Throughout the chat, Jay discussed OKEx’s derivative trading performance and game plans for DeFi, as well as the development of the OKChain ecosystem.

Ever wonder why OKEx is the best among other exchanges, or how we can guarantee safety on OKEx? These questions and more were answered by Jay in the chat — which has been reproduced here. OKEx is one of the most popular cryptocurrency exchanges in the world. Could you please explain to us what it takes to be among the best in this area?

I believe every exchange has its own unique position in the market — but thank you for considering us for this honor and recognizing our teams’ efforts.

At OKEx, we have four main advantages over other exchanges that attract users to us:

First, we offer a wide range of trading products to traders, such as spot trading, futures trading, lending and borrowing, etc. This is one of the main reasons why users come to trade on our platform.

Second, our risk-management system attracts users. You see, we’ve been offering futures since OKEx first launched. Over the years, we’ve been continuously learning how this unpredictable market functions, and we’ve been perfecting our risk-management system in order to deliver a reliable trading platform for our users.

Third, of course, pertains to our liquidity. Needless to say, we are one of the top competitors in this domain, and you can tell this immediately by just examining the spread and depth of our order book. Our tick sizes are very minimal — i.e., 0.1 for our spot and perpetual swap markets, and 0.01 for futures markets — and you would still be able to find a thick depth available.

Finally, our competitive fees should be the lowest in the industry. Whether you trade spot, futures or perpetual swaps, the more you trade, the lower the fees are for all markets. Right now, if you hold more than 2,000 OKB in your account, you can enjoy a 40% fee discount.

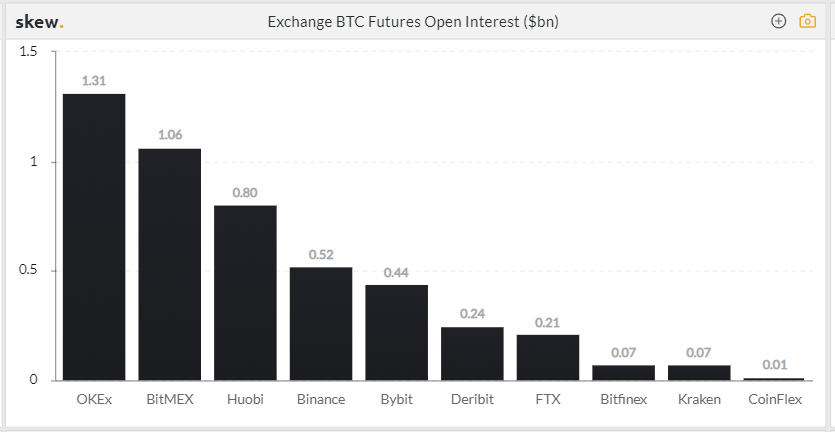

This week, the OKEx ecosystem achieved an industry-leading derivatives turnover and open interest level. Last weekend, more than $1 billion worth of leveraged cryptocurrency positions were liquidated in a sudden price drop. Despite that, OKEx recorded 0% clawback and 0% auto-deleveraging in-profit trades thanks to our comprehensive risk-management system.

There are constant updates and campaigns, but what are the most important recent updates?

The ultimate goal of OKEx is not only to provide users with the best crypto derivatives trading platform but also to act as a one-stop solution for crypto adoption.

We have long regarded decentralized finance as one of the most important developmental directions for blockchain and cryptocurrency. With so many high-quality applications standing out in 2020, OKEx has been actively supporting DeFi by listing the native and governance tokens of the most outstanding DeFi projects — such as BAL, SNX, CELO and DMG.

We’re also expanding our own footprint in this area with products like our C2C Loan, which generates passive income for our users and the development of OKChain — which will be used to support the overall DeFi infrastructure.

Besides DeFi projects, OKEx’s diverse derivatives market has attracted some experienced and professional traders. Last week, two perpetual swap products — DOTUSDT and FILUSDT — were added to our platform. Though the spot trading of Filecoin and Polkadot is not quite ready on OKEx at the moment, traders can enjoy trading the swaps of these innovative and exciting projects right now. At OKEx, we constantly innovate in the cryptocurrency space and find new ways to provide traders with the opportunity to use diverse trading strategies to capitalize on the volatility of high-quality projects such as these to engage and attract more traders.

Lastly, we’re allowing OKB, our adopted global utility token, to be used as collateral in C2C Loans, as well. OKB can now be deposited as collateral, along with Bitcoin (BTC) and Ether (ETH). Users can borrow USDT by pledging OKB with zero service fees, taking advantage of the minimum interest on borrowing, which is as low as 0.01% per day — currently the lowest in the industry, as typical daily rates elsewhere are around 0.1%. OKB is continually focused on expanding its application scenarios, and we are pleased to offer holders the chance to take out loans using OKB at the lowest rates. In addition to this, OKB has teamed up with Aeron’s Pilot Shop to allow holders to buy goods and services with OKEx’s adopted global utility token.

