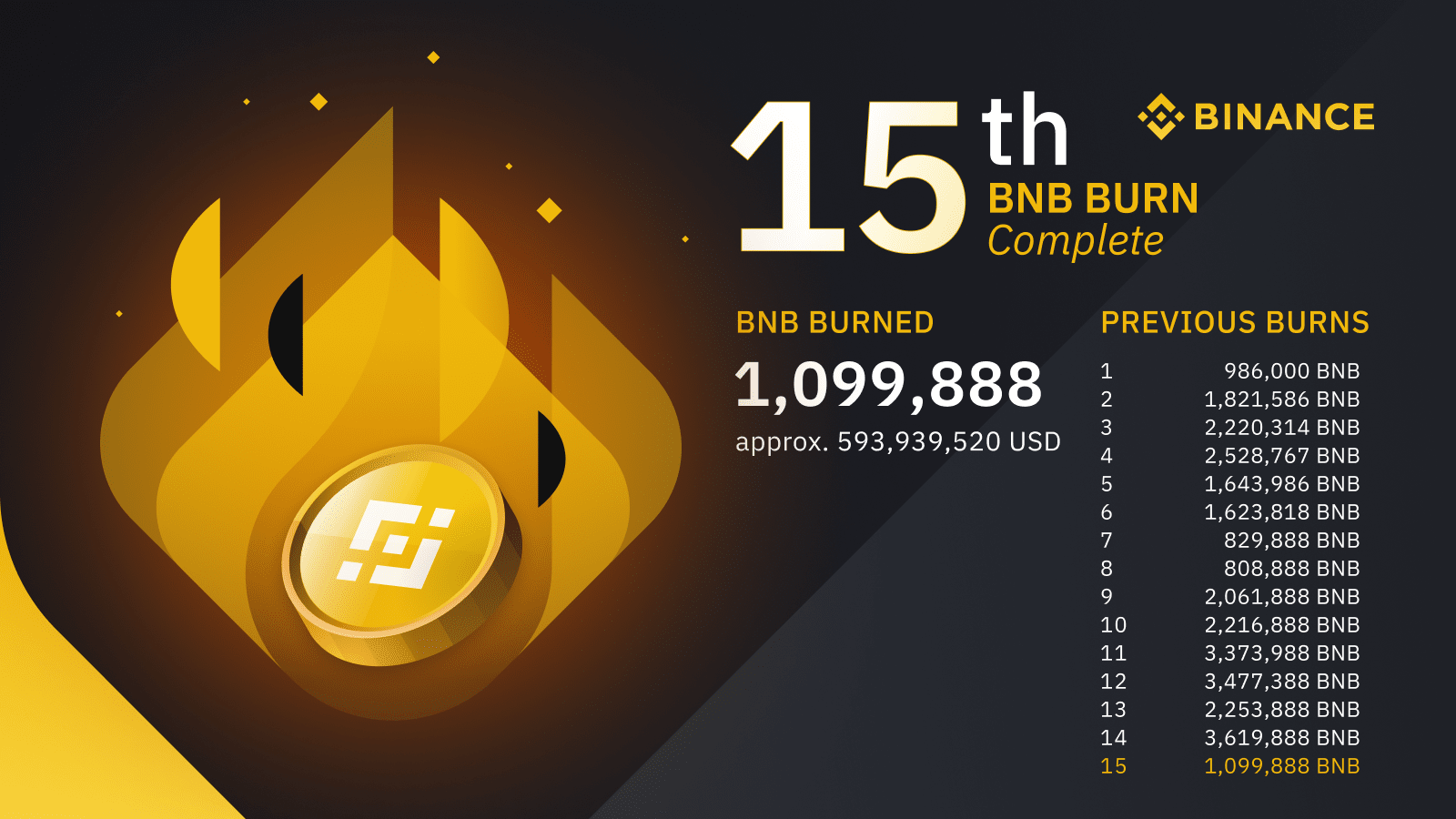

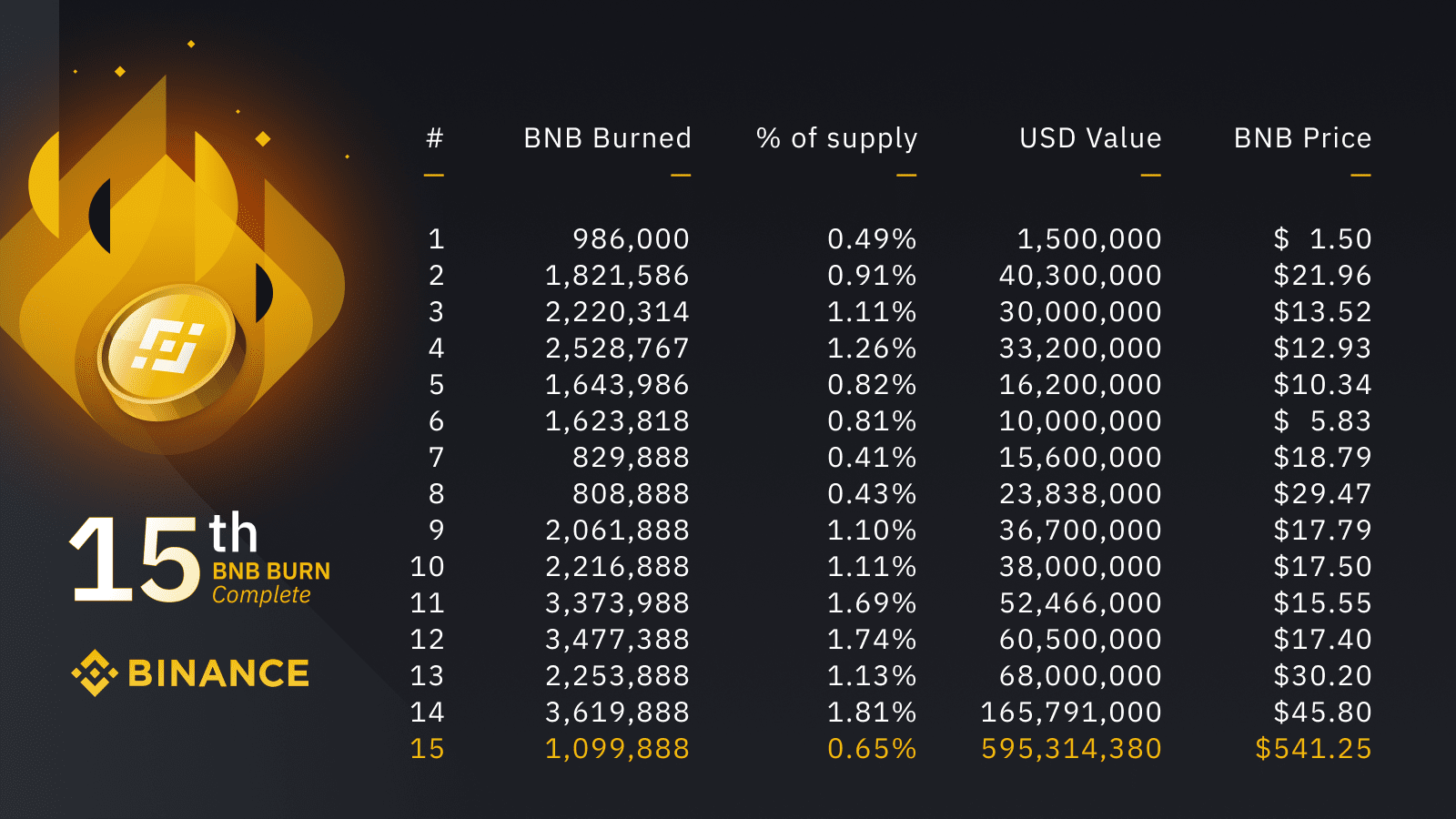

This 15th quarterly BNB burn is the highest-ever in US dollar terms. See the transactions for this burn here: Transfer 1 | Burn.

As usual, I (CZ) will take this opportunity to share a few thoughts.

How Binance Smart Chain Fuels BNB’s Rise to the Top 3

BNB has gone a very long way from being a digital token used for transaction fees and discounts on Binance. This quarter, BNB has risen to become the third-biggest cryptocurrency by market capitalization, behind only Bitcoin and Ethereum.

BNB was on a roll this quarter, rising from $38 (USD) in January to recently as high as $638.57, showing 16.8x growth in just one quarter.

People ask me which factors have contributed to the increase in BNB price. While I don’t have definite answers for that, there are several I think have helped:

Constant BUIDLing by the community and the team over the last 3.5 years.

