At the same time, Bitcoin’s derivatives markets are showing some signs of overheating. Options open interest has climbed to an All-Time High of $49.4 billion—highlighting elevated institutional activity and increased hedging/speculation following the recent Bitcoin ATH. Such positioning suggests that the market is expecting heightened volatility ahead, with expectations of further macro headwinds and structural profit-taking. On-chain metrics corroborate this: the Relative Unrealised Profit indicator has broken above its +2 standard deviation band, a historically euphoric zone that typically precedes sharp intraday swings and local tops.

Despite the pullback, we believe Bitcoin remains structurally strong. This correction appears to be a healthy reset rather than a breakdown—driven by leverage flushing and profit realisation after one of the sharpest recoveries in crypto history.

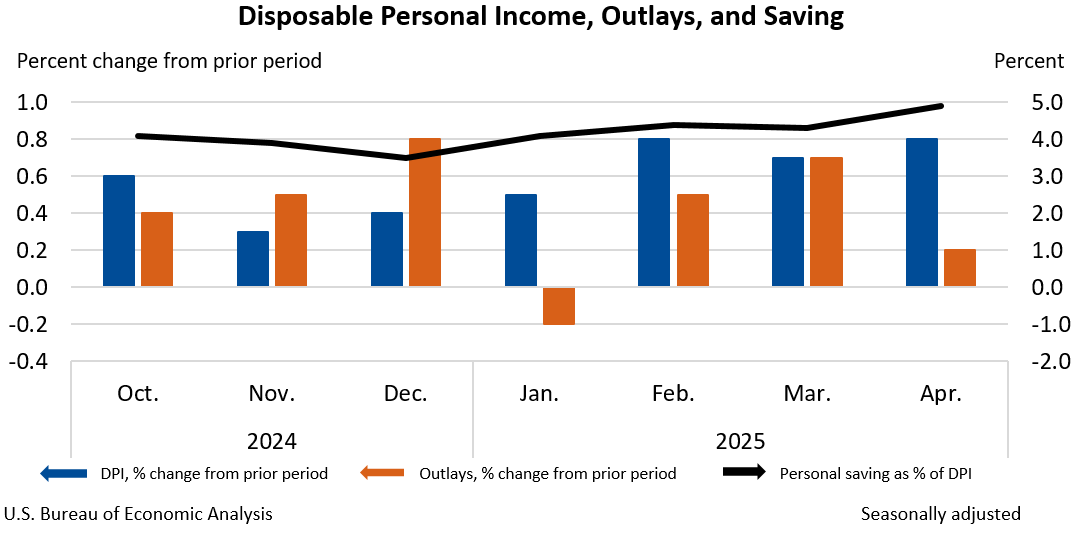

In contrast, the US economy is showing signs of strain as consumers and businesses navigate a landscape marked by trade tensions, cooling demand, and policy uncertainty. Consumer spending slowed significantly in April, with households favouring savings over discretionary purchases amid growing concerns about the long-term effects of tariffs. While inflation remains subdued for now, this may be temporary as businesses begin to pass on higher costs from elevated tariffs.

Trade dynamics have also shifted sharply. Imports fell nearly 20 percent in April after a front-loading rush to beat tariff hikes in the first quarter, which in turn caused the goods trade deficit to shrink by 46 percent. Although this narrowing trade gap could support GDP in the short term, business inventories remained flat, signalling hesitation to invest or restock. In parallel, orders for core capital goods—an indicator of business investment—dropped 1.3 percent, the steepest decline since October, pointing to growing corporate caution.

