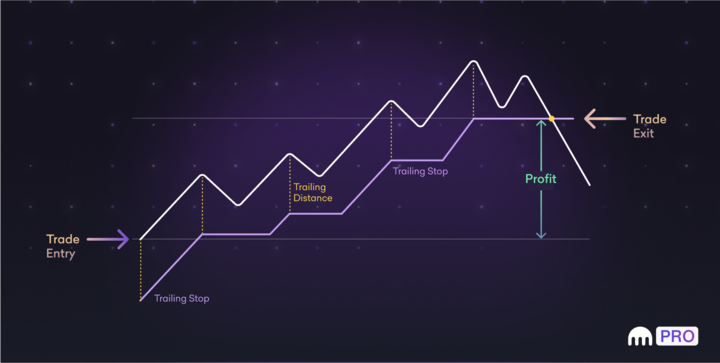

This new conditional order type seeks to secure maximum upside without having to repeatedly, manually readjust orders. Trailing stop orders allow you to stay dynamic and lock in profits at a specific level once a price rally reverses against your favored direction:

What are trailing stop orders?

Trailing stop orders are a type of conditional stop order that automatically adjusts as the market price of an asset changes. Traders use them when they are looking to protect current gains in a trade. They allow a trade to remain open as long as it continues to earn additional profits. It only closes the position out once a certain retracement loss amount (either in percentage or nominal price terms) occurs.

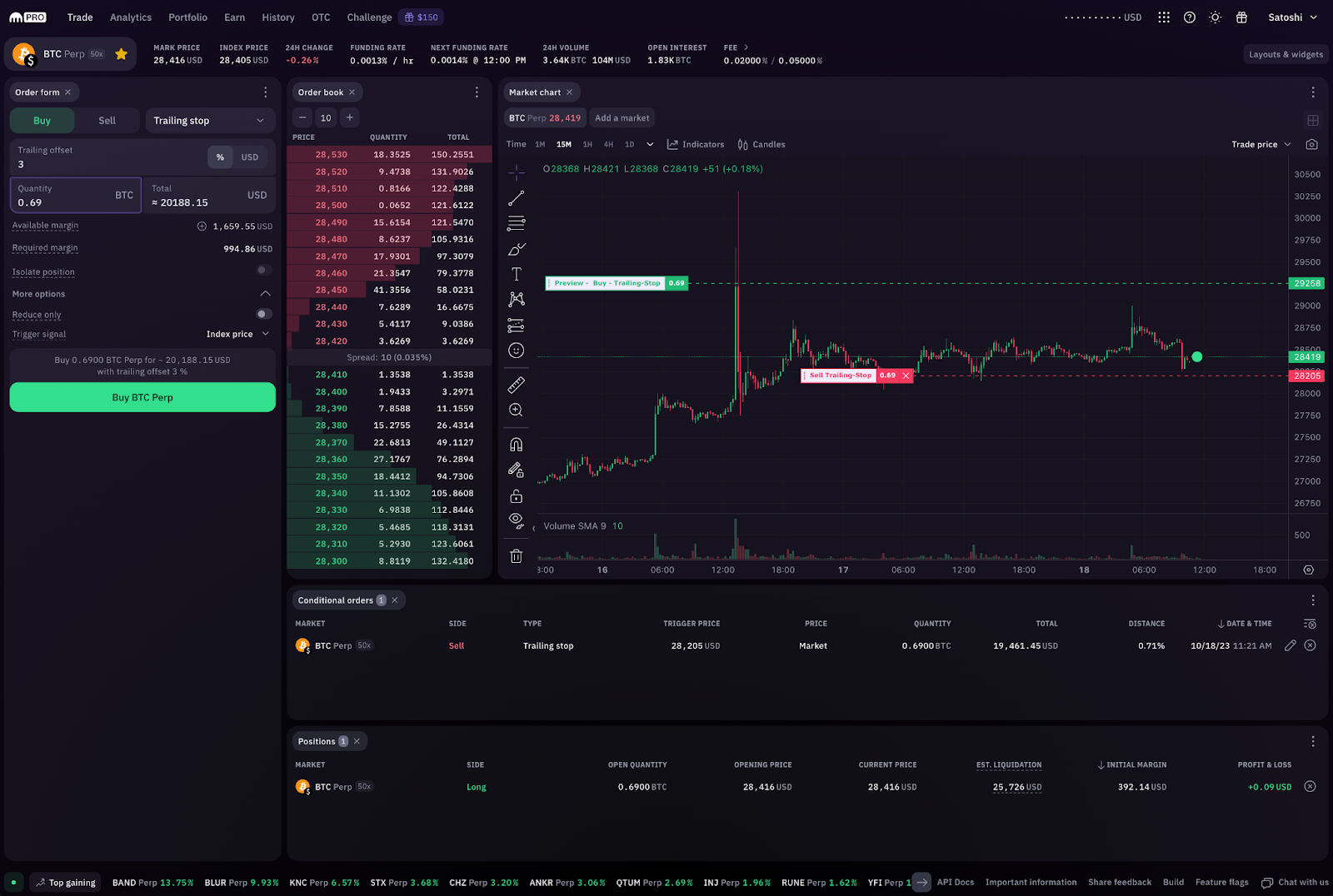

Trailing stops on Kraken Pro can be triggered against either the last, index or mark price of the corresponding spot or futures market.

How do trailing stop orders work on Kraken Pro?

Using trailing stop orders on Kraken Pro involves setting two main parameters:

Trailing offset: This is the offset from the reference price (index or last) at which a dynamic market order will be executed. This can be entered as either a set percentage or a nominal quote currency (e.g., USD) offset.

Order quantity: This is the total amount of your order, the amount you are actually trying to buy or sell.

Example and use case for swing traders

Imagine you’re a swing trader who has an active long position in BTC. The current BTC price is $28,000, and you anticipate that the price will rise in the short term.

You enter your trade at $28,000 and place a trailing stop sell order with a trailing offset of $100. If the BTC price rises to $30,000 (without ever retracing by $100 or more) during the upside rally, your stop order will continually trail the BTC price by $100 — in this example, all the way up to $29,900, $100 below $30,000.

If the price then dips from $30,000 to $29,900, the trailing stop order will execute with a market sell executed at $29,900, thus locking in a +$1,900 price swing on your initial $28,000 entry price.

In this example, using trailing stop orders allows swing traders to capitalize

on short term price movements in a moving market.

Potential advantages for swing traders

For swing traders, trailing orders on Kraken Pro offer a wealth of strategic benefits:

Profit protection: By constantly readjusting to the current market, index or last traded price, trailing stop orders lock in earned upside as long as the price continues to move in your favor without retracing by your trailing offset amount.

Risk management: A trailing stop order executes if a price changes direction by a specified percentage or nominal amount, limiting potential losses.

Emotional control: Remove emotion from a trade. Set your strategic parameters when you open a trade and let your trailing stop automatically execute them.

Market adaptability: Trailing stop orders provide dynamic response to changing market conditions, giving you increased control over your order execution.

Trade trailing stops on Kraken Pro

These materials are for general information purposes only and are not investment advice or a recommendation or solicitation to buy, sell, stake or hold any cryptoasset or to engage in any specific trading strategy. Kraken does not and will not work to increase or decrease the price of any particular cryptoasset it makes available. Some crypto products and markets are unregulated, and you may not be protected by government compensation and/or regulatory protection schemes. The unpredictable nature of the cryptoasset markets can lead to loss of funds. Tax may be payable on any return and/or on any increase in the value of your cryptoassets and you should seek independent advice on your taxation position. Geographic restrictions may apply.

The post appeared first on Kraken Blog.