Background

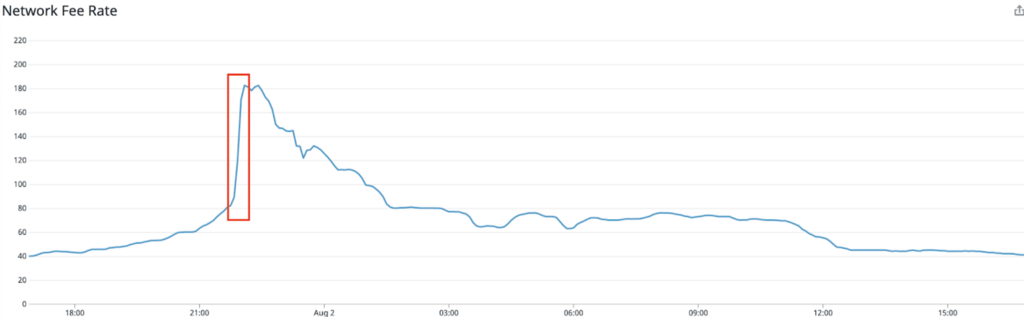

All transactions on Ethereum are required to pay a fee in order to be processed by the network. This network fee is determined by the variable demand for fixed processing capacity on the Ethereum network — when many users are attempting to send transactions at the same time, fees will rise, and they will fall when fewer users are using the network.

At Coinbase, we determine a fee rate that maximizes the speed that a transaction will be processed while simultaneously minimizing how much our users must pay. To this end, we actively track the fee required for a transaction to be included in the subsequent few blocks in real-time. However, spikes in network fees can lead to transactions becoming stuck — i.e. a newer, higher fee transaction will be prioritized by miners over an older, lower fee transaction.

August 1, 2020 Fee Spikes

On August 1st, at around 9:45pm PST, we observed a spike in transaction fees on the decentralized network.

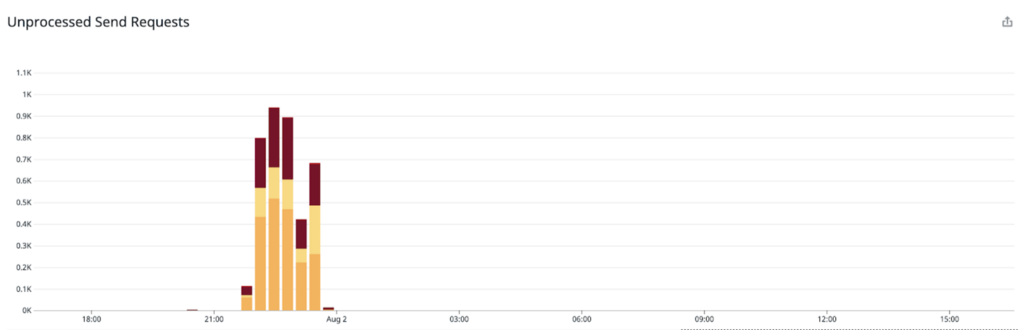

Throughout this spike period, our systems performed as expected and determined a fee that was accurate at the time of estimation. This spike led to a backlog of transactions that were not being picked up by miners and resulted in delayed withdrawals from Coinbase.

Other major exchanges and wallets determine fees in the same way, leading to many users’ deposits into Coinbase being delayed as well.

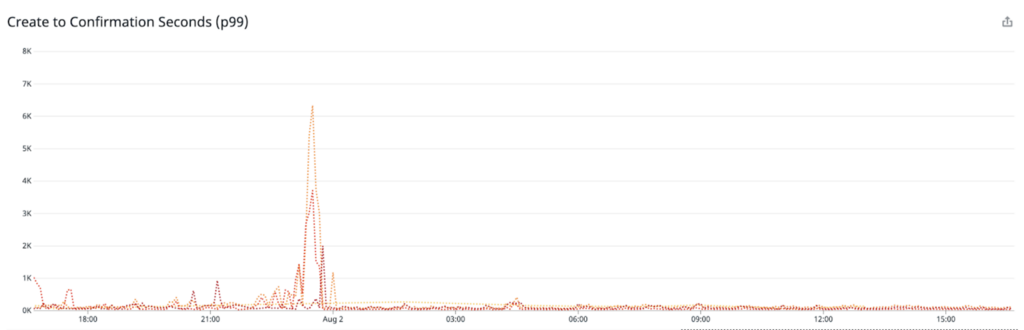

At the peak of this fee spike we observed a total of 559 transactions being delayed across ETH and ERC20s with the average delay spiking at 11:30pm PST at 105 minutes. Transactions broadcast at and after the peak of this spike (10:05pm PST) were not impacted.

The fee spike ended at 10:05pm PST, causing the backlog of transactions to start being processed by the network. The backlog was fully processed by 11:40pm PST.

Looking Ahead

Fee spikes are a common occurrence and are often observed when the network is congested due to price volatility or large network activity. At Coinbase we have implemented transaction replacement which allows us to adjust fees for transactions that we submit to the network after the submission.

As the activity on the Ethereum ecosystem is increasing we are actively monitoring and evaluating our fee strategies to find the right balance between being a good citizen of the network and providing the best experience to our customers.

If you are interested in working on our Crypto team — we are actively hiring. Please reach out and we would love to chat with you.

was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.