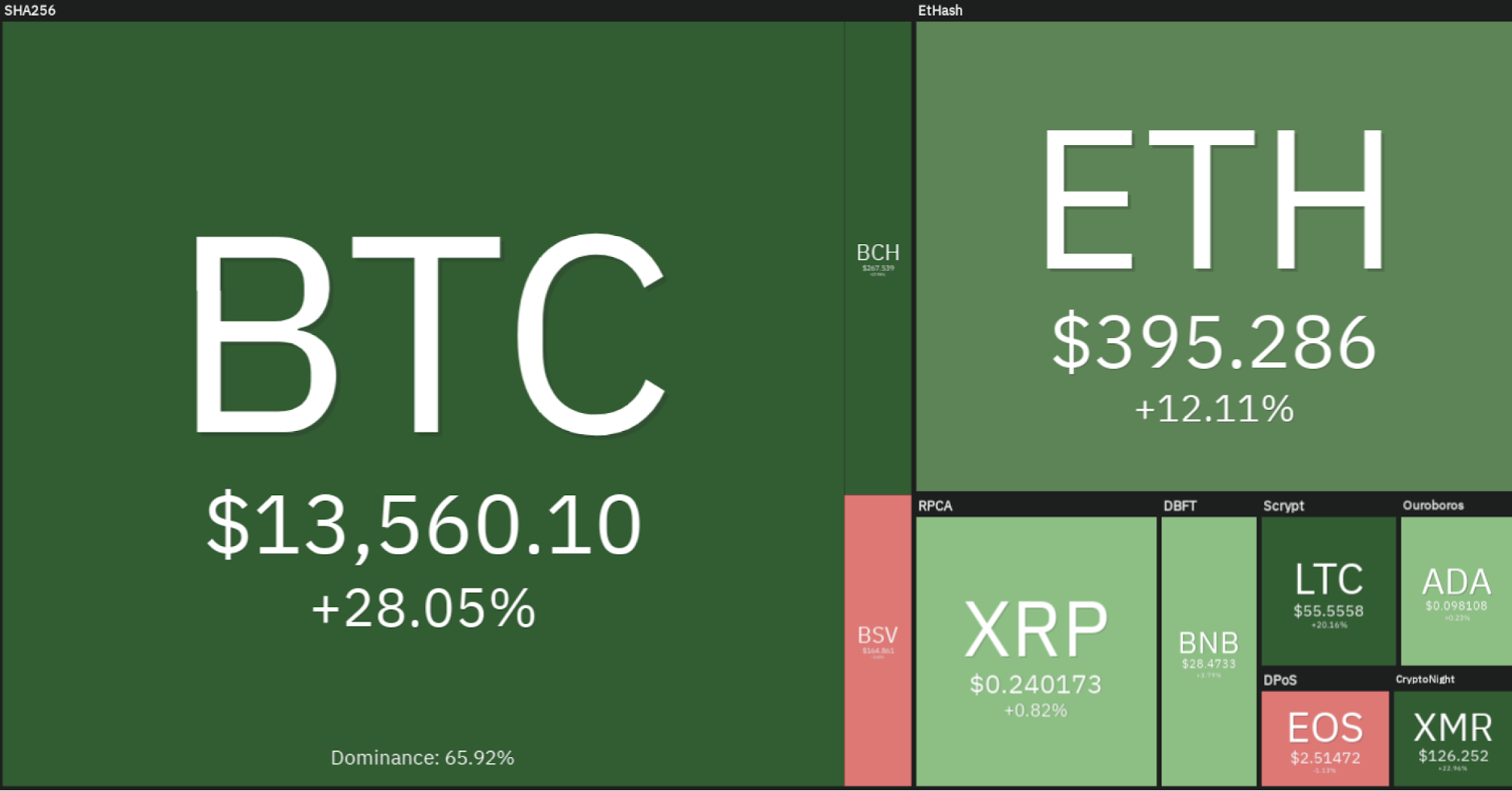

Source: coin360

Altcoins, on the other hand, had an underwhelming month. Large-cap cryptocurrencies such as ETH, XRP, BCH, LTC, and LINK delivered modest gains in October, but have failed to break new highs as trading activity shifted away to bitcoin. For many months, Altcoins have been the key driver of returns for crypto traders. Thus, it is no surprise that altcoins have appeared to be losing steam and disharmonized from Bitcoin's rally.

