Illuvium Land Sale Garners $72M

Illuvium, an up-and-coming Ethereum-based play-to-earn game, has recently completed its first NFT digital land sale on Immutable X, which yielded more than $72 million, despite the prevailing bearish sentiment in the NFT space. Find out more here.

PayPal Allows Crypto Transfer to External Wallets

Payments giant PayPal has rolled out a long-demanded crypto feature that allows users to transfer crypto between PayPal and other wallets and exchanges. Find out more here.

Optimism Loses 20M Tokens in Interlayer Confusion

The launch of Optimism's native token is off to a rough start. The scaling solution provider was given an incorrect blockchain address by the market maker Wintermute.Find out more here.

PartyBid Raises $16M Led by a16z

PartyDAO, the decentralized organization behind the NFT bidding platform PartyBid, has raised $16.4 million in a funding round led by a16z. Find out more here.

L1/L2 Development of the Week

This week, we delved into Stargaze, an NFT market application-specific blockchain that was initially designed to be a crypto-native social network.

We explored its infrastructure, progress, and recent developments to assess what the future could hold for Stargaze.

Click here for the full report.

DeFi Protocol of the Week

This week, we took a dive into Abracadabra Money, a magic spellbook-themed lending protocol that uses interest-bearing tokens as collateral to borrow its USD-pegged stablecoin, Magic Internet Money (MIM).

We also explored the current state of the stablecoin market to better understand the purpose and designs of stablecoins.

Click here for the full report.

On-Chain Round-Up for the Week

The broader crypto market remained largely flat for much of the week after the Monday relief rally lost steam. BTC continues to trade in a narrow range amid a looming liquidity drain in the spot market. Macroeconomic uncertainty and geopolitical turmoil are thwarting investors’ plans to place higher bets on the market’s long-term prospects.

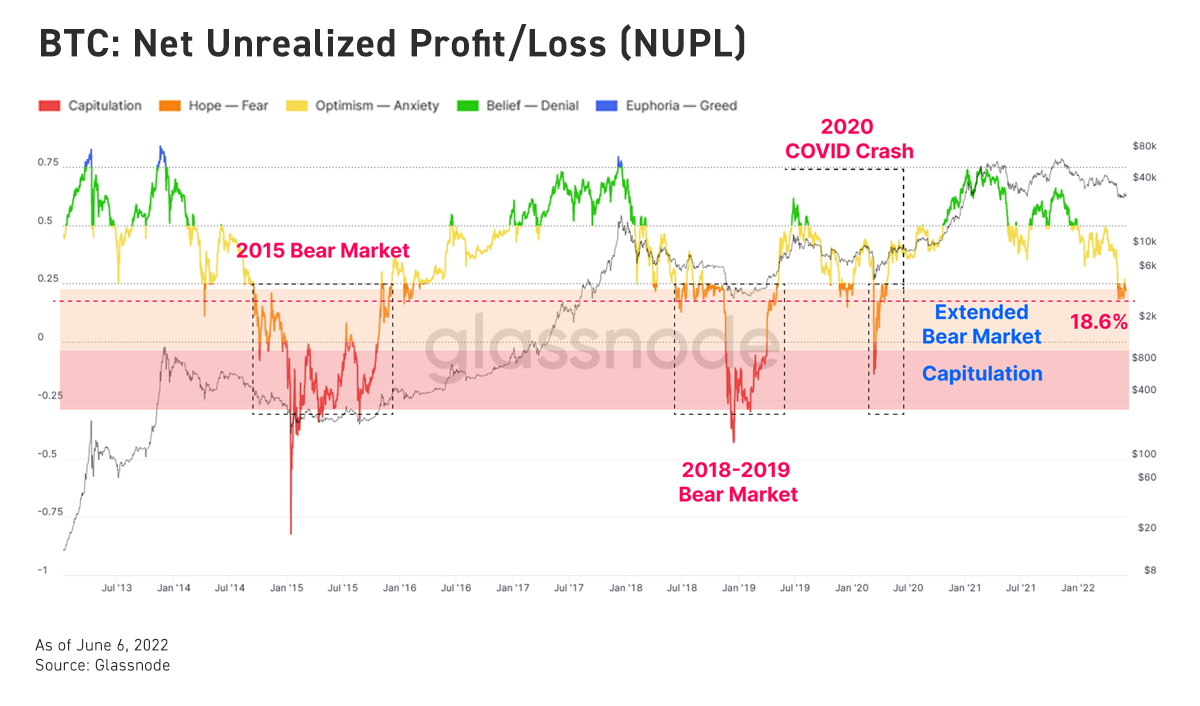

On-chain metrics reveal that the crypto market is still plagued by fear and uncertainty. The Net Unrealized Profit/Loss (NUPL) metric, which maps out the unrealized PnL of the network as a percentage of the market cap, can be used to gauge the market's pain threshold and potential bottom. Since early May, the NUPL has been fluctuating in the 18.6% to 25% range, a level comparable to the pre-capitulation phases in previous bear cycles. Meanwhile, the Market Value to Realized Value (MVRV) ratio is currently sitting at 1.3, indicating that BTC may experience a further decline before reaching a cyclical bottom.

