Over the weekend of April 17-18, 2021, we saw numerous pieces of misinformation spread about our investor and executive stock sales. We’d like to set the record straight.

When investors or executives sell their shares on a listing day — or at any other time — they file a Form 4 with the SEC. These filings are public and available to anyone. Unfortunately, they can be tricky to correctly interpret. Which is what may have led to misinformation being shared on Twitter.

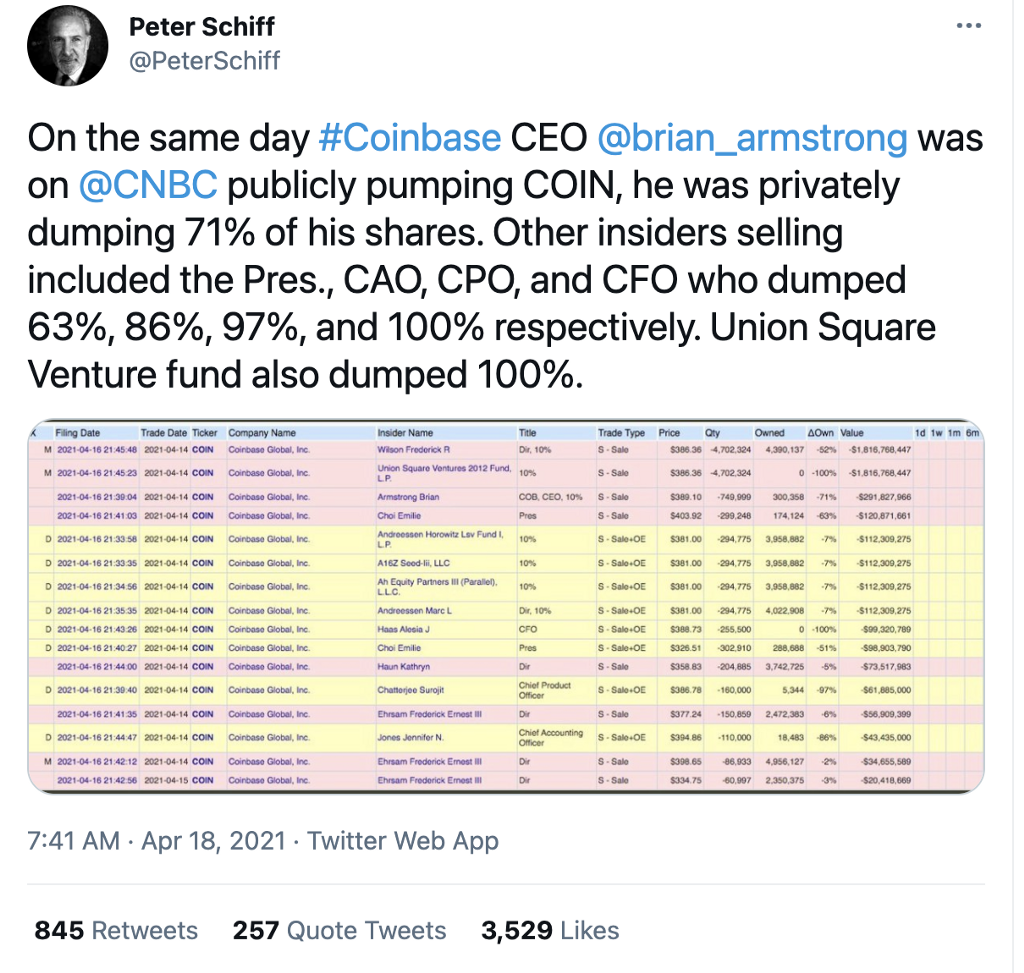

It started with someone creating an erroneous chart:

This led to a false narrative that Coinbase executives were selling the majority of their stock when we listed on Nasdaq, which continued to spread on Twitter:

Here’s the truth:

Brian Armstrong, CEO, sold <2% of his total outstanding equity, not 71%

Alesia Haas, CFO, sold 15% of her total outstanding equity, not 100% as quoted in some reports

Emilie Choi, President and COO, sold 24% of her total outstanding equity

Surojit Chatterjee, Chief Product Officer, sold 8% of his total outstanding equity

Jennifer Jones, Chief Accounting Officer, sold 38% of total outstanding equity

Other execs’ selling percentages are accurately reflected in this piece and the Coinbase filings are listed on our investor site here

These percentages are consistent with executive stock sales in other recent Direct Listings*.

How did this misinformation happen? We’re not sure, but perhaps it’s confusion with the different types of equity that exist and how they’re reported. Class A and Class B shares, options, and RSUs are accounted for differently in different reports. In addition, if an executive did a same day exercise and sale, it looked as though they sold 100% of their shares as opposed to 100% of the shares exercised on the day.

