The key development last week was the a speech by United States Federal Reserve Chairman Jerome Powell at the Jackson Hole Economic Forum. The central bank’s decision to keep interest rates low over the long-term is part of its strategy to stimulate economic growth. Notably, gold prices, along with Bitcoin ( BTC), shook violently after Powell’s speech, but recovered thereafter, reflecting positive market sentiments.

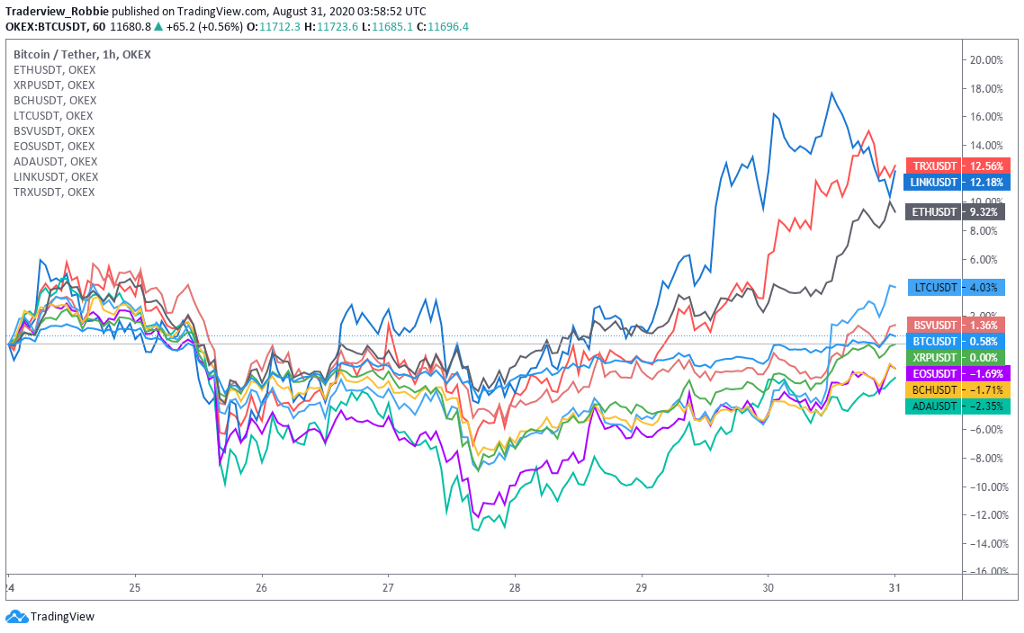

Along with Bitcoin’s rebound in the second half of the week, several major altcoins also surged. TRON ( TRX) benefited from huge demand for DeFi components, rising 12.56% last week to lead large-cap altcoins. Chainlink ( LINK) found support around $13.50 after falling 10% and then quickly rallied 30% to post a 12.18% weekly gain. ( ETH), however, was mostly volatile, falling as low as $370 before rebounding above $400 to close the week at $426.7, up 6.1%.

For today’s BTC and ETH technical analyses, you can refer to our Crypto Market Daily for more insights.

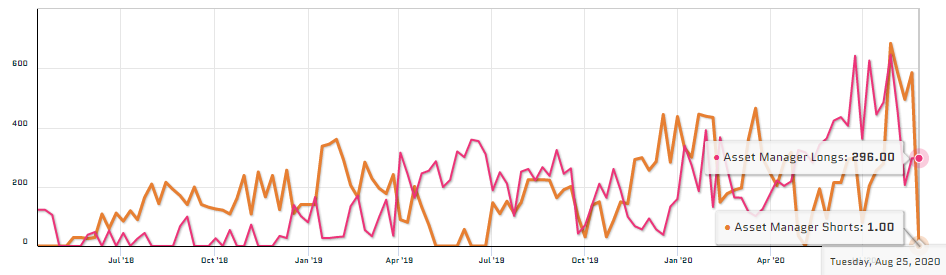

On Aug. 29, the CFTC released the latest CME Bitcoin futures position data as of Aug. 25. Last week’s initial correction led to a large reduction of total open interest. OI dropped sharply from the all-time high of 14,454 to 11,615.

