ProShares Releases New ETF to Short BTC

Exchange-traded fund (ETF) provider ProShares has announced a new product to allow investors to hedge their crypto exposure in a bear market. Find out more here.

Magic Eden Raises $130M

Magic Eden, the leading NFT platform on Solana, is gearing up for a multi-chain expansion. Find out more here.

Argo and DMG Launch Carbon-Neutral Terra Pool

Terra Pool, a joint effort from BTC miners Argo and DMG Blockchain Solutions, concluded its testing phase on Wednesday and is now open to the general public.Find out more here.

Harmony Suffers $100M Theft

The Harmony Blockchain network has announced that Horizon, its cross-chain bridge to Ethereum, fell victim to a theft of approximately $100 million in ETH and other tokens. Find out more here.

L1/L2 Development of the Week

Following the buzz around OP’s airdrop, rumors around the imminent token launch of Arbitrum, another optimistic rollup Layer 2 for Ethereum scaling, began to emerge.

This week, we dived into Arbitrum Odyssey’s announcement for an eight-week activity that rewards participants with NFTs. This campaign is widely perceived as a prelude to its official token launch and airdropping.

Read more here.

DeFi Updates of the Week

This week, we explored ApeX, a decentralized, permissionless, and non-custodial derivatives protocol on the Arbitrum mainnet.

More specifically, we delved into its unique eAMM and PCV business models, tokenomics, and how it is compared to dYdX and GMX in terms of valuation.

Read more here.

On-Chain Round-Up for the Week

The liquidity crises in the broader crypto market have catalyzed massive liquidations of leveraged positions over the weekend, resulting in further price declines. Despite the surge in volatility, BTC has managed to defend the $20k level, building a stronger case for the market to successfully navigate the contagion risks in the near term.

The weekend liquidation cascade has caused the MVRV ratio to plunge to new lows, hinting toward an unprecedented buying opportunity for those who still hold onto their convictions.

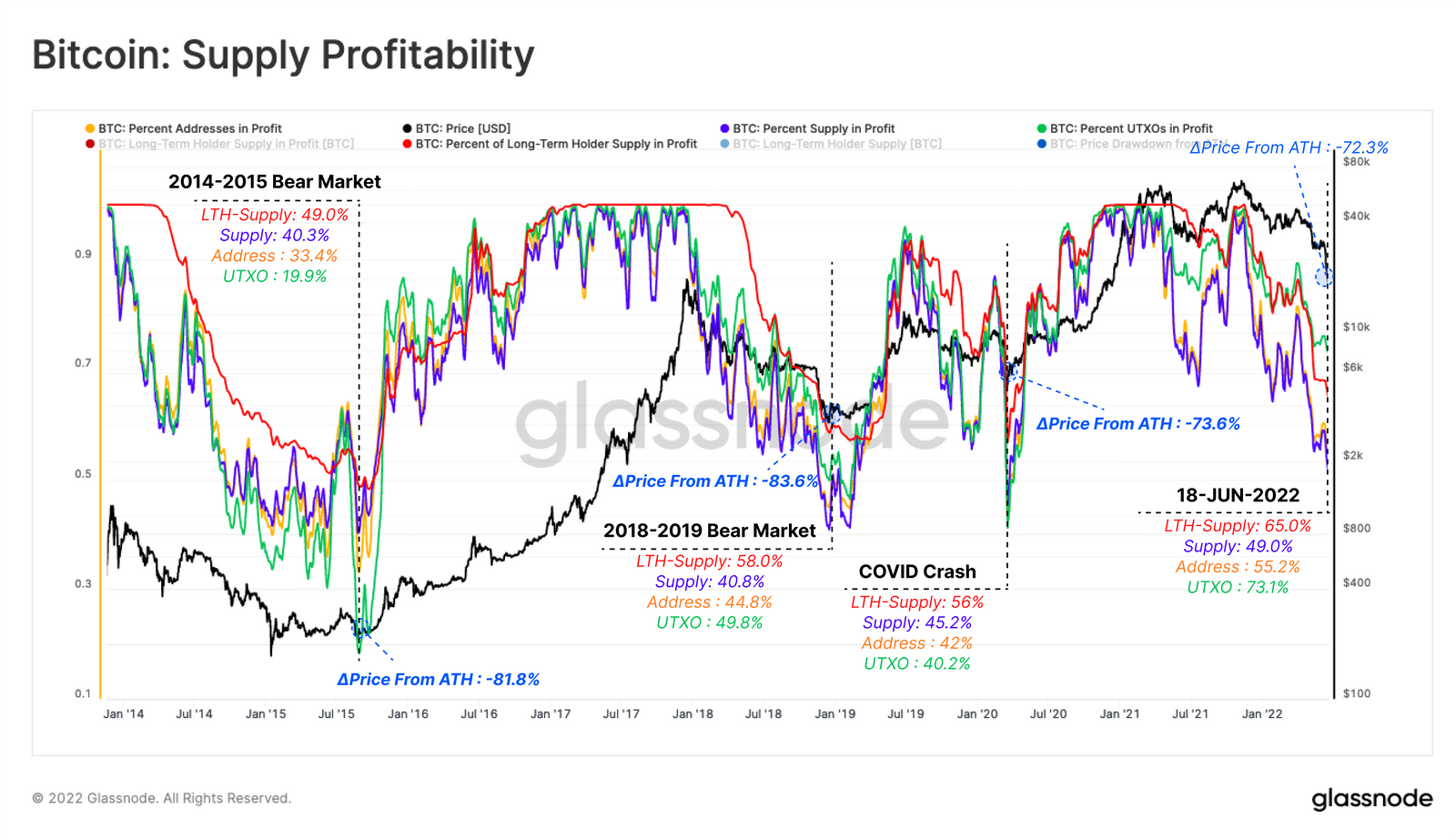

Supply in profit dropped below the 50% mark as the price of BTC went south, indicating that at least half of the supply is deep in unrealized losses. If history serves as any indication, market bottoms in the previous bear cycles often surface when only 40 to 45% of the supply is in profit. Similarly, the percentage of addresses in profit is approaching levels seen during the ICO bear run and the COVID liquidity crunch. Indicators are pointing to a potential bottom in the near term, and hopefully, the market will bounce back after all the financial woes.

