Notably, the world’s most widely traded cryptocurrency, Bitcoin, registered over 36% gains, driven by further positive developments from Wall Street and Main Street, who are finally realizing their long-term potential.

On February 8th, Tesla, the electric-vehicle manufacturer, announced a $1.5 billion investment in Bitcoin. The unexpected news drove the crypto world into ecstasy as Bitcoin surged over 19% just hours after the announcement. That sparked-off a forceful rally that eventually peaked at $58,352 on Binance.

Major financial institutions are also eyeing digital asset investments. A $150 billion investment unit at Morgan Stanley is considering investing in Bitcoin. Meanwhile, BlackRock Financial Management has “started to dabble” in crypto investments, according to Chief Investment Officer, Rick Rieder.

Institutional investors have capitalized on the opportunity to accumulate more. MicroStrategy announced that it had bought over $1 billion worth of additional Bitcoin after finalizing another convertible debt sale.

The software company revealed that it paid an average price of $52,765 per Bitcoin, including fees and expenses. Its acquisition of approximately 19,452 Bitcoins puts MicroStrategy’s total holdings of the bellwether cryptocurrency at 90,531.

Adding to the growing list, equity research provider Motley Fool has also announced a $5 million BTC investment. The firm also made its views public, predicting that Bitcoin could rise to $500,000 over the next 15 years.

