Currently, as Bitcoin consolidates between $11,100 and $12,100, short-term implied volatility is up nearly 20% and medium- to long-term implied volatility has been up 10% over the week — indicating that the market is expecting further price movements.

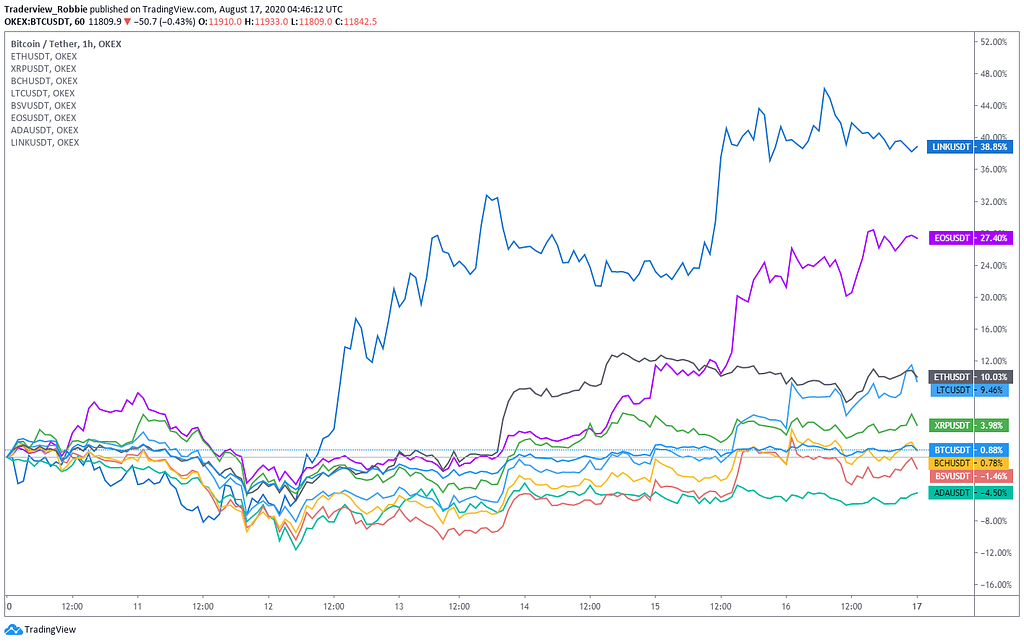

Meanwhile, the Ethereum network’s average transaction fee reached an all-time high of $6.62 on Aug. 13, due to DeFi users rushing into yield-farming projects. The high demand also pushed up the price of Ether ( ETH) by 10.03% in the past week.

The DeFi market fever reached new levels in the past week and prompted projects like TRON ( TRX) and EOS to announce their intentions to enter the space. Consequently, the prices of these protocols also surged over the last seven days, with TRX gaining nearly 33% and EOS rising by 27.40%.

Other altcoins, not associated with DeFi, came up with mediocre figures, with Bitcoin SV (BSV) falling by 1.46% while Bitcoin Cash (BCH) and XRP gained 0.78% and 3.98%, respectively.

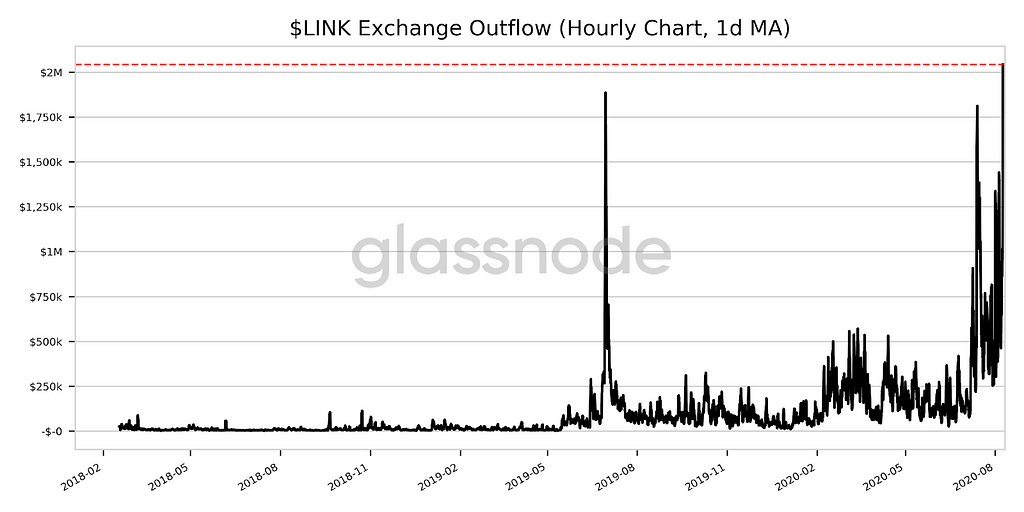

The best performer among the top 10 coins by market cap was Chainlink ( LINK), posting a 38.85% weekly return. LINK moved up quickly after testing the support at $12 on Tuesday, and it kept breaking all-time-high records to reach the $20 mark on Sunday morning. It is currently consolidating at around $19.

