Crypto Scalp Trading: Learn the Basics

Scalp trading, also known as scalping, is a crypto trading strategy to make repeated profits over a short period of time.

Scalp trading is a popular cryptocurrency trading strategy used by leveraging the crypto market’s volatility to make regular short profits. Scalp traders, also called scalpers, seek profits from smaller price swings. The strategy’s main aim is to tighten stop-losses and make moderate short-term profits within a short time frame.

What is scalp trading in crypto?

Scalp trading in cryptocurrency is a short-term trading strategy where traders make multiple small trades throughout the day to profit from minor price movements. The goal is to take advantage of small price fluctuations in high-liquidity markets, often holding positions for just seconds or minutes before selling.

Scalpers invest in assets that are highly volatile and have high trading volumes. This is a unique way to generate on-the-spot profits from highly volatile assets with limited risks.

However, scalping is not everyone’s cup of tea. It requires precision, advanced knowledge of cryptocurrencies, market know-how, and experience in handling volatile assets.

How do scalp traders generate profits?

Scalpers can use their own personalized scalping strategy through real-time technical analysis (TA).

That said, some fundamental principles of scalping will remain the same for all traders.

Technical Analysis allows traders to learn and study market behavior, understand past asset price movements, and make predictions. On average, a scalper takes around 5-10 minutes to complete the process.

The 5 minute candle timeframe is a widely used strategy, since it is open to clear analysis and thus increases the predictability of scalping.

There are two main methods for crypto scalp trading:

Manual Crypto Trading

In manual scalping, traders, closely monitor the market and the price movements of an asset. To maximize profits, traders must track the market movements and make an instant decision to open and close the positions.

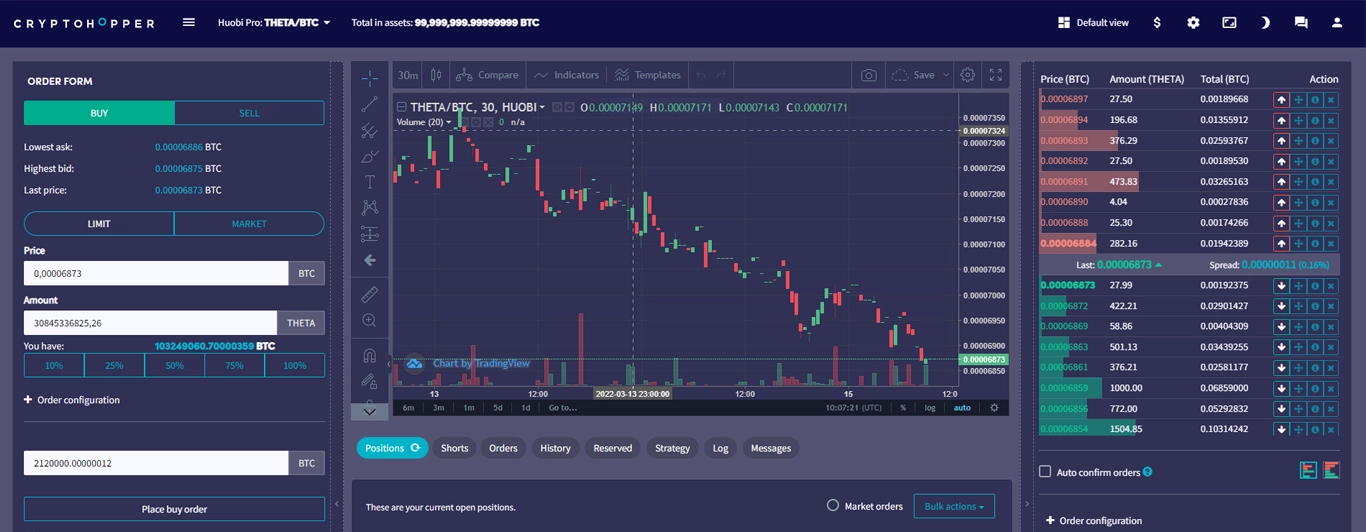

Automated Crypto Trading

In automated trading, traders create a program that analyzes the risks and carries out the trade on behalf of the trader.

In both manual and automated trading, scalping requires precision, intuitive knowledge, and a clear understanding of how the crypto market works.

What is the best timeframe for crypto scalping?

A scalping timeframe refers to the “trading volume” or the total number of trades executed. It also depends on the strategy used for crypto scalping. Scalpers typically prefer 5-30 minutes charts.

Shorter timeframes allow for more frequent trades, but they also increase the risk due to rapid price fluctuations. Traders must balance making enough trades to be profitable and not overwhelming themselves with too many decisions in a short time.

Scalping Pros

Highly profitable, especially for seasoned traders.

Small profits can accumulate to a substantial amount over time.

Less risky for small-time traders and novice traders.

Profits are generated through market fluctuations without the market needs to move in a particular direction.

Scalping Cons

Requires a minimum number of trades to generate substantial profits.