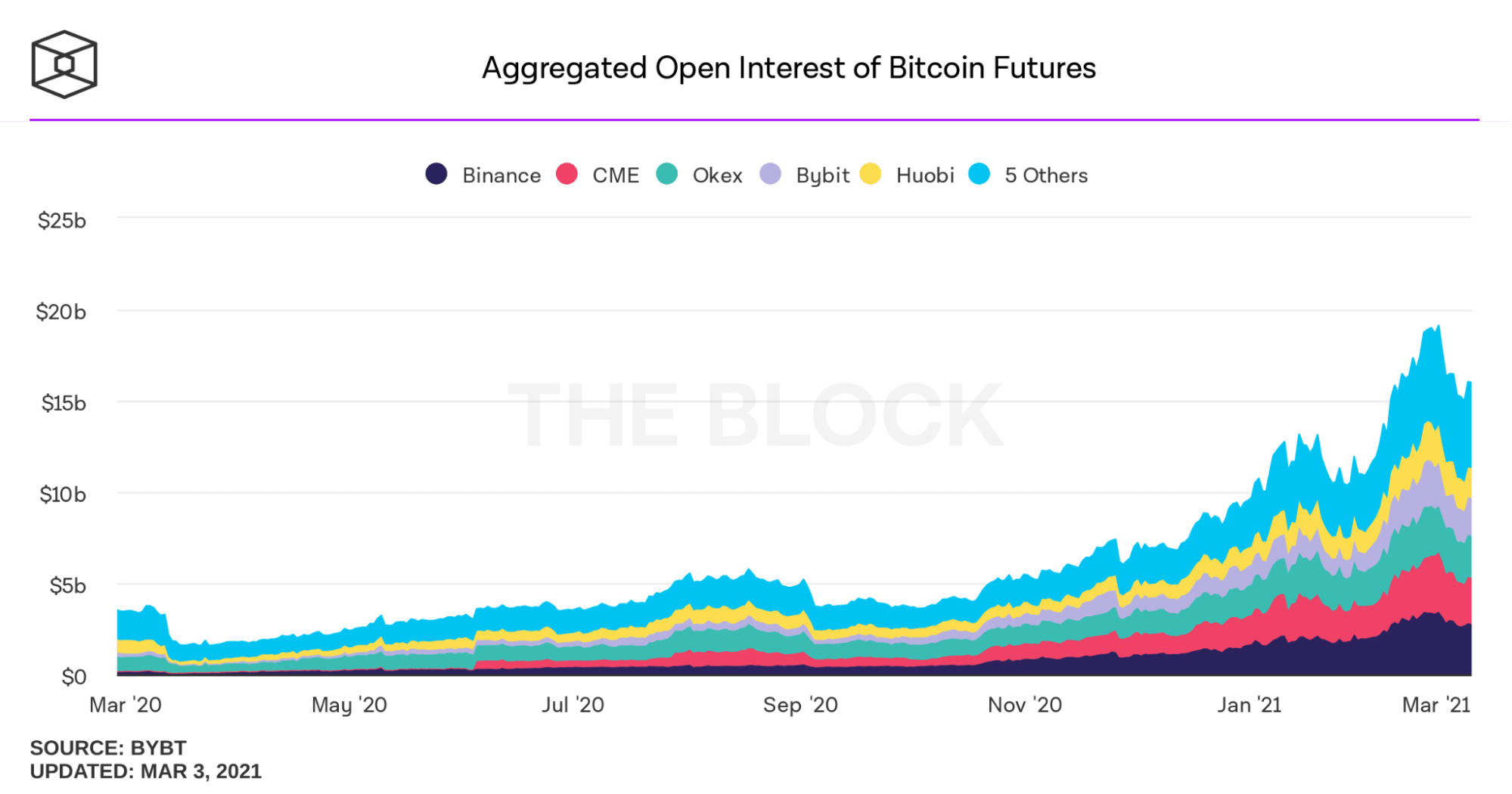

In the derivatives market, Bitcoin’s open interest reached a new milestone. The aggregated Open Interest (OI) across Bitcoin (BTC) futures markets reached more than $19 billion, according to market analytics firm Bybt. On Binance Futures, Bitcoin’s open interest registers a new milestone with a record $3.4 billion of assets locked in BTC futures contracts.

Source: Bybt, The Block

Analysts and traders typically use open interest as an indicator to determine market sentiment and the strength behind price trends. Open interest indicates capital flowing in and out of the market. As more capital flows into the futures market, open interest increases. Conversely, when more capital flows out, it declines. In this scenario, Bitcoin’s increasing open interest is a confirmation of its bull run.

The surge in Bitcoin's open interest coincided with growing demand from institutional funds in the US and Europe such as Square, MassMutual, SkyBridge Capital, and well-respected investors, including Paul Tudor Jones, Raoul Pal, and Elon Musk. All of whom have publicly endorsed Bitcoin as digital gold.

Trade Bitcoin Futures with up to 125x leverage on Binance. Sign up now!

Another market mover is Binance Coin (BNB), which delivered a mind-boggling 375% return in February. The native cryptocurrency of the Binance ecosystem recorded the largest single-day gain in its history, surging over 70% on February 19th to a new high-water mark of $348.

BNB’s rapid surge momentarily moved its market value above $40 billion, becoming the third-largest cryptocurrency for the first time in its history.

Analysts have pointed to three primary reasons behind BNB’s growth, including the exchange’s record high trading volume, the expansion of DeFi related protocols to the Binance Smart Chain, and a steadily expanding ecosystem supported by new partnerships and integrations.

