Find out the benefits of recurring investment and how you can use it to maximize your crypto gains with Binance.

Navigating the volatile crypto market can be tricky for even experienced investors. A popular approach to investing is “time in the market”, which reduces the impact of market volatility. Find out how and why investors use recurring investment strategies to grow their crypto assets here.

The unpredictable nature of the crypto market makes it hard for traders and investors to “time the market” and predict when to enter and exit for profitable trades. To reduce the impact of market volatility and remove the stress of timing the market, many investors turn to recurring investment strategies, also known as having “time in the market”.

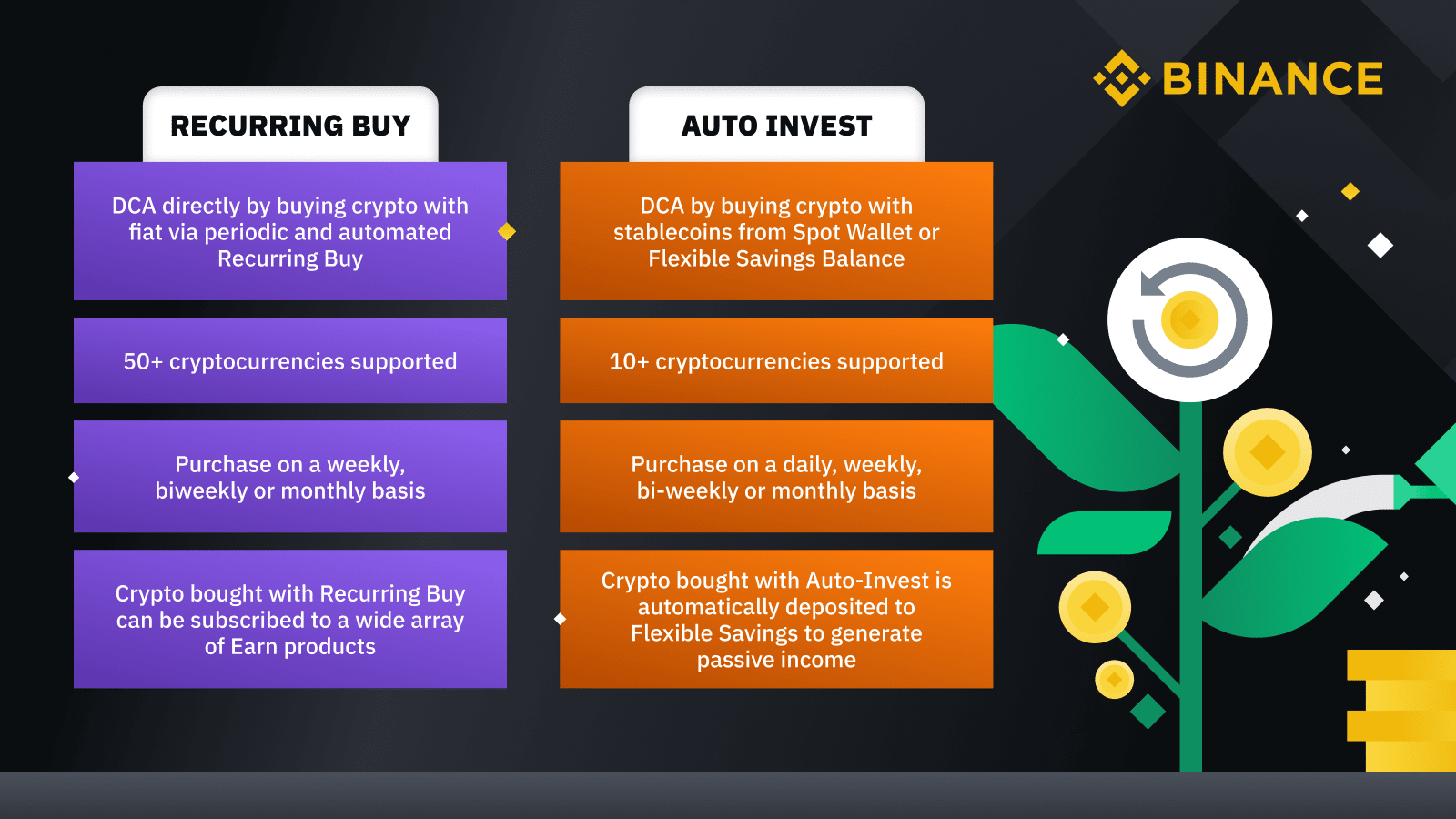

Binance offers two features to take advantage of to adopt a recurring investment strategy to manage your portfolio – Recurring Buy and Auto-Invest. Read more about the difference between the two, the tips to maximizing your gains and how to get started with recurring investment on Binance.

