What’s Stopping Crypto Markets from Entering the Mainstream

Things may not be quite as ostentatious as they were in 2017, but cryptocurrencies are having an outstanding year. Not only has their collective market cap quadrupled since the start of the year, but they are enjoying bullish sentiment on many fronts.

Whether it’s the unmistakable entrance of institutional investors into the crypto space or the fact that you can buy a latte with Bitcoin, cryptocurrencies are undoubtedly trending higher.

Even Facebook, the world’s most popular social media platform, is entering the fray, introducing its cryptocurrency, Libra to its 2.5 billion users.

Consider these growth metrics for the crypto sector:

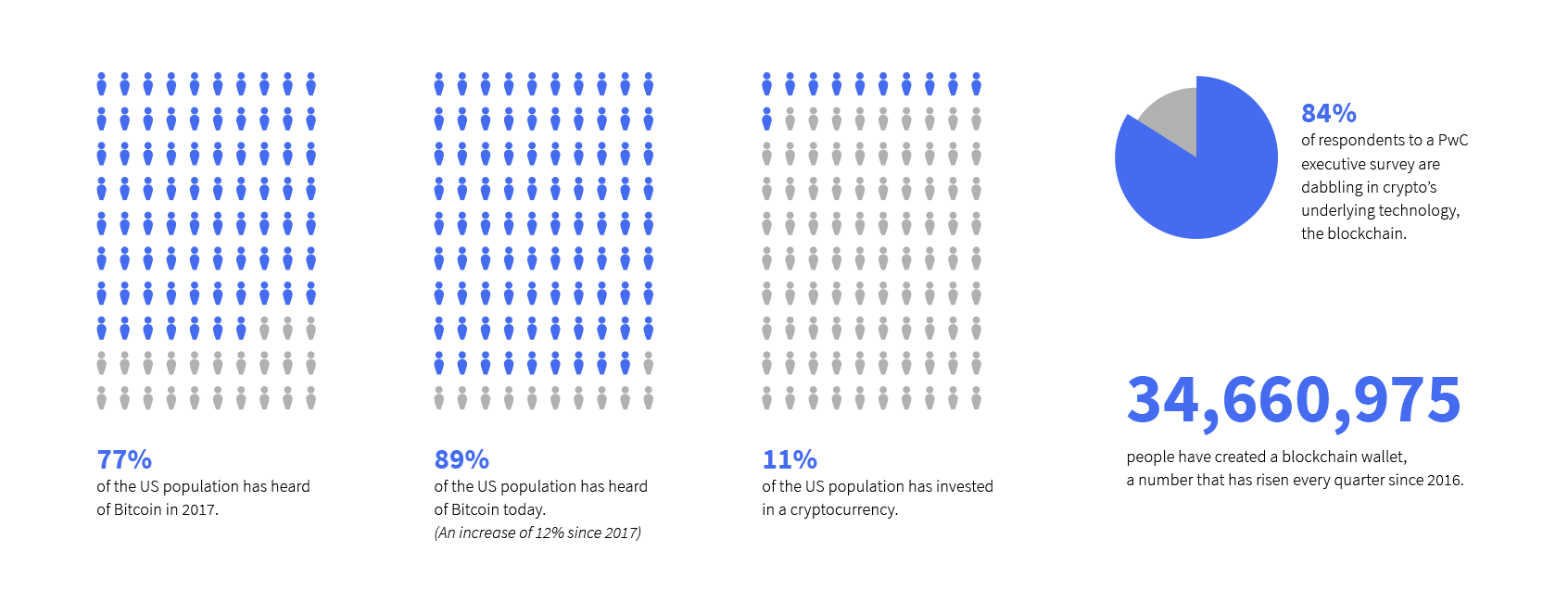

84% of respondents to a PwC executive survey are dabbling in crypto’s underlying technology, the blockchain

89% of the U.S. population has heard of Bitcoin, a 12% increase since 2017

11% of the U.S. population has invested in a cryptocurrency

34,660,975 people have created a blockchain wallet, a number that has risen every quarter since 2016.