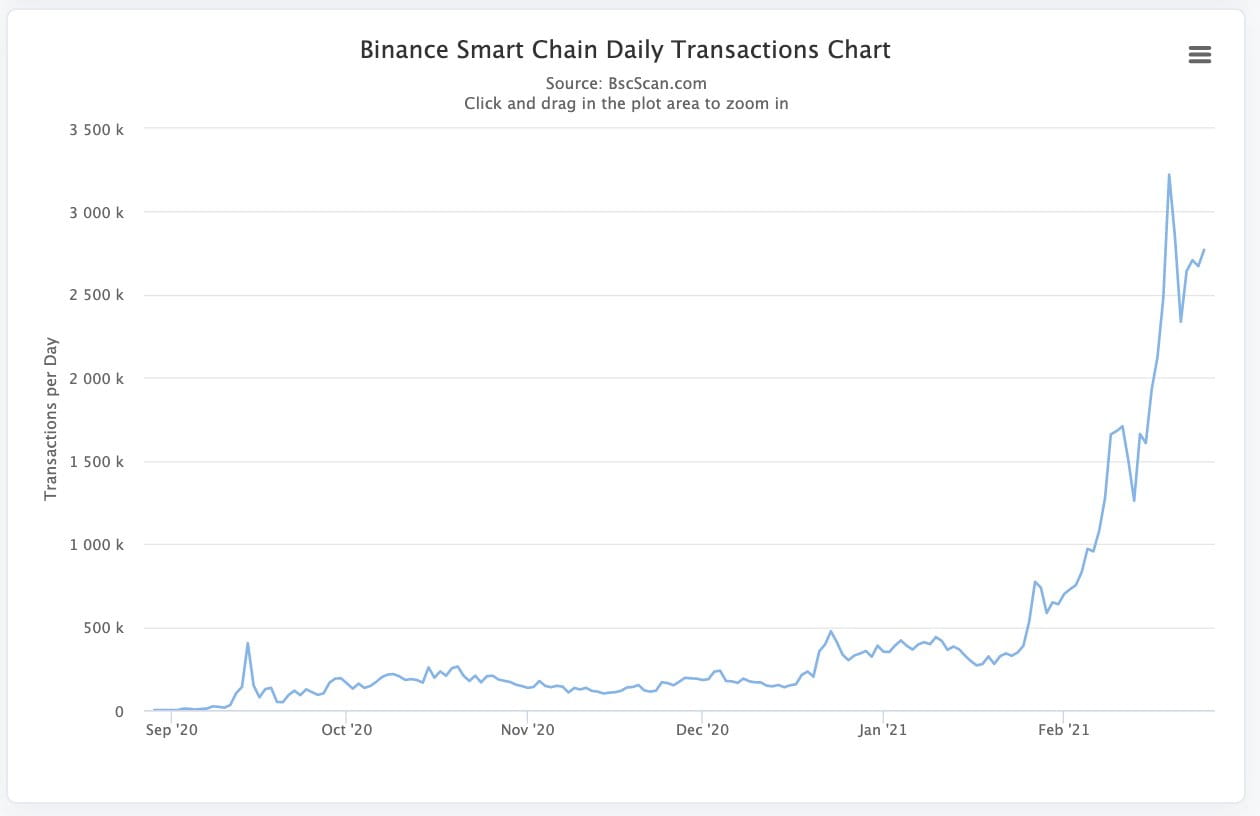

The rapid rise of the Binance Smart Chain (BSC) ecosystem has thrust BNB into the limelight. Binance Smart Chain is increasingly gaining traction within the crypto community as users view it as an excellent alternative to the Ethereum blockchain network. This is shown by BSC’s rapidly growing on-chain activity as daily transactions have increased over six-fold since the start of February.

Source: BSCScan.com

Persistently high gas fees on the Ethereum blockchain have been a bane for users, prompting them to search for alternative venues. Thus, opening opportunities for alternative blockchain networks, including Binance Smart Chain.

BSC’s phenomenal growth has propelled BNB further, surpassing well-known projects, including Polkadot (DOT) and Cardano (ADA). Binance CEO Changpeng Zhao, better known as CZ, noted in his Twitter post that BNB not only made all-time highs in fiat terms, but the token also registered a new all-time high against BTC. Since its inception, BNB has grown 480x against BTC.

Trade Bitcoin Futures with up to 125x leverage on Binance. Sign up now!