According to DeBank, the total market capitalization of decentralized finance exceeded $14 billion last week, of which Chainlink represented 51%. Notably, we can also see how a very large number of LINK tokens are being moved to the various decentralized pools to provide liquidity and generate income.

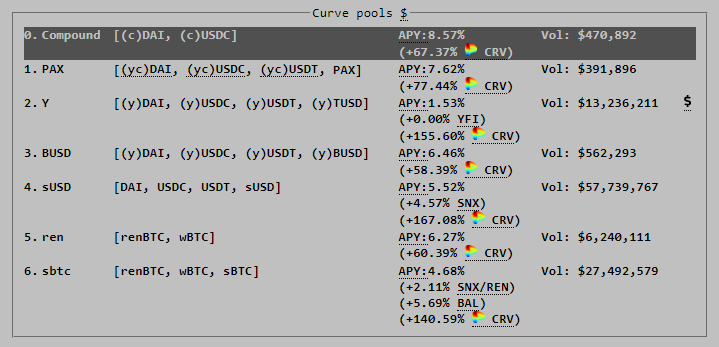

Yield farming, on the other hand, may have reached a short-term peak last week, with the release and crash of YAM, and the much-anticipated Curve ( CRV) going live to disappointing price action.

YAM plummeted below $1 from as high as $150, and has entered negative rebase territory. However, that has not been able to stop the price from falling further, and it is now trading around $0.30. Meanwhile, the huge daily supply of CRV has caused its price to decline since it went live. Over the past four days, its price on OKEx has fallen to $5 from an opening of $50. However, yield-farmers with large capital allocations are still able to maintain decent annualized returns on Curve.

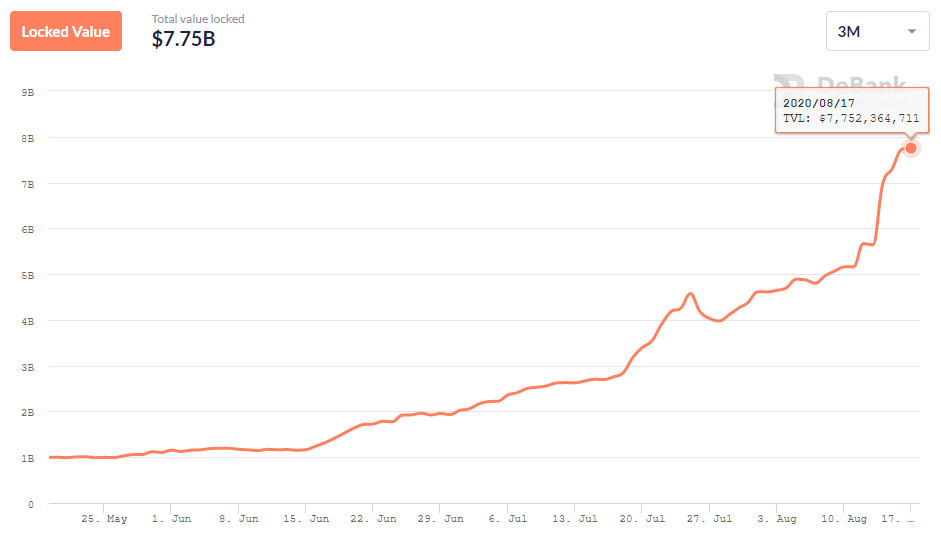

CRV yield farming also boosted three projects — Maker, Aave and Curve — all of which individually recorded total value locked figures over $1 billion last week.

With this, the total value locked in DeFi reached $7.75 billion — a seven-fold increase from three months ago — as per DeBank’s data.

Market participants should also note how the performance of DeFi tokens is diverging, where, apart from LINK, Synthetic ( SNX) soared 53%, Loopring ( LRC) and Aave ( LEND) were up over 20%, but Balancer ( BAL) and Ampleforth (AMPL) were down about 20%.

Looking ahead this week

TRON (TRX), which has been up 45% this month, will launch its decentralized finance ecosystem, JUSTswap, on Aug. 17. The protocol will also start its yield farming, via another project, Just (JST), by the end of this month.

View https://www.okex.com/ for the full report.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.