What is KYC?

KYC is an acronym for “know your customer”, but it could also mean “know your client”. It refers to a mandatory verification of a customer's identity, typically by a financial institution. It includes information that can be used to verify your identity, like a valid identification card, utility bills with your house address, social security number, etc.

Customers are typically required to submit KYC details during account opening and at times, when there has been a change in the information. For example, if you change your name officially a few months after creating your account, you will be required to update your KYC information.

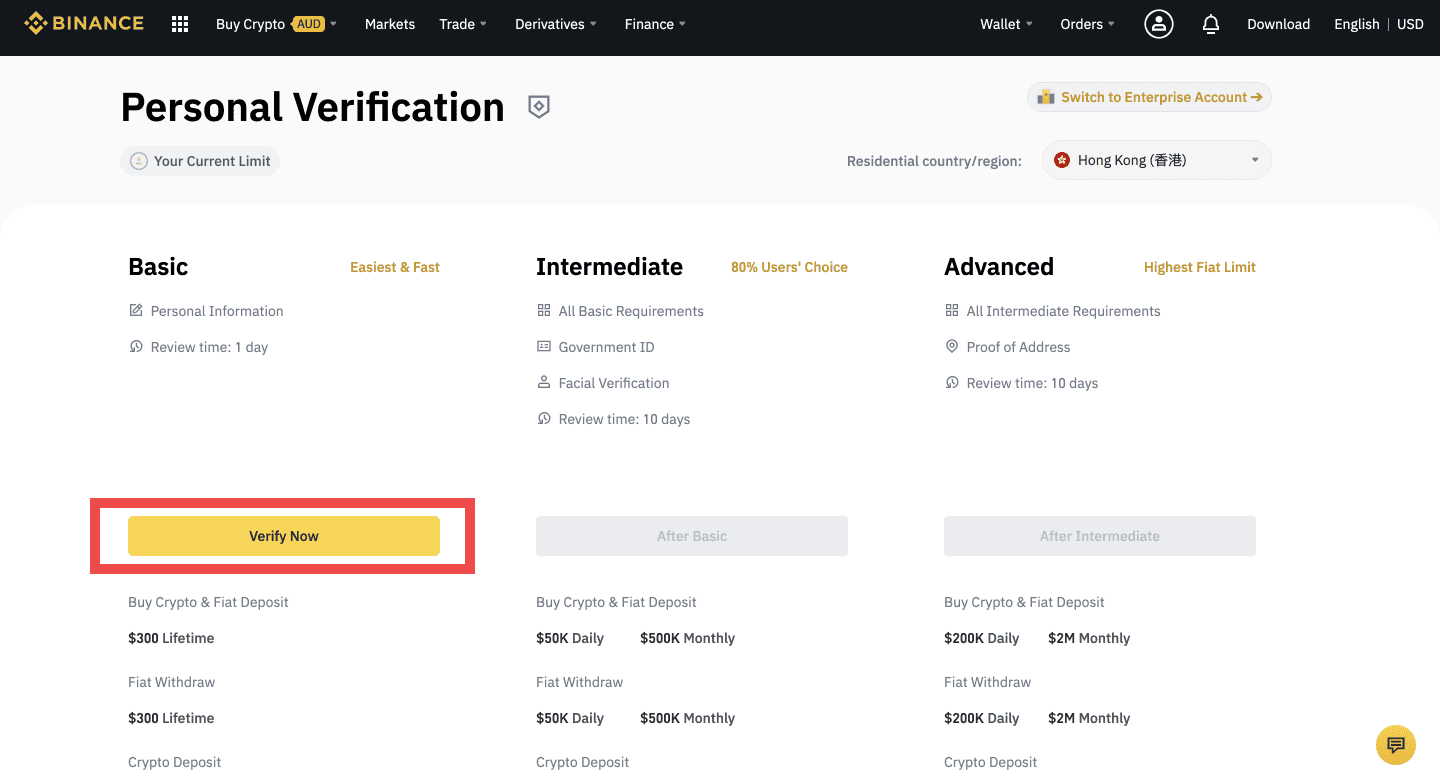

If you do not complete the KYC process, you may not be able to access all the features on a cryptocurrency exchange. For example, Binance.com allows customers to create accounts, use basic functions and perform limited transactions without submitting KYC information. In order to gain full access and increase higher deposits and withdrawal limits, customers will need to complete the KYC verification.