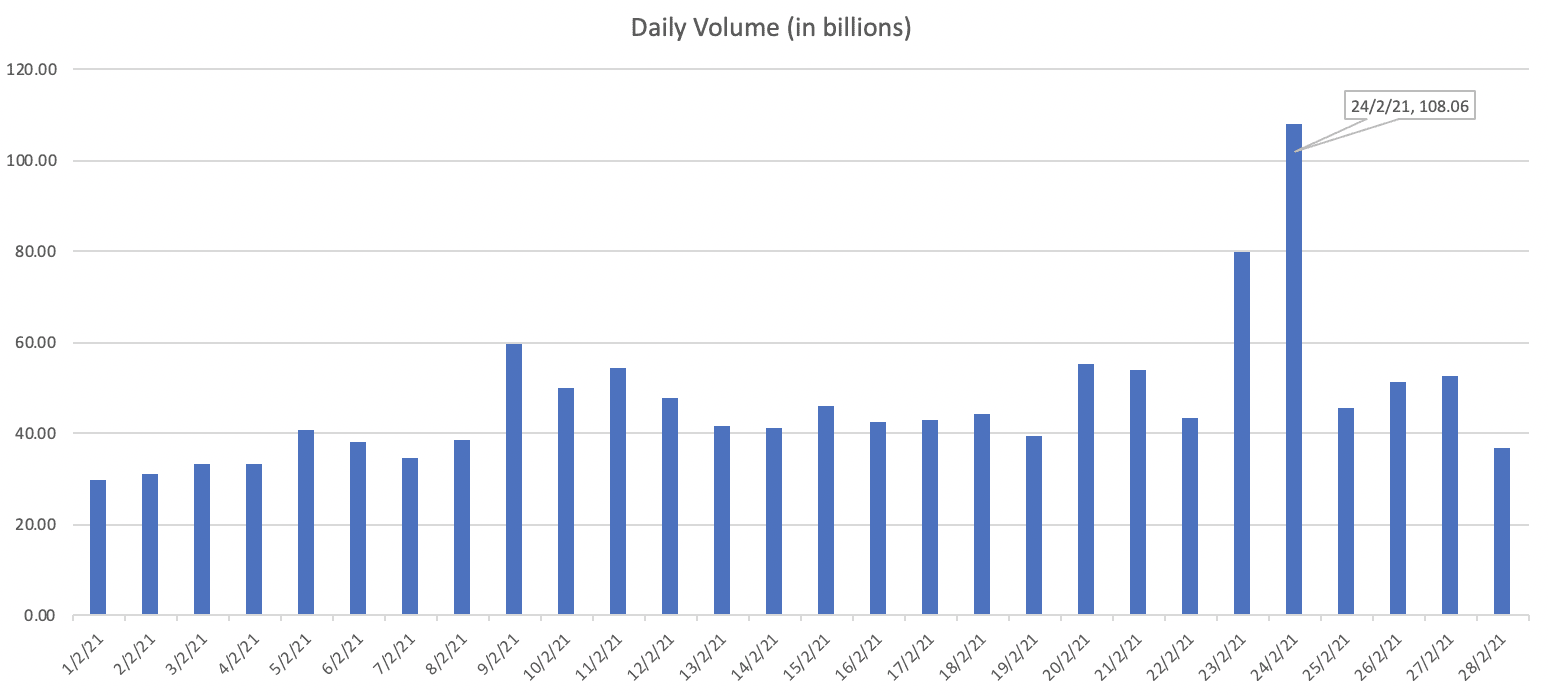

As the entire crypto-economy surged to new heights, trading volume on derivatives exchanges moved in a similar tempo and cadence. Binance Futures maintained its market leadership as the number 1 venue for Bitcoin and Altcoin futures. In February, Binance Futures processed over $1.3 trillion in volume and shattered a new daily volume record with over $108 billion on February 23rd.