Increases overall transaction costs because traders must pay multiple trading commissions.

Time-consuming and requires precision and high concentration.

Crypto Scalping Indicators

Traders rely on technical indicators to inform their scalping decisions. Here are a few common ones:

Moving average (MA)

The MA indicator shows the asset price movement over a given period. Other indicators such as the SMA (Simple Moving Average) and EMA ( Exponential Moving Average) also provide valuable information about recent price changes.

Support and Resistance

These levels help in the quick execution of a trade.

The “Support” level denotes the stage where the price movement has stopped going downwards and moves upwards, while the “Resistance” level denotes the point when the price no longer moves up and starts to fall.

Relative Strength Index (RSI)

The Relative Strength Index RSI determines the entry and exit points for trades. It is a great way to gauge the asset's overall price trend and performance.

Parabolic SAR (Stope and Reverse)

The Parabolic SAR indicator denotes an asset’s momentum to help traders to determine when to enter the trend.

Tips for crypto scalping

Learn the basics - Start with a demo account. It is a good idea, especially for beginners, to open a demo account and practice simulated trading before using real funds.

Gather information – Learn about the different scalping strategies, the crypto exchanges’ various fees, asset reputation in the market, price movements, market behavior, etc. It is also advisable to do a short course in crypto trading or join a community to learn the basics.

Get familiar with trading analysis tools – Research and get acquainted with trading indicators and other applications, such as trading bots and charts, that can help execute trades.

How to start crypto scalping for beginners

Here are a few steps that can help kick-start crypto scalp trading.

Choose the right trading pair – Before choosing the trading pair, traders should understand an asset’s trading volume, liquidity, price volatility, and trading history.

Select a compatible trading exchange – Choose a platform that supports the assets. Also, it is important to know about the reputation of the crypto exchange, as well as its trading fees and costs.

Go for trading tools – Manual trading is time-intensive and requires a lot of knowledge about crypto trading, which can be overwhelming for beginners. Trading tools like bots and other programs can automate the trading process and help traders make the right decisions.

Choose a trading strategy – There are many trading strategies in the market. Choose a strategy that fits your goals.

Crypto Scalping Strategies

Scalping involves using a variety of strategies to generate small but consistent profits from frequent trades. Each strategy can be tailored to different market conditions, asset types, and trader preferences. Let’s explore a few of the most popular crypto scalping strategies:

Range Trading

This process involves identifying the price level range within which the trader will buy and sell the asset. The basic idea is to buy the asset when the price is low and sell it back to make profits when its price increases.

This process may be risky, and scalpers must be aware of price timing.

Bid-Ask Spread

The bid-ask spread is the difference between the ‘bid” price and “ask” price.

It allows traders to open and close positions and make quick profits in between the price movements. There are two types of bid-ask spreads:

Wide Bid-Ask Spread: Here, the ask price is higher than the bid price, and usually happens when there are more buyers than sellers, which leads to a price surge.

Narrow Bid-Ask Spread: This happens when there are more sellers than buyers, and the asking price is less than the bid price.

Arbitrage

With arbitrage, scalpers make profits out of the difference in prices by buying and selling the same asset in different crypto markets. There are two types of crypto arbitrage trading:

Spatial arbitrage: To mitigate risks, the trader opens short and long positions in different crypto exchanges at the same time.

Pairing arbitrage: This is done on one platform instead of different exchanges. Traders try to short the primary asset in the trading pair.

Price Action

Price action strategies involve keeping a close eye on the crypto price movements in the market, verifying the timeframes, and analyzing the price resistances.

Margin Trading with Leverage

Margin trading, or leveraged trading, allows traders to amplify gains from asset price swings in the market. Leverage denotes the ratio between the amount needed to place the open position and the amount the trader can trade.

What’s the Difference Between Day Trading and Scalping?

Both scalping and day trading are short-term strategies, but they differ in duration, frequency, and approach.

As we mentioned, scalping involves making numerous small trades in a short time (often seconds or minutes). Scalpers target tiny price fluctuations, aiming for small profits that add up over time. This strategy requires rapid execution, focus, and precision.

Day trading involves holding positions for several hours but closing them before the end of the trading day. Traders focus on capturing larger price movements and may use both technical and fundamental analysis to guide decisions.

In essence, scalping aims for frequent, smaller profits, while day trading targets fewer, larger price moves within the day.

Scalping

Duration: Seconds to minutes.

Frequency: Multiple trades per day.

Goal: Small, quick profits from price fluctuations.

Day Trading

Duration: Minutes to Hours, closed during the same day.

Frequency: Fewer trades, larger moves.

Goal: Larger profits from intraday trends.

Bottom line

Crypto scalping is a simple trading strategy that is less risky and allows traders to make small regular profits on a trading day. This is one of the best ways to learn and earn through crypto trading, especially for newcomers who want to learn about the basics of crypto trading.

If you're looking to take your crypto scalping to the next level, consider using Cryptohopper. Get started with automated trading.