Safety is one of the most important aspects of an exchange, what can you tell about the safety of OKEx?

Safety and security is indeed our top priority, and we never compromise on it.

For the safety of funds, we have adopted multisig cold wallets to divide our assets to around 500 BTC per wallet so that we don’t carry any single cold wallet with an enormous amount of assets, and we have our risks spread and better managed. We also have an around-the-clock security monitoring system to safeguard our users’ funds. Our clean slate is the best proof of our efforts.

Users’ data and privacy are also well protected at OKEx. User data is encrypted and stored in our backend system — which we’ve spent years optimizing to improve stability. We also conduct regular penetration tests twice a year. Third-party protection services are also employed.

The OKEx trading platform is stable and reliable because we have a sophisticated risk-management system. Data speaks for itself. OKEx has had industry-leading derivative turnover and open interest this week as BTC rises.

Decentralized finance is one of the most popular concepts, recently. Do you have something going on in DeFi and do you have any plans?

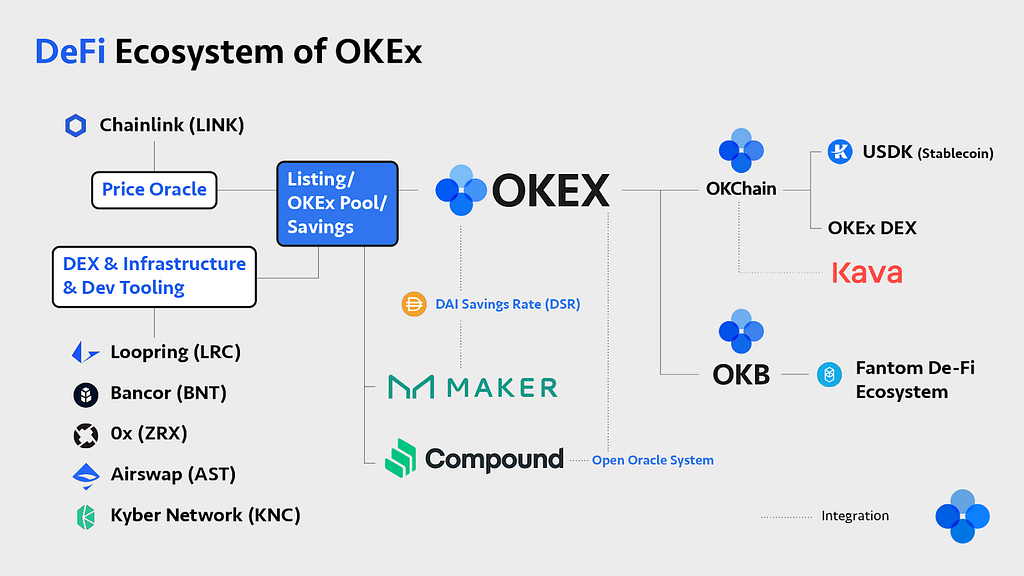

OKEx has been following the growth of the DeFi space for a long time — even taking steps to establish our own ecosystem. From listings, like MakerDAO and some DEX tokens, to technical integrations, like DAI Saving Rate (DSR) and Compound’s Open Oracle System, we think we’ve done brilliantly with our current ecosystem.

Of course, we think these are just the first steps and expect even more DeFi collaborations and projects further down the road.

Let’s talk more about listing DeFi tokens. We believe we offer high-quality solutions and provide value and liquidity to our users — such as MakerDAO, and Compound. We conduct a full evaluation beforehand to assess a project’s user base and community, its potential, past performance, development activity, legal status, etc. Now that we have integrated FCAS (i.e., the Fundamental Crypto Asset Score) with our platform, our users can also benefit from checking the health of the crypto assets we list before making trading decisions. Recently, we’ve added some new potential DeFi governance tokens as well — such as BAL, SNX and DMG.

Although some people believe that centralized exchanges and DeFi are incompatible, we think there is definitely still room for both. Despite already having a footprint in the DeFi space, we believe that centralized exchanges also have a role to play — especially since the DeFi infrastructure is still not fully developed and could use the help of centralized exchanges to grow and mature.

Another interesting factor worth considering is the COVID-19 pandemic. I believe that it will accelerate the move toward decentralized finance, to a certain extent. However, we must remember not to run before we can walk. Proof-of-work blockchains simply are not fast enough to handle mass transactions, yet — and Ethereum 2.0 can only fix this issue gradually. There is still more education needed in the space, in general, as well as improvements in technology, oracles, smart contracts, TPS, interoperability… I don’t have a crystal ball, but I wouldn’t expect to see widespread adoption, probably, for at least another five to 10 years.

