Within an hour of Sunday’s crash, over $1.1 billion worth of positions across the market were liquidated, mostly in Bitcoin and Ether. This marked the biggest liquidation since March 12, which indicates that traders with long positions were over-leveraged. These extreme price movements also led to abnormal prices on some exchanges. OKEx, however, was operating smoothly throughout the price action. Moreover, the $1,500 one-day trading range has also led to another uptick in Bitcoin’s short-term volatility, taking it back to mid-May levels of 11.61%.

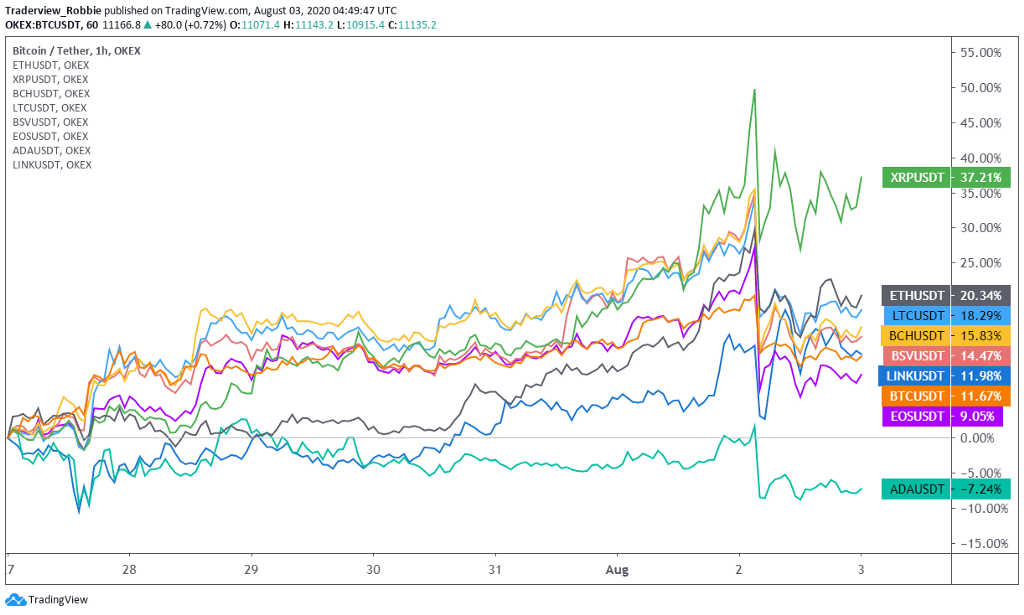

Despite Sunday’s big drop, Bitcoin recovered to $11,100, closing +11.67% on a weekly basis. Moreover, the world’s largest crypto asset was up 24% in July and realized a year-to-date return of 60%.

In terms of large-capitalization altcoins, the best performer last week was XRP, up 37.21%. XRP snapped an eight-day positive trading session and hit a 50% weekly return before the big drop.

Last week’s momentum generator, Ether ( ETH), on the other hand, rose to above $415 for 30 minutes in the early hours of Sunday morning, a new high not seen since August 2018. Then it plunged to $327.8, down more than 20%. But the quick rebound that followed also allowed the Ethereum coin to reap a 20.34% weekly gain.

Litecoin ( LTC) collected a weekly return of 18.29%, while BTC fork Bitcoin Cash ( BCH) and its subsequent fork, Bitcoin SV ( BSV), were up about 15%. Cardano’s Ada ( ADA), however, lost momentum after completing its latest Shelley upgrade, falling 7.24% in the last week.

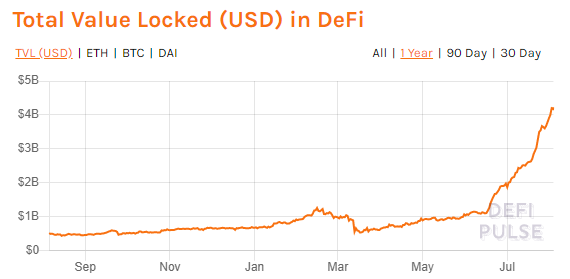

In the decentralized finance sector, the market remains hot. Several DeFi projects are up over 40% in the last week. Among them, the price of yearn.finance is still stable at over $4,000. And Bancor ( BNT) V2 version went live on Aug. 1, with the first trading pair LINK/BNT.

An increase in DeFi adoption can drive demand for Ether, which in turn can drive up the price of ETH and the overall cryptocurrency market enthusiasm. According to DeFiPulse, the total value locked in DeFi exceeded $4 billion for the first time, a metric that has grown by about 800% since the beginning of the year.

Technical analysis

On the BTC weekly chart, the body of last week’s candlestick still hasn’t breached its highs from last August. The price fell sharply after hitting highs in the $12,000 area, indicating strong resistance and selling pressure at that level.

While, the overall bullish pattern has not been clearly destroyed and the $10,700 key support level still holds, we may see some downward pressure in the short term.

Please visit https://www.okex.com/ for the full report.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.