Taken together, it’s clear that crypto is making significant inroads at many levels of the financial and technological space. And yet, obstacles remain to crypto investment markets becoming normative and broadly accepted.

Even though cryptos are outperforming every other major investment vehicle in 2019, including stocks, bonds, gold, and oil, they remain a fringe industry.

Here’s why

#1 Pay-to-Play Market Making

All exchanges, crypto or otherwise, rely on an orderly balance of buyers and sellers who will execute transactions at a fair market value.

These exchanges are facilitated by market makers who set and adjust the quotes to buy, sell, execute, and clear orders. Their integrity is paramount to a successful trading experience.

Unfortunately, there are reports that market makers are being approached by token platforms offering payment for more a more advantageous market for their startup.

For instance, as Eric Gravengaard, co-founded of Athena Bitcoin, told CoinDesk, “Recently, I and some of the companies I am associated with have been approached by token issuers, token technology providers, and token exchanges to make markets for tokens.”

This pay-to-play approach to market making not only runs afoul of traditional regulatory guidelines, but it fosters uncertainty about the integrity of digital assets.

Since mainstream investors aren’t necessarily crypto enthusiasts, they have to be able to rely on the integrity of the metrics, and that will not be possible if the rules are unclear and platforms are willing to pay to pump their price.

#2 Regulations Are Still Unclear

Cryptocurrencies are novel in their technology, and they are unique in the global scope. Unlike traditional fiat currencies that originate in a single country and are bound by its laws and regulations, cryptocurrencies are an independent, global phenomenon that avoids traditional regulatory efforts.

Currently, the global crypto market resides in regulatory limbo, something that applies to digital assets and the exchanges that facilitate their movement.

Even so, a little guidance can go a long way.

Commenting on the lack of regulatory structure, The U.S. Securities and Exchange Commission (SEC) contends that “Many platforms refer to themselves as ‘exchanges,’ which can give the misimpression to investors that they are regulated or meet the regulatory standards of a national securities exchange.”

The solution, it seems, is for countries to begin issuing regulatory guidance on these assets. It’s evident that they are not a fad and that they won’t be going away anytime soon, making it increasingly critical that these assets operate inside the regulatory structure of other prominent investment instruments.

To be sure, none of these issues alone are preventing crypto markets from entering the mainstream investment ecosystem, and other problems will emerge. Instead, they are reflective of the possibility of participating in an emerging asset class that will play an important role in finance in the digital age.

Fortunately, none of these problems are without solutions that will undoubtedly emerge as markets mature and grow. Now that the crypto sector is booming again, there has never been a better time to get started.

#3 Trading Knowledge is a Scarce Resource

Cryptocurrencies aren’t just tradable commodities, but they are definitely tradable commodities, which places crypto markets firmly in a financial space that - burgeoning ecosystems aside - few are familiar with.

Indeed, studies show that significantly more people know about Bitcoin than actually own the cryptocurrency.

While some may be turned off by certain features of the crypto movement, this broad distinction isn’t explainable by indifference alone.

Rather, it’s likely that many people don’t feel that they have an adequate knowledge of crypto markets to make critical investment decisions.

Even for the experienced investor, navigating the myriad of options can be a daunting task, and these problems are only compounded by the lack of tried and true investment methodologies.

#4 Inexperienced Investors

Cryptocurrencies are a relatively novel market, which means that many people don’t have the experience necessary to adequately navigate this space. However, not only are more people entering crypto markets every day, but new products are becoming available that help interested investors gain the traction necessary to begin investing.

For example, Cryptohopper’s trading bot makes it possible for investors to develop a robust trading strategy using established trading practices from experienced investors, allowing new users to attain on-the-ground training as they enter the investment space.

To be sure, cryptocurrencies are daily becoming more integrated into the mainstream investment landscape, but they aren’t there yet. As trading platforms and consumers address many of these consumers, we can expect to see even higher levels of participation, which would be a welcome addition to a crypto market already booming in 2019.

Check out our last blog: Cryptohopper Launches a Mobile App to Up the Convenience Ante Entirely.