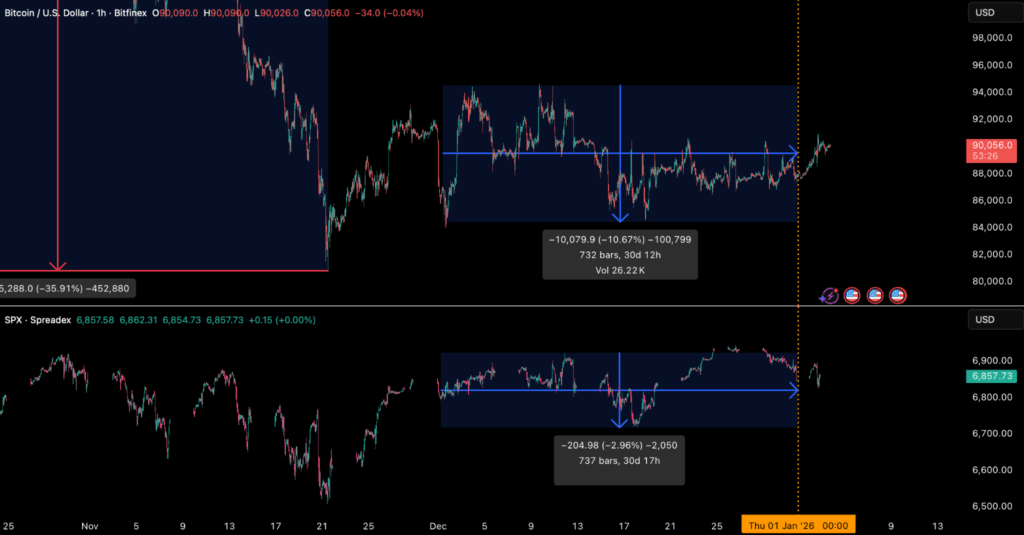

Encouragingly, the pace of ETF-driven selling has slowed materially into year-end, suggesting that much of the de-risking may already be behind us. With liquidity conditions expected to improve into early 2026, upcoming ETF flow prints will be critical in determining whether this nascent recovery can attract fresh institutional capital or whether caution continues to dominate positioning.

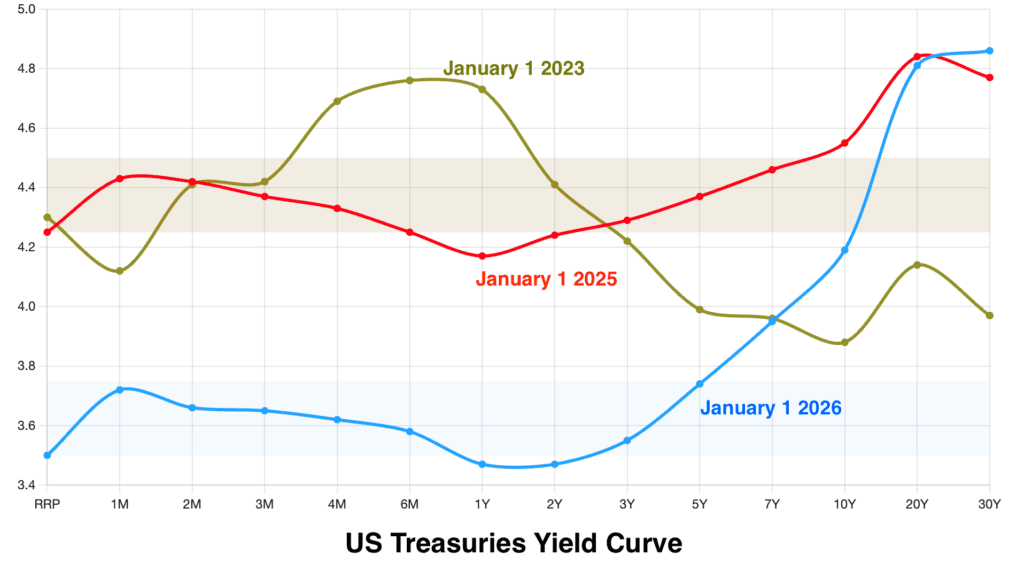

US macro conditions heading into 2026 are being shaped by two reinforcing trends: a steepening yield curve and a structurally weaker dollar. The US Treasury curve has moved decisively out of the inverted state it experienced in 2022–2024 (see chart below), driven by expectations of eventual policy easing at the front end while long-dated yields remain elevated due to inflation uncertainty, heavy issuance, and fiscal concerns. This configuration reflects a repricing of duration and credibility risk rather than renewed growth optimism, keeping financial conditions tighter than headline rate cuts alone would suggest.

At the same time, the US dollar has weakened meaningfully on a year-to-date basis, reflecting policy preferences for improved trade competitiveness and a gradual reassessment of US policy credibility.

While the dollar’s structural foundations remain intact, supported by deep capital markets and sustained demand for Treasuries, the balance of risks points to a managed depreciation rather than a reversal. Together, elevated long-end yields and a softer dollar define a macro environment where liquidity improves only selectively, rewarding assets with near-term cash flows, pricing power, and real or defensive characteristics, while constraining broad-based risk expansion.

Corporate and sovereign engagement with digital assets continued to broaden toward year-end. On the corporate side, treasury-led accumulation remained a dominant theme. Strategy Inc. reinforced its long-term Bitcoin approach with another late-December purchase, lifting its holdings to 672,497 BTC and underscoring its use of equity issuance to systematically build a digital reserve rather than pursue tactical exposure. In parallel, BitMine Immersion Technologies deepened its commitment to Ethereum, growing its holdings to roughly 4.11 million ETH while expanding into staking and validator infrastructure, signalling a shift from passive accumulation toward yield-generating, on-chain strategies.

Beyond corporate treasuries, digital assets are increasingly being integrated into shareholder engagement models, while at the sovereign level, crypto adoption is also advancing, albeit cautiously. Turkmenistan introduced a legal framework permitting domestic cryptocurrency mining and trading under central bank oversight, marking a notable policy shift for one of the world’s most closed economies. While the law formalises licensing and regulatory supervision, it stops short of recognising cryptocurrencies as legal tender and maintains strict controls on internet access, highlighting a selective approach that seeks economic participation without loosening monetary or political control.

The post appeared first on Bitfinex blog.