BlockFi Files for Bankruptcy as FTX Contagion Spreads

Crypto lender BlockFi filed for chapter 11 bankruptcy on Monday, spotlighting the latest contagion effects that have been unleashed by the FTX collapse. Find out more ,here,.

Brazil Backs Law for More Crypto Regulation

After a series of twists and turns over the past seven years, Brazil’s lower house of Congress finally approved a long-awaited crypto regulation bill that aims to boost oversight of the country’s cryptocurrency sector. Find out more ,here,.

Telegram Reveals Plans for Wallet and Dex

Telegram reveals ambiguous plans as the broader industry continues to grapple with the FTX collapse. Find out more ,here,.

Magic Eden Introduces Code to Enforce Creator Royalties

NFT marketplace Magic Eden is set to roll out code allowing NFT creators on the platform to enforce creator royalties on new collections. Find out more ,here,.

Deep Dive

This week, we explore areas of Web3 that would benefit from this year’s World Cup and how.

As Web3 reels from contagious effects induced by FTX’s implosion, we dive into whether the FIFA World Cup hype has indeed provided a boost to Web3’s on-chain activities. Find out more ,here,.

On-Chain Round-Up for the Week

The broader crypto market demonstrated considerable resistance in the face of growing uncertainty and escalating trust crisis, as crypto lender BlockFi became the latest to fall in the ongoing FTX saga. Embroiled in a crypto-specific contagion, major cryptocurrencies seemed to be decoupling from the traditional financial markets. As its members repeatedly telegraphed in recent weeks, Federal Reserve Chair Jerome Powell finally confirmed the slowdown of rate hikes in December, sending U.S. equities higher, while the crypto market behaved unimpressed by the prospect of improved liquidity. As of the time of writing, BTC failed to defend the $17k handle, while ETH headed south towards the $1,250 support.