DeFi hype fades as correlation with Bitcoin goes negative

DeFi, a fast-growing sector, has had a phenomenal run since Q2 this year. Many in the community were acutely focused on the growth of this space, which eventually drove token prices higher. For instance, COMP, AAVE, YFI, and UNI have generated mind-boggling returns in prior months. However, since the correction in early September, most DeFi tokens have displayed a complete turnaround, erasing 70-90% of their gains. Even a Bitcoin rally could not buck the downtrend. In fact, tokens continued to trend lower in recent days.

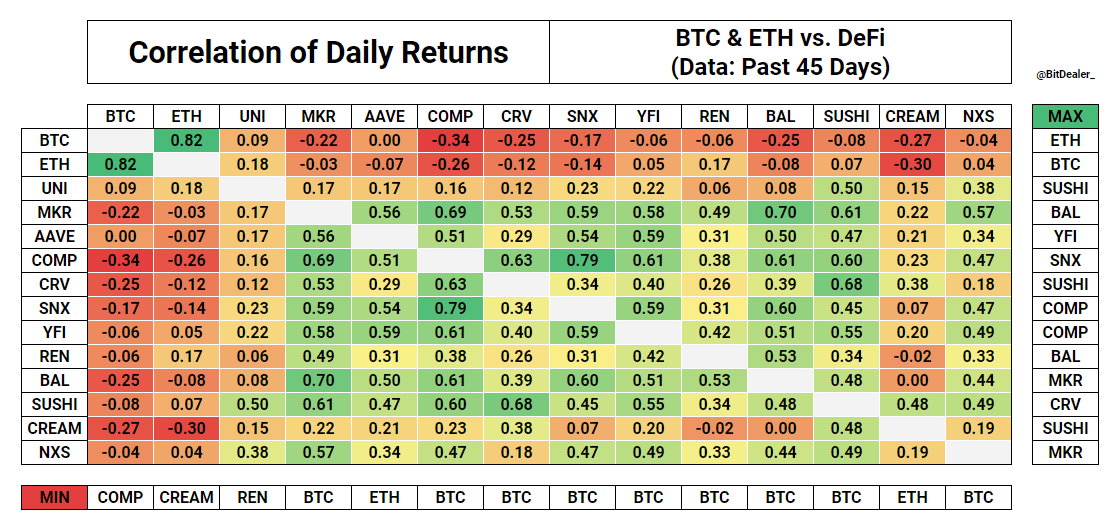

Source: BitDealer

With many DeFi tokens struggling amid Bitcoin’s resurgence, analysts have identified a negative correlation between DeFi tokens and BTC.

The chart above indicates Bitcoin’s negative correlation with 10 DeFi tokens over the past 45 days to November 1st, with only AAVE and UNI showing a neutral relationship with Bitcoin. 7 of 13 DeFi tokens had negative correlations with Ethereum (ETH), despite Ethereum powering much of the DeFi ecosystem. DeFi’s negative correlation with BTC and ETH is no surprise as the DeFi bubble came to a crashing end in September.

Binance’s DEFI Composite Index, which tracks a basket of DeFi tokens, has taken a beating over recent weeks following the abrupt end to DeFi’s bubble. The index declined more than 60% from $1,000 at the start of September to $385 as of this writing.

Despite the massive price retracements in DeFi tokens, the sector’s underlying fundamentals remained stable. DeFi’s Total Value Locked (TVL) has maintained a foothold above $11 billion in the past 30 days, while decentralized exchange (DEX) Uniswap has generated more than $8.5 billion in volume last month. The steady growth, despite its hype dying down, underlines DeFi’s long-term potential and investors’ interest.

