- March trading stats and BTC volatility

- Option expiration day explained

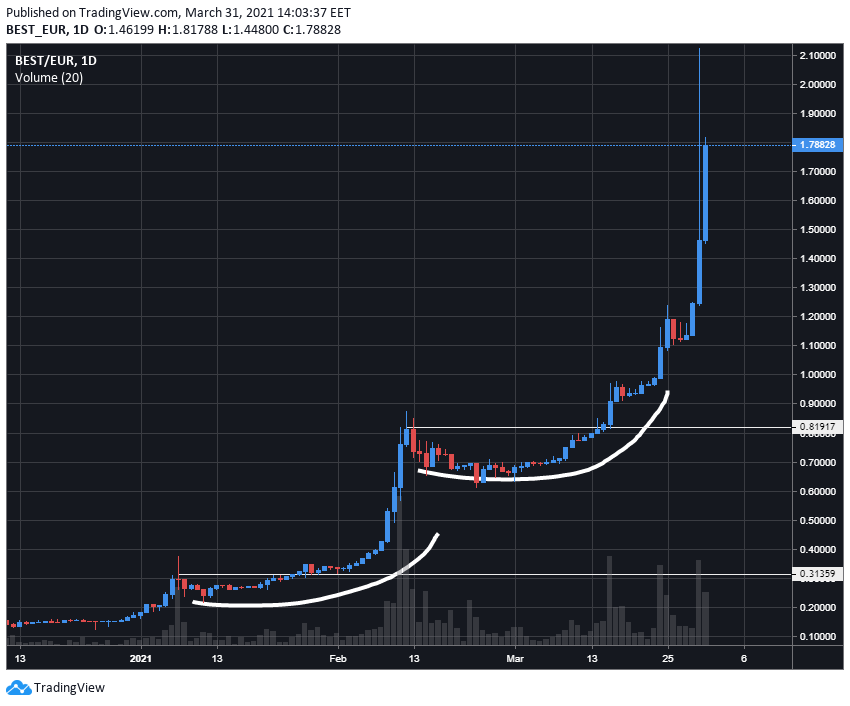

- Some exceptions outperformed (IOTA, BEST)

- PayPal accepting cryptocurrency

- Fidelity launching ETF

- VISA will start to settle payments in USDC stablecoin

Yesterday was the last trading day in March which was very generous with profits. Bitcoin delivered returns of over 30%, with some altcoins delivering even more. Looking back at price action, there were some important events which created volatility, but which did not change the overall picture. The crypto market is still growing and last week was no exception.

The 26th of March was an important day for BTC and ETH as USD 4B options expired. Option expiration days are important as the market tends to move towards the strike price which in this case was much lower, sitting at $44,000 for BTC. Bitcoin moved towards this price and touched its support level. We’ve seen the same pattern with ETH which was following BTC in its movement. These are event-driven factors which cause greater volatility but usually don’t change the overall picture.

On the options expiration date, the issuer has to deliver the real asset, in this case, real Bitcoin or Ethereum, and not fiat money or stablecoins (USD, EUR, USDT...). The issuer of options, in most cases exchanges, needs to buy Bitcoin/Ethereum which will take a significant amount of money away from the exchanges. This event creates a price drop as the issuer has to buy at the lowest price or as close to the strike price of the option to deliver what is owed and to make positive results. On the other side, traders who own options and do not want to own Bitcoin and Ethereum exercise their right early for the fiat money, which creates a price drop, but also take the huge amount of real “physical” Bitcoin and Ethereum out of the market which creates a shortage of supply. As soon as these operations are over, the price moves back again and the market stabilises.

In technical analysis, price patterns are the distinctive formations created by price movement which traders seek to identify possible future direction. BEST successfully broke out from a cup and handle pattern twice recently. This pattern on a price chart is an indicator that resembles a cup with a handle, where the cup is in the shape of a "u" and the handle has a slightly downwards drift. The pattern is considered a bullish signal extending an uptrend, and is used to spot opportunities to go long. BEST briefly soared over the €2 mark on Bitpanda Pro with itshighest volume in a month. It only needed 6 days to double in value. Even though BTC had an impressive return in last weeks, BEST outperformed Bitcoin by more than 400%.

IOTA was also among top coins last week as it performed a massive spike which touched its resistance level at €1.5. The price is now forming a rising wedge pattern. In an uptrend, this is considered as a continuation or reversal pattern, depending on where the break of the trendline will take place.

A couple of great industry news events were driving the market last week. All of them have been positive concerning crypto adoption and well-established names are entering crypto.

Asset management giant, Fidelity Investments, is reportedly preparing to launch its own bitcoin exchange-traded fund (ETF). An ETF is a type of security that tracks an index, a sector, a commodity or other assets, like Bitcoin in this case, which can be purchased or sold on a stock exchange in the same way as a regular stock. Fidelity is only one among many names that want to bring crypto to Wall Street.

Payments processor Visa announced it is now settling payments using the stablecoin USDC on the Ethereum blockchain, becoming the first major payments network to use a stablecoin as a settlement currency. Visa will now be able to manage its crypto debit card business entirely using digital assets.

Another payments processor, PayPal, has announced that it is allowing their U.S. customers to pay with cryptocurrency online. PayPal will convert the cryptocurrency at the point of sale so the merchant receives their local fiat currency.

Both Visa and Paypal are important for the cryptocurrency market as a real case use is becoming a reality.

You are not trading on Bitpanda Pro yet? Register now