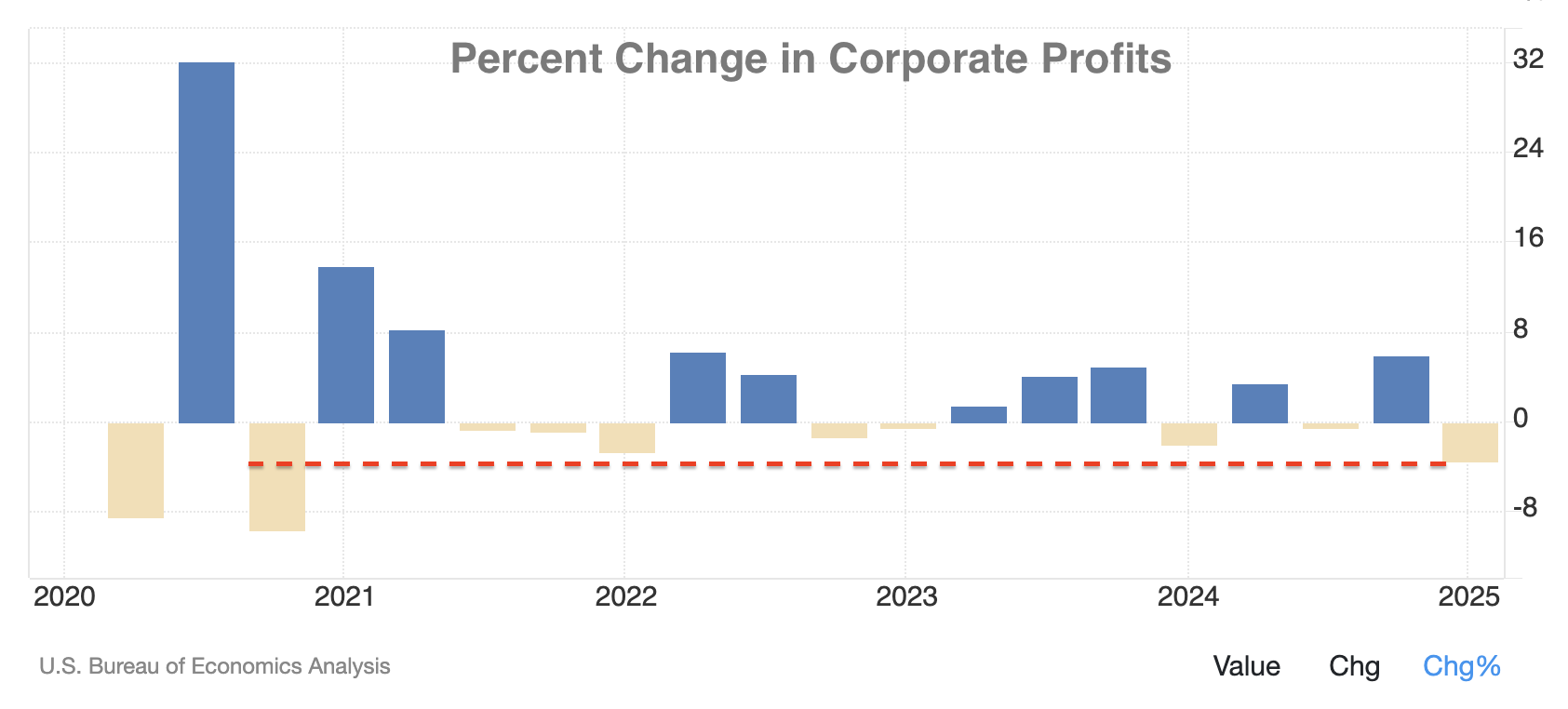

The labour market is also showing early signs of stress, with continuing jobless claims hitting their highest level since 2021 and firms increasingly freezing hiring plans. Corporate profits fell sharply in Q1, and sentiment among business leaders has weakened. Even with a temporary trade truce between the US and China, confidence remains fragile. While consumer sentiment rebounded in May, underpinned by hopes of tariff relief, both businesses and households are adopting a cautious, wait-and-see approach.

The cryptocurrency industry has seen a wave of significant developments across corporate, regulatory, and event global financial sectors. GameStop, the well-known meme-stock made headlines with a bold $513 million investment in Bitcoin, marking a strategic shift toward financial diversification amid declining sales. This move aligns the company with a growing list of firms integrating Bitcoin into their treasury strategies, though it also sparked investor unease over crypto market volatility and the company’s limited experience in managing digital assets.

Meanwhile, the US Department of Labor rescinded its 2022 guidance that discouraged the inclusion of cryptocurrencies in 401(k) retirement plans, signalling a more neutral stance. This change allows fiduciaries greater flexibility to evaluate crypto investments for retirement portfolios, reflecting the digital asset market’s growing maturity and improved regulatory clarity. On the global stage, the Bank of Russia authorized financial institutions to offer crypto-linked financial instruments to qualified investors. Although these products are non-deliverable and tightly regulated, the decision marks a cautious yet significant step toward integrating digital assets into Russia’s financial system. Collectively, these developments underscore a broader trend: cryptocurrencies are moving from the fringes into mainstream financial systems, prompting innovation while raising the stakes for sound regulation and risk management.

The post appeared first on Bitfinex blog.