What is the General Process of KYC?

Depending on the nature of a business, KYC processes may vary but generally, they fulfill similar objectives. KYC comprises the basic features such as data collection and verification. It also involves customer due diligence and ongoing monitoring.

KYC verification is usually grouped into three parts and processes:

1. Customer Identification Program (CIP)

This is the first and most straightforward KYC process. It simply involves the collection and verification of customer data. For banks, this stage usually comes during enrollment. For cryptocurrency exchanges and other less rigid financial institutions, it comes after registration.

2. Customer Due Diligence (DD)

After verifying identity, a company may decide to dig deeper by performing a background check on the customer. The goal of the background test is to perform a risk assessment. If the customer has been flagged for financial fraud in the past or is under investigation, it will be flagged during the background check.

3. Ongoing Monitoring

Ongoing monitoring ensures that KYC information is up to date and allows the system to continually scrutinize transactions that may appear suspicious. For a cryptocurrency exchange, multiple large transactions to a country that is on the US terrorist watch list might be flagged out. Depending on the investigation, the exchange might suspend the customer’s account and report the case to the necessary regulatory and law enforcement bodies.

Why is KYC Mandatory for Most Crypto Exchanges?

Know Your Customer (KYC) regulations are mandatory for major cryptocurrency exchanges because it ensures they comply with regulatory rules and laws. In the past, cryptocurrency exchanges rarely requested KYC details. As the price and interest in cryptocurrencies increased, concerns about crime in areas of money laundering and other illicit activities have also come under scrutiny.

In 2001, KYC verification was introduced and cemented into the Patriot Act. However, it wasn't passed into law until after the 9/11 terrorist attacks. The goal of KYC was to curb illicit activities and to highlight suspicious behaviour as early as possible. Cryptocurrency exchanges utilize these data to track transaction patterns, in order to ensure that there is no money laundering and terrorism funding for example.

Without KYC verification, a cryptocurrency exchange may be held liable when a user gets away with committing a crime because they failed to do due diligence. Henceforth, major exchanges prefer to remain anti-money laundering (AML) compliant.

However, KYC and AML do not convey the same thing.

What is the Difference Between KYC & AML?

The know your customer requirements are just one part of a broader umbrella term commonly called anti-money laundering (AML). AML includes a vast range of regulatory processes designed to curb money laundering. Other AML processes include software filtering, record management, and criminalization. KYC is simply a process of AML that involves identity verification and enhanced due diligence.

KYC, AML and all other processes put in place by regulators make it more difficult for organized criminals and terrorists to hide their illicit activities. They will be unable to make funds acquired through illegal means appear legitimate. While this is a benefit, some members of the cryptocurrency community are divided on whether exchanges should make KYC compliance mandatory. The argument is that KYC and AML regulations are against the concept of decentralization.

How Does KYC Affect Decentralization and Anonymity?

One of the most appealing features of cryptocurrencies and blockchain technology is decentralization. What this means is that no single authority has ultimate control of the system. Instead of a single database, transactions on these blockchains are stored on numerous computers across the globe through peer-to-peer nodes. So KYC requirements make cryptocurrency exchanges similar to traditional financial institutions by giving power to a centralized authority.

For users concerned with the ethos of anonymity via decentralized blockchain, losing anonymity is a high price to pay especially when they submit their KYC details to centralized cryptocurrency exchanges. While cryptocurrency exchanges promise to treat users' private information with care, many people who prefer to maintain anonymity don't want to take that chance. These fears are not unfounded since many exchanges still do not have robust KYC systems to secure consumer information.