Notably, however, long positions of asset manager accounts remain unchanged at 296, but short positions of asset manager accounts plummeted from 585 to 1. We believe this reflects profit-taking with shorts being closed, as well as confidence in Bitcoin’s short-term appreciation.

Moreover, long positions in leveraged fund accounts declined further, from 5,760 to 4,839, while short positions declined from an all-time high of 8,590 to 6,148. The percentage of short position reduction in this segment is greater too, which shows that leveraged funds are also optimistic about the market.

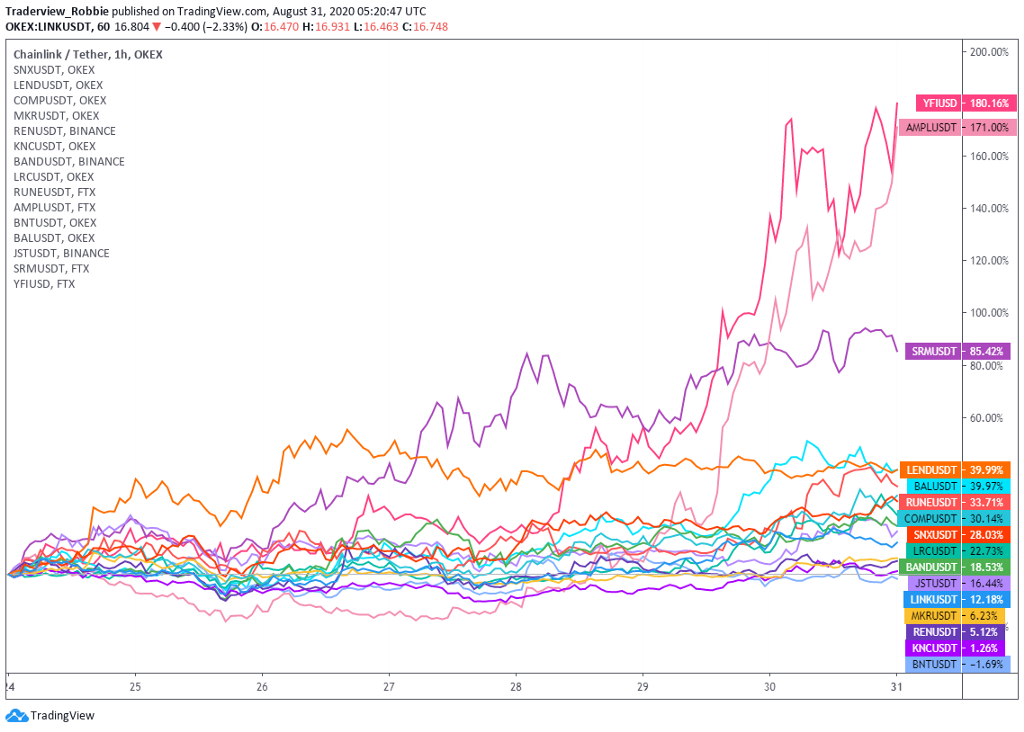

In the DeFi space, while LINK’s weekly return has been decent, several other DeFi tokens skyrocketed over the week.

Yearn.finance ( YFI) surged over the weekend and topped out at an incredible $39,000–1 YFI = 3 BTC — recording a 180% weekly gain. Even its founder, Andre Cronje, said in a recent interview that DeFi is driven by greed and its boom isn’t sustainable.

Ampleforth (AMPL) got out of the death spiral due to the positive reception of newly launched yield-farming projects, and it climbed back above $1. It was then continually bought by traders in anticipation of a token rebase, reaping a weekly 171% return. Another fast riser was Serum (SRM), which was in high demand after the release of its decentralized derivatives exchange, realizing an 85.42% weekly return.

According to DeFiPulse data, the total value locked in DeFI rose from $6.7 billion to $7.8 billion, with a 15% increase last week. Meanwhile, ETH locked in DeFi jumped to 5 million from last week’s 4.7 million. The surging demand and lockups have reduced selling pressure on Ether, allowing it to steadily appreciate in price.

Visit https://www.okex.com/ for the full report.

Not an OKEx trader? Learn how to cryptocurrency-on-okex”>start trading!

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.