The ongoing global pandemic has increased volatility, and new all-time lows and all-time highs are now a regular daily occurrence in all markets, not just the cryptocurrency market. It's not easy to keep up with the pace of modern financial markets.

To survive the storm and prepare for a better future, it's essential to consider all available options and wisely innovate your existing portfolio. If you're new, this article will help you make sense of the basic options.

It doesn't matter if your goal is to buy a new car, pay off your existing debts, buy a new house, or just save for the future. At least one of these 4 investments should be in everyone's portfolio.

Bonds

Bonds are a simple investment vehicle but not too common among young investors. You can understand bonds as an IOU issued by a corporate or government body to obtain investors’ loans. In return, the investors receive annual interest paid as a % of the face value. Bonds are low-risk investments with low return rates, usually used to balance portfolios and decrease volatility. The annual yield can be anywhere from slightly negative to up to 1%.

Theoretically speaking, bonds have an unlimited supply, and it's on the issuer to set the supply. If a company or government needs more money, it can issue more bonds to obtain additional investment.

You can buy bonds from banks, brokers, and other financial institutions. To be taken seriously and seen as an attractive client, you should start your investment with $50,000 or more. Bond investments regularly move above $100-$200k USD.

Risk (Volatility): Low

Min. investment: Depending on the bond, commonly $1,000 or more.

Maturity: Minimum for short-term bonds is one year—usually ten years or more.

Divisibility: None. Bonds are sold as single units or in increments.

Gold

There's no need to explain gold. It is the most popular safe haven and store of value for centuries. In the past, central banks used gold to back most of the world's currencies, including the US dollar. Gold is popular among all generations, and you can buy physical gold or ETF (digital gold shares). Each has its advantages and disadvantages, but in this article, we're looking at the investment potential, which is basically the same for both.

Among many reasons why gold has value, scarcity might be the most important. Gold is scarce, and we know there's only a limited amount of it remaining in the Earth's crust. However, new technologies, space exploration, and undiscovered gold deposits might negatively affect gold's scarcity.

You can buy gold from banks, brokers, exchanges, and even physical stores that sell physical gold for cash. The majority of regular exchanges allow initial investments starting around 5-10 ounces of gold ($1,740/ounce), but new exchanges allow smaller purchases, as low as just a few dollars. Over the last 5 years, gold recorded a 38% price increase.

Risk (Volatility): Medium

Min. investment: Depending on the exchange, starting at few dollars.

Maturity: None. Buy and sell anytime.

Divisibility: Limited. It's difficult to divide physical gold bars into smaller fractions, and doing so drastically reduces its value.

Equity (S&P500)

The S&P 500 is a stock market index that measures the stock performance of 500 major companies listed on the US stock exchanges. It's basically a basket of 500 companies from the US, including Apple Inc., Amazon, Facebook, Microsoft, Tesla, Berkshire Hathaway, and more.

S&P 500 and other equity funds are digitally issued shares of a basket of companies. The performance and financial health of these companies affect the price, and they can always issue more.

You can obtain S&P easily online via many different exchanges and platforms. It is one of the most commonly followed equity indices. The first close of the S&P 500 occurred in August 1982 at a price of only 102.42. The current price is over $3,900, and the 5-year return for S&P 500 is slightly below 100%, making it a desirable long-term investment. Other popular funds similar to S&P 500 are Nasdaq 100 and Dow Industrial (30).

Risk (Volatility): High

Min. investment: Depending on the exchange, some require no minimum.

Maturity: None. Buy and sell anytime.

Divisibility: Buy and sell fractions with $ face value.

Bitcoin

The newest and simplest investment vehicle on the list is the leading cryptocurrency, created by Satoshi Nakamoto in 2009. Often called the digital gold, sound money, or the perfect store of value, Bitcoin caught the public's attention over the last few years and became the most popular investment for investors under 30. Bitcoin's value comes from different traits and fundamentals, but overall it's valued primarily for its scarcity, censorship-resistance, security, and ease of transaction.

Compared to gold, Bitcoin's supply is known, verifiable, and limited. There will ever be only 21 million BTC, and never more. The community expects that the miners will mine the last satoshis in the year 2140.

Of all the 4 assets on the list, bitcoin is the only one available for trading 24/7, all year long. You can buy BTC on cryptocurrency exchanges such as Binance.com, via P2P trading, bitcoin ATMs, vouchers, or a wide range of fiat gateways.

Risk (Volatility): VeryHigh

Min. investment: Depending on the exchange, starting at just $15 on Binance Buy & Sell.

Maturity: None. Buy and sell anytime.