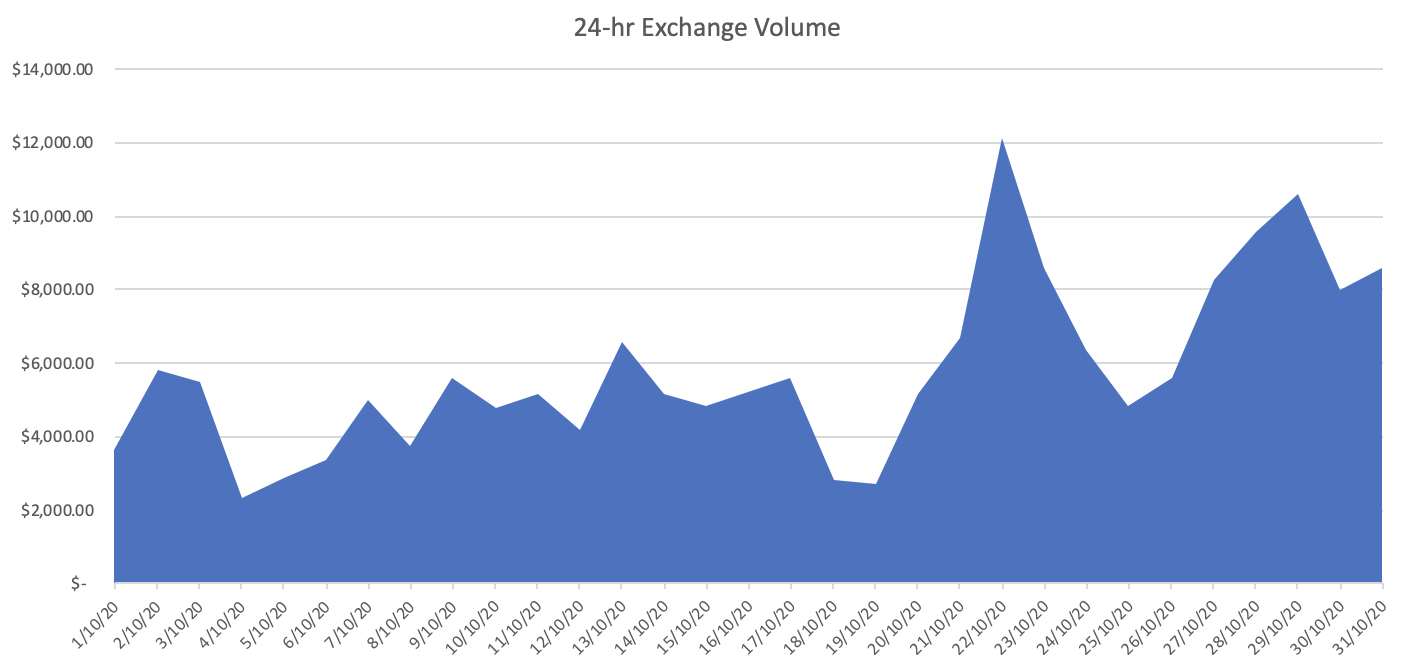

Derivatives volume surged as Bitcoin breakout

In October, Binance Futures processed more than $179 billion in volume, driven by increased trading activity on Bitcoin contracts. Following Bitcoin’s breakout above $12,000, daily trading volume surged beyond $6 billion and has proliferated higher ever since.

Source: Binance Futures

As shown above, daily volume has gradually trended upwards since mid-October. On October 21st, Binance Futures recorded approximately $12 billion in 24-hour volume as Bitcoin surged 7% on the same day.