At OKEx, we strongly believe in #FinanceForAll — that DeFi will provide everybody with equal access to financial services. To fulfill our vision, we are holding a new virtual #OKExDeFi roundtable talk series with leaders — such as Compound, MakerDAO, DMM, Bancor and Loopring — to discuss their DeFi progress, insights and future plans.

One more question. Do you plan to have a meetup with our investors in Turkey? We’d love to see you in Turkey!

Absolutely, we’d love to! Currently, due to the coronavirus pandemic, I believe many people’s daily lives have been affected a lot. When the situation gets better, we’d definitely like to hold meetups in Turkey!

Questions from the Turkish crypto community

Can you tell us about OKChain, please? Is it standard blockchain technology? If not, what is the difference?

OKChain is a commercial blockchain developed by OKEx. It was on Cosmos, but now we’ve launched its testnet. The mainnet, hopefully, will go live very soon!

When OKChain becomes stable, OKB will be migrated from the ERC-20 network to the OKChain mainnet, where OKB will become the native currency of the OKChain network and be used to settle transaction fees as well as for decentralized apps, commonly called DApps, that are developed on OKChain.

DeFi is one of the hottest topics in the blockchain space right now. Can you share your opinion about DeFi with us? Do you think that DeFi will disrupt the existing financial system? What is OKB’s approach toward the DeFi sector?

Oftentimes, projects, companies, tokens and ideas compete with each other. But, in reality, we all want to reach the masses and bring more people to crypto. Instead of fighting against each other, we should be collaborating to make the space shine on the global stage. This is a place for centralized finance, decentralized finance, public blockchains, retail traders and institutions. We need all of them to unleash our full potential, to realize our ambition and to make financial services accessible for all.

OKEx has a marked footprint in DeFi. For example, on our own public chain, OKChain, users can build their own decentralized exchange. OKChain will also support the release of DeFi applications and users can develop distributed financial application scenarios of their own.

In order to improve the value, support and service experience of OKB, the ecosystem added a total of 11 partners worldwide in July. The additions cover many important fields — including DeFi services, online payments, discount premiums, security services as well as ordinary trading. OKB solidified a strategic cooperation with Saturn Network, a well-known DeFi service provider. Users can conduct OKB DEX derivatives while trading on the Saturn Network platform.

What are the OKEx’s listing policies? Which phases should the projects go through to be listed on OKEx?

As for listing, we have stringent requirements for projects. There are clear listing and delisting guidelines regarding information disclosure, market conduct and security — just to name a few.

Whether a project is hot or novel is not the only aspect we look for. When speaking of listings, we hope to introduce quality projects to our users so they can have the opportunity to invest in them. We would only want to pick the best ones in the market.

For more details, you can check our webpage and send your project profiles to [email protected]— our staff will look at them.

Does OKEx plan on getting/creating a system working as an insurance fund in case a hack happens on the exchange?

We don’t have a specific insurance fund for covering asset losses. But, in case our system is compromised in the future, we can and we will cover all losses to our users.

However, we do have an insurance fund in our derivative markets. We believe the sufficiency of an insurance fund indicates the risk-control level of an exchange. Indeed, the combination of OKEx’s existing insurance fund and risk-management system — including the Tiered Maintenance Margin Ratio system, mark price, price limit and so on — makes us strong enough to resist all the extremes that may happen in the crypto market.

As we can see, some extreme market events, like the March 12 crash, didn’t take us down. Even more, we only consumed a reasonable amount of the insurance fund to protect our traders’ profit from clawback or auto-deleveraging due to the extreme market.

Can you explain why staking my cryptocurrencies on OKEx Pool is beneficial for me instead of staking on any other platform? Does OKEx Pool provide higher rewards or other benefits?

Different from other mining pools, OKEx Pool aims to become a world-leading integrated mining pool that supports both proof-of-work and proof-of-stake/PoS-variant mining. Not only do we support 13 major crypto assets for PoW mining, but we also provide hedging and staking services to meet the diversified demands in the market.

We provide four staking periods to meet different users’ needs. For staking yield, OKEx Pool distributes the revenue to users daily. We are continuing to launch a product promotion campaign to increase users’ yield. OKEx Pool launched the promotional campaign “Staking IOST Double Yield” in February.

Do you have any plans to attract non-crypto investors to OKB — and if so, how? What are the actions to increase awareness around OKB in non-crypto space?

I always believe that together, we are stronger. We are very grateful to all of our partners who have supported us along the way to make the whole OKB and OKChain ecosystem known outside the crypto-space.

Visit https://www.okex.com/ for the full report.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involves significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

Follow OKEx

Twitter: https://twitter.com/OKEx

Facebook: https://www.facebook.com/okexofficial/

LinkedIn: https://www.linkedin.com/company/okex/

Medium: https://medium.com/@OKEx

Telegram group (English): https://t.me/OKExOfficial_English

Telegram group (Russian): https://t.me/okexofficial_ru

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.