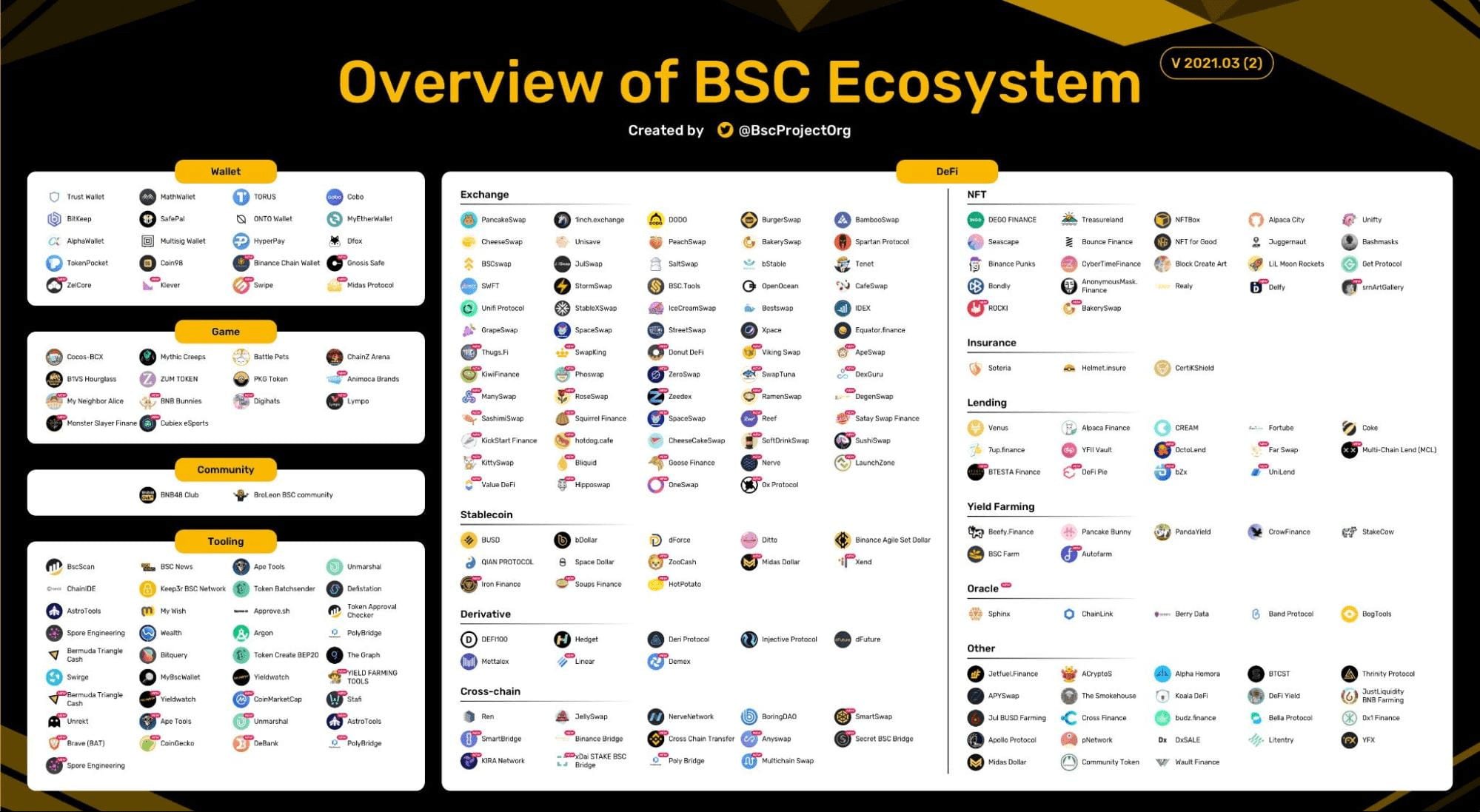

Growth of DeFi and other projects on Binance Smart Chain (BSC).

Coinbase IPO. Yes, it helps BNB as well.

Overall growth of the crypto industry.

And most importantly, your support and contributions to our ecosystem.

I don’t know exactly how much each one has contributed. No one really knows. There is no way to measure. But I do know all of the above helped, and we will continue to execute the things in our control, like building, and hope for the best.

With that said, I am amazed at the tremendous growth that the Binance Smart Chain community has shown this quarter. I’ve done nothing but highlight BSC and the projects that use it on social media, so I’m thrilled with how fast that community is moving.