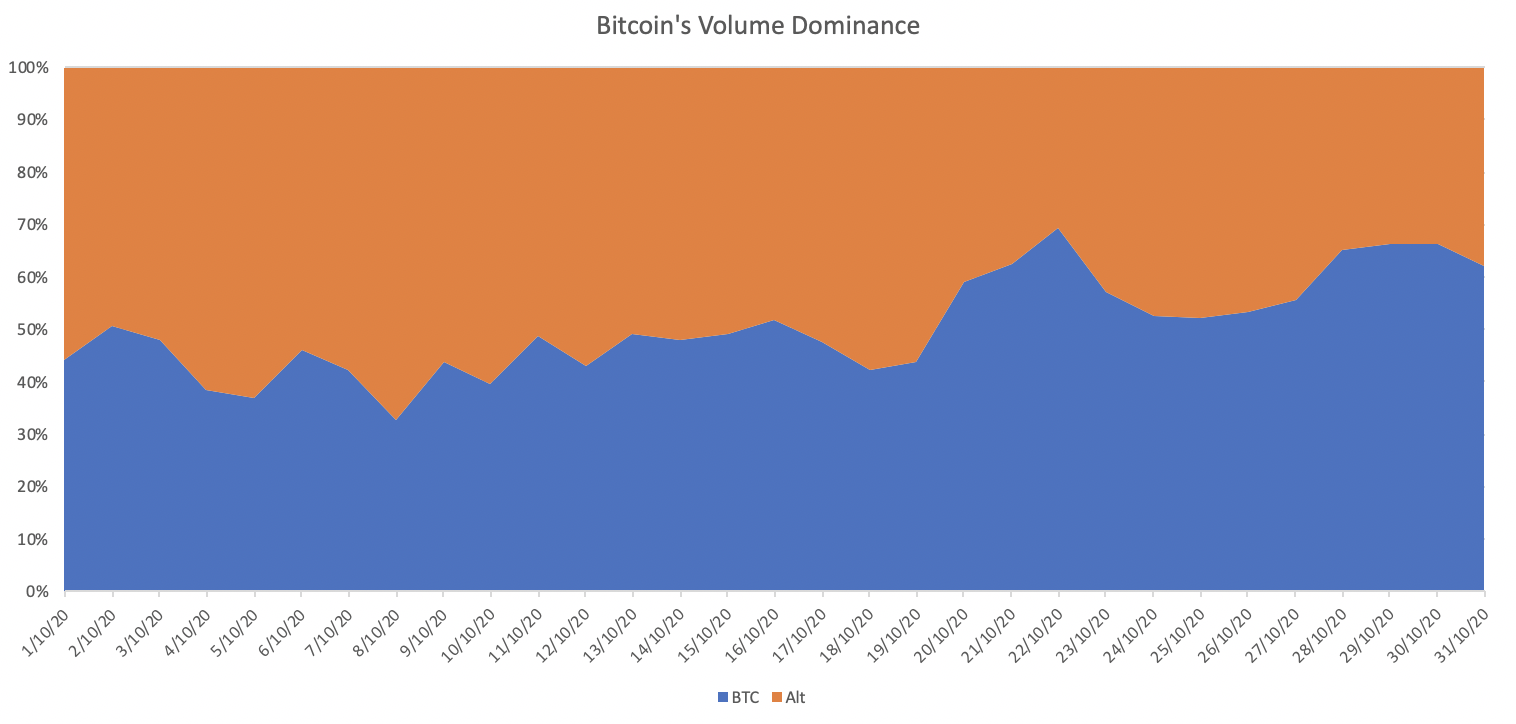

Bitcoin’s volume dominance rose to a 3-month high

Without surprise, Bitcoin’s volume dominance surged and crossed above 50% since the breakout above $12,000. Bitcoin’s volume dominance has been suppressed in prior months as ‘alt-season’ dominated headlines. However, market sentiment has completely reversed in favor of Bitcoin in October. Bitcoin’s growing volume dominance indicates traders’ renewed interest in the bellwether cryptocurrency as altcoin season ends abruptly.