Source: Binance Futures

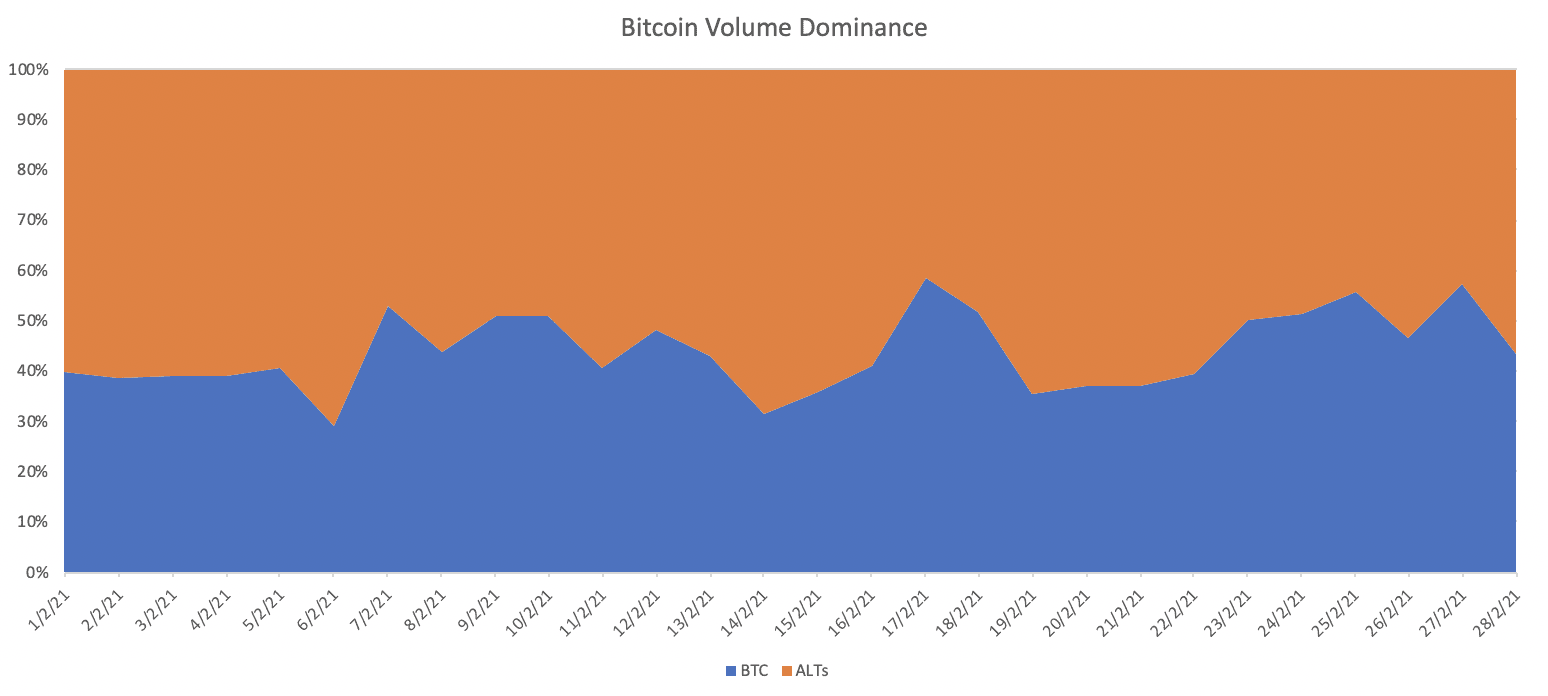

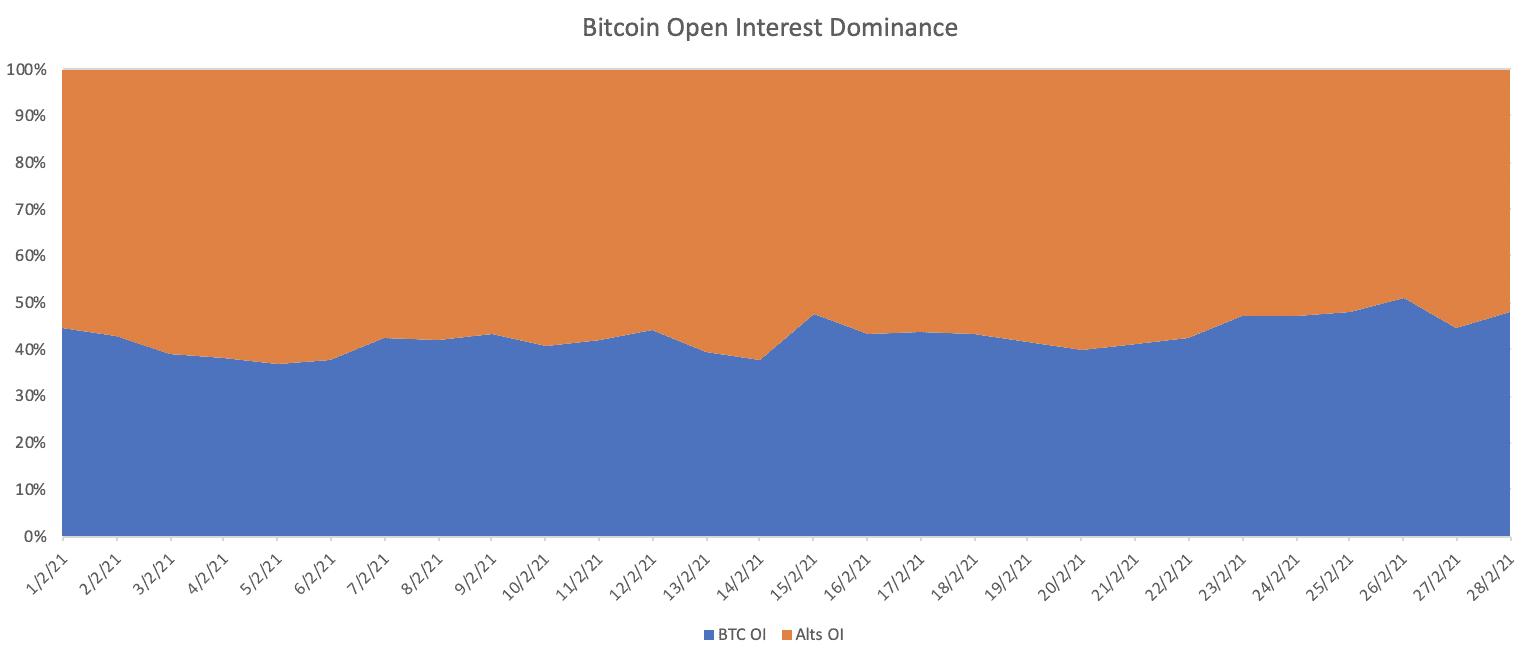

Bitcoin’s volume dominance held in the range of 40-50%, a significant decline from preceding months. This is due to increased trading activity on several well-known altcoin contracts such as BNB, ADA, and DOT.

ADA and DOT received a fresh wave of optimism and buying volume after a Dubai-based crypto investment fund, FD7 Ventures, announced plans to sell off 750M USD worth of their Bitcoin holdings to increase the company’s positions in Cardano (ADA) and Polkadot (DOT).

As a result, trading volume for ADA and DOT futures contracts has surged to a new record, averaging over $3 billion and $1 billion in daily volume, respectively. The open interest for ADA futures also rose to over $220 million, gaining over 100% in the last two weeks. Similarly, open interest for DOT contracts marked a new all-time high of over $200 million.

Source: Binance Futures

Trade Bitcoin Futures with up to 125x leverage on Binance. Sign up now!