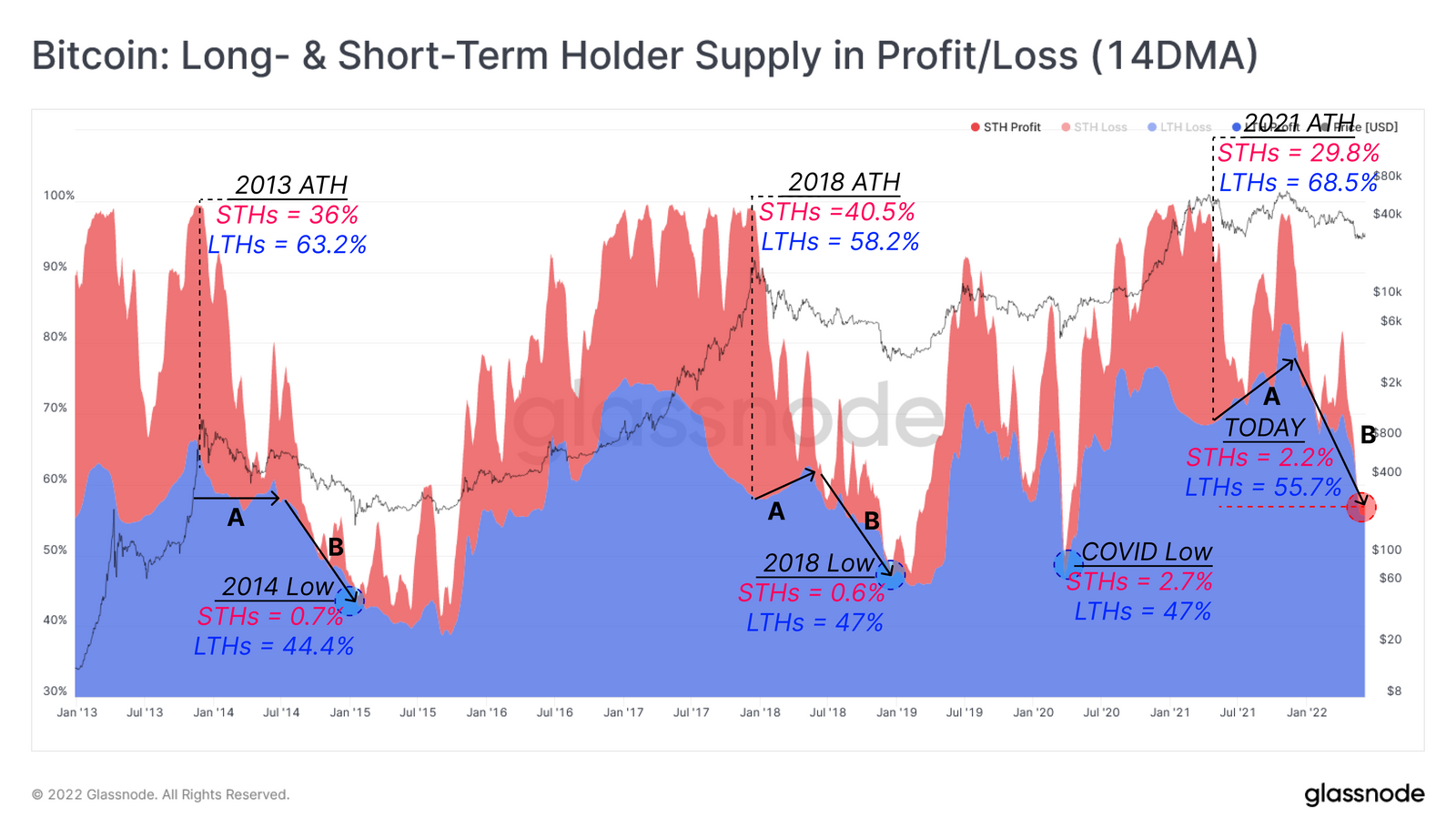

In a typical bear market, the percentage of short-term holders diminishes as speculative traders exit the market. As a result, coins are redistributed to long-term holders, who continue to accumulate and dominate the circulating supply. In the current phase, short-term holders are almost entirely at loss, with only 2.2% of the supply in profit. Long-term holders are shouldering most of the market’s unrealized supply, as the percentage in profit drops from 68.5% to 55.7%.