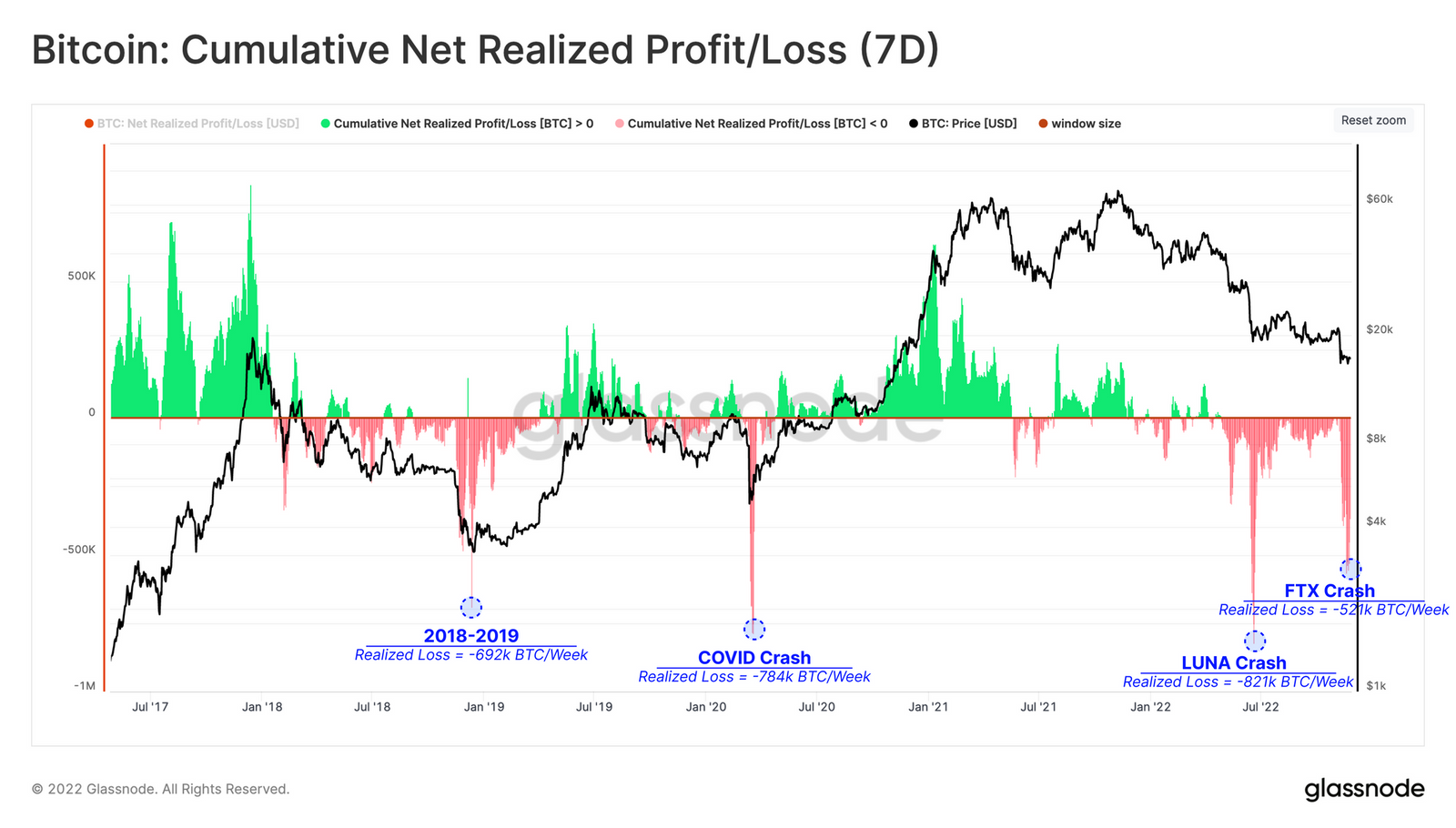

In retrospect, on-chain metrics categorize the recent meltdown triggered by the FTX contagion as one of the worst selloffs in the history of BTC. In absolute numbers, the crypto market saw a net realized loss of 521k BTC, which is comparable to the height of the bearish cycle from 2018 to 2019. However, the market has also demonstrated considerable strength when compared to the COVID crash, or the more recent LUNA implosion, with only a 26% correction.