The misinformation continued:

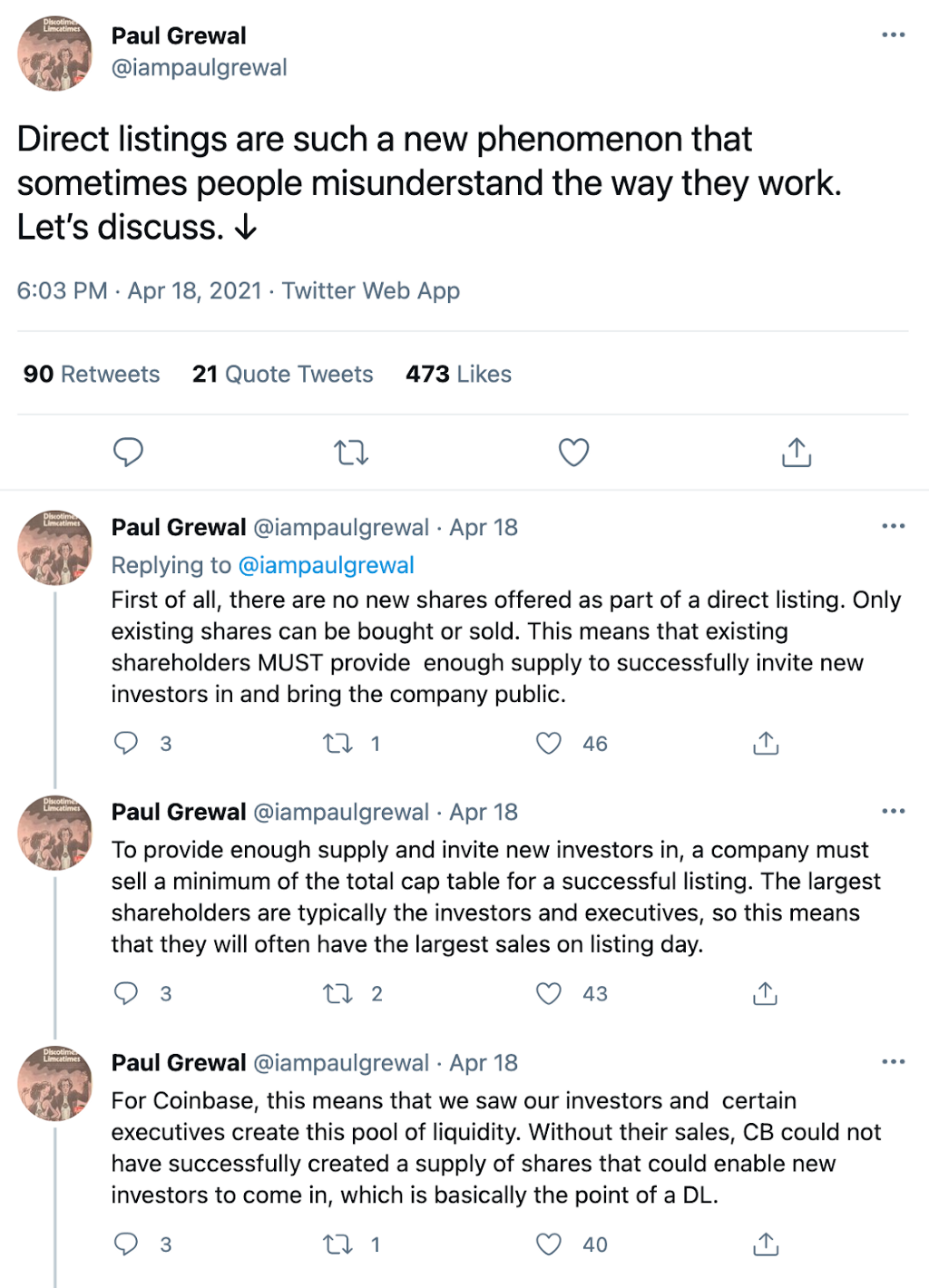

Again, false and harmful. In direct listings, there are no new shares offered. Existing shareholders need to sell portions of their total holdings to create a market, particularly in the first days of trading (as was the case here). This is different from IPOs (Initial Public Offerings) where new shares are offered as part of the listing so investors and executives are not relied upon to sell any shares to create supply for new investors.

Our Chief Legal Officer, Paul Grewal, explains:

Summary

Coinbase executives and early investors sold portions of their total holdings to create liquidity on the opening day of trading for Coinbase stock. These sales are critical to a direct listing. Despite misguided commentary on social media and in some news outlets, these sales represented small percentages of their overall holdings. Our executives and investors may continue to sell their holdings — or buy additional stock — at various points in the future. These transactions will always be publicly visible via SEC disclosures.

*Based on a review public disclosures of executive sales following the direct listings of Asana, Palantir, Roblox and Slack. Asana’s executive officers sold 1.67%; Palantir’s executive officers sold 7.29%; Roblox executive officers sold 4.21%; and Slack executives sold 4.18% of total executive officer holdings. Coinbase Section 16 officers sold 3.32% of total Section 16 officer holdings.

was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.