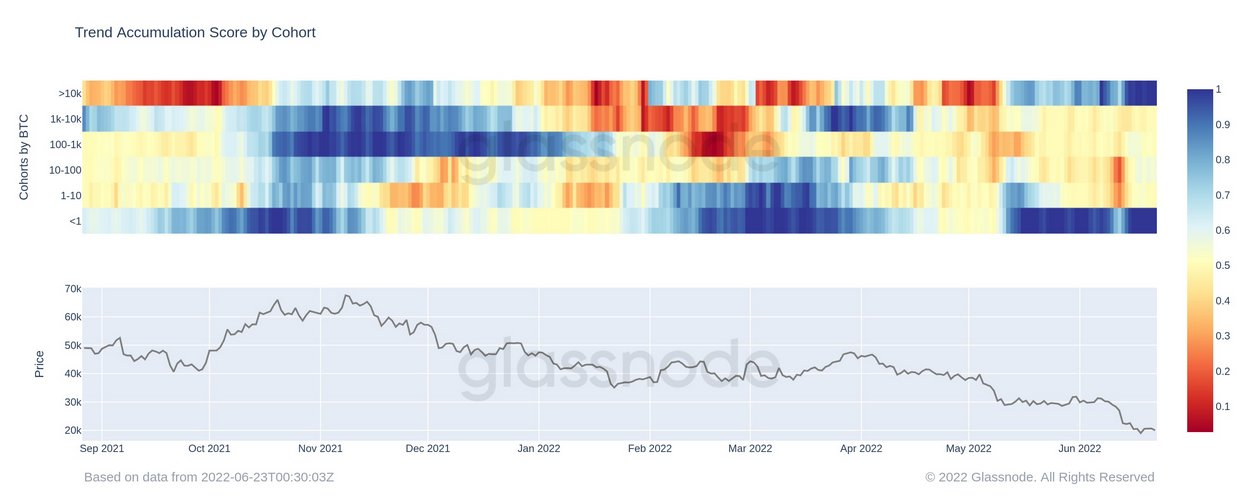

The two cohorts that take advantage of the recent sell-offs are whales and small-time retailers. Both groups have been stacking up their BTC holdings in full swing since the start of the recent market meltdown. Cohorts with BTC holdings between 1k to 10k BTC remain on the sidelines, waiting for clearer signals from the market.

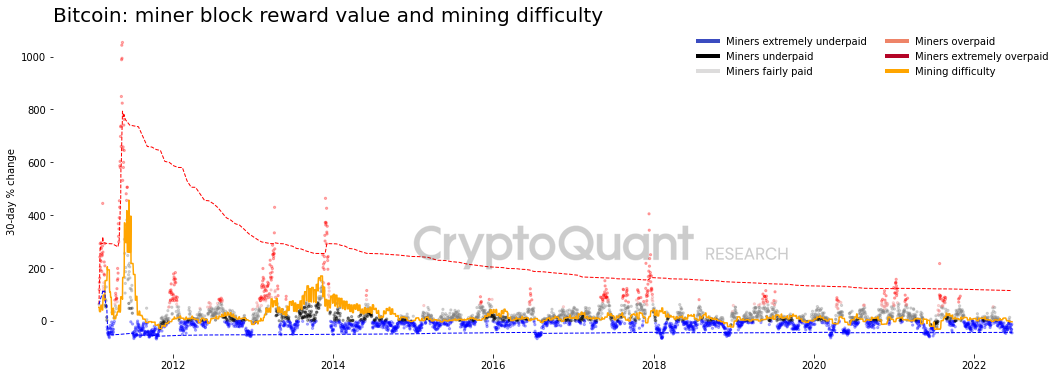

On the other hand, miners have been hit hard by the confluence of dwindling profits per block and high mining difficulty. These seasoned market participants have now entered the “extremely underpaid” territory, and are forced to sell their BTC holdings to fund their operations.

Macro Events to look out for in the Coming Week

Jun 29, 2022 |

|

Jun 30, 2022 |

|

Jul 1, 2022 |

|

Jul 5, 2022 |

|

Jul 7, 2022 |

|

Jul 8, 2022 |

|

Three coins to watch

Token | Reason |

ADA | Despite recent volatility, ADA has managed to weather through the market downturn well in the past week. The impending Vasil hard fork, though being pushed to late July, will still be one of the biggest upgrades to Cardano since the Alonzo hard fork, and it looks like the dev team is taking an abundance of caution to press forward. |

HNT | Nova Labs (former Helium Inc.) announced new tokens to incentivize users to provide coverage for the Helium network. These new tokens will be exchangeable with the network’s native token HNT, which will also serve as an underlying currency for the Helium ecosystem. |

UNI | Uniswap Labs has officially expanded into the NFT field with its acquisition of Genie. Positive synergy is expected from the integration between Uniswap and Genie. Uniswap will become a one-stop platform for users and developers, boosting its trading volume. |