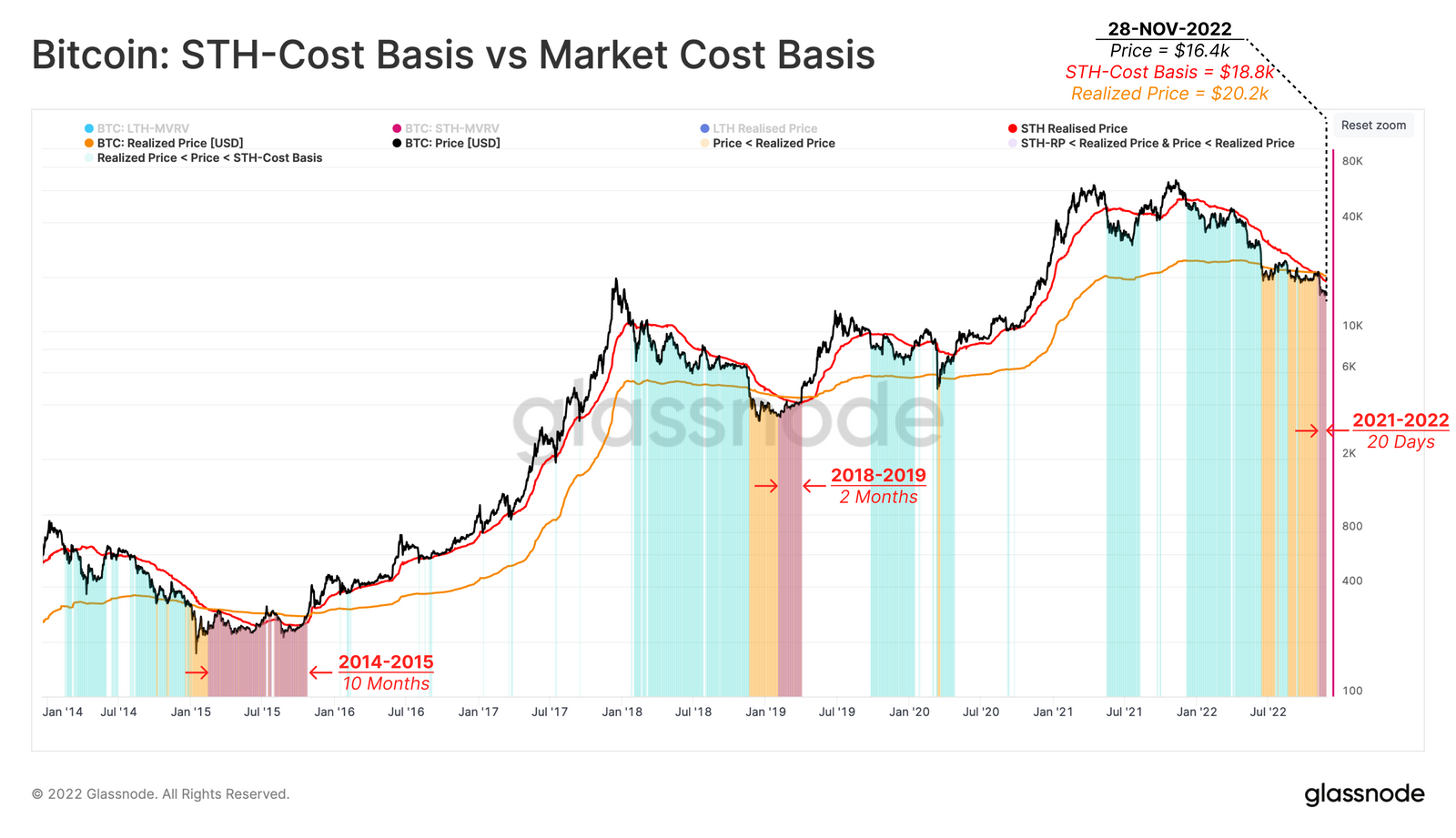

As the FTX debacle continues to unfold, the market structure has gone through some notable changes, with a significant volume of coins changing hands at heavily discounted prices. The short-term holders’ cost basis dips below the realized price, suggesting that many directional traders had entered after the market bottomed out, thus gaining a superior position relative to an average holder.