What Is Recurring Investment?

Recurring investment refers to the method of investing a specific amount of money regularly, often on an automated basis. It incorporates the Dollar-Cost Averaging (DCA) strategy to build one’s portfolio by investing small amounts regularly. This method applies to both traditional and crypto investments, allowing investors to potentially acquire more assets at a lower average cost than if they were making a lump sum investment.

3 Main Benefits Of Recurring Investment

While a simple theory, investing on a recurring basis has several benefits compared to investing in lump sums. Below are three key advantages of recurring investment.

1. Steady portfolio growth

Recurring investments ensure that you spread out your investments over time, allowing you to grow your crypto portfolio with new funds consistently. As crypto projects grow with the developments of the space, so will their revenue, profits and token price. Investing with a longer time frame ensures that you don’t miss out on their growth as you are accumulating assets regularly.

2. Better managed risks

Recurring investment manages impact and risks from the volatile crypto market better. Instead of hoping that a lump sum investment will pay off, spreading out your investments also smooths out the market’s ups and downs, ensuring that you don’t put all your eggs in one basket. Because you break your investments into smaller chunks, it also allows you to invest within your financial means each month, letting you have the flexibility to increase or reduce your investment amounts depending on your financial situation at the moment.

3. More disciplined investing

We all know how impulse trading can end up being detrimental to our crypto portfolios. For example, being emotionally charged can cause investors to sell on impulse or miss out on price dips out of fear. Fortunately, recurring investments can help disconnect our emotions from our investments as both the amount and period are predetermined months before purchase. Ultimately, recurring investments ensure that you invest with discipline regardless of market conditions, allowing you to focus on long-term crypto accumulation.

How To Set Up Recurring Investments

If you’re considering recurring investment as a strategy, there are two simple ways to invest on a recurring basis with Binance.

Recurring Buy on Binance

Recurring Buy is a feature designed to let users automate the purchase of crypto. It operates on a DCA investment strategy, allowing users to choose the crypto they want to purchase, the amount they want to invest and how often they want to purchase the crypto. With Recurring Buy, users can save the hassle of making purchases manually and instead automate cryptocurrency purchases.

Read more: How To Grow Your Crypto Portfolio with Recurring Buy

Mechanics of Recurring Buy

Users can buy crypto with fiat via Recurring Buy, choosing to buy weekly, bi-weekly or monthly. You can even set the day and time for the recurring purchase. To set it up, simply connect and pay with your VISA/ Mastercard. For a detailed step-by-step guide, click here to set up your Recurring Buy in less than 10 minutes.

Congratulations! You have now successfully set up your first recurring investment with Binance. With your crypto portfolio steadily growing over time, you can now explore other products to subscribe your funds to and maximize your crypto gains.

Auto-Invest on Binance

Auto-Invest is a Binance Earn feature that allows you to automate crypto investments and earn passive income at the same time. Unlike Recurring Buy plans, Auto-Invest plans allow you to purchase crypto regularly only via stablecoins USDT and BUSD. Buy stablecoins with fiat to set up an Auto-Invest plan. You can read more about Auto-Invest here.

Recurring Buy Or Auto-Invest?

Recurring Buy and Auto-Invest are both ways you can start investing on a recurring basis, but they don’t offer the exact same features. We have listed down the differences below to help you choose the investment method that suits you better.

Conclusion

With recurring investments, the biggest advantage that one can have is time. You can easily get started on Binance simply by buying crypto via the Recurring Buy function or set up an Auto-Invest plan.

Interested in moving up the ladder on your recurring investment journey? Explore other investment solutions offered by Binance Earn that lets you reap more rewards in the long run.

Ready To Start Your Cryptocurrency Adventure With Binance?

Get started by signing up for a Binance.com account or download the Binance crypto trading app. Next, verify your account. After you have verified your account, there are three main ways to buy cryptocurrencies on Binance using cash: you can buy crypto with cash from Binance via bank transfer, card channels or e-wallets options.

Buy BUSD, BNB and cryptocurrencies with a Debit Card, Credit Card, or via Bank Transfer

Linking your debit card, credit card, or bank account (available in many regions) is one of the easiest ways to buy Bitcoin and more than 100+ cryptocurrencies.

Disclaimer: Cryptocurrency investment is subject to high market risk. Binance is not responsible for any of your trading losses. The opinions and statements made above should not be considered financial advice.

Read the following helpful articles for more information:

(Support) How to complete Identity Verification?

(Support) How to Buy Crypto with Debit/Credit Card on the Website and the App