How much growth are we talking about here?

1. BSC reached as much as 4.9 million daily transactions (as of April 8). That’s 300% more than Ethereum’s all-time high in daily transactions.

2. The total unique address count on BSC has reached 64 million in just eight months. For comparison, Ethereum is at 148 million.

3. Currently, 450+ projects have been built on top of Binance Smart Chain.

4. BSC played a significant role in growing the number of active dApp wallets (+639% in Q1 across all blockchain platforms), bringing in an average of 105,000 daily active wallets, compared to 458,000 daily active wallets for the entire industry.

Crypto Bull Run

It took 11 years for crypto to grow its market cap to $1 trillion, but it took just one quarter to add another trillion.

At the beginning of it all is, of course, Bitcoin. From starting the year at $29,000, BTC saw highs of $60,000 during Q1 and has even surpassed that in recent days. That’s 2x growth in a quarter, thanks to everyone’s continued work in the crypto industry, as well as increased adoption from institutions such as Tesla, PayPal, MicroStrategy, and more.

Understandably, Bitcoin’s shine has rubbed off on many of the top cryptocurrencies in the industry. We’ve seen several cryptocurrencies reach or regain their all-time highs, even compared to the bull run of 2017. Of course, this renewed enthusiasm for crypto is good news for our exchange, and I think it is also good news for BNB.