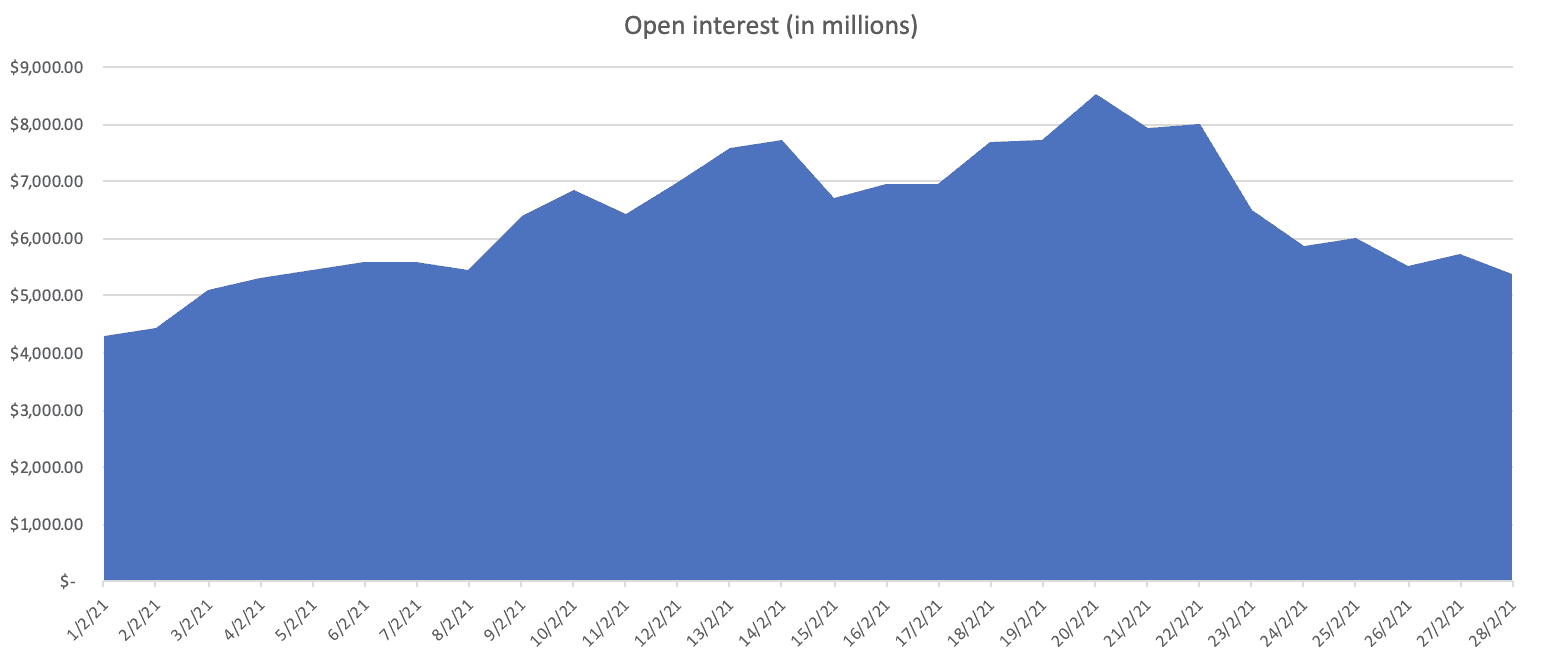

Open interest on Binance peaked at $8 billion as Bitcoin surged towards $58,000. As the rally unfolded, open interest was substantially reduced to $5.4 billion by month-end. Despite the pullback, open interest on Binance expanded 31% from $4.1 billion in January.

Source: Binance Futures

We observed a similar trend in Bitcoin’s open interest dominance. The phenomenal growth of blockchain platform tokens has shifted traders’ attention towards the altcoin sector in early February. As such, altcoin contracts have driven most of the open interest growth but subsided towards the month-end as Bitcoin makes a comeback.

Source: Binance Futures

How Far Could Bitcoin Go?

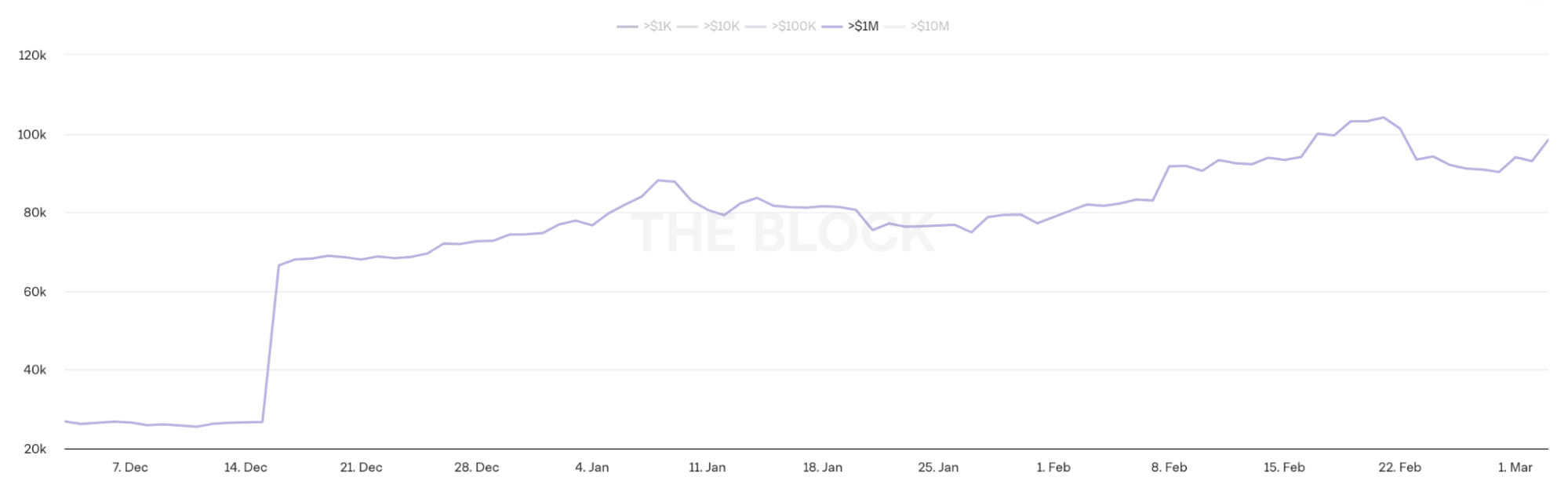

Despite Bitcoin growing more than a two-fold year to date, new evidence suggests that large investors are still accumulating more of the bellwether cryptocurrency. According to data aggregator CoinMetrics, on-chain data show that whales are buying Bitcoin rather than selling it, likely in anticipation of more future upside.

