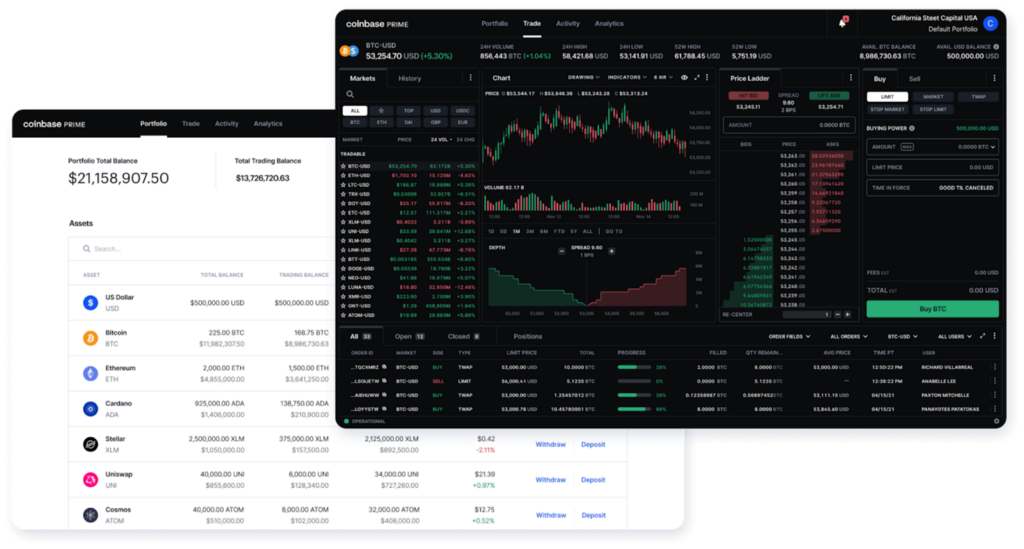

Today we are doubling down on our commitment to serving the growing Institutional market by launching the beta version of Coinbase Prime, our fully integrated prime brokerage solution that provides best-in-class custody, advanced trading, data analytics, and prime services.

Coinbase Prime, separate from Coinbase Exchange, was built with the specific requirements and services clients need to participate in digital assets. Whether you’re a financial institution, institutional investor, or company looking to add crypto to your balance sheet, Coinbase Prime has the tools and services you need.

Institutional acceptance of crypto has grown at a breakneck pace — as we’ve seen over the past six months alone, leading investors are either actively allocating a portion of their portfolios to crypto or are seriously exploring it. At the same time, we’re seeing tremendous interest from corporations that are looking to diversify their balance sheets with crypto including MicroStrategy and Meitu.

Coinbase has reimagined our Prime offering based on feedback from hundreds of clients to bring the first integrated product offering to market. We are bringing trading, algos, smart order routing, along with one of the strongest custody offerings in the industry — building our institutional product suite to provide institutions with the most seamless, intuitive, and trusted solution to manage crypto assets. We have invested in multiple acquisitions over the past three years signalling our commitment to the institutional space (skew, Tagomi and Xapo) and our desire to bring a fully integrated solution to the market. Advanced traders need more complex tooling, trading features, and reporting — we are proud to bring them that and much more with the launch of Coinbase Prime.

Coinbase Prime will offer clients a variety of new features and benefits, including:

Seamless transfers between our segregated cold storage and trading balance

Access to more than 10 venues for deep liquidity

Smart order routing will automatically route your order to the venue with the best all-in prices

Advanced algorithms designed to minimize market impact and slippage

Detailed trade cost analysis reports providing transparency on exactly how your trade was executed

Enhanced user roles, fine-grained permissions, and sub-accounts

Crypto-native features like staking and governance

Concierge support from our coverage, account management and trading team

Coinbase Institutional product suite includes:

To learn more about Coinbase Prime, Custody, OTC trading, or Coinbase’s white label brokerage services click here.

was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.