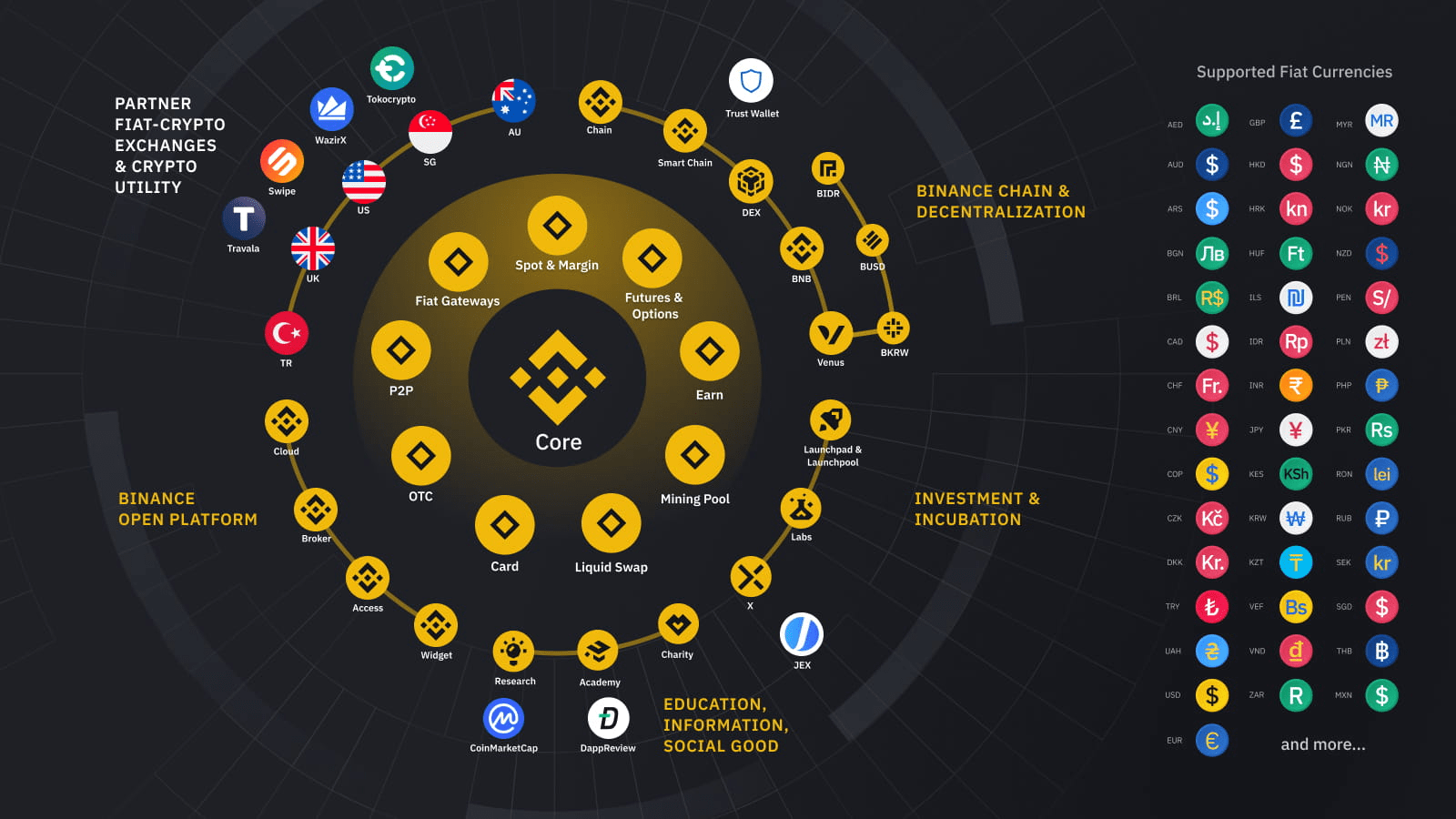

As you know, BNB is the native coin for Binance Chain and BSC. BNB’s use cases have expanded to hundreds of applications on numerous platforms and projects within the crypto ecosystem. It’s used to pay transaction fees on Binance.com, Binance DEX, Binance Chain, and BSC. It’s used on multiple DeFi platforms built on BSC that provide financial payments solutions. With the growth of BSC, more people are using BNB, and the more utility it has, the more value it gains.

This quarter, we’ve seen how a bullish crypto industry became a factor in how much BNB has grown. And we also see how BNB has contributed to the overall rise of the industry.

People always told me BNB was undervalued, and I, of course, always biasedly agreed with their opinions. But I might never know how much undervaluation there is for BNB, or the entire crypto industry, for that matter. Given that, the numbers I stated earlier for BSC would provide some insight on that.

The Binance Ecosystem Keeps on BUIDLing

At Binance, we don’t know where the market is headed or how the BSC community intends to grow further. But what we know and do best is to expand our ecosystem, to serve our users with their much-requested products and solutions that expand financial freedom.

In Q1 2021, Binance recorded growth of 260% and 346% in traded volume and users respectively, while the total market value of cryptocurrencies recently surpassed $2 trillion. This indicates accelerated crypto adoption by everyone around the world, from casually engaged individuals who trade every now and then to institutions that keep crypto in their treasuries and even engage in using crypto for their operations.

During the past few months, the Binance team has tirelessly worked to deliver the following services and more:

1. We unveiled Binance Pay during Binance Blockchain Week in February, and since then, the service now features pay and merchant functions allowing users to pay, send and receive crypto payments around the world without incurring any fees. After the beta phase, during which about 250,000 users interacted and experienced Binance Pay, we have now made it available for both peer-to-peer payments and merchant-based transactions, with support for 30+ currencies.

2. The Binance Card is an important instrument that allows our customers to pay for whatever they want with crypto, directly from their Binance Card at more than 60 million merchants around the world. After the launch of the Binance Card in the European Economic Area (EEA) during Q3 2020, we have been working hard to roll out the card in other geographies as well.

3. We also launched Binance Lite, which features a user-friendly interface for buying and trading crypto with some of the lowest fees. Right now, you can switch between default (Pro) mode and Lite mode on your Binance app. Lite mode has made it easier for many people to buy, sell, deposit, and make their crypto transactions.

4. We welcomed new advisors to the team, Senator Max Baucus as our new Policy & Government Relations Advisor and Rick McDonell and Josée Nadeau as new Compliance and Regulatory Advisors. As crypto gains more crypto acceptance, we view their additions as important parts of our continued collaboration with government and regulatory entities around the world.

5. As of March 2020, Binance Launchpool featured several successful crypto projects, recorded $4.64 billion in total value locked (TVL), and distributed $529 million in tokens to 408,783 crypto holders, who have since watched their holdings bloom with the recent rise of the crypto market. Also, Binance Launchpad continues to be popular to users, notching a total of 38.8 million in total commitments through token offerings.

Customer Service

Amid all that excitement, we are also experiencing one severe problem. Our customer support is completely overwhelmed. Fast growth is a great thing for crypto, but it does bring problems too.

I want to make it clear that we are very aware of this issue. It’s our number one priority. We have an aggressive roadmap for improving all parts of our customer support process. If you’re interested in learning more about that, you can read my recent letter to the community on this topic.

As always, we thank you for your unwavering support and contributions to the Binance ecosystem!

- CZ