Source: Binance Futures

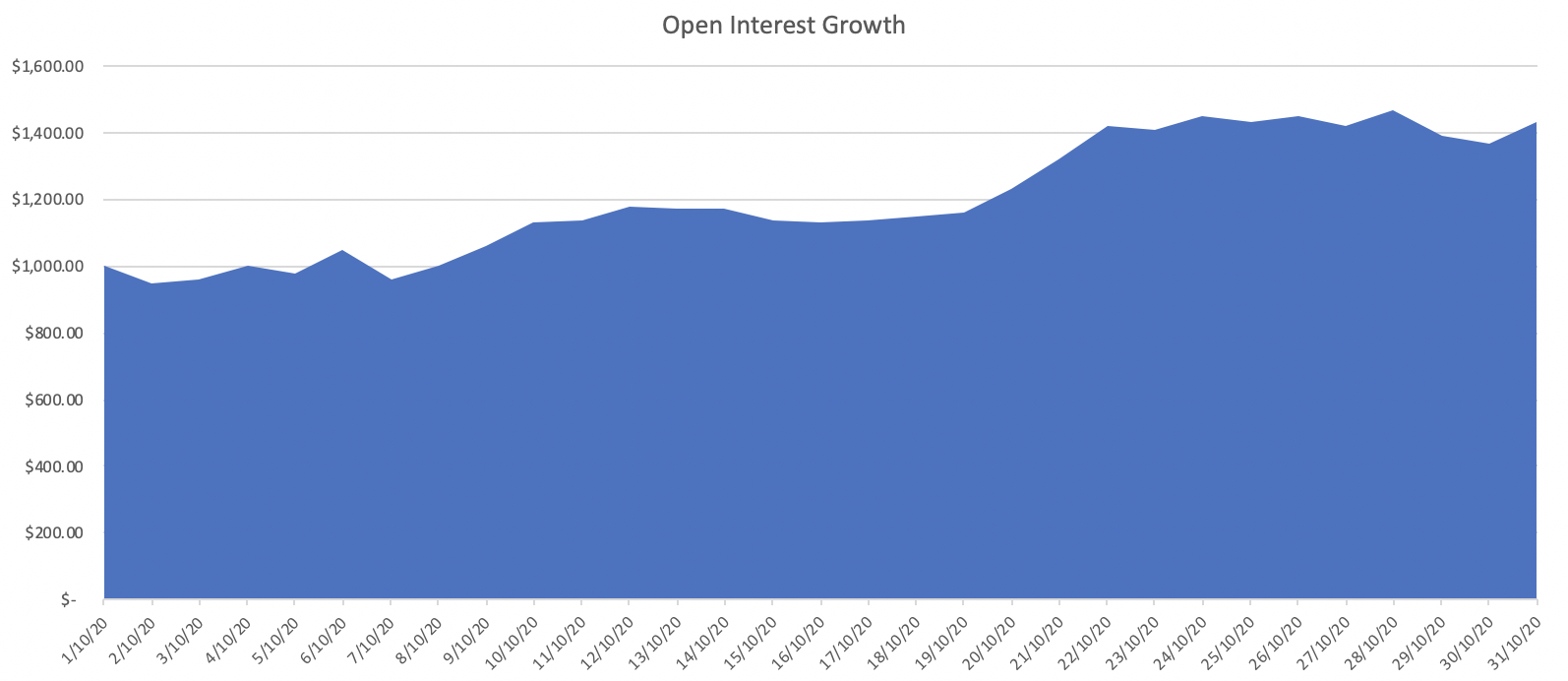

Binance Futures’ open interest largest since inception

In October, Binance Futures’ open interest marked a new all-time high. Binance’s open interest grew by 43% to $1.43 billion, growing the most among major exchanges. In October, the average daily open interest has grown to $1.2 billion, a 33% increase vs. $900 million in September.

Source: Binance Futures

Rising prices coupled with rising open interest may indicate that new money is flowing into the market (reflecting new positions). This could be a sign of bullish sentiment if the increase in open interest is being fueled by long positions.