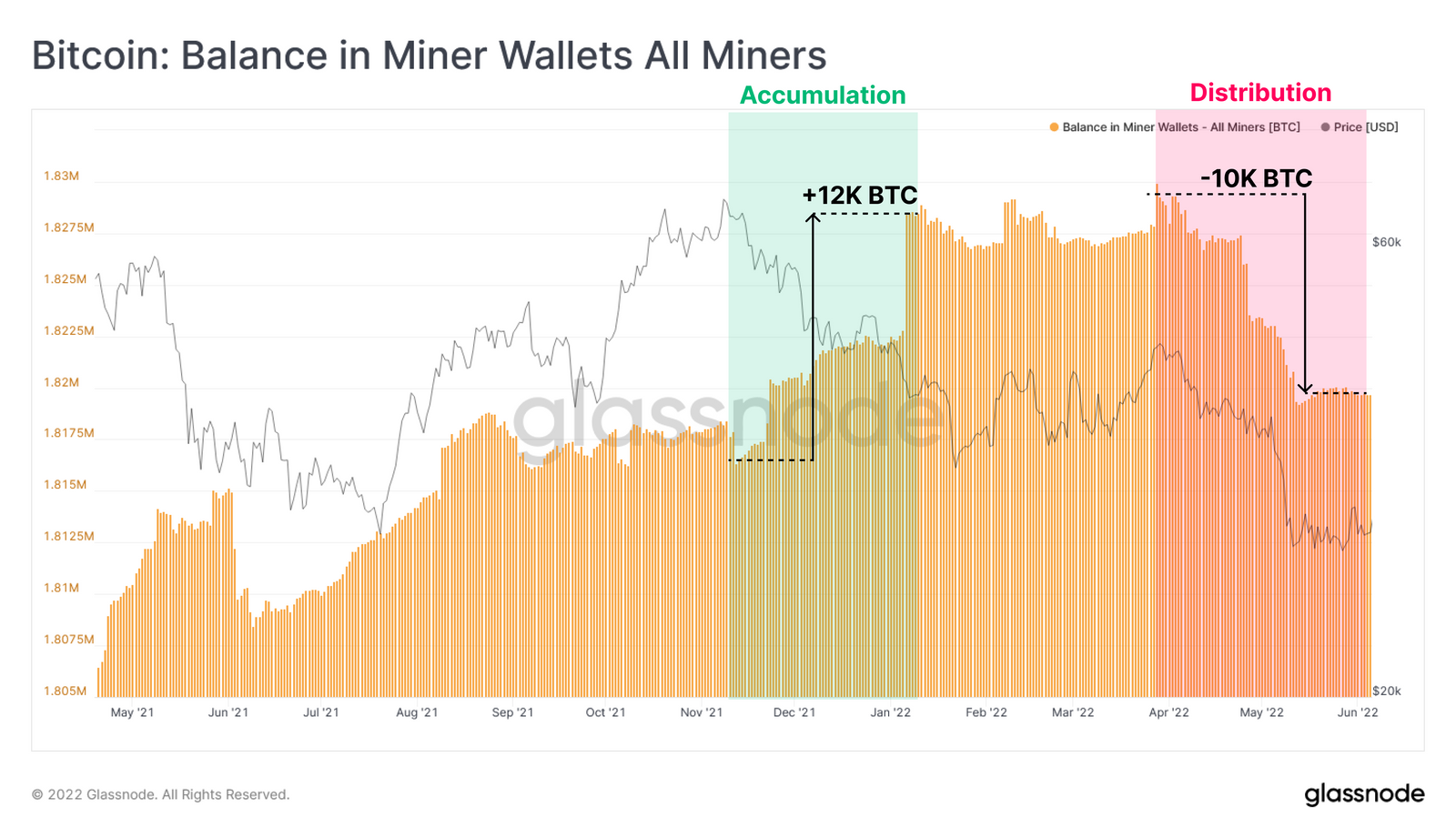

Meanwhile, miners, who have been accumulating during the recent market crash, are now net distributing, as many are forced to unplug their rigs in the face of plummeting revenues and weakening spot prices. Since the collapse of Terra’s Luna Classic, miners have piled on to the selling pressure by distributing approximately 10k BTC. The distinct change in miners’ behaviors has also caused the hashrate to plunge in the past week, resulting in an even lower block production rate.

Macro Events to look out for in the Coming Week

Jun 10, 2022 |

|

Jun 15, 2022 |

|

Jun 17, 2022 |

|

Jun 20, 2022 |

|

Three coins to watch

Token | Reason |

CRV | Curve has recently seen its share of DEX volume triple as investors look for safer trading alternatives. As investors source for stablecoin liquidity, the growing demand for Curve’s utility token will likely become a tailwind to CRV’s price action. |

IMX | Immutable X, a Layer 2 NFT marketplace, leverages Validium solution from StarkWare. Immutable X assisted Illuvium in a whopping $72M land sale and might attract more web3 games to its platform featuring zero transaction fee and high throughput. |

TRX | Following the unfortunate Terra collapse and recent market crash, Tron’s market share doubled. TRX has also absorbed some capital from Terra with a $10m incentive fund to attract Terra developers to migrate to the TRON ecosystem. |