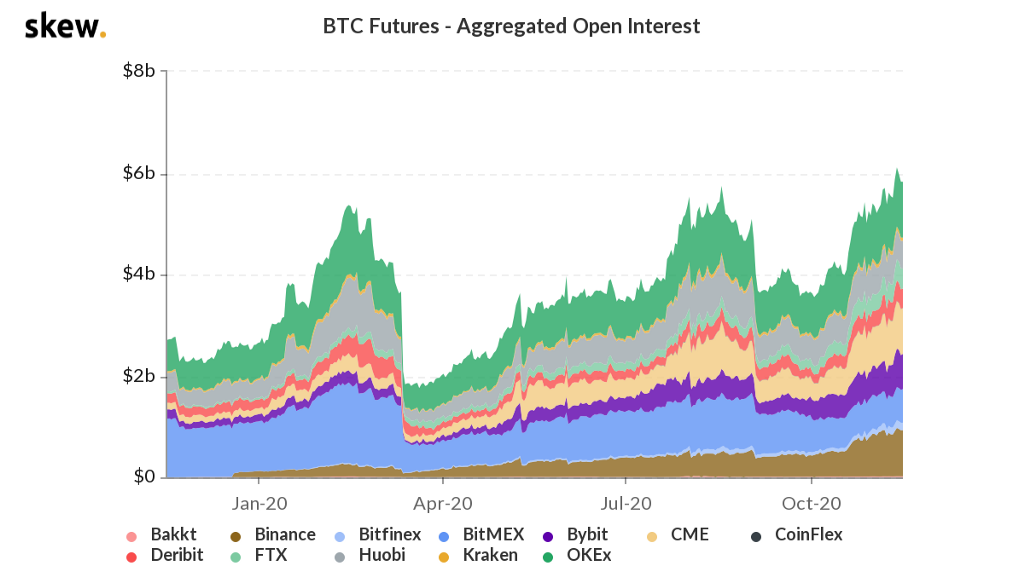

Along with the continued rise in price, the aggregated open interest of BTC futures also increased by nearly 9% from a week ago, surpassing $6 billion for the first time and setting an all-time-high record of $6.1 billion on Nov. 12, as per skew’s data.

While the CFTC did not update the COT report this week, demand from institutional and retail investors is still robust. PayPal started to offer BTC, Ether ( ETH), Litecoin ( LTC), and Bitcoin Cash ( BCH) to its users, which is a milestone for the further mainstream adoption of cryptocurrency. The payment giant also raised the weekly transaction limit for users from $10,000 to $20,000, which could be an indicator of demand.

The price of BTC is still above $16,000, which shows that the overall market trend is quite strong. However, traders need to keep an eye on volumes.

From the major altcoins, only LTC and XRP outperformed Bitcoin last week with 4.49% and 5.42% gains respectively. Bitcoin Cash ( BCH) and Bitcoin SV ( BSV), which have historically been closely tied to Bitcoin, were the worst performers, down 7.74% and 12.10% respectively. BCH finished its hard fork on Sunday, but the market didn’t respond positively to that. The BCHN chain is currently 57 blocks ahead of the BCHA chain, according to Coin Dance.

Ether ( ETH) underperformed last week, dropping 2.41%, but DeFi protocols made a big comeback for the second week in a row. The prices of several decentralized exchange native tokens exploded, with SushiSwap ( SUSHI) surging 85.25%, while Curve ( CRV) and Uniswap ( UNI) rose 45.07% and 34.37% respectively.

Visit https://www.okex.com/ for the full report.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.