There have been reports of hackers getting access to the KYC information of cryptocurrency users by taking advantage of loopholes on the software of exchanges. Binance is one of the few exchanges with a secure and dedicated system for KYC data collection and management.

Binance’s Responsibility and Obligations to KYC

Binance is the largest cryptocurrency exchange per market capitalization in the world. As such, the exchange is dedicated to maintaining KYC compliance. KYC not only protects the exchange, it also provides an additional layer of security to each user's account while allowing them to enjoy unrestricted use of Binance's services.

Benefits of Verification on Binance: Enjoy Upgraded Tiers

One primary benefit of KYC on Binance is that users enjoy a tier upgrade with lower fees and higher withdrawal limits. While unverified users can only withdraw a maximum of 2 BTC daily, those with verified accounts can withdraw up to 100 BTC daily.

Keep in mind that KYC is primarily reserved for users who opt for the credit and debit card transaction options. Those who want to perform significant transactions regularly will also benefit from completing their KYC on Binance. People who don't complete their verification may run into some problems withdrawing funds from their Binance accounts. So, Binance encourages all users to complete the KYC process as soon as possible.

How to KYC on Binance

The KYC verification process on Binance is straightforward. The steps below will show you how to verify your Binance account.

1. Visit Binance.com

If you are a new user, you will have to create an account with your email address and password. The account creation process doesn't take more than five minutes. If you are an existing user, simply log in with your details.

2. Click on Identification

At the top right corner of your computer screen, click on your profile avatar. That is your user center. You will see a list of options right after your user details. Click on identification to proceed to step three.

3. Click on Verify

On the next page, you should see a bold yellow button with the word verify. This should start the verification process. Note that the verification documents depend on your nationality. So, after choosing your nationality, upload your government-issued ID, name, house address, photo ID, postal code, and every other detail.

4. Complete the Verification

Confirm that all the details submitted are accurate to make sure that your verification is accepted. Complete the process and proceed to trading. Alternatively, you can opt for advanced verification method after completing basic verification.

Binance has three verification tiers: basic, intermediate and advanced.

Basic | Intermediate | Advanced | |

Information Required | Personal information | Basic information Government ID Facial Verification | All intermediate requirements Proof of address 10 days review time |

Benefits | $300 Lifetime Buy Crypto & Fiat Deposits Limit $300 Lifetime Fiat Withdrawal Max. 2 BTC withdrawal daily | $50,000 Daily Buy Crypto & Fiat Deposits Limit $50,000 Daily Fiat Withdrawal Max. 100 BTC Daily P2P/OTC/Binance Card Perks | $200,000 Daily Buy Crypto & Fiat Deposits Limit $2000,000 Daily Fiat Withdrawal No limit BTC withdrawal P2P/OTC/Binance Card Perks |

Submitting all your details for verification should not take more than one hour. Afterward, you will have to wait for your verification to be processed.

Submit your KYC verification on Binance. If you don't have a Binance account yet, you can sign up to get started.

Bottomline

KYC is a crucial part of AML in the financial sector including the cryptocurrency sector. These financial regulations help provide a safe and crime-free environment for businesses to thrive. You may not enjoy full anonymity during cryptocurrency transactions, but Binance and other major exchanges are trying to remain KYC compliant for the sake of protecting their users.

Ready to kickstart your cryptocurrency journey with Binance?

Get started by signing up for a Binance.com account or download the Binance crypto trading app. Next, verify your account to increase your crypto purchase limit.

Complete Basic and Advanced Verification on Binance

After you have verified your account, there are two main ways to buy cryptocurrencies on Binance using cash: you can buy crypto with cash from Binance via bank transfer or card channels, or buy crypto with cash from other sellers on Binance P2P.

Disclaimer: Cryptocurrency investment is subject to high market risk. Binance is not responsible for any of your trading losses. The opinions and statements made above should not be considered financial advice.

Read the following helpful articles for more information:

(Support) How to Complete Identity Verification?

(Support) How to Buy Crypto with Debit/Credit Card on the Website and the App