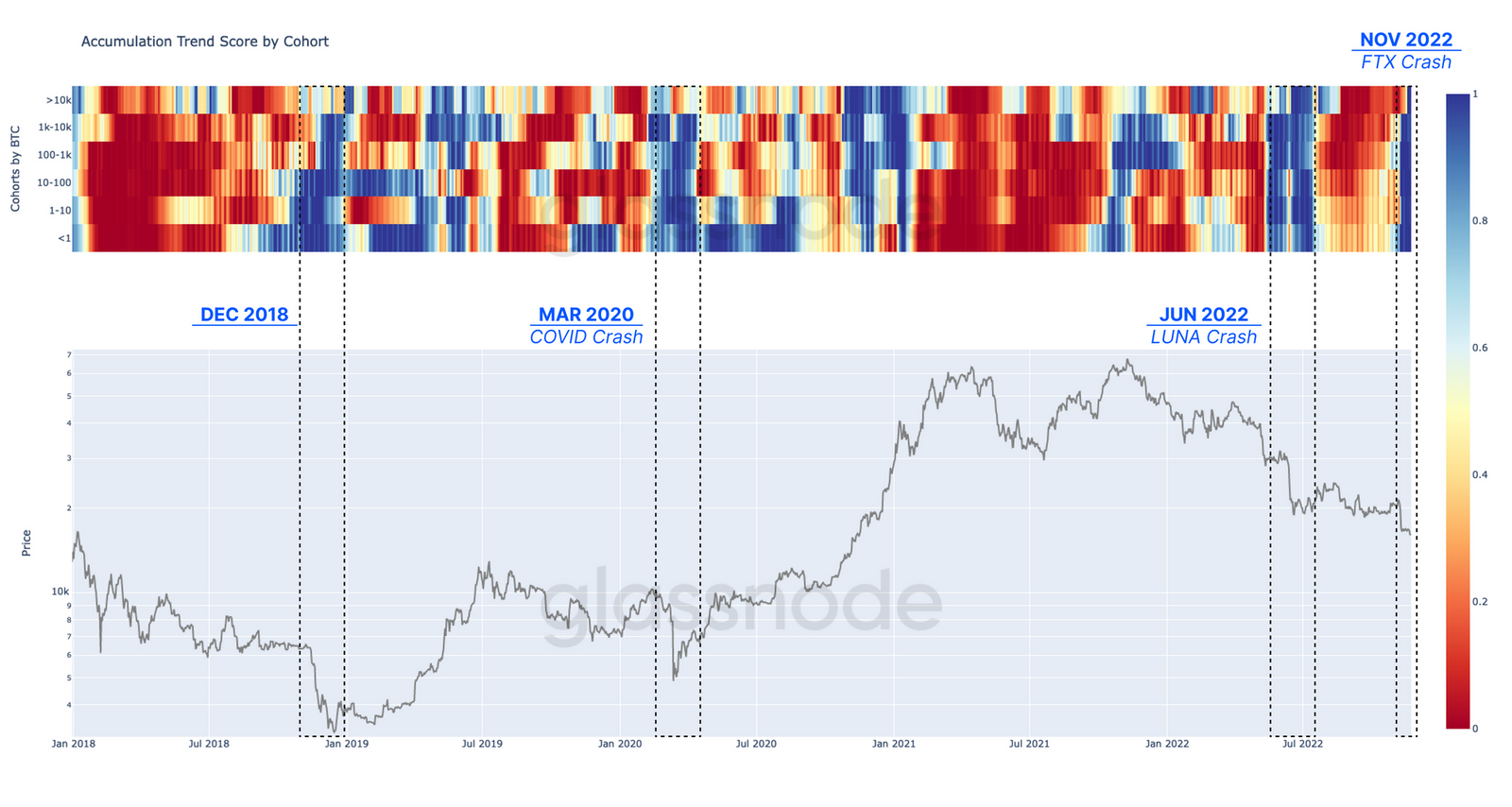

The accumulation trend confirms that holders across all cohorts entered the heavy accumulation phase, with many perceiving the current price discovery period as an opportunity to stack up their holdings. It also signals that coins are moved in large quantities to self-custody.

Macro events to look out for in the coming week

,,,,,,,,,Dec 2, 2022 |

|

Dec 5, 2022 |

|

Dec 6, 2022 |

|

Dec 8, 2022 |

|

Dec 9, 2022 |

|

Three coins to watch

,,,,,,,Token | Reason |

,FTM, | Fantom’s recent upside momentum has been chalked up to a positive update on the state of Fantom’s treasury after its advisor Andre Cronje revealed how Fantom’s financial situation evolved over the years in a blog post. The revelation, especially during a period when crypto projects’ liquidity has been in question, is a strong shot in the arm for the network and will likely provide some tailwinds to its native token. Despite Fantom’s TVL having plunged from its peak, investors’ focus has seemingly shifted from fundamentals to assessing who may survive an extended crypto winter. |

,TON, | Telegram has huge plans for its blockchain-based platform Fragment to move beyond the sales of usernames to become a host of blockchain tools, including non-custodial wallets and decentralized exchange. The username sales platform has already been a huge success, raking in $50 million worth of TON in less than a month. The token’s upside potential may be further boosted by the blueprint. |

,UNI, | Uniswap’s recent launch of its NFT marketplace aggregator has boosted a significant surge in the network activity, with the count of new addresses and active addresses soaring to new highs. As the bear market favors the leading player, as the absolute leader in spot trading, Uniswap’s footprint in NFT may possibly grow its user base and, in turn, expand its influence in the cryptoverse. |