Divisibility: 1 bitcoin (BTC) = 100,000,000 satoshi (sat)

Conclusion

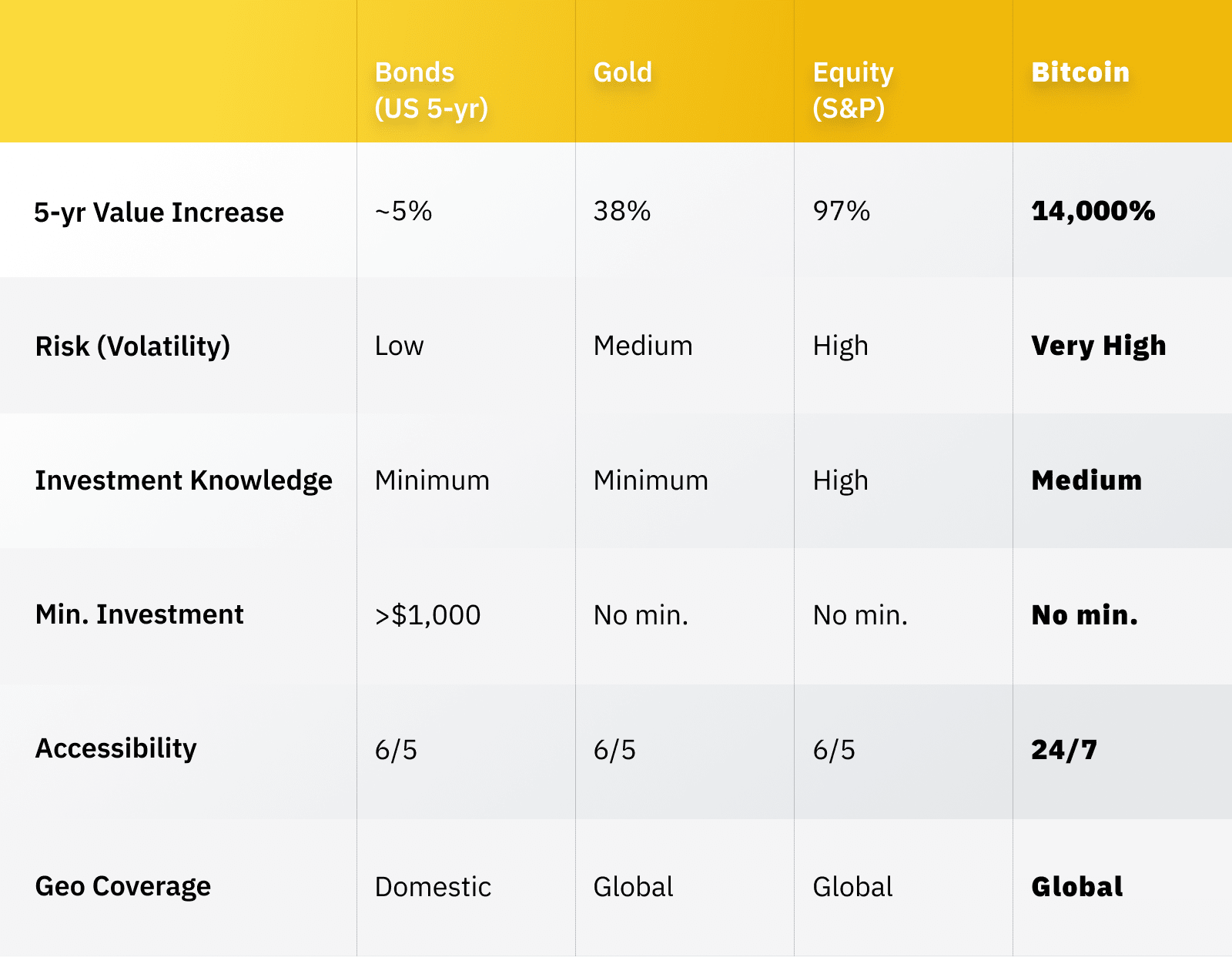

To further illustrate the advantages and risks of investing in bonds, gold, equity, and Bitcoin, we have created this comparison table below.

Before the advent of Bitcoin, common knowledge dictated that you should go for bonds to grow your holdings slowly but surely and that buying equity is your best bet for maximum potential growth. But Bitcoin’s emergence in the past decade, especially its rise to the mainstream in the last few years, has challenged this investment paradigm. It is almost impossible to ignore how game-changing Bitcoin has been in our perception of what constitutes a store of value.

This year, we have seen many institutions and companies flock towards Bitcoin amid global uncertainty. The sheer scale of Bitcoin’s value increase, plus its improving position as a viable long-term investment, has turned the world’s top cryptocurrency into perhaps the most viable option for storing your hard-earned money.

Buy Bitcoin with just $15. Click below!