Bitcoin Addresses with Balance Over $1M

Source: Coinmetrics, The Block

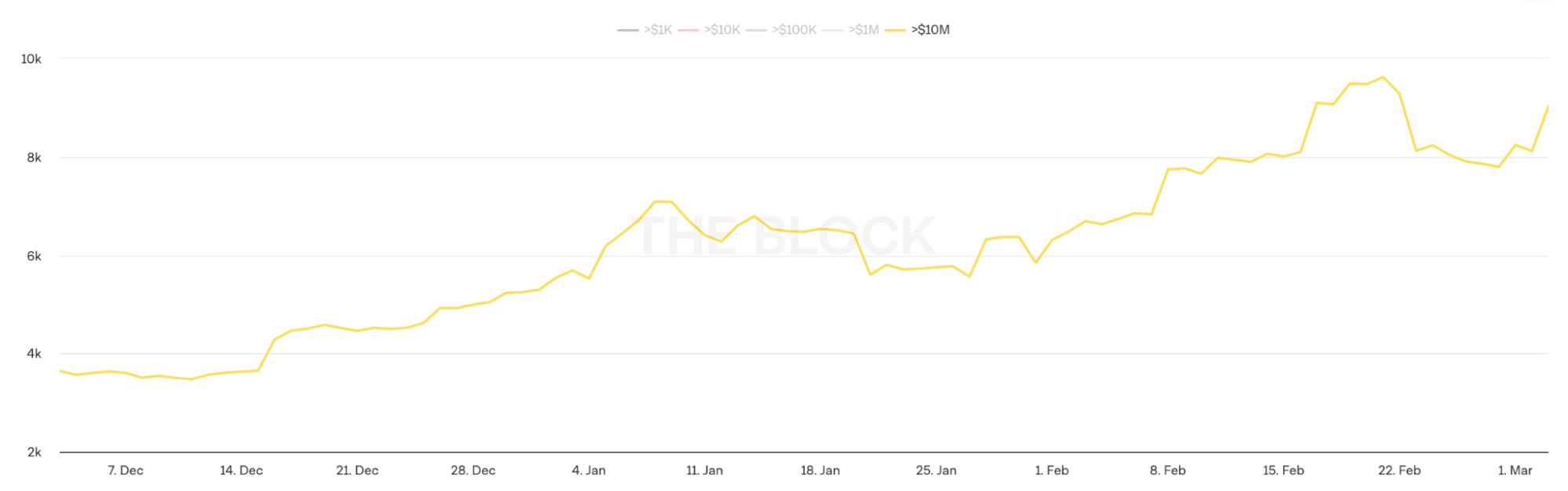

Bitcoin Addresses with Balance Over $10M

Source: Coinmetrics, The Block

Whales or high-net-worth investors might be accumulating Bitcoin rather than taking profit on their positions because they might believe a supercycle might be emerging.

Bitcoin has not had this much institutional interest before the current bull cycle, particularly from public companies and financial institutions. The cryptocurrency is becoming highly compelling in an environment where the continuous expansion of the money supply by central banks is forcing some companies to look for alternatives to cash.

While large investors are still accumulating Bitcoin, there are a few near-term obstacles ahead that could threaten the crypto rally. Rising bond yields are starting to weigh on risk assets and causing the US Dollar to strengthen. As benchmark Treasury yields rise amid expectations for more robust growth, the key question on investors' minds is how high they can climb before spoiling the global risk asset rally.

The relentless downtrend in bond prices unnerved investors and put pressure on stock markets, with the tech-centric Nasdaq suffering its worst single-day loss since October. Clearly, the equity markets are reluctant to rally further as interest rates go up rapidly.

The pace of that yield jump would ripple through all the various assets and countries; even cryptocurrencies have not been spared. During the same period, most cryptocurrencies, including Bitcoin and Ethereum, have suffered losses amid the strengthening US Dollar. Should the US Dollar continue to strengthen further, it could spell a turbulent journey ahead for cryptocurrencies and risk assets alike.

Trade Bitcoin Futures with up to 125x leverage on Binance. Sign up now!