In the futures market, the new quarterly contract BTCUSD0326 has gone live, while the previous quarterly contract, BTCUSD1225, became the bi-weekly contract. BTCUSD0326 is now trading around $18,300 levels with a premium of $450, or roughly 2.50%, over the index price.

In last week’s Futures Friday article, we noted that several ratios returned to intermediate levels, indicating that retail traders do not have a clear attitude toward the price. The indicators generally show a lack of bullish sentiment.

This week, the long/short ratio fell to a multi-week low and open interest also fell to a new low not yet seen in December. Although the rapid upward movement of the BTC margin lending ratio on Wednesday showed that some traders were trying to catch the bottom, the price fell again today, possibly trapping some longs.

OKEx BTC Quarterly Futures ( BTCUSD1225 ), as of 8:00 am UTC on Dec. 11. Source: OKEx, TradingView

OKEx trading data readings

Visit OKEx trading data page to explore more indicators.

BTC long/short ratio

Overall, the long/short ratio continued to move downward, from around 0.9 at the end of last week to the current 0.8. At one point during Wednesday’s price plunge, the long/short ratio had a quick upward move, indicating that a number of retail traders were trying to buy the dip. However, the ratio then quickly retraced, indicating that these traders quickly closed out their positions.

The long/short ratio compares the total number of users opening long positions versus those opening short positions. The ratio is compiled from all futures and perpetual swaps, and the long/short side of a user is determined by their net position in BTC. In the derivatives market, whenever a long position is opened, it is balanced by a short position. The total number of long positions must be equal to the total number of short positions. When the ratio is low, it indicates that more people are holding shorts.

The current long-short ratio has fallen to its lowest point in weeks, showing a clear lack of confidence among retail investors to go long.

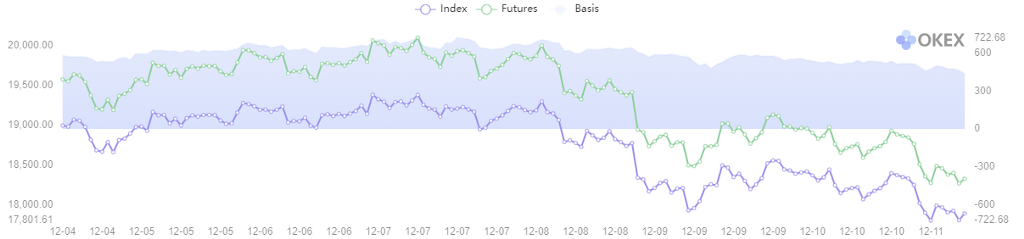

BTC basis

Since the new quarterly contract went live this week and is far from the expiration date, it maintains a premium of more than $450, or 2.6%. The premium has been down from the mid-week’s $500, but this still shows the market’s confidence in the next year.

This indicator shows the quarterly futures price, spot index price and also the basis difference. The basis of a particular time equals the quarterly futures price minus the spot index price. The price of futures reflects the traders’ expectations of the price of Bitcoin. When the basis is positive, it indicates that the market is bullish. When the basis is negative, it indicates that the market is bearish. The basis of quarterly futures can better indicate the long-term market trend. When the basis is high (either positive or negative), it means there’s more room for arbitrage.

At the same time, we note that the funding rate for perpetual contracts remained subdued for the majority of this week, indicating that the market is not exactly bullish.

Visit https://www.okex.com for the full report.

OKEx Insights presents market analyses, in-depth features and curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.