Meanwhile, the total cryptocurrency market capitalization rose to another yearly high of $404 billion — up from $355 billion at the beginning of the month, per data from CoinGecko.

On the other hand, the lack of price reversals and volatility led to a decline in monthly trading volume, along with the desire to de-risk ahead of the United States presidential election. CryptoCompare noted in its October Exchange Review that monthly derivatives volumes remained relatively stable in October, while spot volumes decreased significantly. According to the report, large declines of 30% or more in monthly spot trading volumes were seen across many top-tier exchanges.

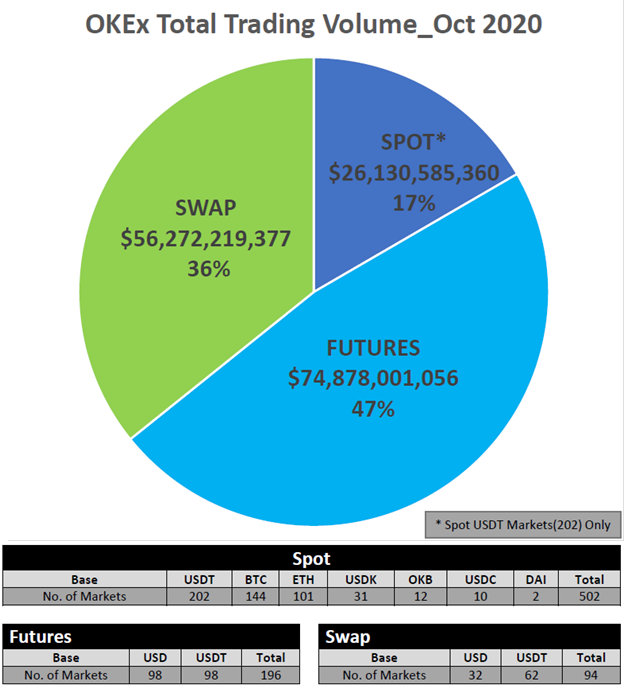

At the end of October, according to data from skew, OKEx had the highest aggregated open interest for BTC futures across all exchanges, at $1.1 billion. It also had the highest open interest for Ether ( ETH) futures, at $240 million. However, the same industry-wide trend in spot volume was observed in the OKEx October’s microstructure report. Spot volume on the exchange decreased by 42% when compared to the previous month. Futures and swap volumes saw smaller declines of around 16%.

In October, the number of spot trading pairs on OKEx increased by 20. There are now 502 spot trading pairs.

DeFi trading volume percentage increased

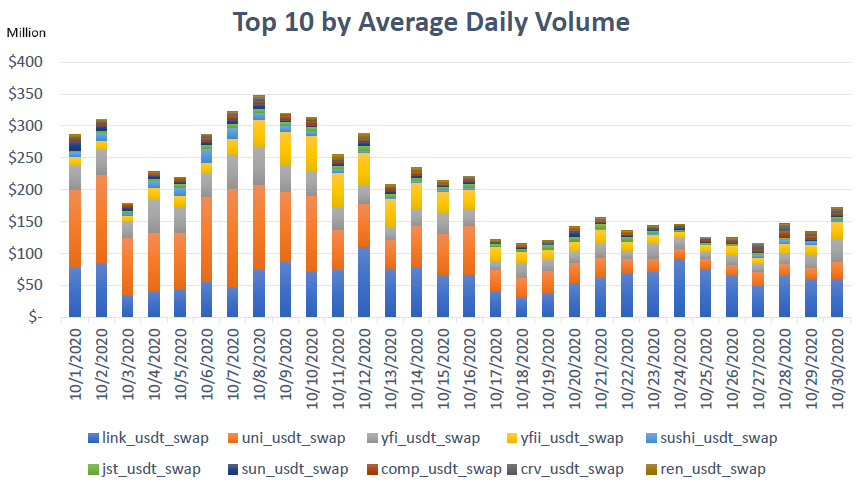

Despite tumbling token prices in the world of decentralized finance, the trading volume of DeFi tokens remained constant — down only 2% month-over-month. DeFi’s share of the total swap trading market rose from 13% to 16%.

Among USDT-margined DeFi swaps, Uniswap’s governance token ( UNI) and Chainlink ( LINK) have the largest monthly volume, at around $2 billion each. Despite the price of UNI dropping by almost 50% in October, it is still the most popular DeFi token on the market.

The complete dataset for OKEx’s DeFi Market Microstructure Report for October can be downloaded here.

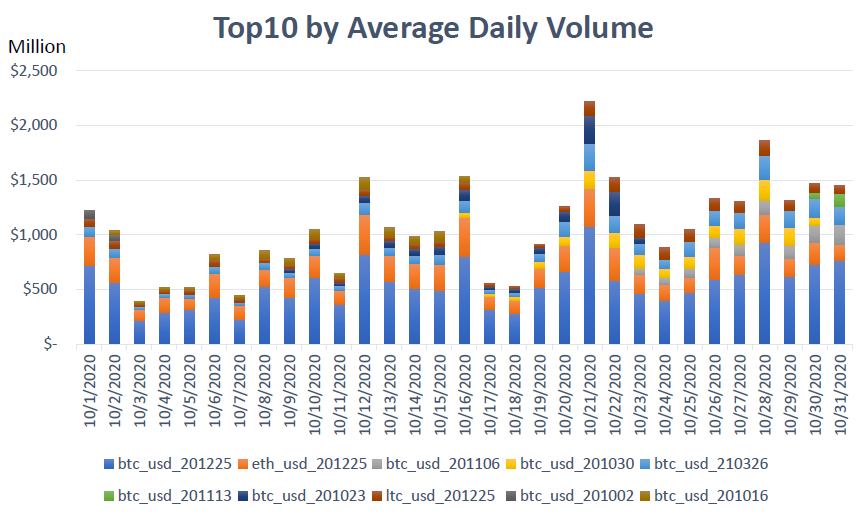

Futures volume uptick after Bitcoin price breaks $12,000

Futures, the most traded product on OKEx, saw volumes drop by 16% in October to $75 billion.

OKEx now offers a total of 196 futures instruments — 22 instruments more than in September- which allowed traders to make more complex combinations and trades with different expiry dates.

The market was not active in the first half of October. However, the price of BTC broke through a key resistance level of $12,000 on Oct. 21. Futures volume then amplified and printed a monthly high.

Among futures, coin-margined contracts were more popular than USDT-margined contracts. For example, the most heavily traded BTC quarterly future ( BTC_USD_201225) generated a total volume of $16.9 billion, while the most heavily traded USDT-margined quarterly future ( BTC_USDT_201225) posted $10.4 billion monthly volume.

Visit https://www.okex.com/ for the full report.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features and curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.