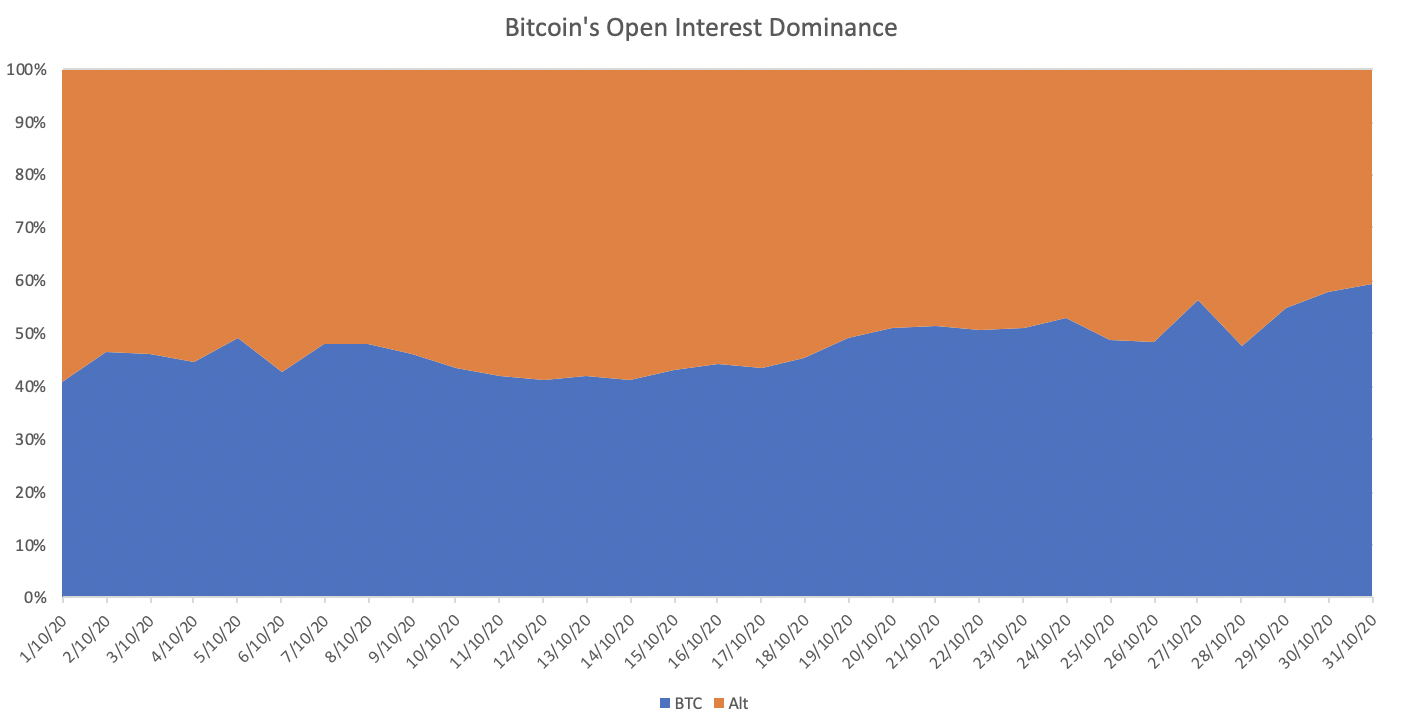

Similar to volume trends, Bitcoin’s open interest dominance steadily grew from 40% to 60%, suggesting that traders are positioning long-term directional bets on Bitcoin.

Source: Binance Futures

As mentioned above, Bitcoin’s rising open interest dominance is a positive sign, indicating that a long-term Bitcoin bull-market could be on its way.

Bitcoin crosses above $14,000 barrier — $20,000 next?

October was a significant month for Bitcoin as prices hit $14,000 for the first time in more than a year. Following two price rejections at the $14,000 level, Bitcoin has finally had a breakthrough and is currently changing hands at $15,000 as of this writing. This recent breakout is a significant milestone for Bitcoin investors as it clears the way for prices to climb to its previous high of $20,000.

While the price action signals a bullish trend for Bitcoin, many traders expect some kind of correction in the near-term as Bitcoin takes a breather to build more momentum for its next leg.

Historically, Bitcoin would transit to a consolidation range or a short-term correction after a significant upward move; it appears to be the case in previous breakouts above $10,000 and $12,000.

When would altcoins recover?

Most large-cap altcoins have remained muted in the course of the Bitcoin resurgence, including BCH, XRP, LTC, EOS, XLM, LINK, BNB, TRX, and ADA. However, ETH has just crossed above $420 as of this writing, surging more than 10% following an announcement on its ETH 2.0 upgrade.

The upgrade is expected to have a positive impact on ETH as it will significantly boost the network’s compatibility, scalability, and security. Additionally, the upgrade will shift Ethereum’s consensus mechanism to a Proof-Of-Stake, incentivizing investors to keep and lock-up their Ether for staking rewards. This will then reduce the supply of ETH tokens while demand continues to grow strong as large investors flood in seeking steady gains.

Read more about Ethereum 2.0: What is The Potential Impact of Ethereum 2.0 on The Derivatives Market?

Considering these catalysts, the upgrade could drag out ETH from its recent slump and potentially inject more positive sentiment into the altcoin sector.

Newly Launched: Binance Futures Battle Competition!

Binance Futures Battle blends elements of gaming and cryptocurrency trading by placing traders head to head in a battle to see who is the most profitable over a certain period of time.

Join our Bitcoin trading battle and earn points regardless of whether you win or lose. It is a great way to test how good you are against some of the best traders in the game.

With 2.5 BTC up for grabs, be sure not to miss out. Start Battle now!

For details about Binance Futures Battle, visit our support page.

More information about Binance Futures Battle Competition can be found here.